Irs Form 843 Printable

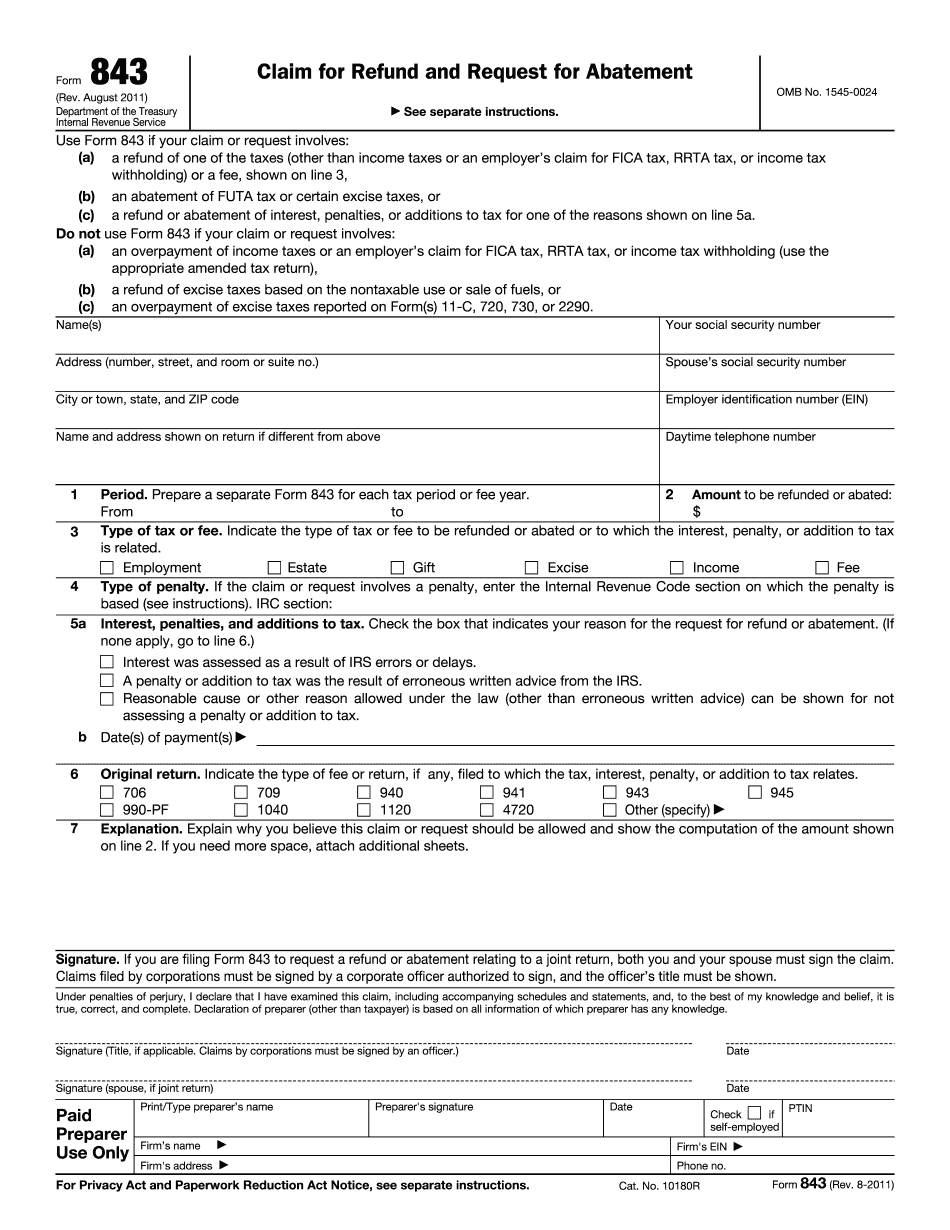

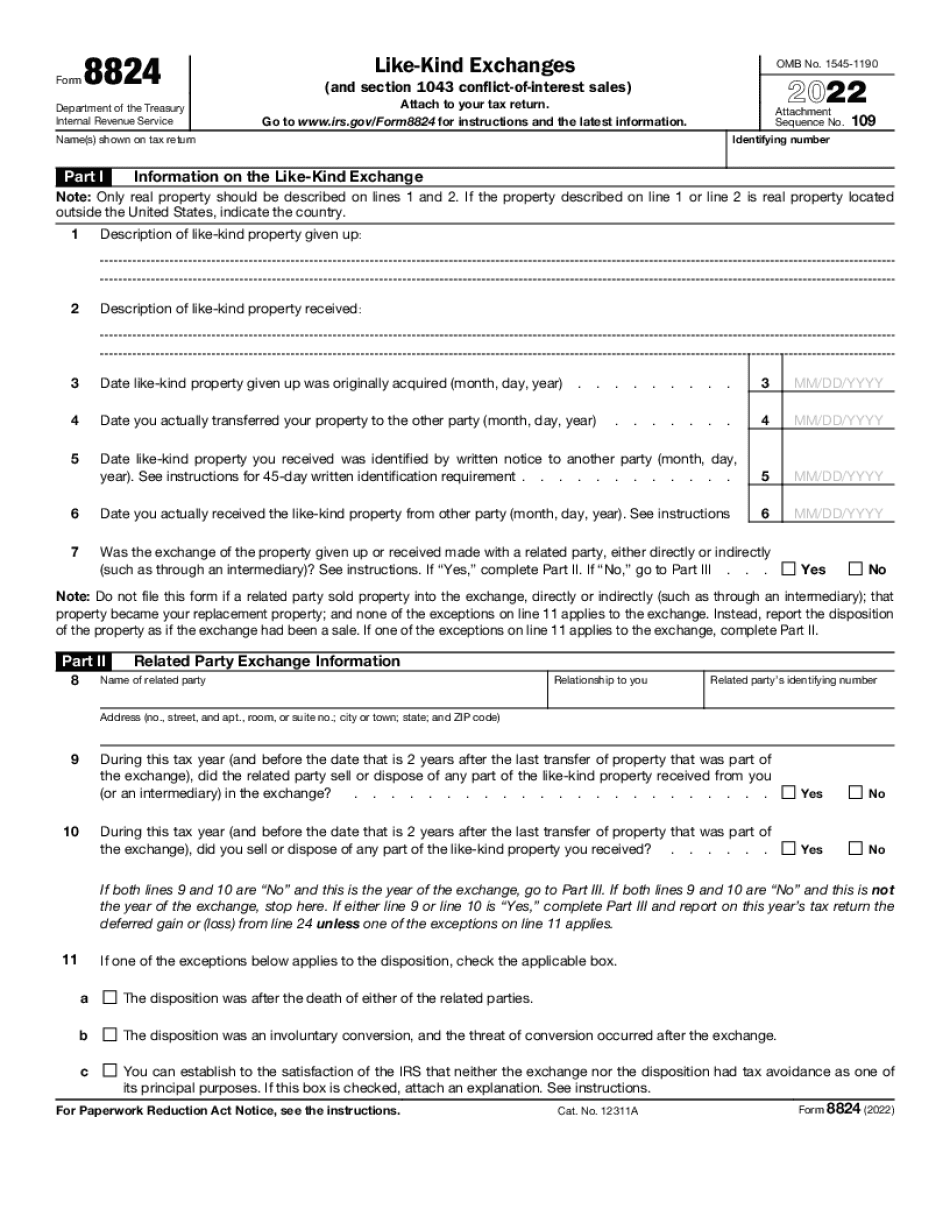

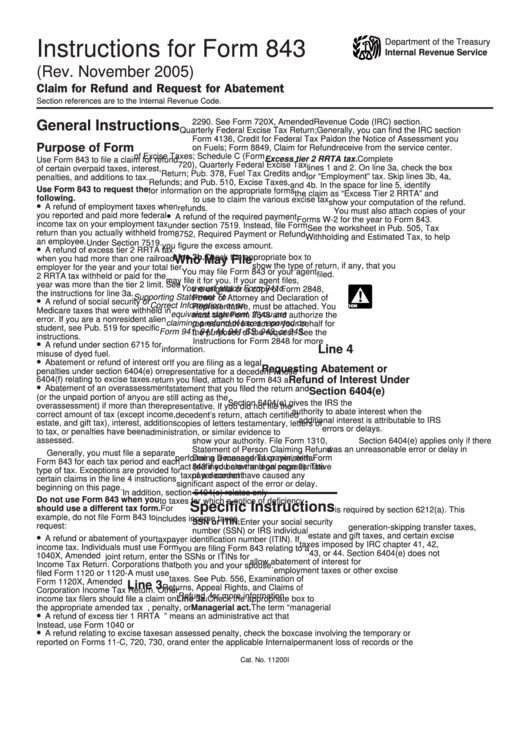

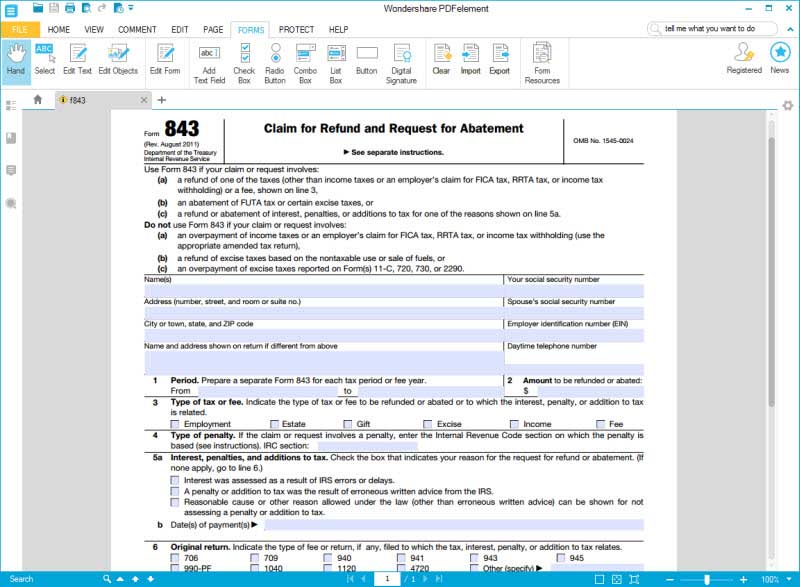

Irs Form 843 Printable - Web form 843 is a multipurpose form used by individuals and businesses to request the refund or removal of various taxes, interest, and penalties. Web to generate form 843:go to screen 61, claim of refund (843).check the box, print form 843 with complete return.scroll down to the claim/request information. Turbotax does not support irs form 843. Check the box print form 843. Line 2 is the total fees/penalties. For example, if on your employment tax return you reported and paid. Web learn how to use irs form 843 to request the irs to abate or erase certain taxes, penalties, fees, and interest. Web download form 843 and the instructions on the irs website. If you are filing form 843 to claim a. Web form 843 is a tax document issued by the internal revenue service (irs) used by taxpayers to make a claim for a refund of certain assessed taxes or to request. Turbotax does not support irs form 843. Use form 843 if your claim or request involves: Line 1 is the tax year the abatement is for. Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Web download form 843 and the instructions on the irs website. Typically, that involves filing form 843. Find out the purposes, filling out, sending, and responding. You can also use this form to. Web form 843, claim for refund and request for abatement can be completed by making entries on the 843 screen. Turbotax does not support irs form 843. Typically, that involves filing form 843. For example, if on your employment tax return you reported and paid. Web use form 843 to file a claim for refund of certain overpaid taxes, interest, penalties, and additions to tax. Line 2 is the total fees/penalties. Form 843 is a multipurpose tax document issued by the irs to claim a refund of. Use form 843 if your claim or request involves: Web download form 843 and the instructions on the irs website. This form is not available in our program. Click on claim for refund (843). Use form 843 if your claim or request involves: Web to generate form 843:go to screen 61, claim of refund (843).check the box, print form 843 with complete return.scroll down to the claim/request information. A refund of one of the taxes (other than. Web form 843, claim for refund and request for abatement can be completed by making entries on the 843 screen. Line 1 is the tax year. Web june 7, 2019 5:08 pm. Web learn how to use irs form 843 to request the irs to abate or erase certain taxes, penalties, fees, and interest. Typically, that involves filing form 843. For example, if on your employment tax return you reported and paid. This form is not available in our program. Web form 843 is a tax document issued by the internal revenue service (irs) used by taxpayers to make a claim for a refund of certain assessed taxes or to request. Form 843 is a multipurpose tax document issued by the irs to claim a refund of certain taxes or request abatement of interest or penalties applied in error. A. Web department of the treasury. Use form 843 if your claim or request involves: Typically, that involves filing form 843. Line 2 is the total fees/penalties. A refund of one of the taxes (other than. Web use form 843 to file a claim for refund of certain overpaid taxes, interest, penalties, and additions to tax. Before you get too excited, you. Line 2 is the total fees/penalties. First, download the form from the irs website or get a copy from a local irs office. Web the irs will often remove penalties for paying or filing. Web the irs will often remove penalties for paying or filing late, but to get relief, you must ask for it. If you are filing form 843 to claim a. Web 1 best answer. Web taxpayers can complete form 843: Web to generate form 843. Web taxpayers can complete form 843: For example, if on your employment tax return you reported and paid. Web form 843 is a multipurpose form used by individuals and businesses to request the refund or removal of various taxes, interest, and penalties. Web use form 843 to file a claim for refund of certain overpaid taxes, interest, penalties, and additions to tax. You can also use this form to. Line 1 is the tax year the abatement is for. Claim for refund and request for abatement, and attach their rationale and evidence to support their reasonable cause. First, download the form from the irs website or get a copy from a local irs office. This form is not available in our program. Web june 7, 2019 5:08 pm. Before you get too excited, you. Web to generate form 843:go to screen 61, claim of refund (843).check the box, print form 843 with complete return.scroll down to the claim/request information. Last updated june 07, 2019 5:08 pm. Use form 843 if your claim or request involves: A refund of one of the taxes (other than. Web download form 843 and the instructions on the irs website.

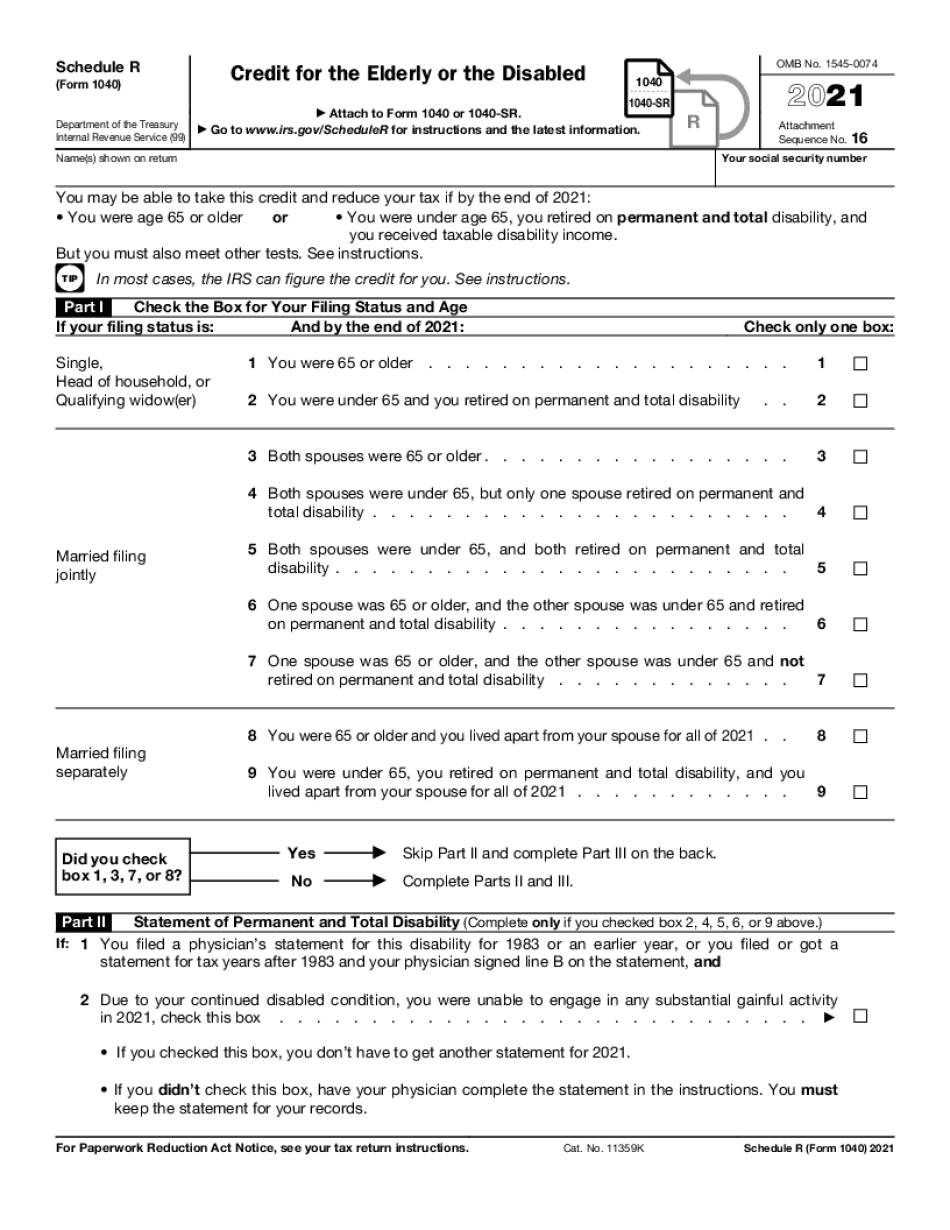

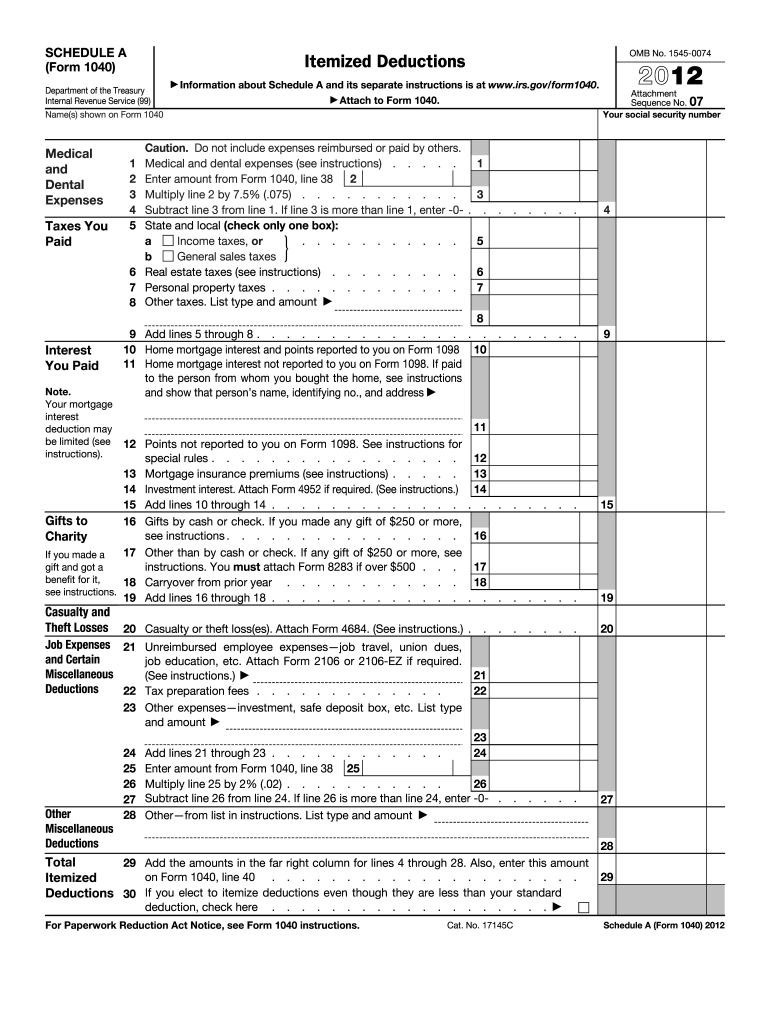

2022 Schedule R (Form 1040) Internal Revenue Service Fill Online

Irs Form 843 Printable

Irs Form 843 Printable

Irs Form 843 Printable Portal Tutorials

Irs Form 3911 Printable

Irs Form 843 Printable

IRS Form 843 Instructions

Irs Form 8615 Printable Printable Forms Free Online

Irs Printable Form 1040

Irs Form 843 Printable

Find Out The Purposes, Filling Out, Sending, And Responding.

Web 1 Best Answer.

Use Form 843 If Your Claim Or Request Involves:

Line 2 Is The Total Fees/Penalties.

Related Post: