Head And Shoulders Pattern Bullish

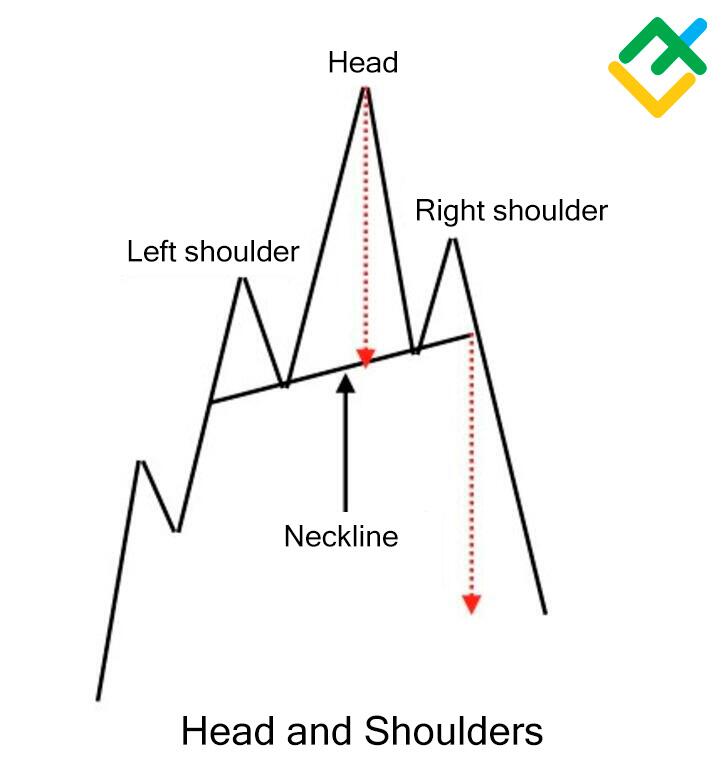

Head And Shoulders Pattern Bullish - Web a bullish head and shoulders pattern is also called an inverse or reverse head and shoulders pattern. It consists of 3 tops with a higher high in the middle, called the head. It is the opposite of the head and shoulders chart pattern,. The head and shoulders pattern is one of the most reliable reversal patterns. Web the head and shoulders pattern is seen as a warning sign for traders and investors who were previously bullish on an asset. Btc/usdt daily chart | credit: It appears in a bearish market and signals a trend reversal up. Standard head and shoulder patterns are an indicator of a sizable downward price reversal from a prior upward trend, so head and shoulder patterns are bearish. An inverse head and shoulders. It is considered one of the most reliable chart patterns and is identified by three peaks. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. If you want to up your trading game, you'll need to get familiar with how to spot this powerful formation. As a trader, being able to recognize these chart patterns can give you a huge advantage. It is often referred to as. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. Btc/usdt daily chart | credit: Web a head and shoulders pattern is a bearish reversal pattern, which signals that the uptrend has peaked, and the reversal has started as the series of the higher highs (the first and second peak) is broken. When the price reaches the head low, it turns up, and a new bullish trend starts. The pattern resembles a human head and shoulders, hence the name. Web the head and shoulders chart pattern is a technical analysis chart formation used to identify potential reversals in the trend of a stock. Web head & shoulders are reversal patterns (like double/triple. Web is a head and shoulders pattern bullish? This pattern, recognized for indicating potential upward momentum, suggests a positive shift in market dynamics. It is often referred to as an inverted head and shoulders pattern in downtrends, or simply the head and. It appears in a bearish market and signals a trend reversal up. 5 reasons why forex traders should. The analyst also predicts that near’s bullish trend against. Web a bullish head and shoulders pattern is also called an inverse or reverse head and shoulders pattern. Web the head and shoulders formation is one of the most famous chart patterns, known for its performance in bullish conditions. The pattern resembles a left shoulder, head, and right shoulder, hence the. It consists of 3 tops with a higher high in the middle, called the head. As a trader, being able to recognize these chart patterns can give you a huge advantage. The head and shoulders pattern is exactly what the term indicates. Web is a head and shoulders pattern bullish? Web the head and shoulders pattern is one of the. The pattern resembles a left shoulder, head, and right shoulder, hence the term head and. It appears as a series of three peaks with the middle one being the highest (the head). What does a head and shoulders pattern tell you? The head and shoulders chart pattern is a reversal pattern and most often seen in uptrends. It consists of. Web head & shoulders are reversal patterns (like double/triple tops/bottoms and wedges) that form at the top or bottom of a trend with the bottoms being bullish and the tops being bearish. On the other hand, reverse, or inverse head and shoulder patterns indicate a bullish chart reversal from a downward trend to an. Web a head and shoulders pattern. The pattern resembles a human head and shoulders, hence the name. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. Web head & shoulders are reversal patterns (like double/triple tops/bottoms and wedges) that form at the top or bottom of a trend with the bottoms being bullish and. Web a bullish head and shoulders pattern is also called an inverse or reverse head and shoulders pattern. Web the head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. If you want to up your trading game, you'll need to get familiar with how to spot this powerful formation.. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. Web the head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. The pattern can be used to predict both the reversal point and the target price. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. It appears in a bearish market and signals a trend reversal up. It is considered one of the most reliable chart patterns and is identified by three peaks. A characteristic pattern takes shape and is recognized as reversal formation. Standard head and shoulder patterns are an indicator of a sizable downward price reversal from a prior upward trend, so head and shoulder patterns are bearish. Not only is “head and shoulders” known for trend reversals, but it’s also known for dandruff reversals as well. Web head & shoulders are reversal patterns (like double/triple tops/bottoms and wedges) that form at the top or bottom of a trend with the bottoms being bullish and the tops being bearish. Web a bullish head and shoulders pattern is also called an inverse or reverse head and shoulders pattern. The pattern resembles a human head and shoulders, hence the name. If you want to up your trading game, you'll need to get familiar with how to spot this powerful formation. The head and shoulders pattern is exactly what the term indicates. However, this pattern is mostly associated with shorting strategies based on a massive distribution pattern that looks like a.

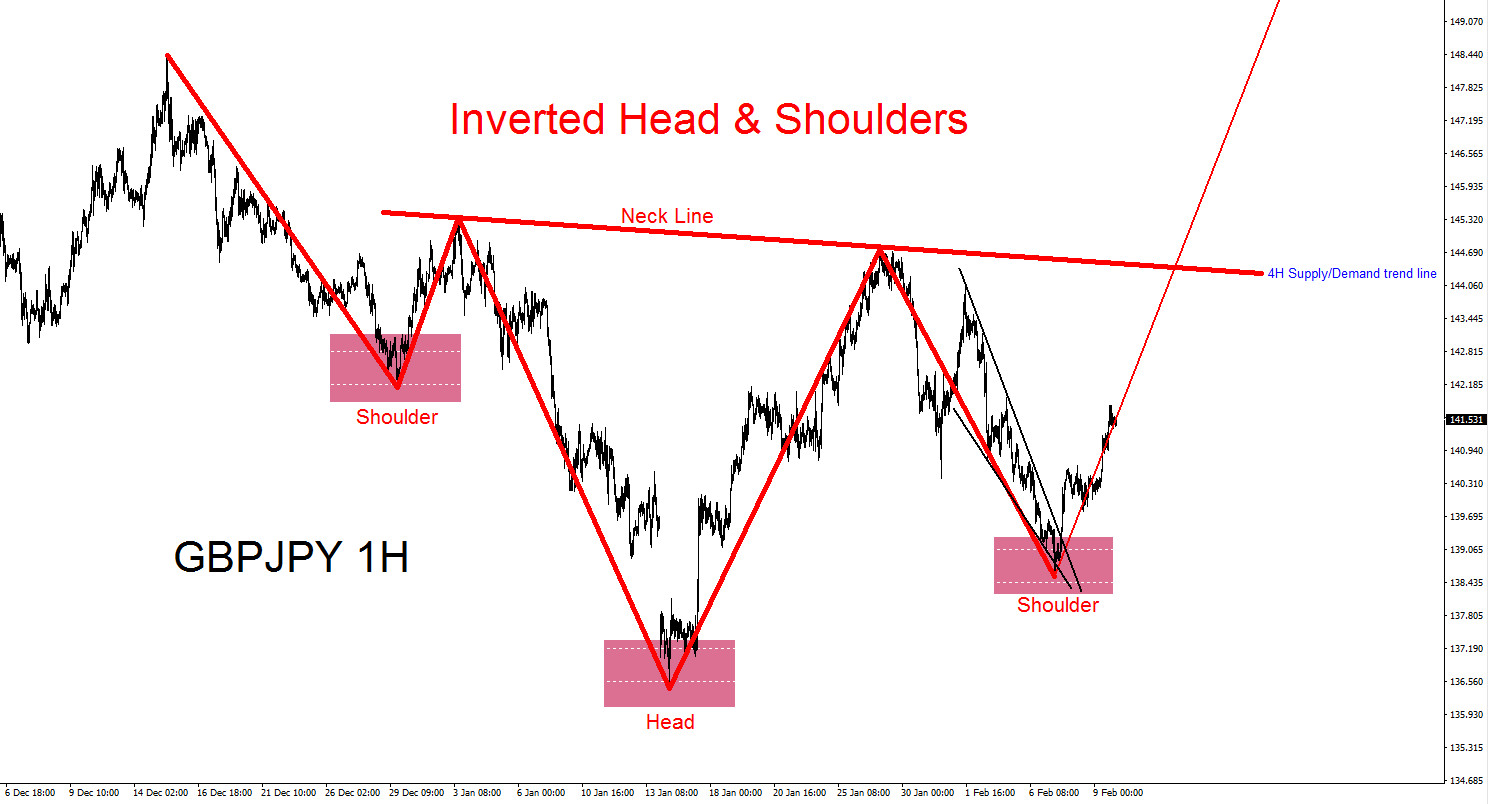

GBPJPY Bullish Trend Starting? Part 2

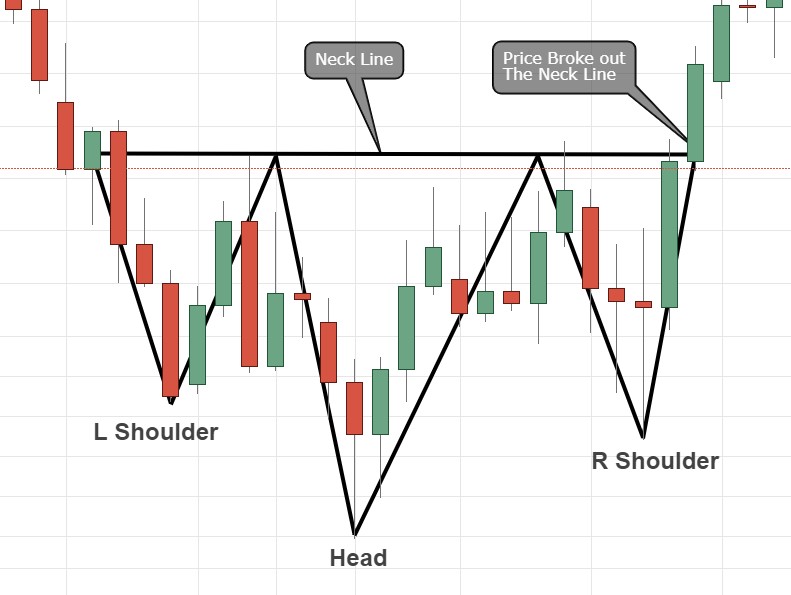

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

Bullish Inverted Head and Shoulder YouTube

BTC BULLISH head and shoulders pattern for BINANCEBTCUSDT by saeidghp

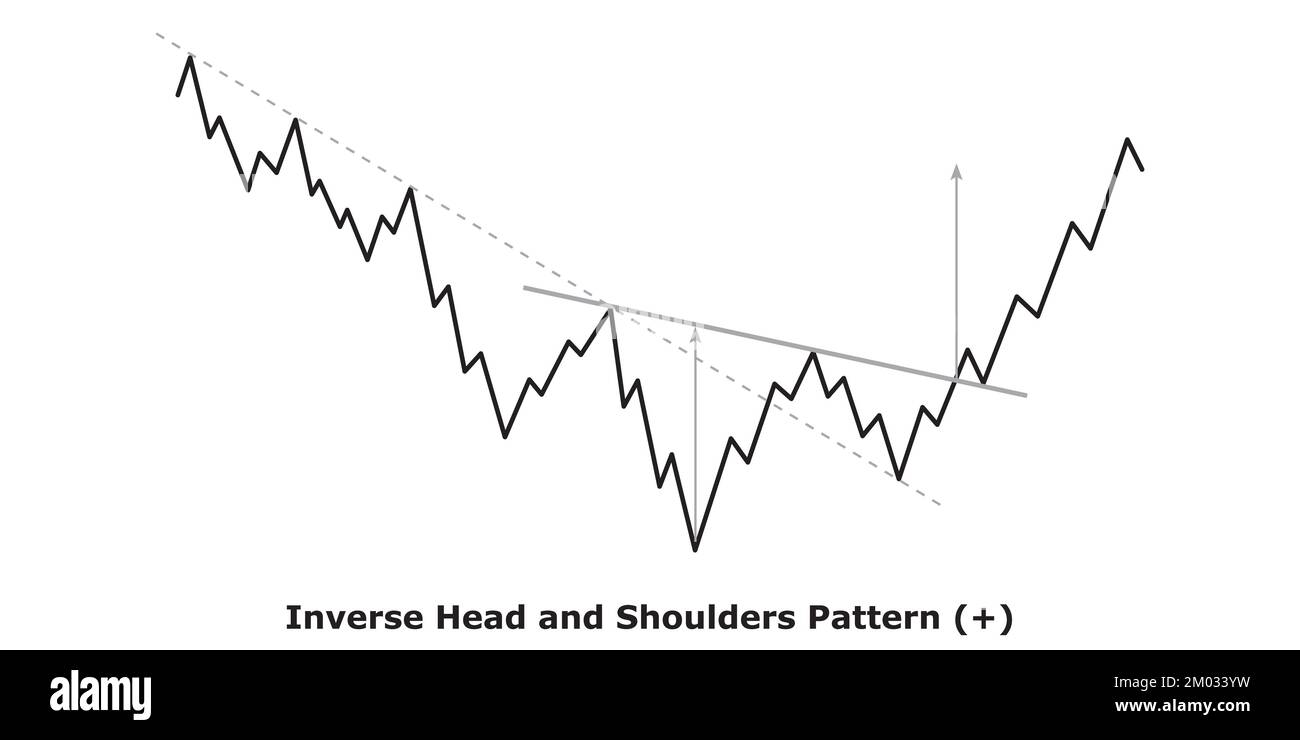

Inverse Head and Shoulders Bullish (+) White & Black Bullish

Head and Shoulder Chart pattern for BULLISH TREND formed YouTube

Five Powerful Patterns Every Trader Must know Video and Examples

XAUUSD > Bullish Head and Shoulders Pattern!! for OANDAXAUUSD by

Head and Shoulders Pattern Definition, Stock Trading Chart, Bullish

Quantum Materials Corp. (fka QTMM) Bullion HeadAndShoulder pattern...

This Pattern, Recognized For Indicating Potential Upward Momentum, Suggests A Positive Shift In Market Dynamics.

There Are Two Things To Keep In Mind When Looking For A Head And Shoulders Pattern.

It Is The Opposite Of The Head And Shoulders Chart Pattern,.

When The Price Reaches The Head Low, It Turns Up, And A New Bullish Trend Starts.

Related Post: