Head And Shoulders Pattern Bottom

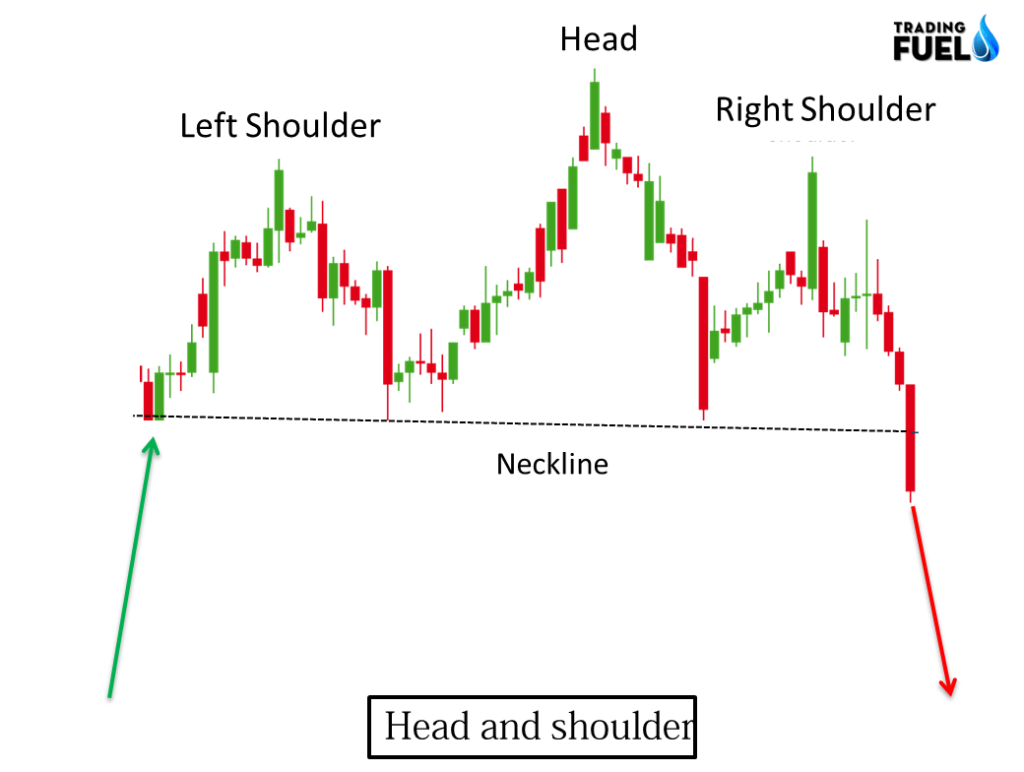

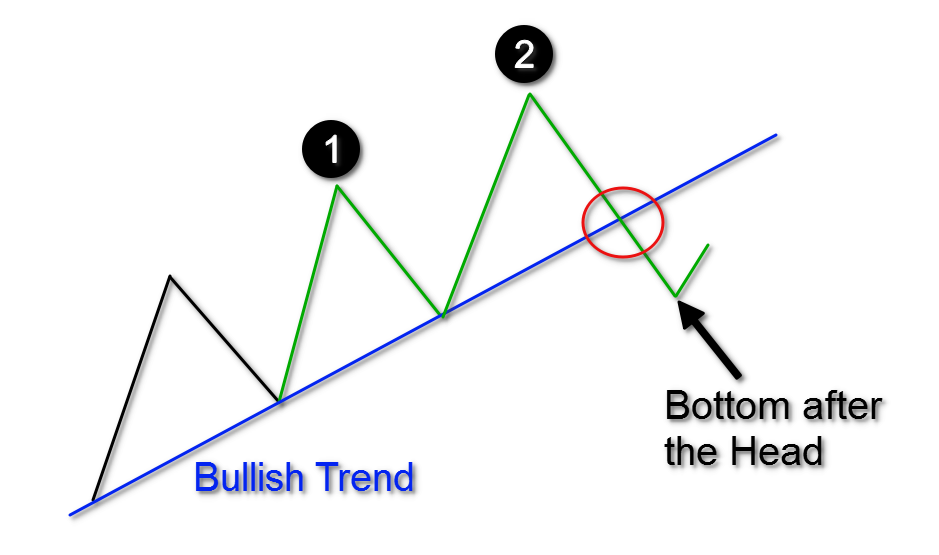

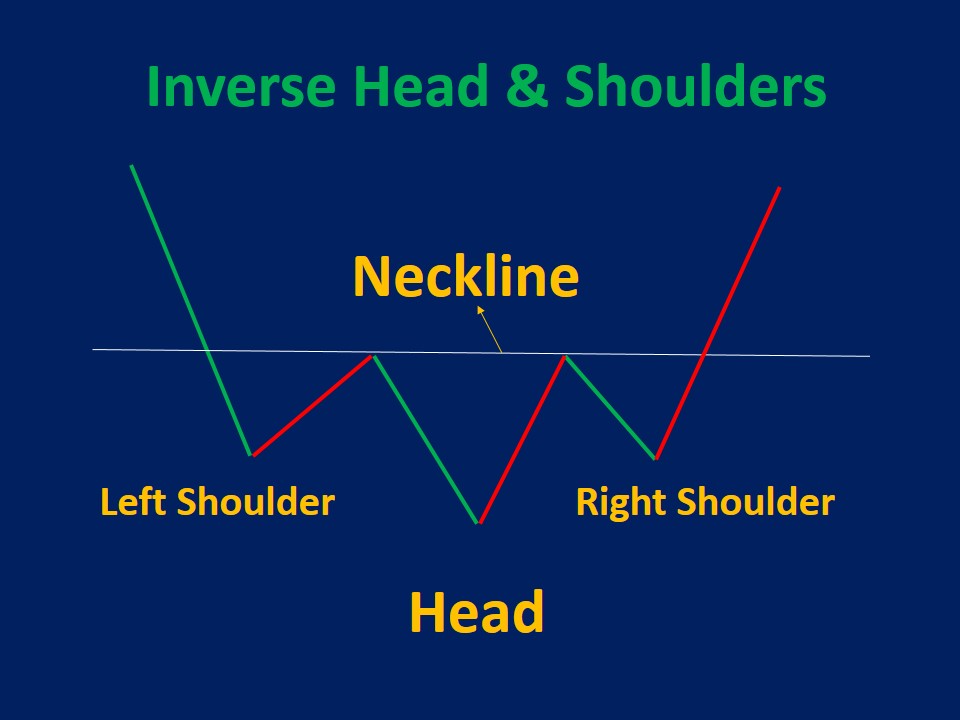

Head And Shoulders Pattern Bottom - The head and shoulders chart pattern is used in technical analysis, often identifying the turning point of a trend. Web as a major reversal pattern, the head and shoulders bottom forms after a downtrend, with its completion marking a change in trend. Head and shoulders pattern examples. Web bitcoin’s price chart is showing an inverse head and shoulders pattern, a strong indicator that often predicts a reversal of a previous downward trend. The triple bottom chart pattern is a rare, but extremely effective reversal pattern. Web the head and shoulders bottom is a popular pattern with investors. Web a head and shoulders pattern occurs at the end of a lengthened uptrend and generally signals a reversal. It often indicates a user profile. This pattern marks a reversal of a downward trend in a financial instrument's price. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. The middle peak, or head, is the highest and is flanked by two lower peaks, the shoulders. Web an icon in the shape of a person's head and shoulders. The pattern is shaped with three peaks, a left shoulder peak, a higher head peak, and a right shoulder peak similar in height to the left shoulder. Web a head and. Web in this potential inverse head and shoulders pattern, btc is completing the right shoulder. The volume levels throughout the pattern mimic those of the head and shoulders bottom; Web head and shoulders formations consist of a left shoulder, a head, and a right shoulder and a line drawn as the neckline. It is often referred to as an inverted. The pattern resembles a left shoulder, head, and right shoulder, hence the term head. The bottom head and shoulders pattern is very similar to the double bottom pattern or triple bottom pattern and are similar in many ways. Bitcoin’s retrace to $56,000 has likely marked the local price bottom, according to popular crypto analyst rekt. The head represents the low. Confirmation comes with a resistance breakout. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height, and the middle is the highest. Look for a pair of shoulders on opposite sides of a head. The pattern contains three successive troughs with the middle trough (head). The bullish sentiment declines, and the price breaks below the neckline after the right shoulder. Web head and shoulders formations consist of a left shoulder, a head, and a right shoulder and a line drawn as the neckline. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are. Web as a major reversal pattern, the head and shoulders bottom forms after a downtrend, with its completion marking a change in trend. Web in this potential inverse head and shoulders pattern, btc is completing the right shoulder. This candlestick pattern suggests an impending change in the trend direction after the sellers failed to break the support in three consecutive. The head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. It typically forms at the end of a bullish trend. Head and shoulders pattern examples. The triple bottom chart pattern is a rare, but extremely effective reversal pattern. power of patterns in forex trading! The middle peak, or head, is the highest and is flanked by two lower peaks, the shoulders. Head and shoulders pattern examples. It often indicates a user profile. “if $56,000 was not the bottom then. Bitcoin’s retrace to $56,000 has likely marked the local price bottom, according to popular crypto analyst rekt. The break even failure rate is low and the performance is good from this chart pattern. Volume is absolutely crucial to a head and shoulders bottom. power of patterns in forex trading! The head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Web the pro is the. The head and shoulders chart pattern is used in technical analysis, often identifying the turning point of a trend. Here are some key ones: The head represents the low and is fairly central to the pattern. The pattern resembles a left shoulder, head, and right shoulder, hence the term head. Web the head and shoulders pattern is a market chart. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height, and the middle is the highest. Ideally, the two shoulders would be equal in height and. The pattern contains three successive peaks, with the middle peak ( head) being the highest and the two outside peaks ( shoulders) being low and roughly equal. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. The middle peak, or head, is the highest and is flanked by two lower peaks, the shoulders. The volume levels throughout the pattern mimic those of the head and shoulders bottom; Overall performance rank (1 is best): Web an icon in the shape of a person's head and shoulders. The head represents the low and is fairly central to the pattern. The pattern is shaped with three peaks, a left shoulder peak, a higher head peak, and a right shoulder peak similar in height to the left shoulder. Web a rounding bottom could be thought of as a head and shoulders bottom without readily identifiable shoulders. It consists of 3 tops with a higher high in the middle, called the head. It’s rare since the successive creation of. Web a head and shoulders pattern occurs at the end of a lengthened uptrend and generally signals a reversal. It resembles a baseline with three peaks with the middle topping the other two. The bottom head and shoulders pattern is very similar to the double bottom pattern or triple bottom pattern and are similar in many ways.

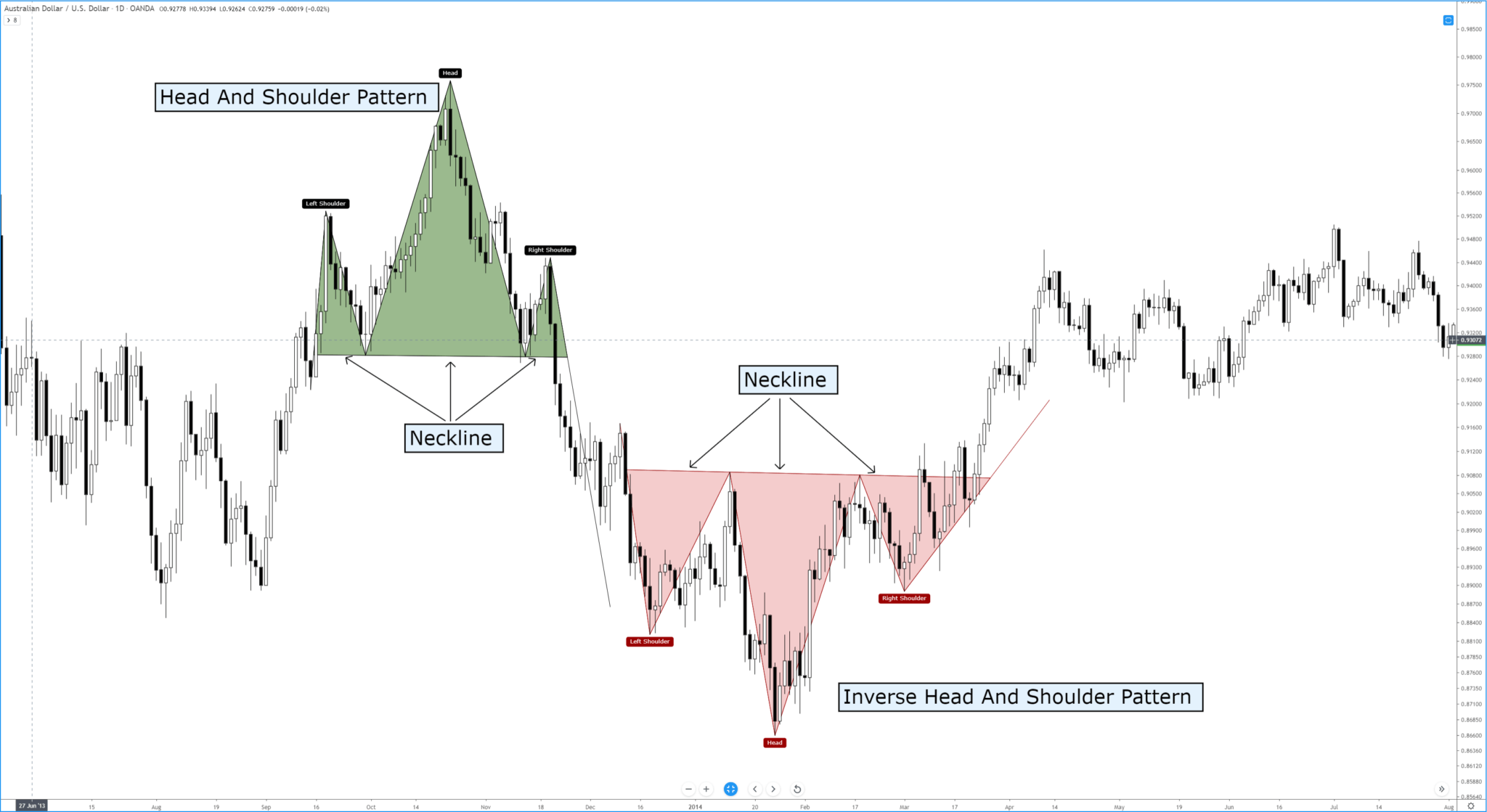

Chart Patterns The Head And Shoulders Pattern Forex Academy

The Head and Shoulders Pattern A Trader’s Guide

Head and Shoulders pattern How To Verify And Trade Efficiently How

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Head and Shoulders Trading Patterns ThinkMarkets EN

How to Trade the Head and Shoulders Pattern Trading Pattern Basics

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

Homily Chart(English) Learning Chart Pattern 6 Head and shoulders

Head and Shoulders Pattern Types, How to Trade & Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Head_And_Shoulders_Pattern_Sep_2020-01-4c225a762427464699e42461088c1e86.jpg)

What Is a Head and Shoulders Chart Pattern in Technical Analysis?

Web The Head And Shoulders Pattern Comes In Two Forms, Top And Bottom.

Key Components Of The Head And.

Because We’re Discussing Bottom And Not Top Patterns, The Head Should Pro T Ru D E Below The Lows Of The Two Shoulders.

Web An Inverse Head And Shoulders, Also Called A Head And Shoulders Bottom Or A Reverse Head And Shoulders, Is Inverted With The Head And Shoulders Top Used To Predict Reversals In Downtrends.

Related Post: