Irs Form 1310 Printable

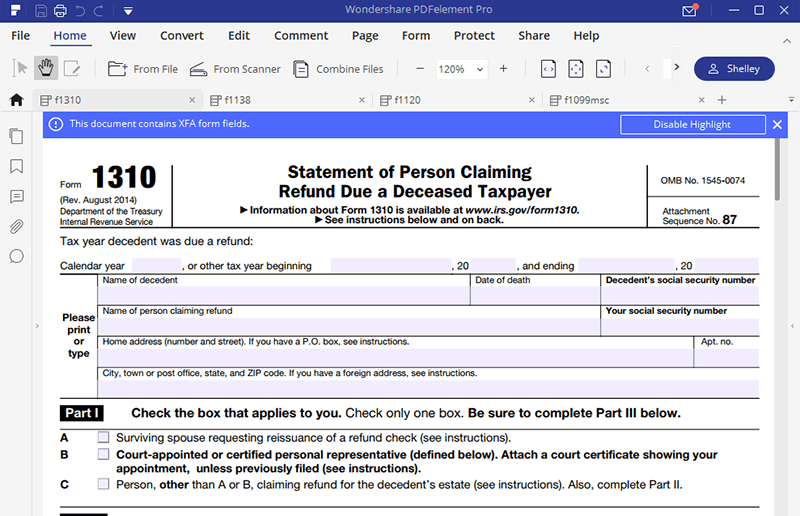

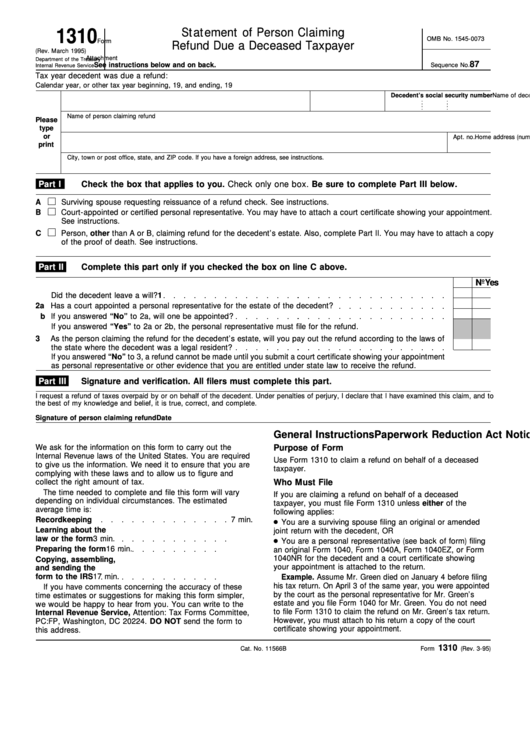

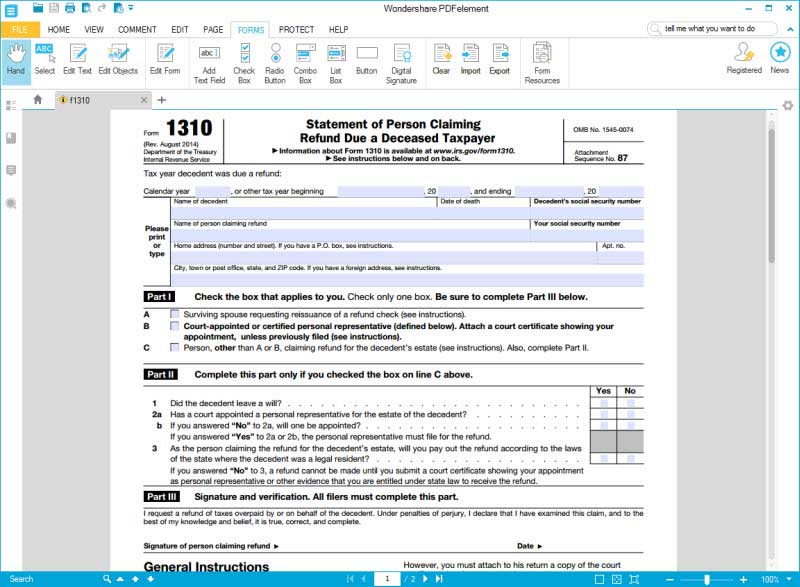

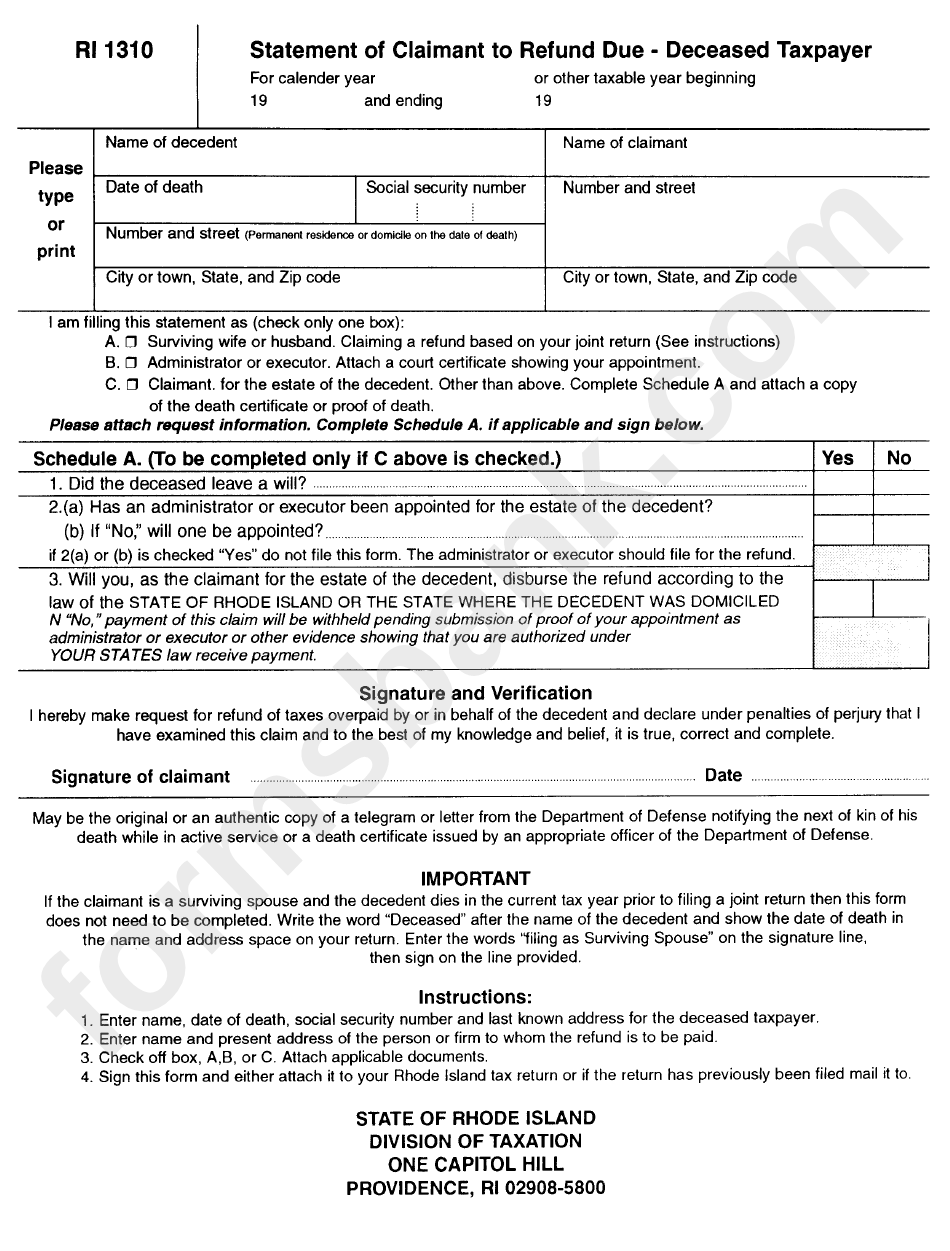

Irs Form 1310 Printable - Web 1 best answer. File irs form 1310 if you want to claim the tax refund for a decedent return (that is, a return filed on the behalf of a. The date of death was noted on the 2021 tax return and filing as surviving spouse printed on the 1040 and form. Client filed mfj as a surviving spouse. Web download and print the official irs form 1310 for claiming refund due a deceased taxpayer. You are a surviving spouse filing an original or. Learn when and how to file this form, and what other documents. You are the surviving spouse filing a joint return, or. Web learn how to file taxes for a deceased taxpayer, including the details of irs form 1310. Web learn who can request a tax refund for a deceased person, which tax forms to file, and how to complete and mail form 1310. Web statement of person claiming refund due a deceased taxpayer (form 1310) unless: Web 1 best answer. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Follow the instructions and complete the required information for the decedent,. You are a surviving spouse filing an original. Web 1 best answer. How to resolve form 1310 critical diagnostic ref. Form 1310 is a tax form that is used to claim a refund for a deceased taxpayer. Web the following articles are the top questions referring form 1310. Although turbotax fills out the 1310 internally, it does not include it when you print you returns for filing or. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Find out the details and related tax forms that. Web download and print irs form 1310, used to claim a refund on behalf of a deceased taxpayer. Web learn how to. You are a surviving spouse filing an original or. Web statement of person claiming refund due a deceased taxpayer (form 1310) unless: Web download and print irs form 1310, used to claim a refund on behalf of a deceased taxpayer. Web 1 best answer. You are the surviving spouse filing a joint return, or. Web learn who can request a tax refund for a deceased person, which tax forms to file, and how to complete and mail form 1310. Client filed mfj as a surviving spouse. You are the surviving spouse filing a joint return, or. Web the following articles are the top questions referring form 1310. You can also efile your federal and. Web 1 best answer. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: You are a surviving spouse filing an original or. How to resolve form 1310 critical diagnostic ref. Find out who is responsible, when to file, how to claim a refund, and more. This seems like a bug to me. File irs form 1310 if you want to claim the tax refund for a decedent return (that is, a return filed on the behalf of a. Web statement of person claiming refund due a deceased taxpayer (form 1310) unless: Learn when and how to file this form, and what other documents. Web if. Web learn how to file taxes for a deceased taxpayer, including the details of irs form 1310. How do i generate form 1310? Choose from the following frequently asked questions about form 1310: You can also efile your federal and. File irs form 1310 if you want to claim the tax refund for a decedent return (that is, a return. Web learn who can request a tax refund for a deceased person, which tax forms to file, and how to complete and mail form 1310. 5 star rated24/7 tech supportmoney back guaranteecancel anytime Web 1 best answer. It is filed as part of a complete tax return and may also include additional forms to. How do i generate form 1310? Web learn who can request a tax refund for a deceased person, which tax forms to file, and how to complete and mail form 1310. This seems like a bug to me. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web download and print. Form 1310 is a tax form that is used to claim a refund for a deceased taxpayer. Client filed mfj as a surviving spouse. Web learn how to file taxes for a deceased taxpayer, including the details of irs form 1310. Choose from the following frequently asked questions about form 1310: Web 1 best answer. File irs form 1310 if you want to claim the tax refund for a decedent return (that is, a return filed on the behalf of a. You are the surviving spouse filing a joint return, or. 5 star rated24/7 tech supportmoney back guaranteecancel anytime Follow the instructions and complete the required information for the decedent,. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Find out who is responsible, when to file, how to claim a refund, and more. Web learn how to file irs form 1310, statement of person claiming refund due a deceased taxpayer, if you are a surviving spouse, beneficiary, or executor of an estate. The date of death was noted on the 2021 tax return and filing as surviving spouse printed on the 1040 and form. How do i generate form 1310? Learn when and how to file this form, and what other documents. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies:

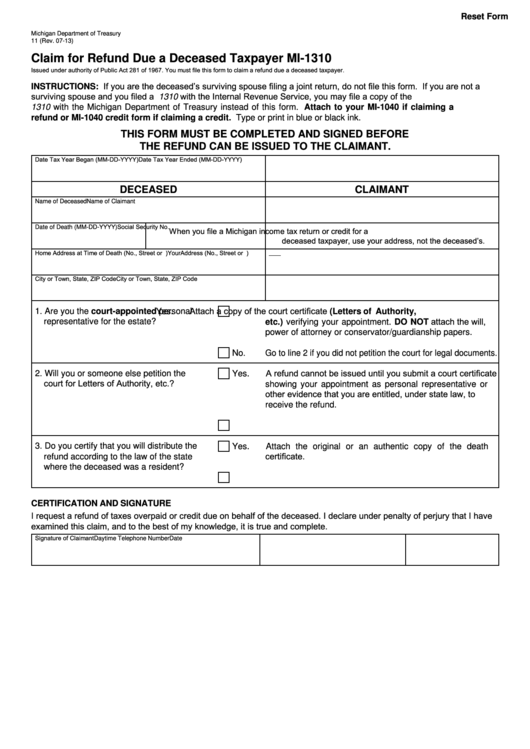

Fillable Form Mi1310 Claim For Refund Due A Deceased Taxpayer

What is IRS Form 1310? Claiming Refund Due a Deceased Taxpayer

IRS Form 1310 How to Fill it Right

Irs Form 1310 Printable 2020 2021 Blank Sample to Fill out Online

Printable Irs 1310 Form Printable Printable Forms Free Online

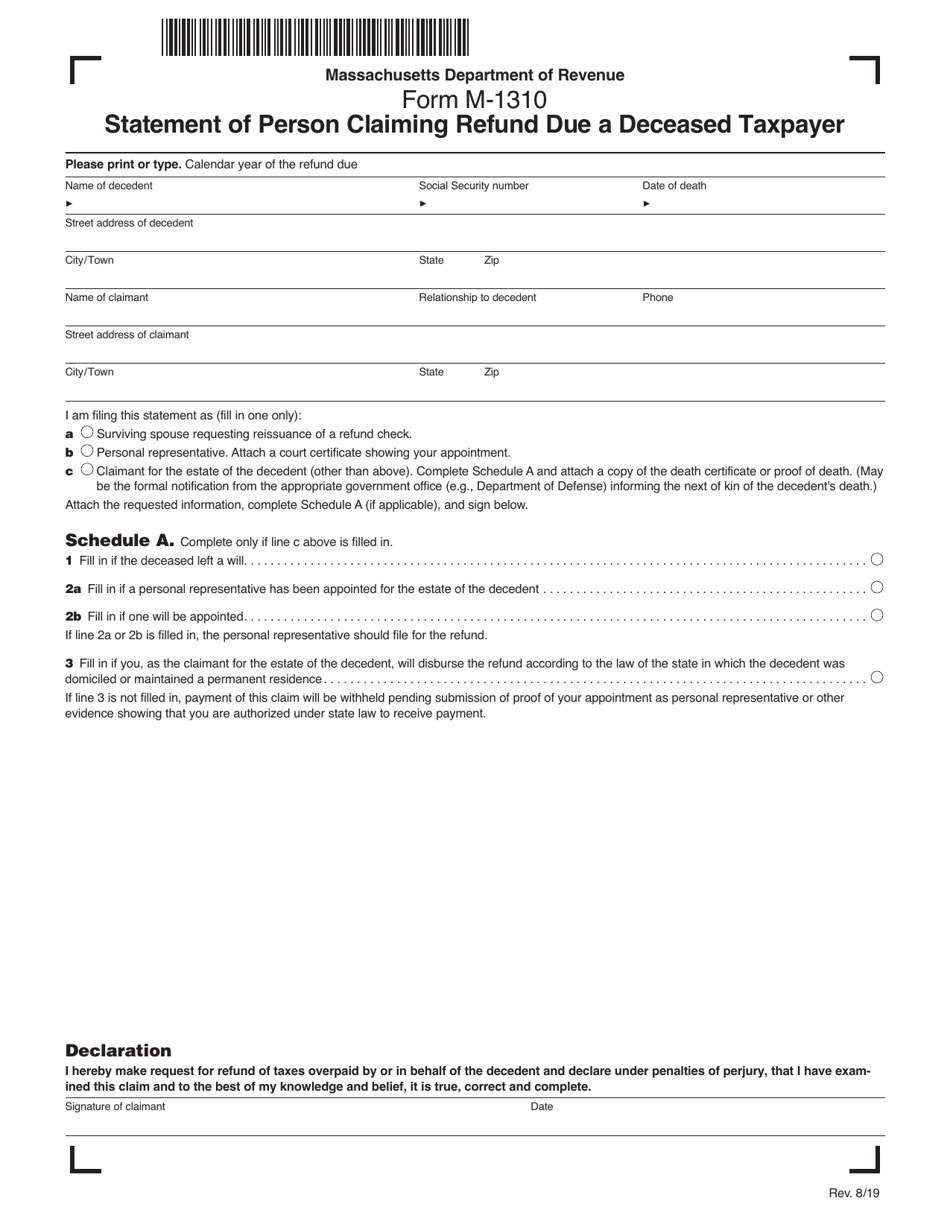

Form M1310 Download Printable PDF or Fill Online Statement of Person

How to File IRS Form 1310 Refund Due a Deceased Taxpayer

IRS Form 1310 How to Fill it with the Best Form Filler

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Printable Irs 1310 Form Printable Printable Forms Free Online

Web Learn Who Can Request A Tax Refund For A Deceased Person, Which Tax Forms To File, And How To Complete And Mail Form 1310.

Web Download Or Print The Latest Version Of Form 1310, Statement Of Person Claiming Refund Due A Deceased Taxpayer, For Tax Year 2023.

Find Out The Details And Related Tax Forms That.

It Is Filed As Part Of A Complete Tax Return And May Also Include Additional Forms To.

Related Post: