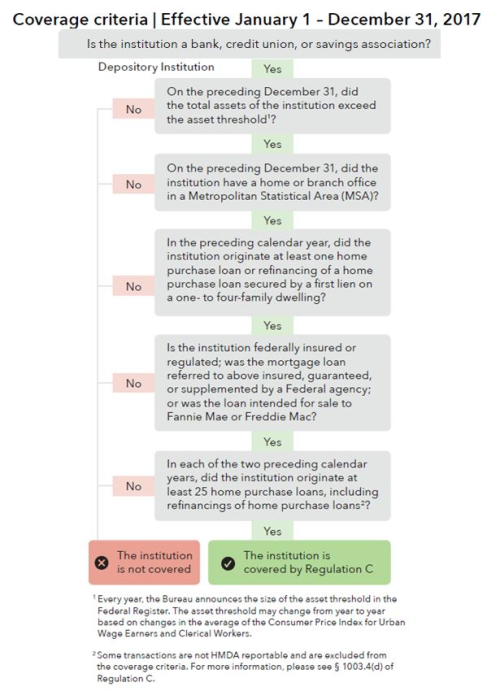

Hmda Flow Chart

Hmda Flow Chart - Under hmda and regulation c, a transaction is reportable only if it is an application for, an origination of, or a purchase of a covered loan. We have flowcharts, data guides, collection forms, etc., designed with the intent of helping you comply with the hmda requirements. Web the home mortgage disclosure act (hmda) was enacted by congress in 1975 and was implemented by the federal reserve board's regulation c. Web 📄️ hmda data collection timelines. The cfpb will process the hmda data for the federal hmda reporting agencies and the ffiec, and Edits that check whether the loan/application register is in the correct format and whether the data covers the. You can download it here: There are four types of edits: Web this chart is intended to be used as a reference tool for data points required to be collected, recorded, and reported under regulation c, as amended by the hmda rules issued on october 15, 2015, on august 24, 2017, and on october 10, 2019.a relevant regulation and commentary sections are provided for ease of reference. Web the federal hmda reporting agencies (the board, cfpb, hud, fdic, ncua, and occ), referred to as the “appropriate federal agency” in regulation c, agreed that, beginning on january 1, 2018, all hmda filers will file their hmda data with the cfpb. Web the cfpb recently posted the reportable hmda data: Web hmda edits are rules to assist filers in checking the accuracy of hmda data prior to submission. Under hmda and regulation c, a transaction is reportable only if it is an application for, an origination of, or a purchase of a covered loan. Edits that check whether the loan/application register. Information regarding the hmda platform can be located at: Web 📄️ hmda data collection timelines. This chart is intended to be used as a reference tool for data points required to be collected, recorded, and reported under regulation c, as amended by the hmda rules issued on october 15, 2015, on august 24, 2017, on october 10, 2019. Answers to. Our free resources are a treasure trove of helpful information. On march 15, 2023, the cfpb published the 2023 hmda institutional coverage chart and 2023 hmda transactional coverage chart. Web the chart serves as a reference tool for data points that are required to be collected, recorded, and reported under regulation c, as amended by hmda rules, which were most. Web this chart is intended to be used as a reference tool for data points required to be collected, recorded, and reported under regulation c, as amended by the hmda rules issued on october 15, 2015, and on august 24, 2017, and section 104(a) of the economic growth, regulatory relief, and consumer protection act as implemented and clarified by the. Under hmda and regulation c, a transaction is reportable only if it is an application for, an origination of, or a purchase of a covered loan. The cfpb will process the hmda data for the federal hmda reporting agencies and the ffiec, and A financial institution is a subsidiary of a bank or savings association (for purposes of reporting hmda. Web 📄️ hmda data collection timelines. Edits that check whether the loan/application register is in the correct format and whether the data covers the. Web filers will submit their hmda data using a web interface. Web hmda edits are rules to assist filers in checking the accuracy of hmda data prior to submission. Information regarding the hmda platform can be. Our free resources are a treasure trove of helpful information. A suite of tools that allows users to filter, summarize, download, and visualize hmda datasets. Institutional coverage charts are reference tools illustrating the criteria to help determine whether an institution is covered by regulation c. Transactional coverage charts are reference tools illustrating one approach to help determine whether a transaction. There are four types of edits: Web the home mortgage disclosure act (hmda) was enacted by congress in 1975 and was implemented by the federal reserve board's regulation c. The cfpb will process the hmda data for the federal hmda reporting agencies and the ffiec, and The 2015 hmda rule modified the types of institutions and transactions subject to regulation. The guide will instruct the beginner user how to find and download hmda data, select subsets and filters for the data, and begin to analyze the hmda data using pivot tables, grouping data The 2015 hmda rule modified the types of institutions and transactions subject to regulation c, the types of data that institutions are required to collect, and the. Frequently asked questions (faqs) on the home mortgage disclosure (hmda) rule, which is located in regulation c. Web 📄️ hmda data collection timelines. Institutional coverage charts are reference tools illustrating the criteria to help determine whether an institution is covered by regulation c. Transactional coverage charts are reference tools illustrating one approach to help determine whether a transaction is reportable. A beginner's guide to hmda data; Regulation c, requires lending institutions to report public. There are four types of edits: We recommend that hmda filers use a modern browser, such as the latest version of google chrome ™, mozilla ® Web the cfpb recently posted the reportable hmda data: Hmda filing platform//ffiec.cfpb.gov/filing/ 📄️ hmda quarterly graphs. The updated charts are effective january 1, 2023. The cfpb will process the hmda data for the federal hmda reporting agencies and the ffiec, and Web hmda edits are rules to assist filers in checking the accuracy of hmda data prior to submission. Transactional coverage charts are reference tools illustrating one approach to help determine whether a transaction is reportable under hmda. A regulatory and reporting overview reference chart for hmda data collected in 2023a. Frequently asked questions (faqs) on the home mortgage disclosure (hmda) rule, which is located in regulation c. Under hmda and regulation c, a transaction is reportable only if it is an application for, an origination of, or a purchase of a covered loan. You can download it here: The 2015 hmda rule modified the types of institutions and transactions subject to regulation c, the types of data that institutions are required to collect, and the processes for reporting and disclosing the required data. Web we have published our 2018 flowchart for hmda transactions.

HMDA Flowchart

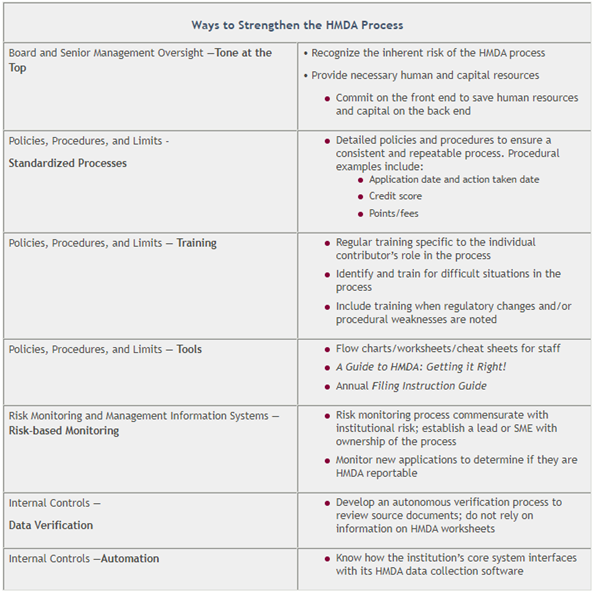

Sound Practices for Effective HMDA Compliance NAFCU

A Guide To HMDA Reporting Getting It Right!

HMDA Reporting Process

hmdatridchart

2017 Adjusted Threshold Levels for Regulations Z and C; Updated HMDA

Hmda Flow Chart Cheat Sheet

Hmda Flow Chart Cheat Sheet

Hmda Flow Chart Cheat Sheet

Your top 10 HMDA questions answered Part 6 HousingWire

A Financial Institution Is A Subsidiary Of A Bank Or Savings Association (For Purposes Of Reporting Hmda Data To The Same Agency As The Parent) If The Bank Or Savings Association Holds Or Controls An Ownership Interest In The Financial Institution That Is Greater Than 50 Percent.

Web 9 The Federal Hmda Reporting Agencies (The Board, Cfpb, Hud, Fdic, Ncua, And Occ), Referred To As The “Appropriate Federal Agency” In Regulation C, Agreed That, Beginning On January 1, 2018, All Hmda Filers Will File Their Hmda Data With The Cfpb.

These Materials Illustrate One Approach To Help Determine Whether.

Follow Us On Youtube, Linkedin, And Facebook For Continued Updates.

Related Post: