Hammer Stock Pattern

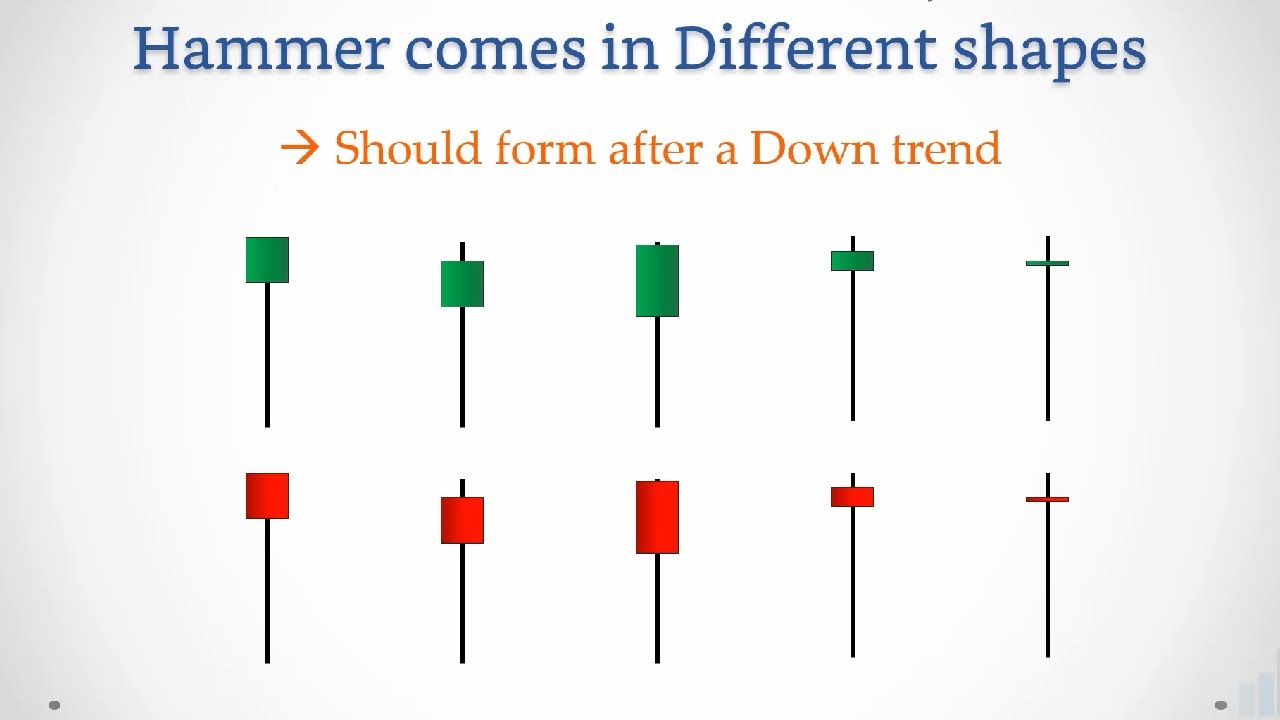

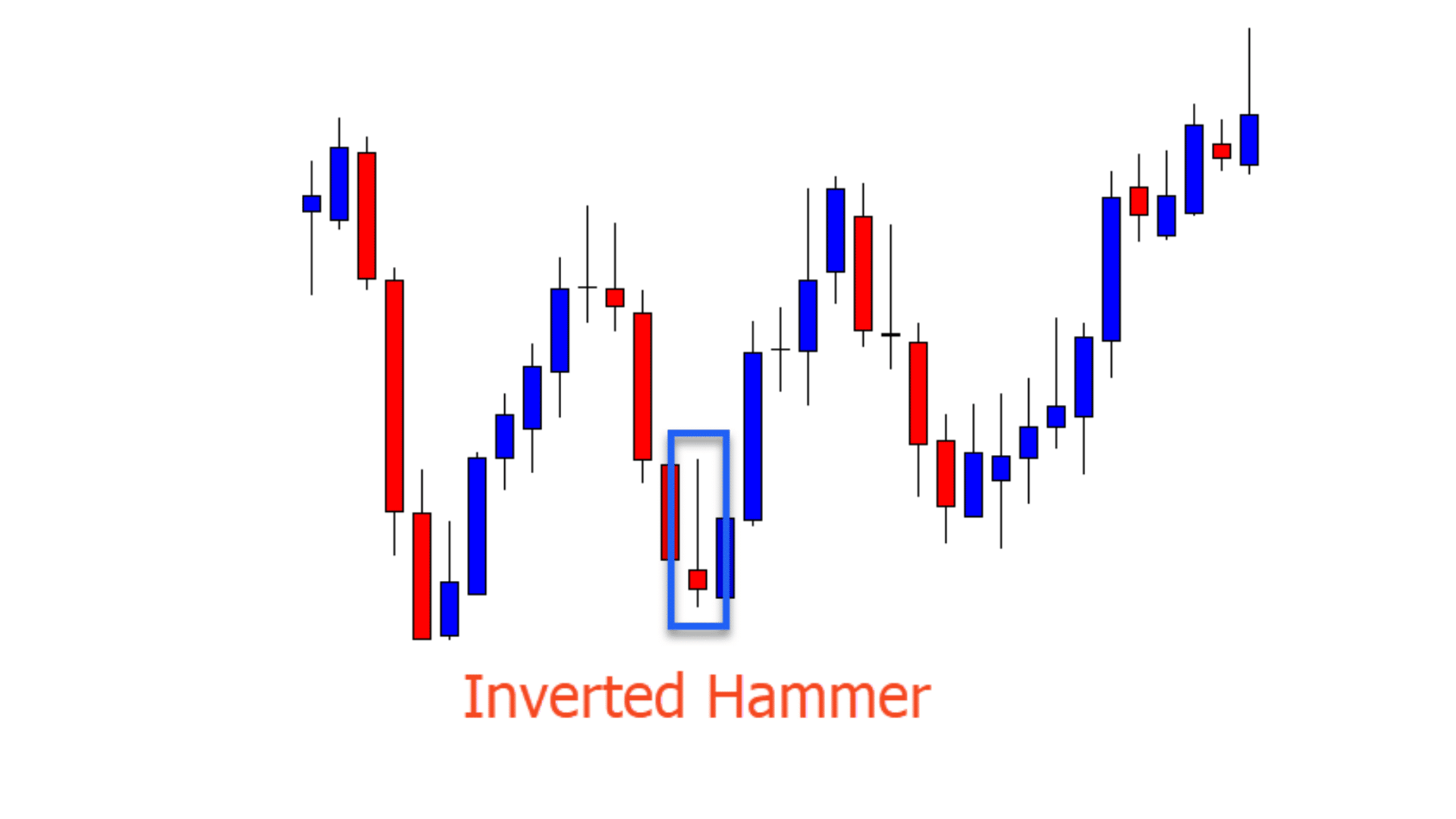

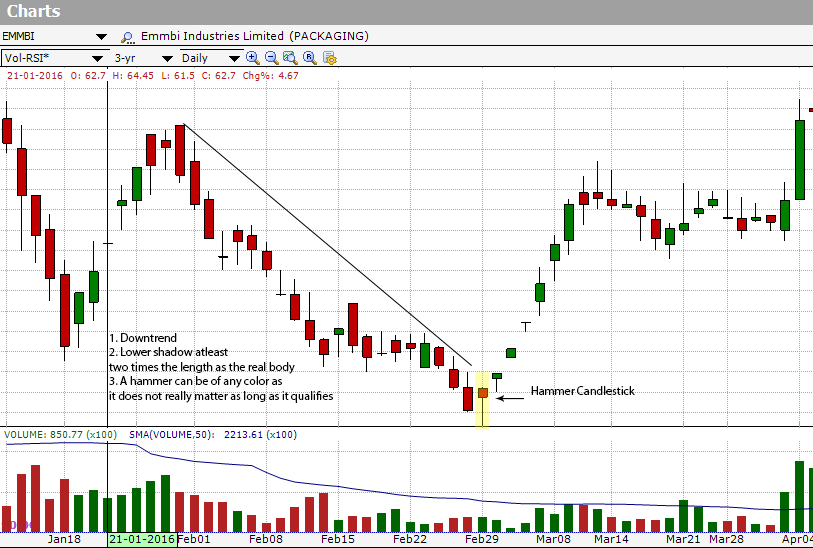

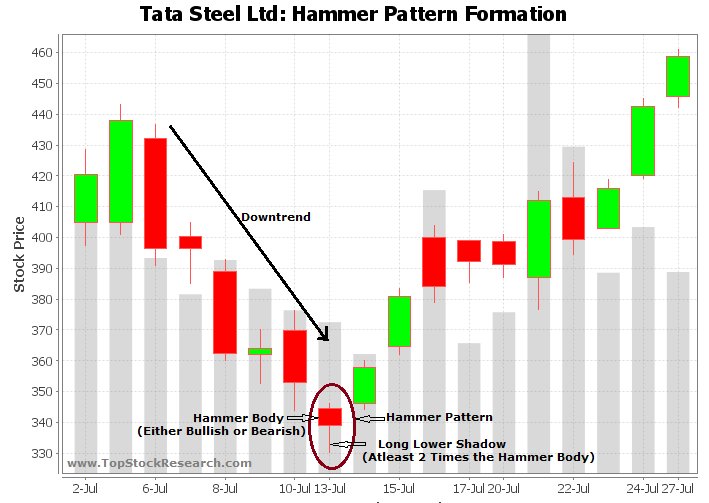

Hammer Stock Pattern - Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to. Web the hammer pattern is a significant candlestick pattern that traders frequently use in technical analysis to identify potential reversals in market trends. Web a downtrend has been apparent in utz brands (utz) lately. While the stock has lost 5.8% over the past week, it could witness a trend reversal as a hammer chart pattern was. The opening price, close, and top are approximately at the same. It is characterized by a small body and a long lower wick, resembling a hammer, hence its. Web the hammer is a single candlestick pattern that forms during a downtrend and signals a potential trend reversal. The following characteristics can identify it: Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. Web the hammer pattern consists of one candlestick with a small body, a long lower shadow, and a small or nonexistent upper shadow. Web a hammer candle is a popular pattern in chart technical analysis. Web hammer technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web. On the call side, the maximum. This pattern appears like a hammer, hence its name: The candle is formed by a long lower. Web hammer technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. A hammer is a price pattern in candlestick charting that occurs when a. Web a downtrend has been apparent in utz brands (utz) lately. Web the hammer pattern is a significant candlestick pattern that traders frequently use in technical analysis to identify potential reversals in market trends. The long lower shadow is a strong indication. This pattern appears like a hammer, hence its name: Web the hammer pattern consists of one candlestick with. Web the hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. The long lower shadow of the hammer shows that the stock attempted to sell off during the. If you are viewing flipcharts of any of the candlestick patterns page, we. Learn how to identify, use, and limit hammer candlesticks with examples. Web the hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of. While the stock has lost 5.8% over the past week, it could witness a trend reversal as a hammer chart pattern was. It indicates a potential price reversal to the upside, but confirmation is required. The long lower shadow of the hammer shows that the stock attempted to sell off during the. Web a downtrend has been apparent in definitive. The long lower shadow of the hammer shows that the stock attempted to sell off during the. Web a downtrend has been apparent in definitive healthcare corp. The following characteristics can identify it: Web a downtrend has been apparent in utz brands (utz) lately. It consists of a small real body that emerges after. Web hammer technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web the hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart. A hammer is a price pattern in candlestick charting that occurs when a security trades lower than its opening, but rallies near the opening price. Web hammer technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The long lower shadow is a strong indication. While the stock. The following characteristics can identify it: While the stock has lost 24.3% over the past week, it could witness a trend reversal as. While the stock has lost 5.8% over the past week, it could witness a trend reversal as a hammer chart pattern was. Web a hanging man is a bearish candlestick pattern that forms at the end of. A hammer is a price pattern in candlestick charting that occurs when a security trades lower than its opening, but rallies near the opening price. Web this page provides a list of stocks where a specific candlestick pattern has been detected. Learn how to identify, use, and limit hammer candlesticks with examples and psychology. The long lower shadow of the hammer shows that the stock attempted to sell off during the. The candle is formed by a long lower. The following characteristics can identify it: Web hammer technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The opening price, close, and top are approximately at the same. Web a downtrend has been apparent in definitive healthcare corp. Web the hammer pattern is a significant candlestick pattern that traders frequently use in technical analysis to identify potential reversals in market trends. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Web the hammer pattern consists of one candlestick with a small body, a long lower shadow, and a small or nonexistent upper shadow. Learn what it is, how to identify it, and how to use it for. The long lower shadow is a strong indication. If you are viewing flipcharts of any of the candlestick patterns page, we. Web a hammer candle is a popular pattern in chart technical analysis.

Candle Patterns Picking the "RIGHT" Hammer Pattern YouTube

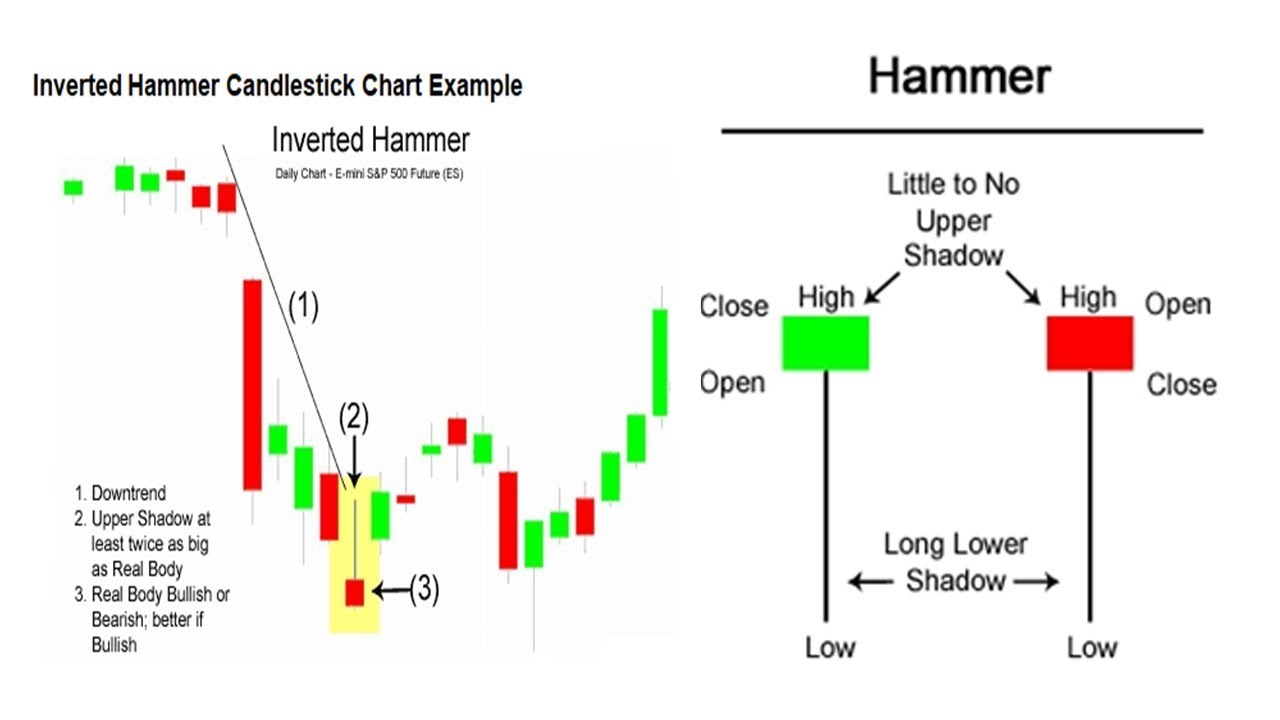

Inverted Hammer Candlestick Pattern Quick Trading Guide

Hammer, Inverted Hammer & Hanging Man Candlestick Chart Patterns

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

Trading The Hammer CandleStick Pattern Quick Tutorial YouTube

How to Trade the Hammer Candlestick Pattern Pro Trading School

How To Trade Blog What Is Hammer Candlestick? 2 Ways To Trade

Hammer Candlestick Chart Pattern Candlestick Pattern Tekno

Tutorial on How to Trade the Inverted Hammer signalHammer and inverted

While The Stock Has Lost 24.3% Over The Past Week, It Could Witness A Trend Reversal As.

Web A Downtrend Has Been Apparent In Utz Brands (Utz) Lately.

Web Technical & Fundamental Stock Screener, Scan Stocks Based On Rsi, Pe, Macd, Breakouts, Divergence, Growth, Book Vlaue, Market Cap, Dividend Yield Etc.

Web The Hammer Is A Single Candlestick Pattern That Forms During A Downtrend And Signals A Potential Trend Reversal.

Related Post: