Inverse Head And Shoulders Pattern Bullish Or Bearish

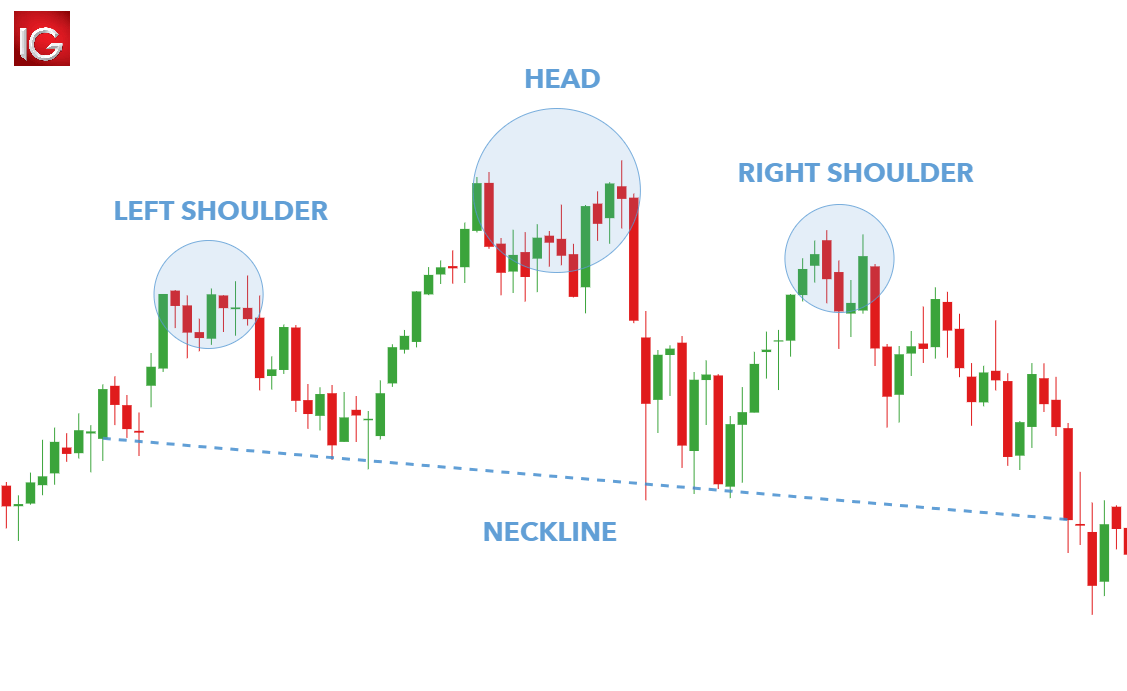

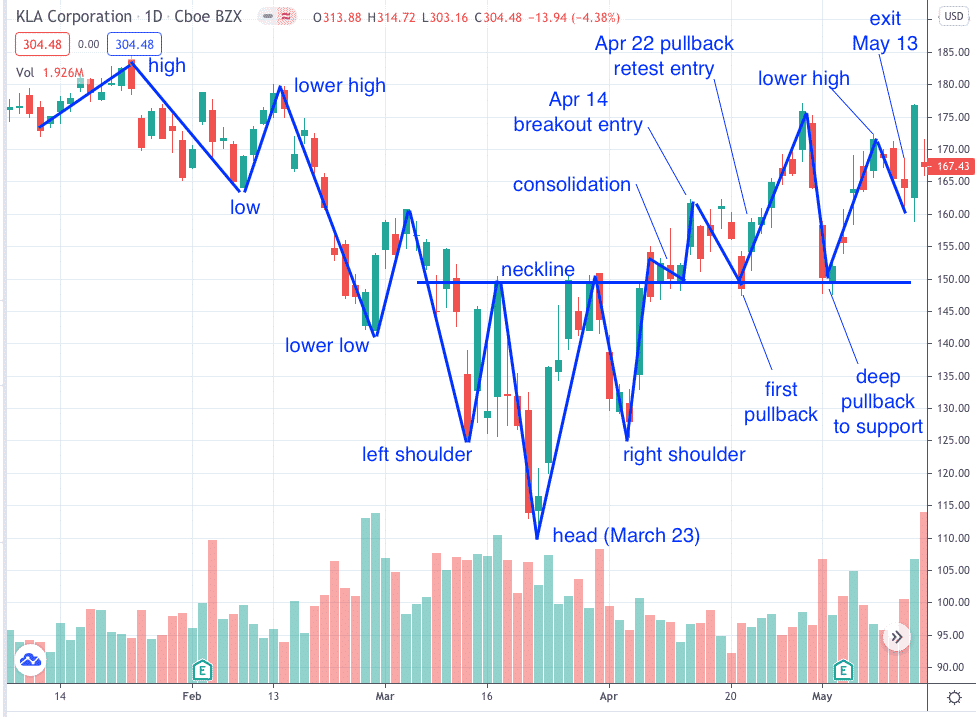

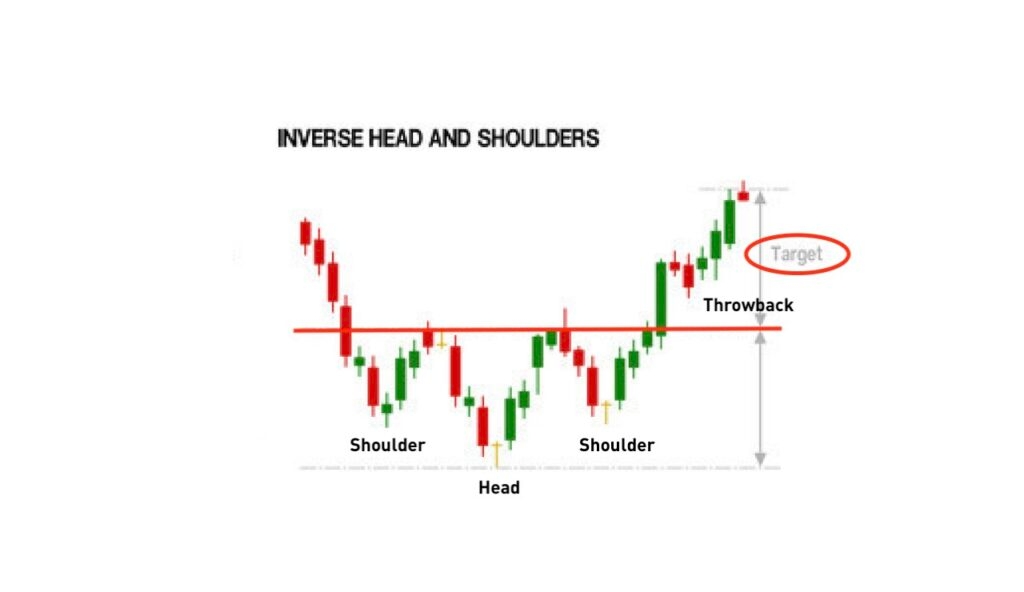

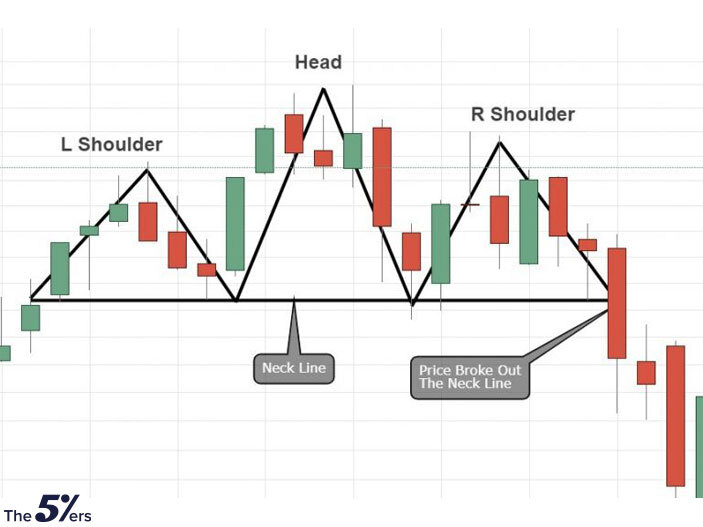

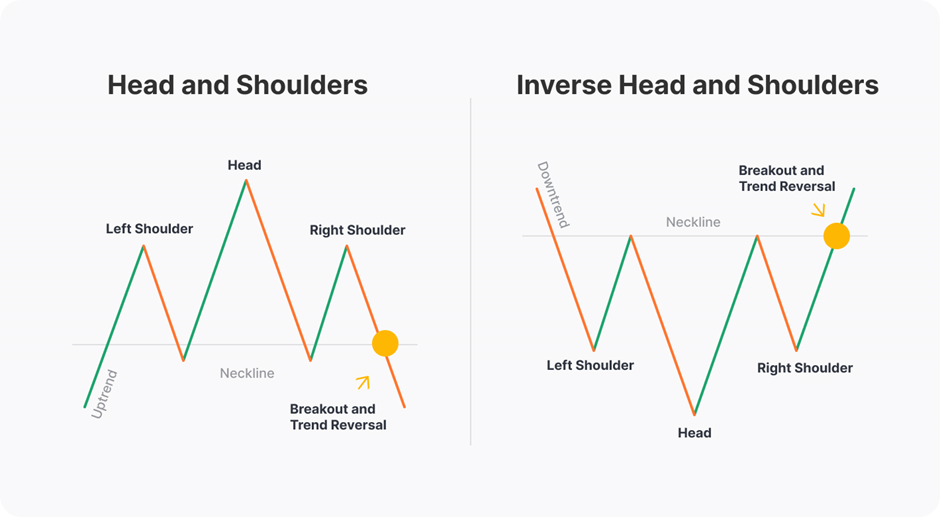

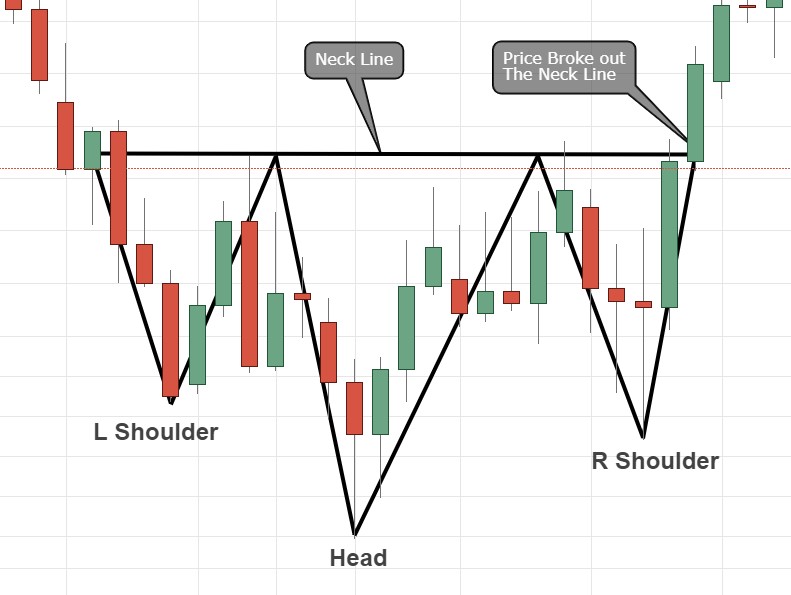

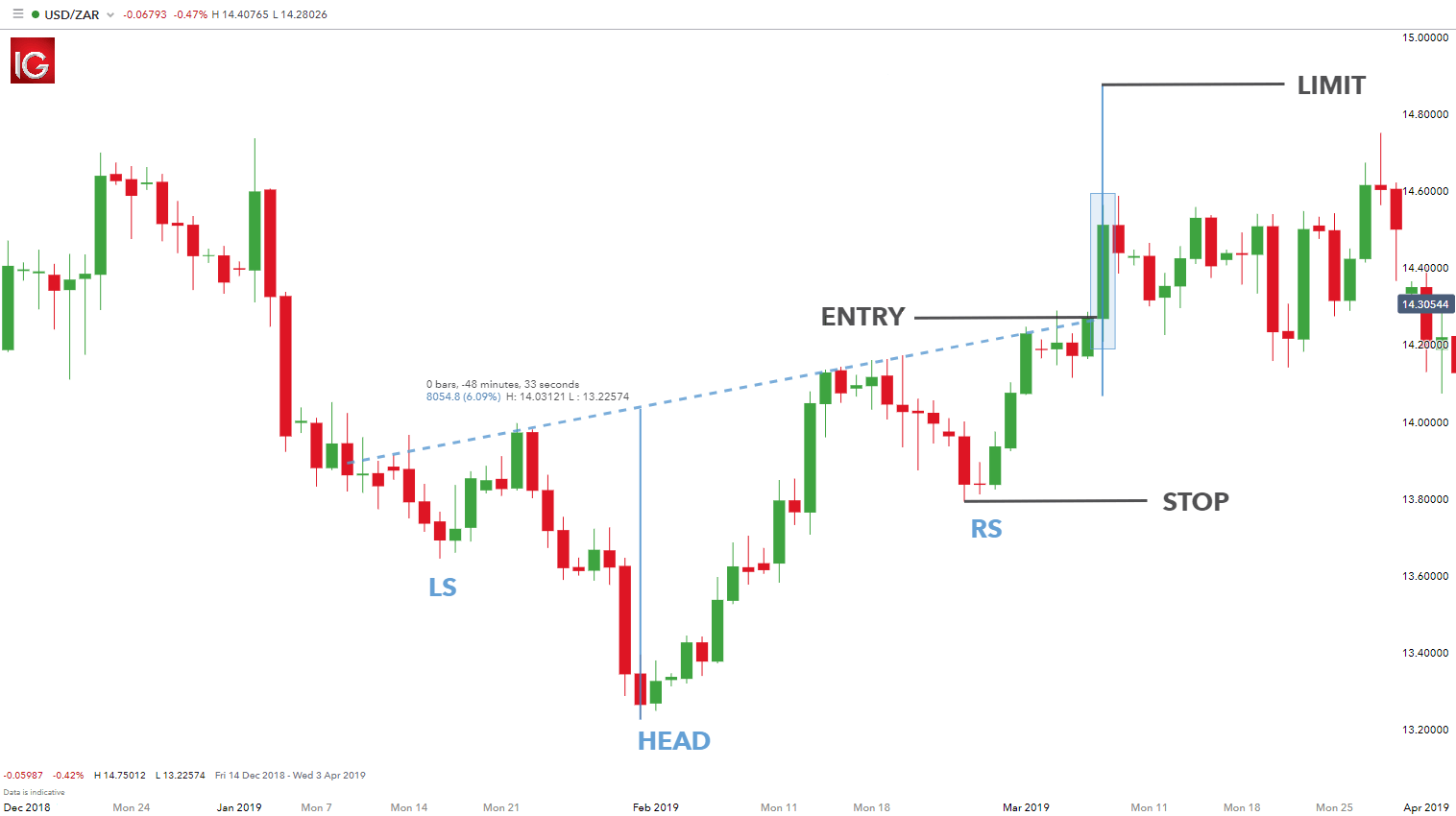

Inverse Head And Shoulders Pattern Bullish Or Bearish - It’s the opposite of the head and shoulders. What is the inverse head and shoulders candlestick pattern? Web on the other hand, an inverse head and shoulders pattern is a bullish reversal pattern that signals a potential trend reversal from bearish to bullish. Web mostly the cup and handle pattern is considered bullish but its twin inverse cup and handle looks forward to decline in the price. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. Web on the other hand, the inverse head and shoulders is a bullish reversal pattern that occurs at the end of a downtrend. Web the inverse head and shoulders pattern suggests going from a downtrend to an uptrend. Web an inverse head and shoulder pattern is similar to the standard head and shoulder patterns except it is inverted, and it also indicates a bullish trend reversal upon. Web head & shoulders are reversal patterns (like double/triple tops/bottoms and wedges) that form at the top or bottom of a trend with the bottoms being bullish and the tops being. It is characterized by a. Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern, with a price. Web on the other hand, an inverse head and shoulders pattern is a bullish reversal pattern that signals a potential trend reversal from bearish to bullish. Web mostly. How to trade in inverse head and shoulders pattern. The sellers have run out of gas as they were unable to. It is characterized by a. Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern, with a price. Web mostly. How to trade in inverse head and shoulders pattern. Is the inverse head and shoulders bullish or bearish? Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Web on the other hand, the inverse head and shoulders is a bullish reversal pattern that occurs at. The inverse head and shoulders pattern is a bullish candlestick formation. Web a traditional head and shoulders pattern indicates a bullish to bearish trend, whereas the inverted head and shoulders signals the opposite. Web the inverse head and shoulders pattern encapsulates a storyline of market sentiment evolution, a narrative that describes the transition from widespread pessimism. The sellers have run. Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern, with a price. The sellers have run out of gas as they were unable to. Web an inverse head and shoulder pattern is similar to the standard head and shoulder patterns. Market sentiment is shifting from bearish to bullish. Web on the other hand, the inverse head and shoulders is a bullish reversal pattern that occurs at the end of a downtrend. Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Despite the bearish outlook, kevin. Web on the other hand, the inverse head and shoulders is a bullish reversal pattern that occurs at the end of a downtrend. Web mostly the cup and handle pattern is considered bullish but its twin inverse cup and handle looks forward to decline in the price. This pattern is formed when an asset’s price. The sellers have run out. Despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and. The first and third troughs are. Web on the other hand, an inverse head and shoulders pattern is a bullish reversal pattern that signals a potential trend reversal from bearish to bullish. The inverse. Formation of the head and shoulders pattern in trendline indicates a reversal in. It is the opposite of the head and shoulders chart pattern, which is a bearish formation. Web an inverse head and shoulder pattern is similar to the standard head and shoulder patterns except it is inverted, and it also indicates a bullish trend reversal upon. Web may. Web there is a bullish divergence developing in the macd’s momentum, aligning with this positive outlook. Web the inverse head and shoulders pattern suggests going from a downtrend to an uptrend. The first and third troughs are. Web the inverse head and shoulders, or inverted h&s pattern, is formed at the end of a downtrend. The head and shoulders pattern. Despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and. The first and third troughs are. Web the inverse head and shoulders pattern encapsulates a storyline of market sentiment evolution, a narrative that describes the transition from widespread pessimism. Web the inverse head and shoulders, or inverted h&s pattern, is formed at the end of a downtrend. Web there is a bullish divergence developing in the macd’s momentum, aligning with this positive outlook. Web an inverse head and shoulder pattern is similar to the standard head and shoulder patterns except it is inverted, and it also indicates a bullish trend reversal upon. How to trade in inverse head and shoulders pattern. Web bitcoin’s price chart is showing an inverse head and shoulders pattern, a strong indicator that often predicts a reversal of a previous downward trend. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. It is the opposite of the head and shoulders chart pattern, which is a bearish formation. Web a traditional head and shoulders pattern indicates a bullish to bearish trend, whereas the inverted head and shoulders signals the opposite. Btc/usdt daily chart | credit: This pattern is formed when an asset’s price. It’s the opposite of the head and shoulders. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. Web on the other hand, the inverse head and shoulders is a bullish reversal pattern that occurs at the end of a downtrend.

The Head and Shoulders Pattern A Trader’s Guide

Inverse Head and Shoulders Pattern How To Spot It

What is Inverse Head and Shoulders Pattern & How To Trade It

Bullish Inverted Head and Shoulder YouTube

Head and Shoulders Pattern What Is It & How to Trade With It? Bybit

Five Powerful Reversal Patterns Every Trader Must know My Forex Signals

How to Trade with the Inverse Head and Shoulders Pattern Market Pulse

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Five Powerful Patterns Every Trader Must know Video and Examples

The Head and Shoulders Pattern A Trader’s Guide

Web The Head And Shoulders Pattern Is An Accurate Reversal Pattern That Can Be Used To Enter A Bearish Position After A Bullish Trend.

Web May 12, 2024.

What Is The Inverse Head And Shoulders Candlestick Pattern?

The Inverse Head And Shoulders Chart Pattern Consists Of Three (3) Troughs:

Related Post: