Hammer Pattern

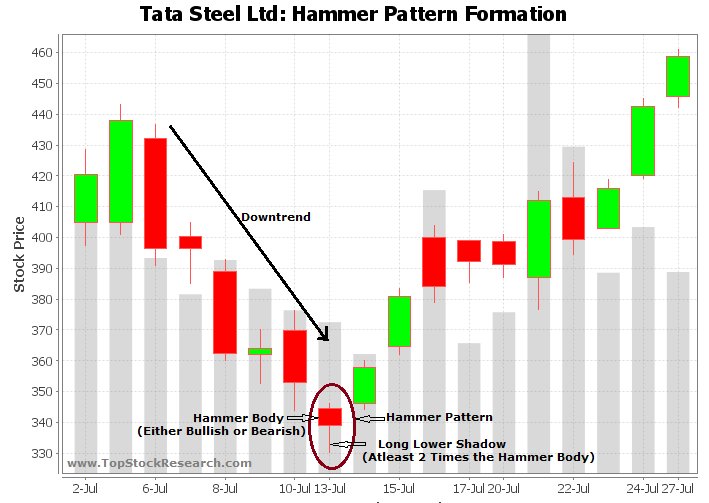

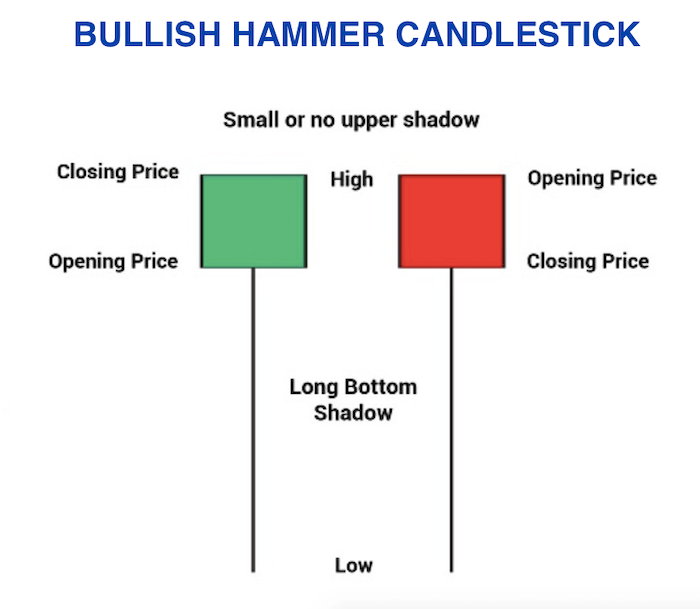

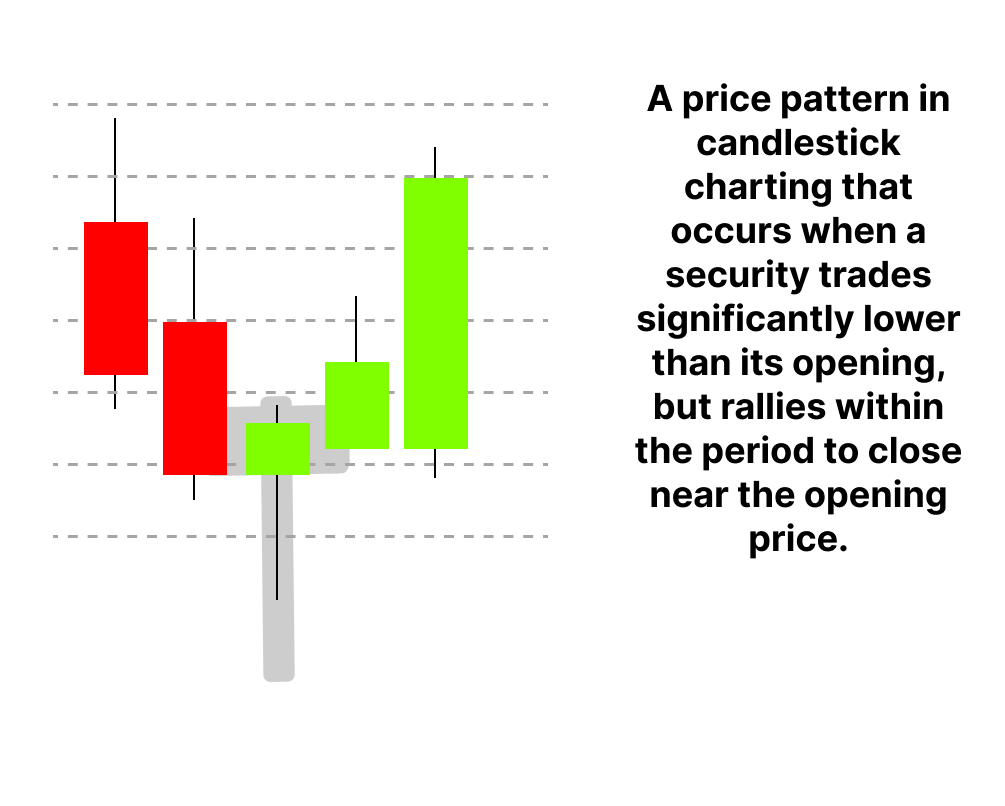

Hammer Pattern - Web a downtrend has been apparent in definitive healthcare corp. Web the bullish hammer is a single candle pattern found at the bottom of a downtrend that signals a turning point from a bearish to a bullish market sentiment. Web the hammer is a japanese candlestick pattern. For investors, it’s a glimpse. Web the hammer candlestick pattern is considered a reversal pattern as it signals the reversal of the ongoing trend and shows the presence of the opposing party in the. Web model had no effect on precipitation patterns. Web learn how to identify and use the hammer candlestick pattern, a bullish reversal signal that occurs at the bottom of a downtrend. #reels #explore #candlestickpatterns #candlesticks #candlestick #stockmarket. (2008) concluded that advection is of central importance, by bringing ions to and away from the calcite surface. Web the “hammer” candlestick pattern is a candlestick that often serves as a signal of a possible reversal of the current downtrend. (2008) concluded that advection is of central importance, by bringing ions to and away from the calcite surface. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. #reels #explore #candlestickpatterns #candlesticks #candlestick #stockmarket. But then surges back close to the opening price by. Hammer chart pattern is formed. Web learn how to identify and use the hammer candlestick pattern, a bullish reversal signal that occurs at the bottom of a downtrend. Web the “hammer” candlestick pattern is a candlestick that often serves as a signal of a possible reversal of the current downtrend. Web the hammer candlestick pattern is used by seasoned professionals. While the stock has lost 24.3% over the past week, it could witness a trend reversal as a hammer chart. For investors, it’s a glimpse. It usually appears after a price decline and shows rejection from lower prices. Find out the difference between. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Illustrated guide to hammer candlestick patterns. Web a hammer candlestick pattern is formed when a stock trades much lower than its opening price. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. Web the hammer candlestick pattern is considered a reversal pattern as. Web the “hammer” candlestick pattern is a candlestick that often serves as a signal of a possible reversal of the current downtrend. Web learn how to identify and use the hammer candlestick pattern, a bullish reversal signal that occurs at the bottom of a downtrend. The hammer pattern is a. Web learn how to identify and trade the hammer candlestick. Derived from japanese candlestick chart analysis methods, this single. Hammer chart pattern is formed. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Web a downtrend has been apparent in definitive healthcare corp. The hammer pattern is a. For investors, it’s a glimpse. Find out the difference between. Web the hammer is a japanese candlestick pattern. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. Illustrated guide to hammer candlestick patterns. Web the hammer candlestick pattern is considered a reversal pattern as it signals the reversal of the ongoing trend and shows the presence of the opposing party in the. Find out the difference between. Web hammer candlestick formation in technical analysis: (2008) concluded that advection is of central importance, by bringing ions to and away from the calcite surface. Web. (2008) concluded that advection is of central importance, by bringing ions to and away from the calcite surface. Web learn how to identify and trade the hammer candlestick pattern, a single candle formation that signals a potential trend reversal. Find out the difference between. Web the hammer pattern is a crucial technical analysis tool used by traders to identify potential. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Derived from japanese candlestick chart analysis methods, this single. Web a downtrend has been apparent in definitive healthcare corp. Web learn how to identify and trade the hammer candlestick pattern, a single candle formation that signals a potential trend reversal. Web a hammer candlestick. (2008) concluded that advection is of central importance, by bringing ions to and away from the calcite surface. Illustrated guide to hammer candlestick patterns. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. It’s a bullish reversal pattern. Web hammer candlestick formation in technical analysis: Web the hammer is a japanese candlestick pattern. While the stock has lost 24.3% over the past week, it could witness a trend reversal as a hammer chart. For investors, it’s a glimpse. Web the bullish hammer is a single candle pattern found at the bottom of a downtrend that signals a turning point from a bearish to a bullish market sentiment. Web the hammer candlestick pattern is used by seasoned professionals and novice traders. Find out the difference between. Web learn how to identify and use the hammer candlestick pattern, a bullish reversal signal that occurs at the bottom of a downtrend. Web learn how to identify and trade the hammer candlestick pattern, a bullish reversal signal that indicates the end of a downtrend and the start of an uptrend. It usually appears after a price decline and shows rejection from lower prices. Web the hammer candlestick pattern is a technical analysis tool used by traders to identify potential reversals in price trends. Web the hammer pattern is a crucial technical analysis tool used by traders to identify potential trend reversals in various financial markets.

Hammer Candlestick Pattern Trading Guide

Tutorial on Hammer Candlestick Pattern

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

Hammer Candlestick Pattern Forex Trading

Hammer Candlestick Pattern The Complete Guide 2022 (2022)

How to Trade the Hammer Candlestick Pattern Pro Trading School

Hammer Candlestick Pattern Strategy Guide for Day Traders DTTW™

How to trade Hammer candlestick pattern Effects & Benefits of Hammer

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Web A Hammer Candlestick Is A Chart Formation That Signals A Potential Bullish Reversal After A Downtrend, Identifiable By Its Small Body And Long Lower Wick.

Derived From Japanese Candlestick Chart Analysis Methods, This Single.

Web Learn How To Identify And Trade The Hammer Candlestick Pattern, A Single Candle Formation That Signals A Potential Trend Reversal.

This Pattern Is Typically Seen As A Bullish.

Related Post: