H Pattern Bullish Or Bearish

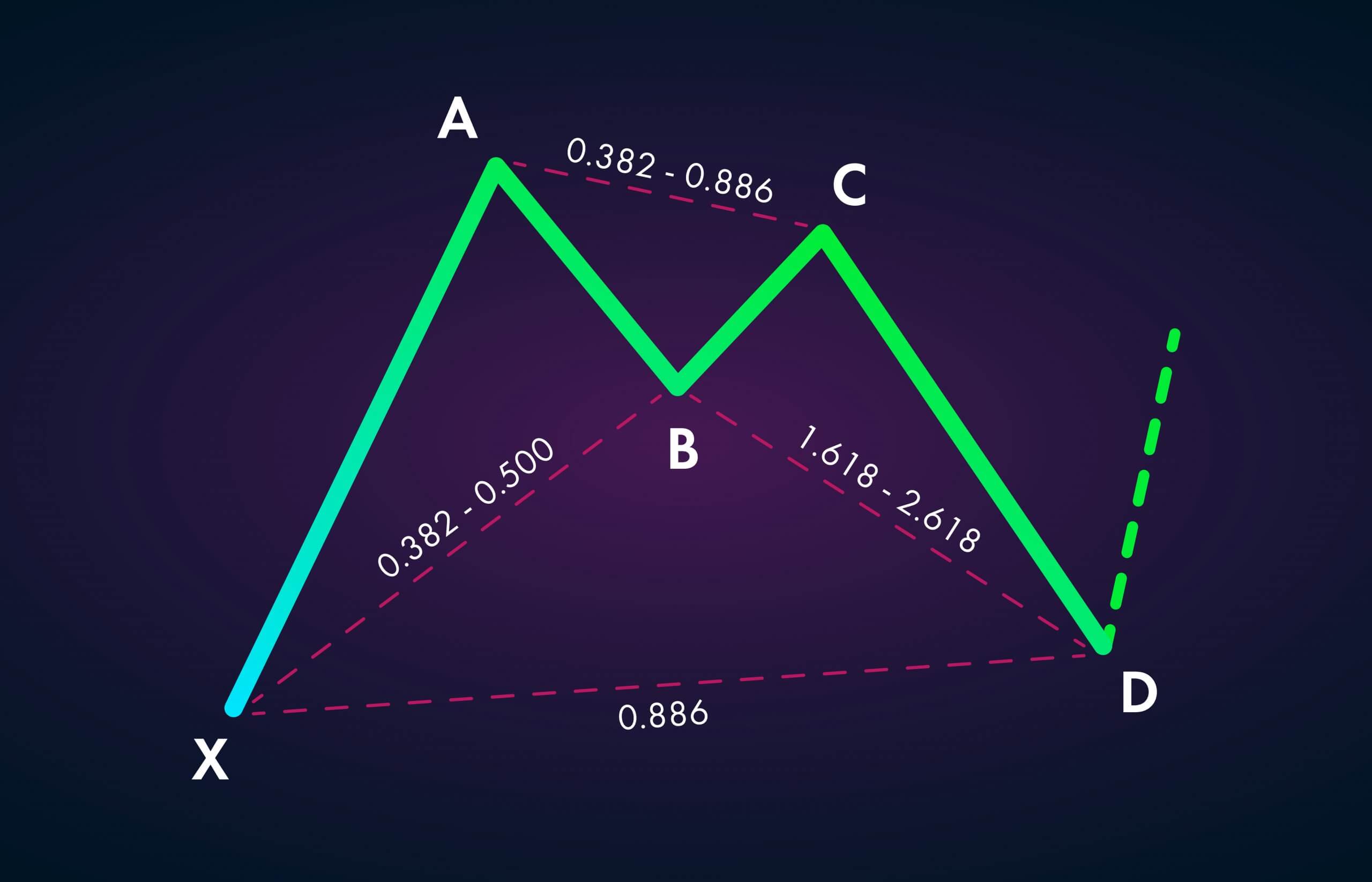

H Pattern Bullish Or Bearish - It could be a buy (in bullish patterns) or a sell (in bearish patterns). Web aurora seen in atlanta area around 10:30 p.m. It typically forms at the end of a bullish trend. On the other hand, reverse, or inverse head and shoulder patterns indicate a bullish chart reversal from a downward trend to an. Ab is a down leg that extends from 1.13 to 1.618 beyond point x. If one happens, the next resistance will be at $0.000032, 35% above the current price. Web head and shoulders pattern: Hanging man sounds negative, and it is actually. Again, traders can be bearish on a stock for any time frame, depending on. Next, identify the reversal pattern’s high, low, and mean at the bottom. Web the h pattern, a distinctive formation on stock price charts, serves as a harbinger of potential trend reversals after a significant price decline. An h pattern in cryptocurrencies and other markets is typically a bearish chart pattern. Web head and shoulders pattern: Again, traders can be bearish on a stock for any time frame, depending on. (emily smith/cnn) a. Web conversely, bearish price action could result in the btc token plunging toward its crucial support level of $60,000. Again, traders can be bearish on a stock for any time frame, depending on. Is an h pattern bullish or bearish? Split the range of the move in half. Web this candlestick closes above the middle of the first long black. On the other hand, a breakdown can trigger a 46% drop to the closest support at $0.000012. People expect a stock or market to trend downward. Essentially, it is a red hammer that appears after a bullish section. With a bear flag pattern the consolidation within the large body of a bearish candle is within half the bar, or at. It usually sends prices back down the same way the positive trend built them up before the indicator. Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern, with a price target of $0.22. The h pattern’s sell strategies are useful. (emily smith/cnn) a stunning aurora, caused by a severe geomagnetic storm, is painting the sky shades of pink, purple and green as it spreads into. Ultimately, a trader aims to trade a 50% retracement of the total move. These patterns resemble “m” or “w” patterns and are defined by 5 key pivot points. Known for its resemblance to the lowercase. It usually sends prices back down the same way the positive trend built them up before the indicator. Now we move to the bearish candlestick patterns that foreshadow drops in price. Hanging man sounds negative, and it is actually. The h pattern’s sell strategies are useful to adopt and apply as they can help you hedge against downside risks and. The pattern resembles a human head and shoulders, hence the name. Web head & shoulders are reversal patterns (like double/triple tops/bottoms and wedges) that form at the top or bottom of a trend with the bottoms being bullish and the tops being bearish. In the end, the cd is a leg down that retraces 0.50 of bc. Web it’s similar. With a bear flag pattern the consolidation within the large body of a bearish candle is within half the bar, or at times 1/3 of the bearish bar. Web conversely, bearish price action could result in the btc token plunging toward its crucial support level of $60,000. Web head and shoulders pattern: Web the h pattern, a distinctive formation on. Web top 10 best bullish patterns tested & proven reliable. Standard head and shoulder patterns are an indicator of a sizable downward price reversal from a prior upward trend, so head and shoulder patterns are bearish. On the other hand, a breakdown can trigger a 46% drop to the closest support at $0.000012. The h pattern’s sell strategies are useful. Research shows the most reliable and accurate bullish patterns are the cup and handle, with a 95% bullish success rate, head & shoulders (89%), double bottom (88%), and triple bottom (87%). Web the profit target for the inverse head and shoulders pattern would be: It typically forms at the end of a bullish trend. (emily smith/cnn) a stunning aurora, caused. Cardano has a strongly bearish market structure the technical indicators projected a deep price drop could arrive soon cardano [ada] formed a bullish chart pattern that could see. Web it’s similar to a bear flag however it’s distinctive. Next, identify the reversal pattern’s high, low, and mean at the bottom. The aim of the scanner is to detect the h patterns using the following indications: The bullish counterpart to the standard h pattern. Known for its resemblance to the lowercase ‘h’, this pattern unfolds through a sharp fall in a stock’s price, followed by a false recovery that fails to sustain momentum—the infamous “dead. Web inverse head and shoulders: Usually, “d” is identified by a confluence of projections, retracements, and extensions of prior swings (legs. Web the head and shoulders stock pattern is a technical analysis chart pattern that indicates a potential trend reversal from bullish to bearish. On the other hand, a breakdown can trigger a 46% drop to the closest support at $0.000012. An inverse head and shoulders, often referred to as a head and shoulders bottom, is a chart pattern, used in technical analysis to predict the reversal of a current. Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern, with a price target of $0.22. The h pattern’s sell strategies are useful to adopt and apply as they can help you hedge against downside risks and secure your trades during downside movements. Ultimately, a trader aims to trade a 50% retracement of the total move. Web head and shoulders pattern: An h pattern in cryptocurrencies and other markets is typically a bearish chart pattern.

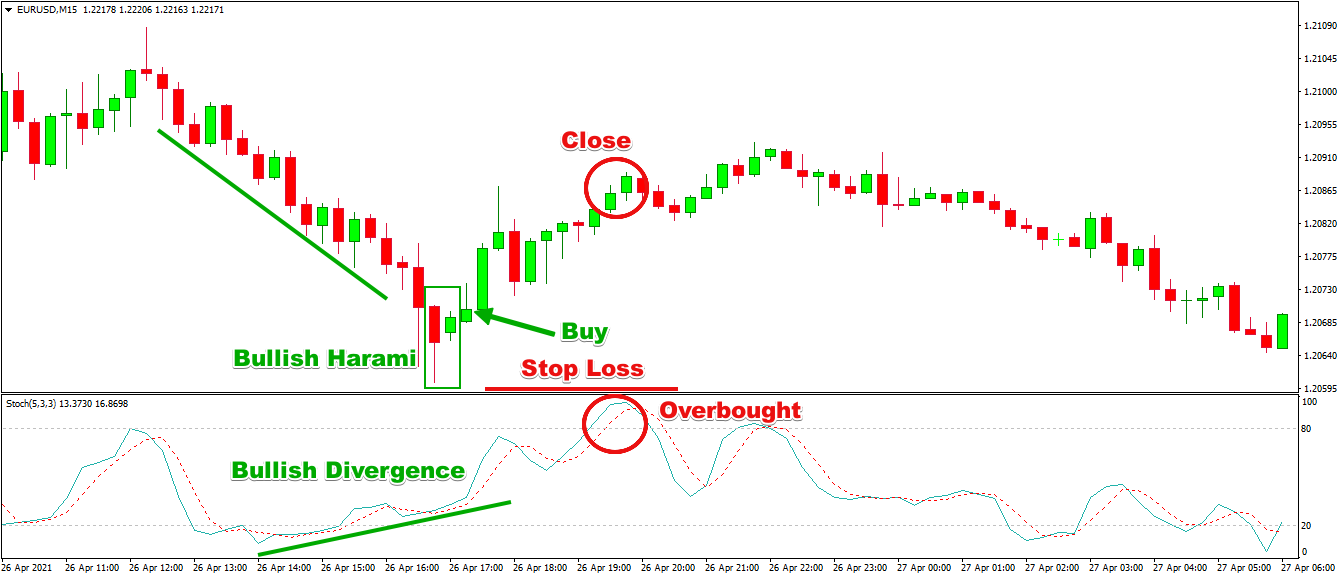

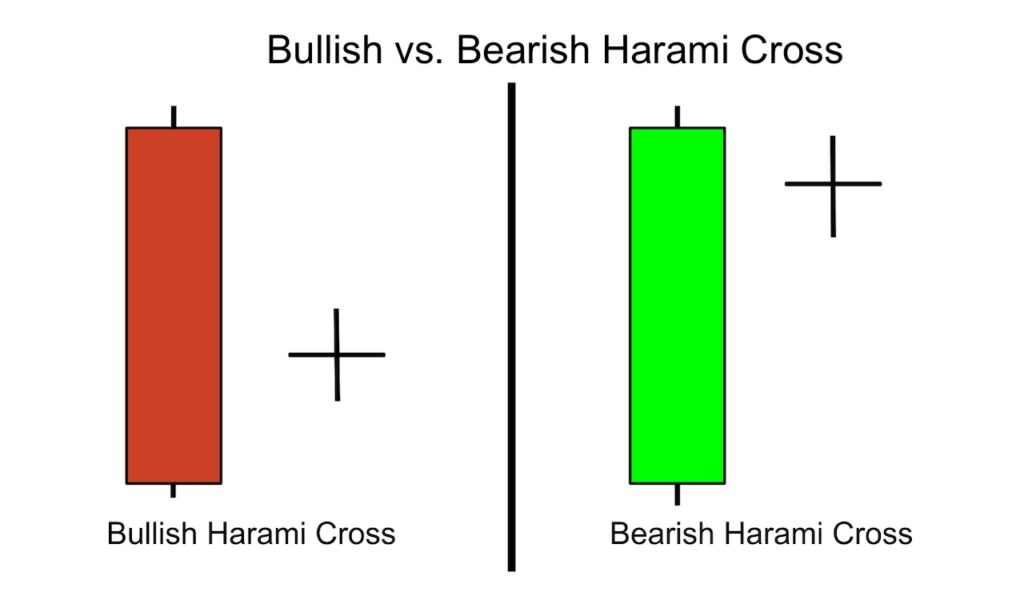

Bullish & Bearish Harami Patterns Forex Training Group

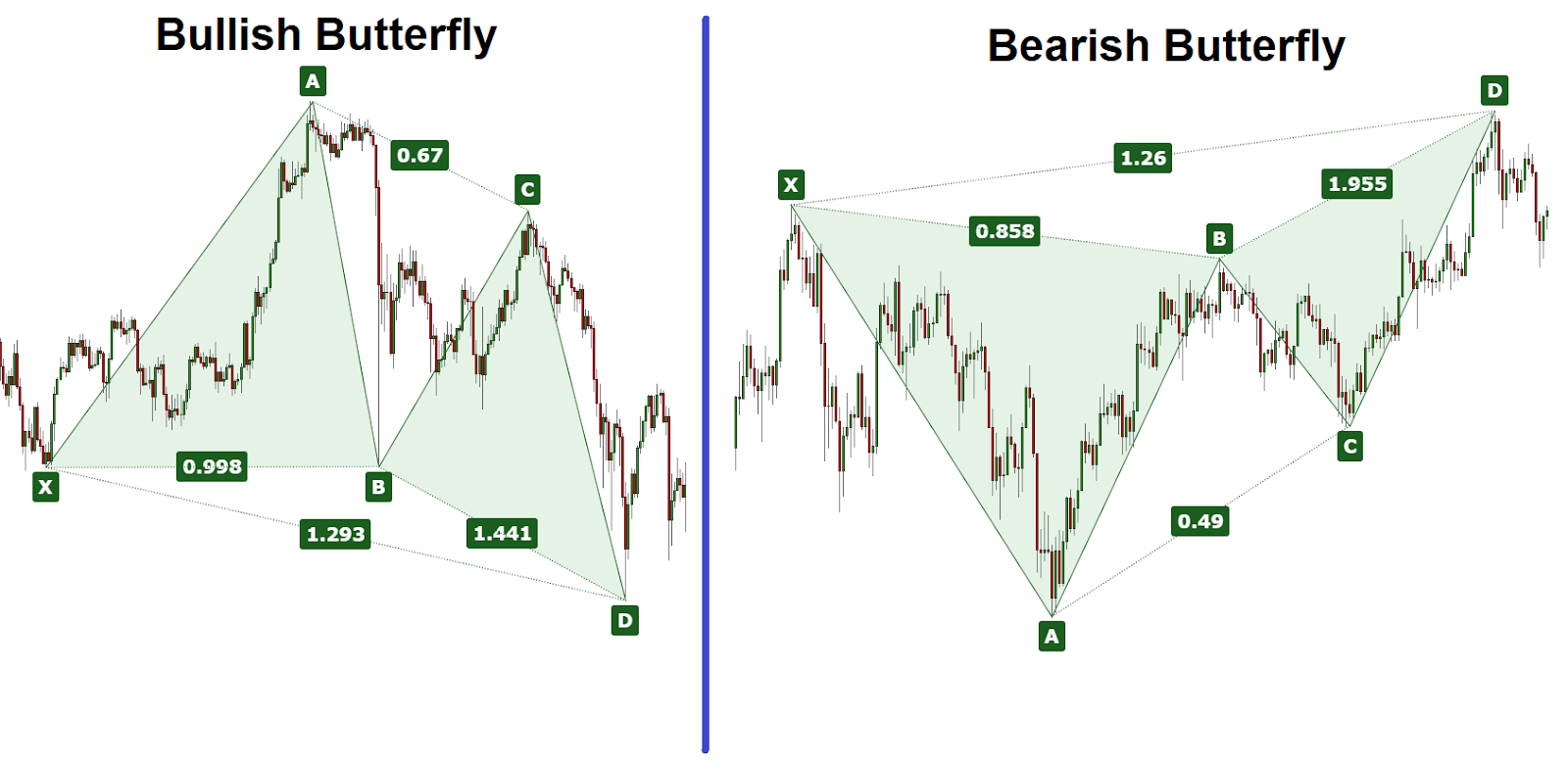

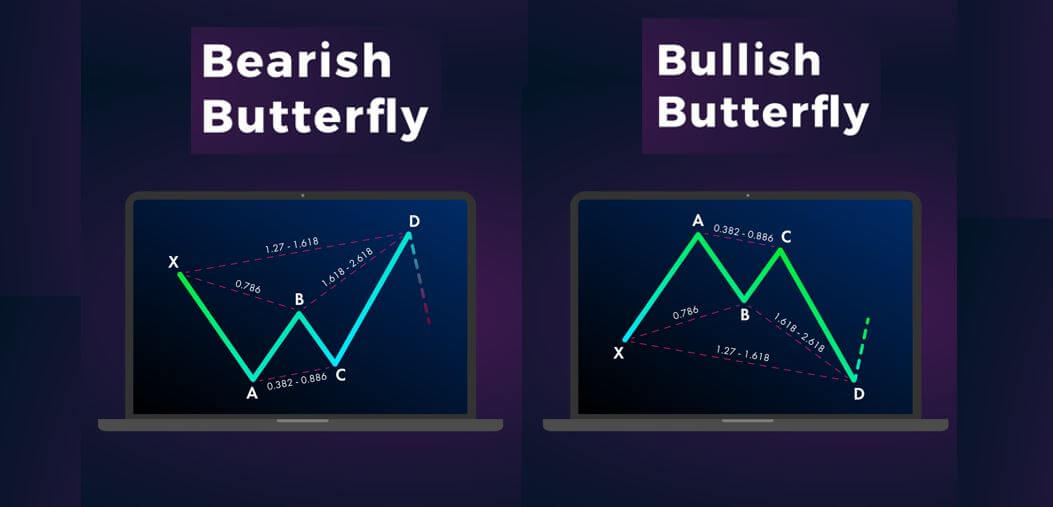

How to Identify & Trade Harmonic Butterfly Pattern for Profits Bybit

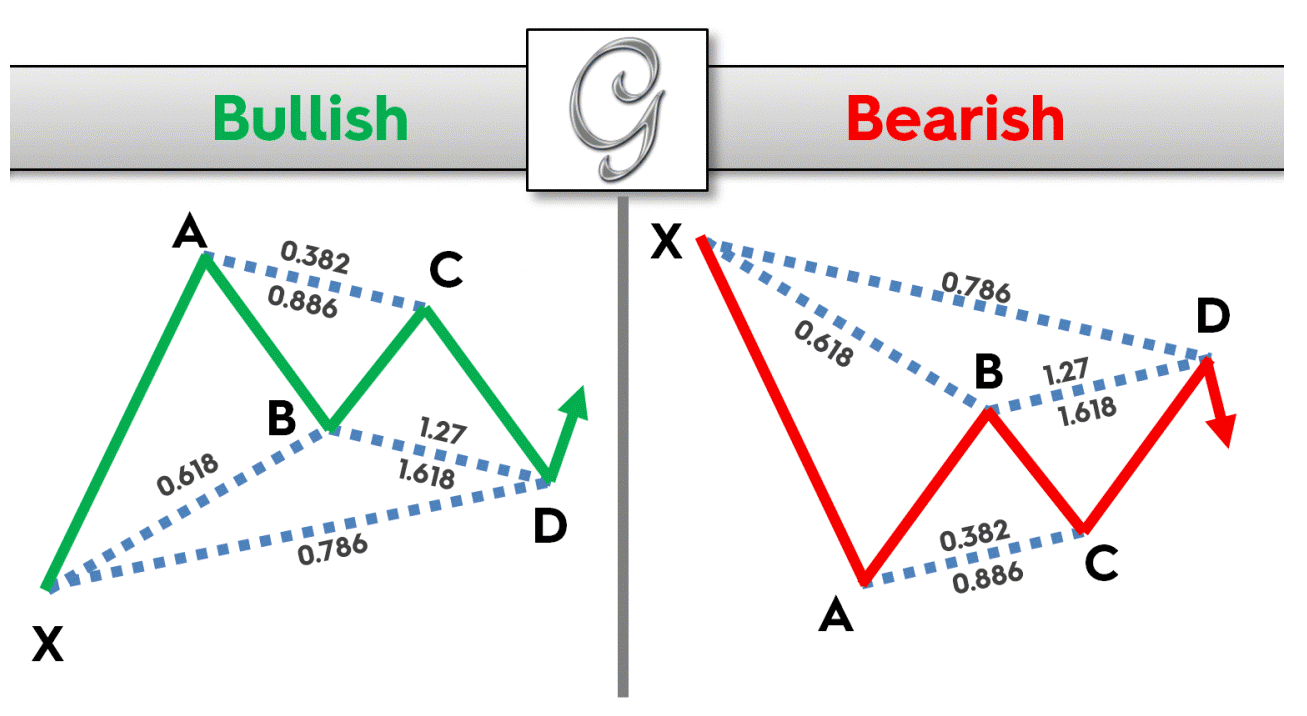

The Forex Harmonic Patterns Guide ForexBoat Trading Academy

Bullish vs Bearish Chart Pattern Intraday trading Market strategy

123. Trading The Bullish & Bearish Bat Pattern Forex Academy

BULLISH AND BEARISH PATTERNS Candlestick patterns, Forex trading

Bullish Vs Bearish how to tell if a market is bear or bullish

How to Use Bullish and Bearish Harami Candles to Find Trend Reversals

Learning To Trade The Bullish & Bearish ‘Butterfly’ Harmonic Pattern

Bullish and bearish belt hold candlestick patterns explained on E

Web Head & Shoulders Are Reversal Patterns (Like Double/Triple Tops/Bottoms And Wedges) That Form At The Top Or Bottom Of A Trend With The Bottoms Being Bullish And The Tops Being Bearish.

Web Bullish Means There’s A General Sentiment That A Stock Or Market Will Trend Upward.

These Patterns Resemble “M” Or “W” Patterns And Are Defined By 5 Key Pivot Points.

If One Happens, The Next Resistance Will Be At $0.000032, 35% Above The Current Price.

Related Post: