Hammer Candlestick Pattern Meaning

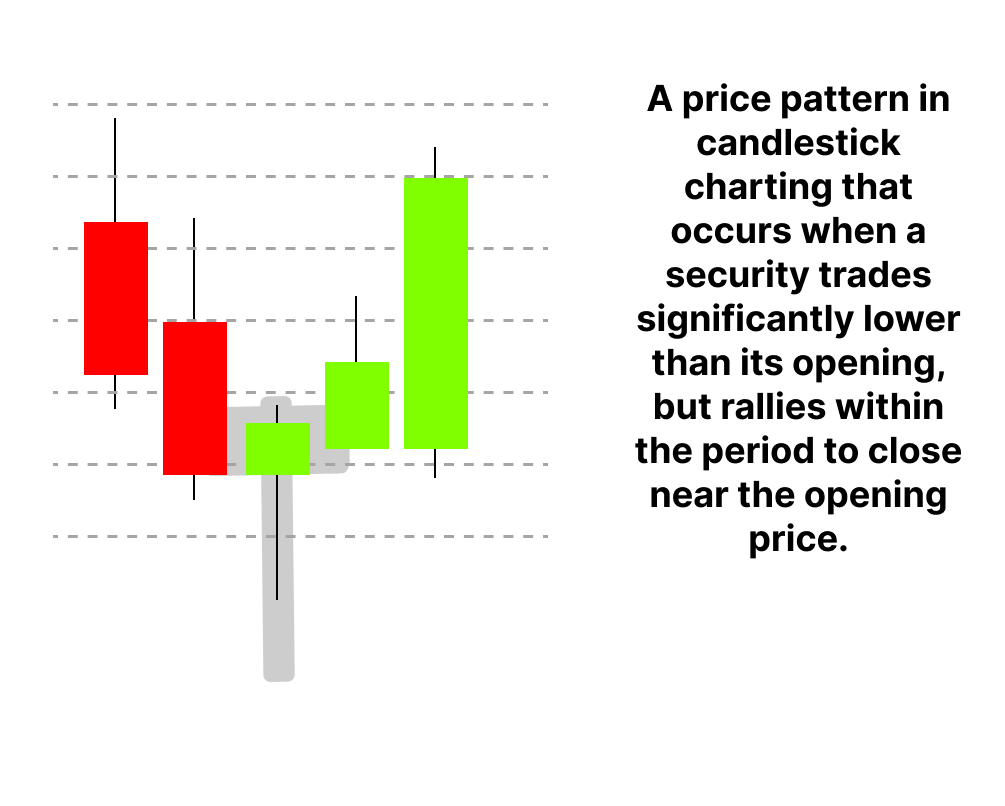

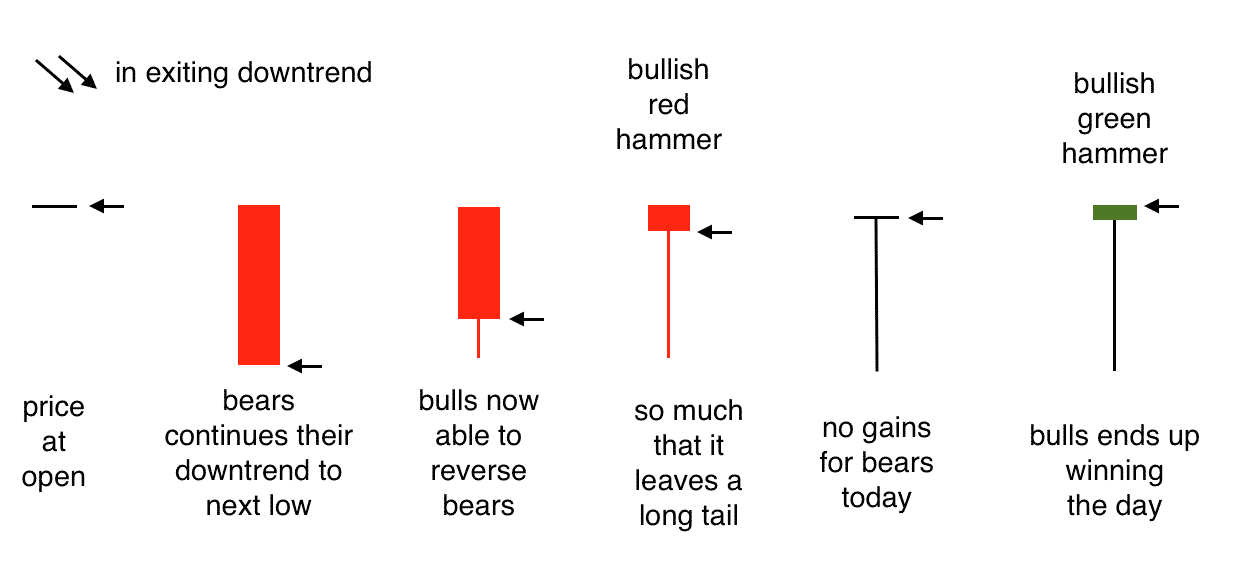

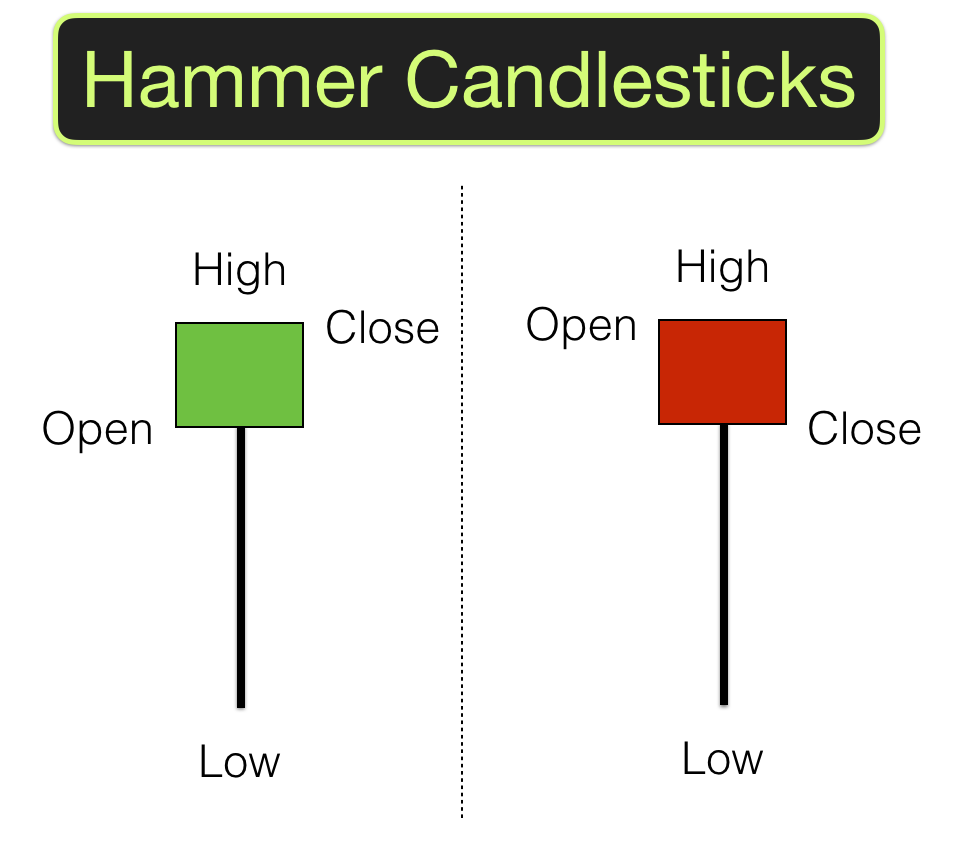

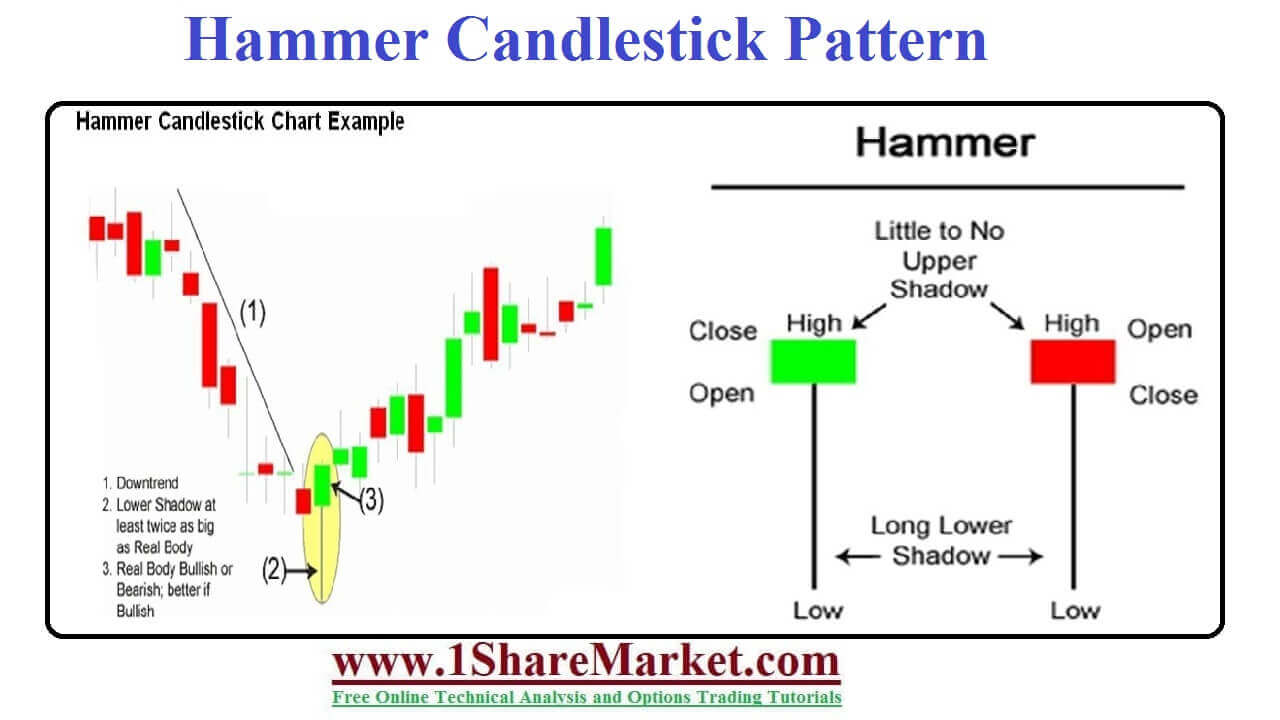

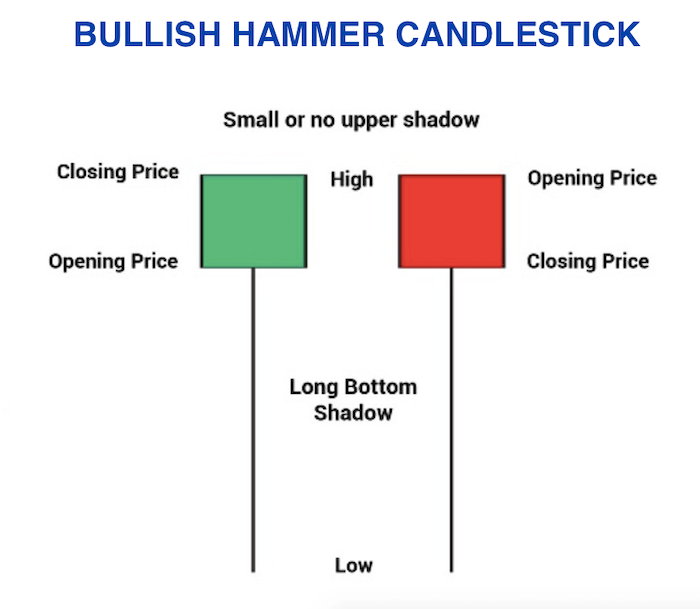

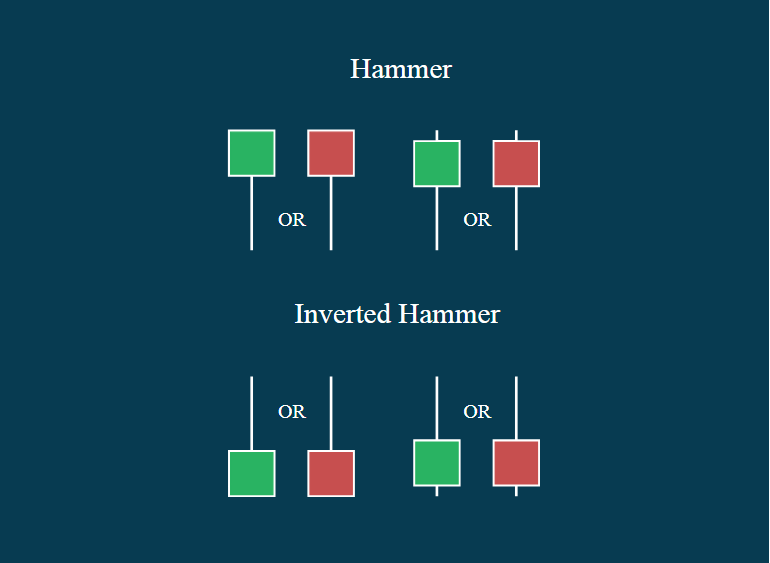

Hammer Candlestick Pattern Meaning - The hammer is associated with the return of a positive trend in. Web what is the hammer candlestick pattern? A minor difference between the opening and closing prices forms a. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to. They consist of small to medium size lower shadows, a real body,. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. This is one of the popular price patterns in candlestick charting. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Know how to identify hammer. Web a hammer candlestick pattern is a candlestick pattern that resembles a hammer or the letter 't' in the english alphabet. Web a hammer candlestick pattern is a candlestick pattern that resembles a hammer or the letter 't' in the english alphabet. Web what is the hammer candlestick pattern? A minor difference between the opening and closing prices forms a. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. The hammer candle is another. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Find out the bullish and bearish meanings, the. For investors, it’s a glimpse. A minor difference between the opening and closing prices forms a. Web economists and traders analyze. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Web the hammer candlestick is a pattern formed when a financial asset trades significantly below its opening price but makes a recovery to close near it within a. For. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. Web what is the hammer candlestick pattern? It signals that the market is about to change trend direction and advance. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero). Web among the various tools and formations employed in technical analysis, the hammer candlestick pattern stands out as a powerful indicator. Know how to identify hammer. While the stock has lost 5.8% over the past week, it could witness a trend. Web a hammer candlestick is a significant pattern in technical analysis used by traders to interpret price movements in. Web what is the hammer candlestick pattern? The hammer is associated with the return of a positive trend in. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. The hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. It signals that the market is about to change trend direction. Find out the bullish and bearish meanings, the. Traders can observe the hammer. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Know how to identify hammer. Web what is a hammer chart and how to trade it? The hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the. Web what is the hammer candlestick pattern? Find out the bullish and bearish meanings, the. Web what is a hammer chart and how to trade it? A minor difference between the opening and closing prices forms a. While the stock has lost 5.8% over the past week, it could witness a trend. Web a hammer candlestick pattern is a candlestick pattern that resembles a hammer or the letter 't' in the english alphabet. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Web the hammer candlestick is a type of bullish. Web zacks equity research may 10, 2024. Web economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading, forex trading (foreign. Web the hammer candlestick is a pattern formed when a financial asset trades significantly below its opening price but makes a recovery to close near it within a. They consist of small. Web the hammer candlestick is a pattern formed when a financial asset trades significantly below its opening price but makes a recovery to close near it within a. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to. While the stock has lost 5.8% over the past week, it could witness a trend. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Find out the bullish and bearish meanings, the. A minor difference between the opening and closing prices forms a. Web what is the hammer candlestick formation? They consist of small to medium size lower shadows, a real body,. The hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. This is one of the popular price patterns in candlestick charting. Web what is the hammer candlestick pattern? Web a hammer candlestick has a small real body near the top of the trading range and a long lower shadow that is at least twice the length of the real body. Web a hammer candlestick pattern is a candlestick pattern that resembles a hammer or the letter 't' in the english alphabet. Web hammer candlestick pattern occurs when a stock trades lower than its opening price but goes up to the opening price.

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

Hammer Candlestick Meaning, Types, Examples, Interpretation vlr.eng.br

Hammer Candlesticks Shooting Star Candlesticks

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

What Is Hammer Candlestick? 2 Ways To Trade With This Pattern

Hammer candlestick pattern Defination with Advantages and limitation

How to trade Hammer candlestick pattern Effects & Benefits of Hammer

Hammer Candlestick What Is It and How to Use It in Trend Reversal

What Is Hammer Candlestick? 2 Ways To Trade With This Pattern

Web A Hammer Candlestick Is A Significant Pattern In Technical Analysis Used By Traders To Interpret Price Movements In Financial Markets, Particularly In Stocks, Forex, Or.

Web Economists And Traders Analyze Hammer Candlestick Patterns To Understand Price Action And Selling Pressure In Stock Trading, Forex Trading (Foreign.

Web What Is A Hammer Chart And How To Trade It?

Web Learn How To Identify And Use The Hammer Candlestick Pattern, A Powerful Indicator Of Potential Trend Reversals.

Related Post: