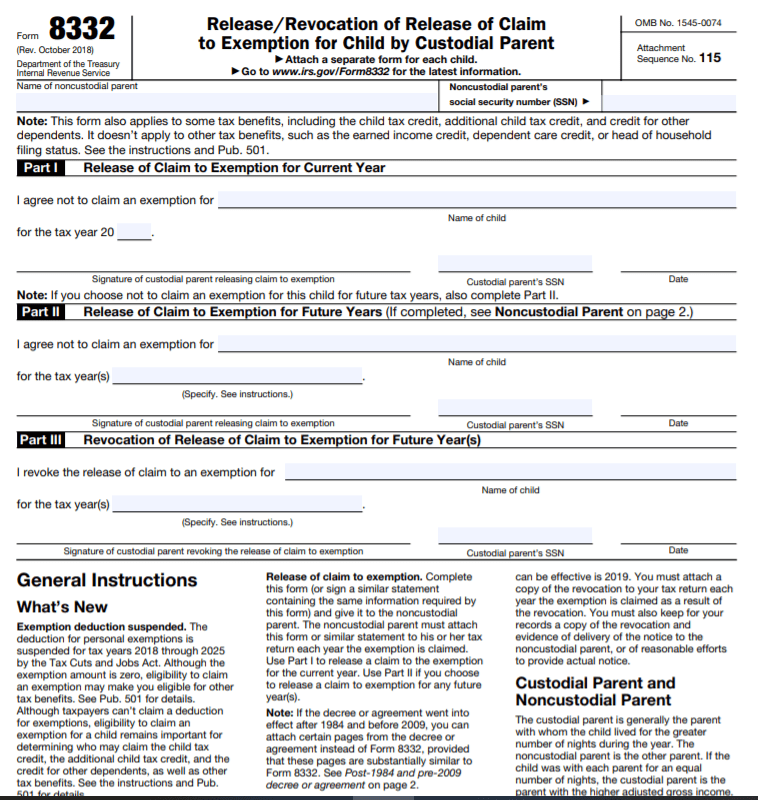

Irs Form 8332 Printable

Irs Form 8332 Printable - Permission can also be granted for future tax years so you do not need to repeatedly file this form. Web form 8332 is generally attached to the claimant's tax return. Release of claim to exemption for child of divorced or separated parents. Irs form 8332 is often used in custodial parent, u.s. Have the social security numbers for yourself and the other parent. Thus, the irs concluded that the father was correct in claiming the children. Web how do i complete irs form 8332? Name name of of noncustodial noncustodial parent parent claiming claiming exemption. The most important reason to file a form 8606 is to clarify your tax picture regarding iras and inherited iras, so that you don’t end up paying more. All noncustodial parents must attach form 8332 or a similar statement to their return each year the custodial parent provides the release. This can be done by writing “all future. Web how do i complete irs form 8332? Web information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. Thus, the irs concluded that the father was correct in claiming the children. Web information about. Be sure to keep copies of. Do not use this form if you were never married. Web what is form 8332 used for? Web this would enable the return to be electronically filed and form 8332 to be sent to the irs along with form 8453. This can be done by writing “all future. If you have custody of your child, but want to release the right to claim your child as a dependent to the noncustodial parent you’ll need to fill out form 8332. In 2018, you decided to revoke the previous release of exemption. Web however, if the special rule on page 2 applies, then the child will be treated as the. Irs form 8332 is often used in custodial parent, u.s. Web this would enable the return to be electronically filed and form 8332 to be sent to the irs along with form 8453. Web exemption for your child on form 8332 for the years 2016 through 2020. Attach to noncustodial parent’s return each year exemption is claimed. All that’s needed. February 2009) department of the treasury internal revenue service. Person (including a resident alien), to provide your correct tin. Web prepare the form 8332 on the custodial parent's return. Web information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. All that’s needed. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Web how do i complete irs form 8332? Release of claim to exemption for child of divorced or separated parents. Follow the onscreen instructions to complete the return. Attach to noncustodial parent’s return each year exemption is claimed. At the top of the form, fill out the noncustodial parent's name and social security number. Complete the lower part of screen 8332. Attach to noncustodial parent’s return each year exemption is claimed. December 2000) department of the treasury internal revenue service. The irs also stated it was permissible for part i not to be completed. December 2000) department of the treasury internal revenue service. Be sure to keep copies of. On the pdf screen, enter information about the 8332 pdf including this exact description 8332. The irs also stated it was permissible for part i not to be completed. Attach to noncustodial parent’s return each year exemption is claimed. Release of claim to exemption for child of divorced or separated parents. Make entries in these fields: Web information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. Tax legislation changes can adjust the rules and benefits tied to claiming dependents, making it. The relevance of form 8332 is particularly highlighted in the context of ongoing tax reforms. Attach to noncustodial parent’s return each year exemption is claimed. Web when to use form 8332. Web this would enable the return to be electronically filed and form 8332 to be sent to the irs along with form 8453. While the tax benefit of exemptions. To complete form 8332 in turbo tax, type revocation of release of claim to exemption for child of divorced or separated parents in the search box and choose jump to. Follow the onscreen instructions to complete the return. Complete the lower part of screen 8332. Release of claim to exemption for child of divorced or separated parents. So noncustodial parents can only use form 8332 to increase their tax refunds by $1,500 to $2,000 per child by claiming the additional child tax credit or the child tax credit. See what is backup withholding, later. Web the irs noted that regs. Web this would enable the return to be electronically filed and form 8332 to be sent to the irs along with form 8453. Be sure to keep copies of. Name name of of noncustodial noncustodial parent parent claiming claiming exemption. Tax legislation changes can adjust the rules and benefits tied to claiming dependents, making it vital for parents to stay informed about the latest tax laws. If you have custody of your child, but want to release the right to claim your child as a dependent to the noncustodial parent you’ll need to fill out form 8332. Print, sign, and distribute to noncustodial parent. Fill out the release/revocation of release of claim to exemption for child by custodial parent online and print it out for free. Web them with form 8332, release/revocation of release of claim to exemption for child by custodial parent, or a similar statement. Delete the data entered in release of claim to exemption (8332) to prevent the form 8453 from generating.

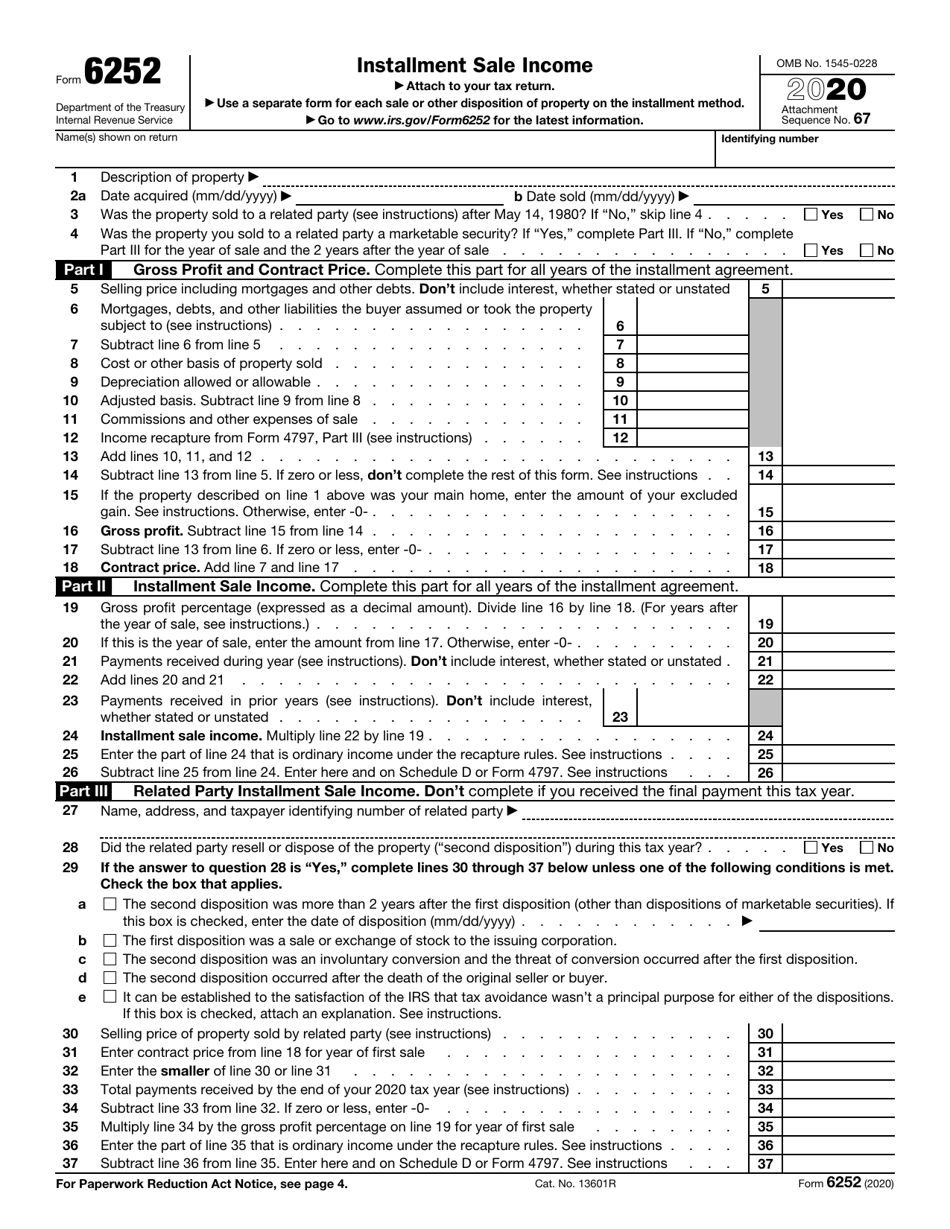

Irs Fillable Forms 2020 Fill Online Printable Fillable Blank Form

IRS Form 8332 How Can I Claim a Child? The Handy Tax Guy

Irs Form 8332 Printable

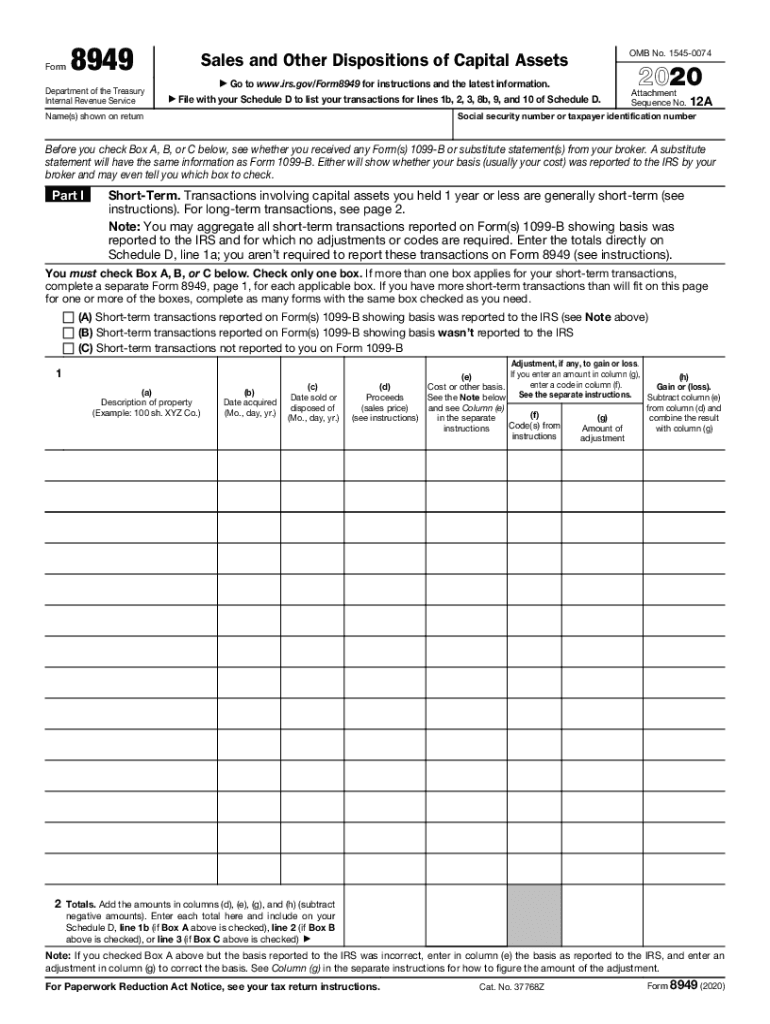

Fillable Irs Form 8949 Printable Forms Free Online

Printable Irs Form 8822 Printable Forms Free Online

Boost Efficiency With Our PDF Converter For IRS Form 8332

Irs Form 8332 Printable

Irs Form 4506 T Printable Printable Forms Free Online

Tax Form 8332 Printable

Form 8332 Release/Revocation of Release of Claim to Exemption for Ch…

February 2009) Department Of The Treasury Internal Revenue Service.

Attach A Separate Form For Each Child.

There Are Three Parts To Form 8832.

Web Prepare The Form 8332 On The Custodial Parent's Return.

Related Post: