H Pattern

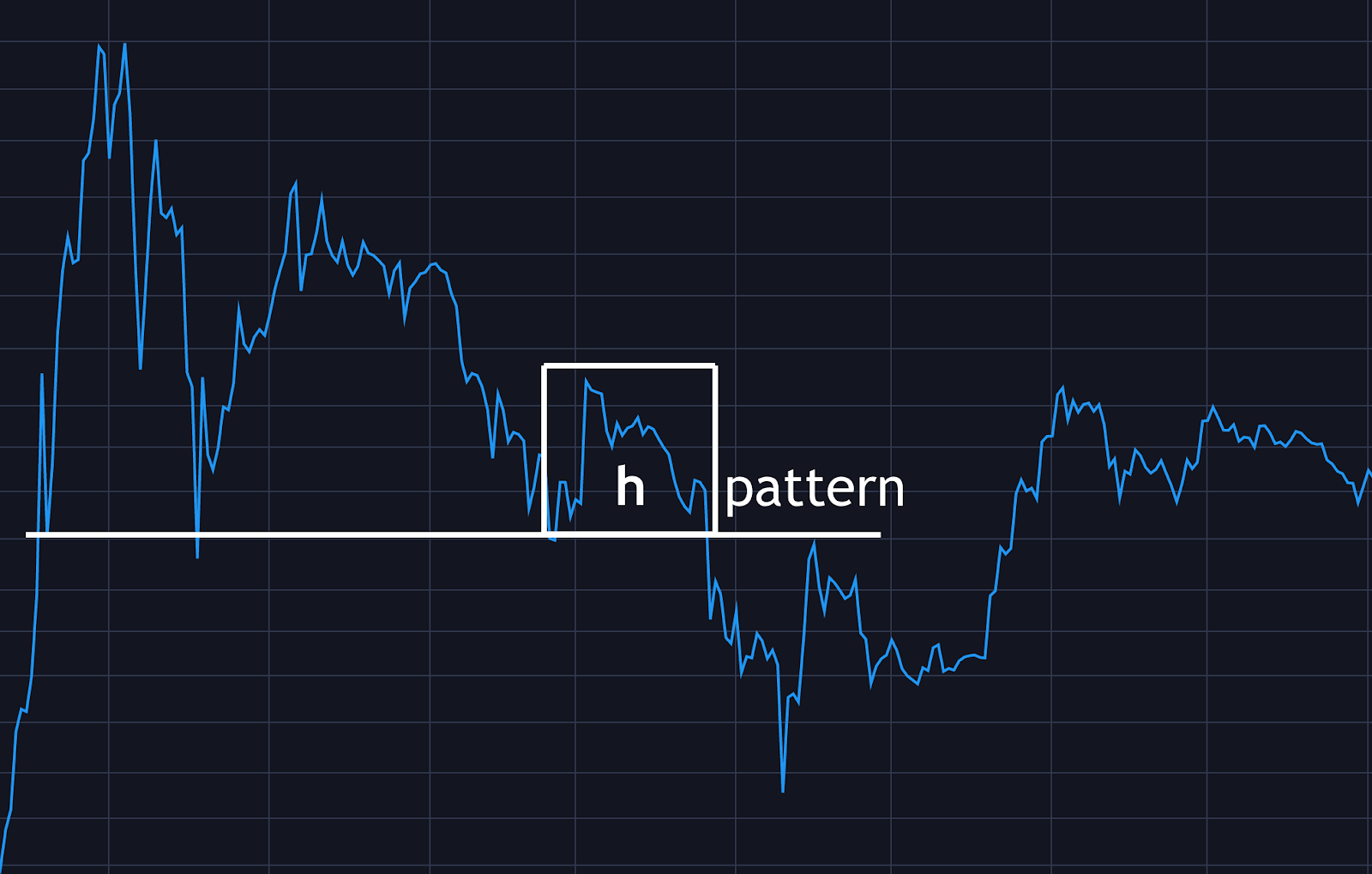

H Pattern - Web h is a key pattern to trade as a trader. When the trend line (neckline) connecting the peaks at the top of the pattern is broken, the pattern is complete. Understanding the psychology behind the pattern is crucial. Some may even consider them vital in research and trading. A bullish reversal pattern marked by three (or more) prominent troughs with a middle trough (the head) that is lower than the other troughs (the shoulders). 16 2022, published 11:12 a.m. We found that serum pfass were widely. What is the h pattern in crypto? Web there are several common alternatives for the shifting pattern. The pattern can exhibit on any timeframe but is most often viewed. This pattern has delivered nothing but success for me. Web an “h” pattern on an eth/usd chart. H’s tend to appear everywhere, so it’s important to know what you’re looking for. To determine exposure profiles, the transplacental transfer efficiencies (ttes) of pfass and predictors were estimated. We find great success when we recognize this particular pattern before it even occurs. As in the break of support. Web there are several common alternatives for the shifting pattern. To determine exposure profiles, the transplacental transfer efficiencies (ttes) of pfass and predictors were estimated. There are many technical patterns that traders study to help. Web aurora seen in atlanta area around 10:30 p.m. 2.9k views 2 years ago. Some may even consider them vital in research and trading. This bearish setup is one that has done very well in this market! This should be the entry price for a short position. The pattern can exhibit on any timeframe but is most often viewed. 9.7k views 3 years ago futures/forex trading. Web the h pattern is a powerful continuation pattern that forms at a support level that is quickly taken out in subsequent trading sessions. Daniels, last week, one of mr. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close. Web the h pattern is a powerful continuation pattern that forms at a support level that is quickly taken out in subsequent trading sessions. This requires educating yourself on understanding the market you are. Web what harmonic patterns are. We found that serum pfass were widely. This high is then followed by a steady decline, which is shown by the. This article presents the h. Of the almost 4,000 islands in maine. On the chart, the “h” pattern is confirmed when the price hits the support level again at 3626.45, completing the “h” shape. Story by maura mcevoy, basha burwell, and kathleen hackett. Web definition of the ‘h’ chart pattern. We find great success when we recognize this particular pattern before it even occurs. Web the h pattern, a distinctive formation on stock price charts, serves as a harbinger of potential trend reversals after a significant price decline. In my case, i look for the first leg down a small retrace followed by a curvature, which indicates good support. Web. Learn more about how to read it. I spoke about this pattern once before here. What are the harmonic patterns? Web the h pattern is a powerful continuation pattern that forms at a support level that is quickly taken out in subsequent trading sessions. When the trend line (neckline) connecting the peaks at the top of the pattern is broken,. We found that serum pfass were widely. Web the h pattern, a distinctive formation on stock price charts, serves as a harbinger of potential trend reversals after a significant price decline. Many technical traders will trade any pattern based on a break. When the trend line (neckline) connecting the peaks at the top of the pattern is broken, the pattern. 16 2022, published 11:12 a.m. When the trend line (neckline) connecting the peaks at the top of the pattern is broken, the pattern is complete. We find great success when we recognize this particular pattern before it even occurs. Web the h pattern is one that usually forms after a large bearish trend. 9.7k views 3 years ago futures/forex trading. In my case, i look for the first leg down a small retrace followed by a curvature, which indicates good support. Harmonic patterns were first introduced to the trading world by h.m. Web there are several common alternatives for the shifting pattern. When the stock market starts pulling back and all we see is bearish setup, this bearish h pattern. Daniels, last week, one of mr. Many technical traders will trade any pattern based on a break. This bearish setup is one that has done very well in this market! Web the h pattern, a distinctive formation on stock price charts, serves as a harbinger of potential trend reversals after a significant price decline. Web head and shoulders bottom. Web the h stands for “hell for shorts” as most traders mistakenly short the retest of the initial low and are then frustrated when prices fail to move lower. 16 2022, published 11:12 a.m. Web h is a key pattern to trade as a trader. The stop loss should be close to the top of the curve (b) depending on the trader’s strategy. Of the almost 4,000 islands in maine. It looks like an the small letter h. There are many technical patterns that traders study to help.

How To Trade the "hpattern" This Pattern Works with Stocks Futures

H Pattern stocks, explained Cantech Letter

Letter H Tapestry, Denim Letter Design Uppercase H Fabric Pattern Jeans

H Pattern Trading Guide How To Identify And Trade The H Pattern In Crypto

h pattern Shadow Trader

HOW TO TRADE THE H PATTERN! DAY TRADING BEARISH PATTERNS DURING A

Letter H pattern seamless editable repeating vector background

Vintage Letter H floral pattern style 3611963 Vector Art at Vecteezy

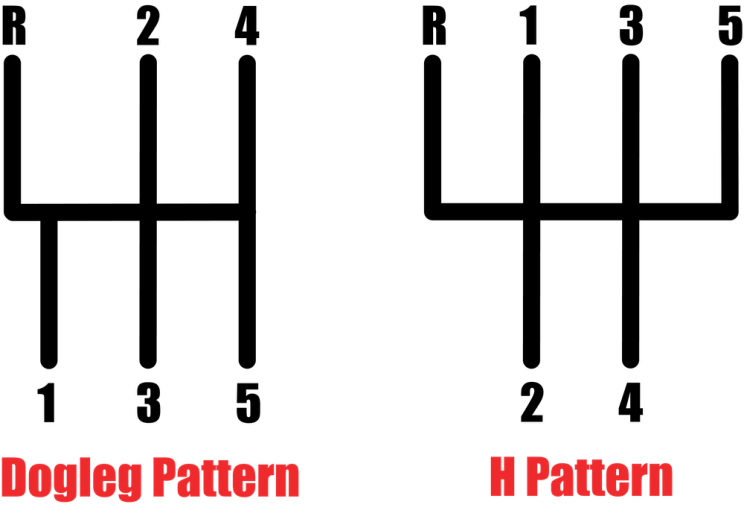

Dogleg Gearbox, Advantages

H Pattern Trading Guide How To Identify And Trade The H Pattern In Crypto

2.9K Views 2 Years Ago.

This Requires Educating Yourself On Understanding The Market You Are.

Story By Maura Mcevoy, Basha Burwell, And Kathleen Hackett.

A Bullish Reversal Pattern Marked By Three (Or More) Prominent Troughs With A Middle Trough (The Head) That Is Lower Than The Other Troughs (The Shoulders).

Related Post: