Gartley 222 Pattern

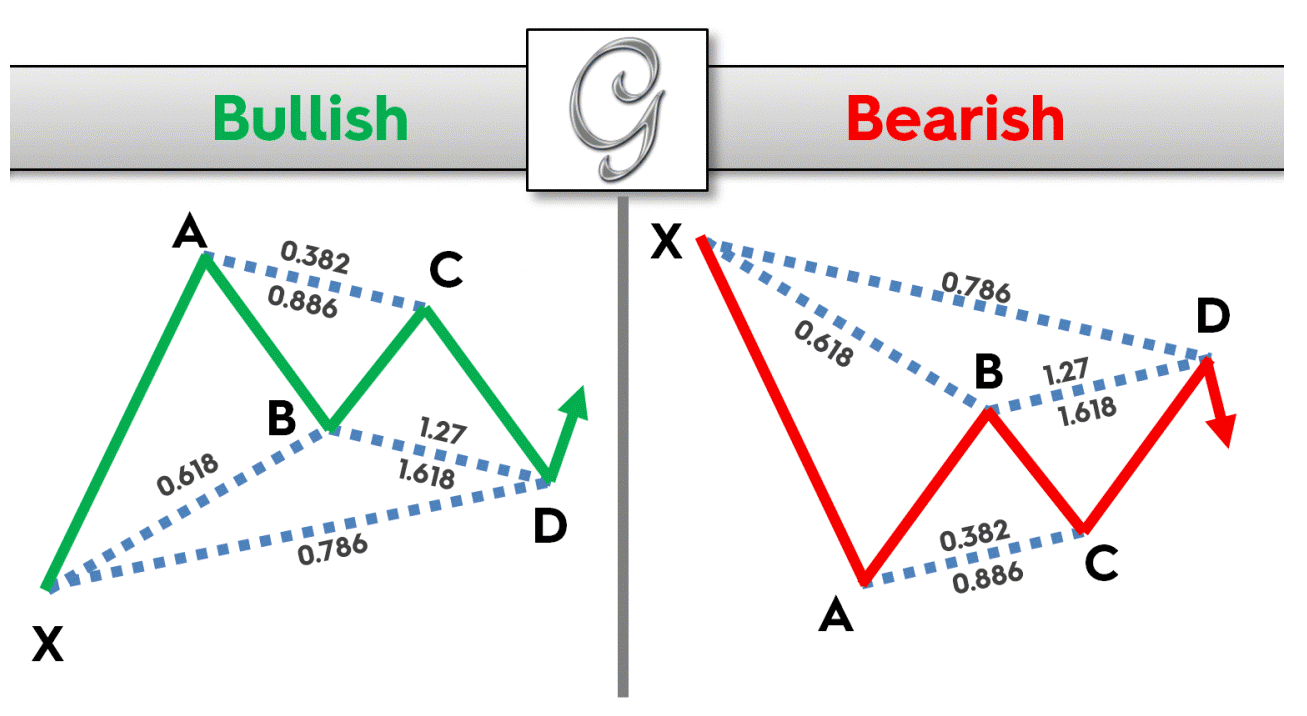

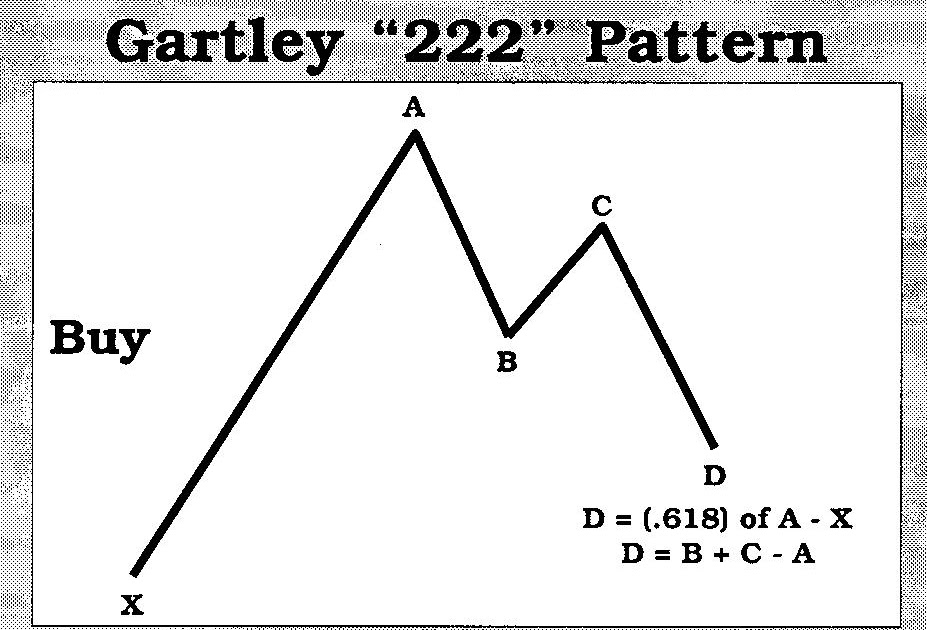

Gartley 222 Pattern - What is the gartley pattern? Web the pattern is also called the ‘222 pattern’ or ‘gartley 22’ because the details of how to identify and trade it are found on page 222 of the book. Web gartley (or gartley 222) is a bullish but complex chart pattern (a trading setup, really). Web it is also known as the ‘222 pattern’ because details of how to identify and use it are found on page 222 of gartley’s book, ‘profits in the stock market’. Xa could be any move on the chart. Bc should be either 38.2% or. I will simply refer to this pattern as the “gartley.”. The gartley pattern is a harmonic chart pattern, based on fibonacci. Ab should be 61.8% of xa. The important features of the gartley are the specific location of the various points: The gartley “222” pattern is named for the page number it is found on in h.m. The important features of the gartley are the specific location of the various points: I will simply refer to this pattern as the “gartley.”. Gartleys are patterns that include the basic abcd pattern we’ve already talked about, but are preceded by a significant high. Gartleys book, profits in the stock market. The important features of the gartley are the specific location of the various points: Gartley’s pattern built the foundation for what is now known as harmonic trading and would prove to be a cornerstone for future traders. The gartley “222” pattern is named for the page number it is found on in h.m.. The gartley pattern is a harmonic chart pattern, based on fibonacci. Web the gartley pattern is a harmonic chart formation that relies on the fibonacci sequence for construction. The pattern looks like an m/w and its swings are designated with the points x, a, b, c, and d. What is the gartley pattern? Ab should be 61.8% of xa. Web it is also known as the ‘222 pattern’ because details of how to identify and use it are found on page 222 of gartley’s book, ‘profits in the stock market’. Gartleys are patterns that include the basic abcd pattern we’ve already talked about, but are preceded by a significant high or low. The gartley pattern is a harmonic chart. Web other names for the gartley pattern: What is the gartley pattern? Internationally known author and trader thomas bulkowski tests how well it performs. The gartley pattern is a harmonic chart pattern, because it uses fibonacci numbers to attempt to identify precise price points at which a trend will either breakout or retrace. Gartley patterns are the most commonly used. Gartleys book, profits in the stock market. Gartley’s book, profits in the stock market, on page 222. I will simply refer to this pattern as the “gartley.”. The pattern looks like an m/w and its swings are designated with the points x, a, b, c, and d. Web the pattern is also called the ‘222 pattern’ or ‘gartley 22’ because. The important features of the gartley are the specific location of the various points: Gartley’s book, profits in the stock market, on page 222. Gartley’s pattern built the foundation for what is now known as harmonic trading and would prove to be a cornerstone for future traders. Web it is called a gartley 222 because it is found in h.m.. Gartley’s book, profits in the stock market, on page 222. Internationally known author and trader thomas bulkowski tests how well it performs. The important features of the gartley are the specific location of the various points: Web this is why it is also known as the ‘222 pattern.’. The gartley pattern is a harmonic chart pattern, based on fibonacci. Web updated may 25, 2022. What is the gartley pattern? I will simply refer to this pattern as the “gartley.”. The important features of the gartley are the specific location of the various points: The gartley pattern is a harmonic chart pattern, because it uses fibonacci numbers to attempt to identify precise price points at which a trend will either. Bc should be either 38.2% or. The formation was intended for the stock market but may be applied to any instrument or product. Gartley’s book, profits in the stock market, on page 222. Web the pattern is also called the ‘222 pattern’ or ‘gartley 22’ because the details of how to identify and trade it are found on page 222. I will simply refer to this pattern as the “gartley.”. Web other names for the gartley pattern: What is the gartley pattern? The pattern looks like an m/w and its swings are designated with the points x, a, b, c, and d. Web this is why it is also known as the ‘222 pattern.’. Web the pattern is also called the ‘222 pattern’ or ‘gartley 22’ because the details of how to identify and trade it are found on page 222 of the book. Gartley’s book, profits in the stock market, on page 222. The formation was intended for the stock market but may be applied to any instrument or product. Gartleys book, profits in the stock market. Web gartley (or gartley 222) is a bullish but complex chart pattern (a trading setup, really). Xa could be any move on the chart. As a harmonic pattern, the gartley swings should correspond to specific fibonacci levels: Web it is called a gartley 222 because it is found in h.m. Web it is also known as the ‘222 pattern’ because details of how to identify and use it are found on page 222 of gartley’s book, ‘profits in the stock market’. Gartley’s pattern built the foundation for what is now known as harmonic trading and would prove to be a cornerstone for future traders. Gartley and detailed further by scott carney.

Harold McKinley Gartley Who’s?

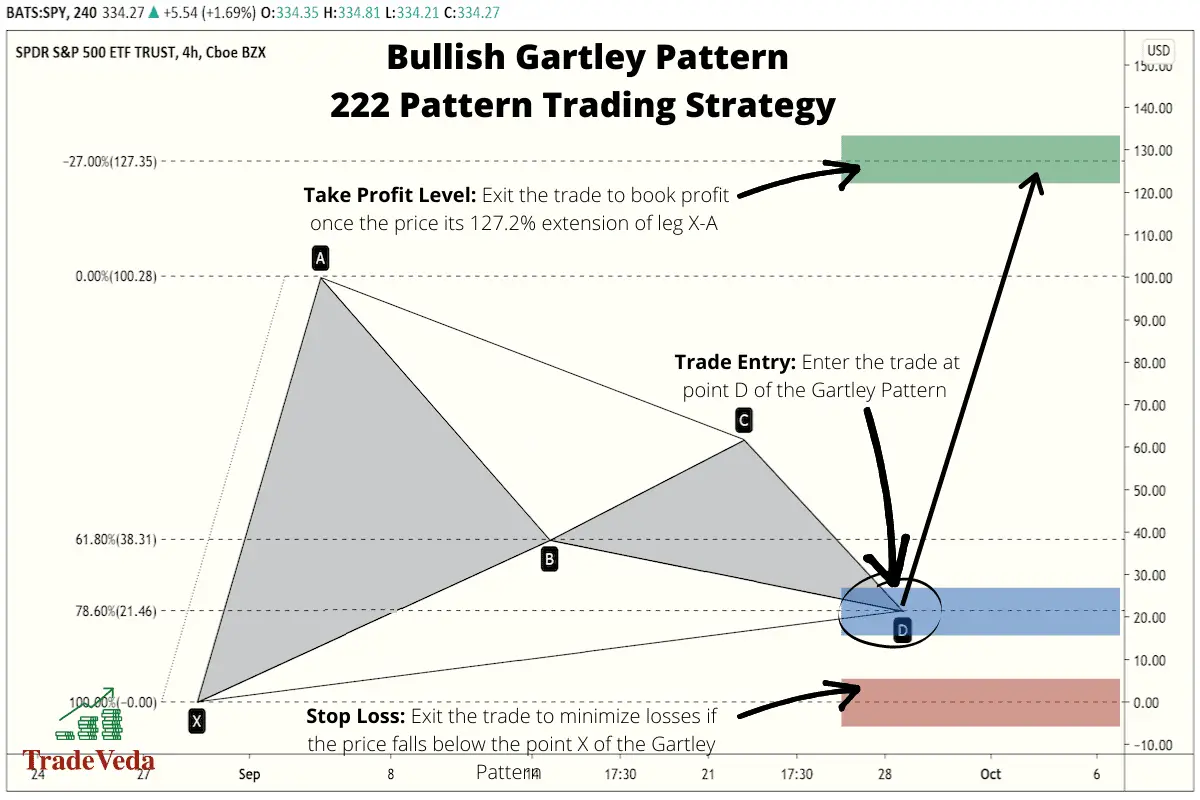

bullishgartleypatter222strategy TradeVeda

GARTLEY 222 PDF

Gartley "222" pattern formed for NASDAQAMZN by Prome — TradingView

Bearish Harmonic Gartley 222 Pattern Folge dem Echtzeit TradingSignal

The Forex Harmonic Patterns Guide ForexBoat Trading Academy

:max_bytes(150000):strip_icc()/GartleyPattern-5541ce000da34023a20348e5681bbffb.png)

What Is a Gartley Pattern? Chart Pattern Explained and Example

AUDNZD Bullish Harmonic Gartley 222 Pattern Trading4Freedom

serbuo gartley 222

Estrategia formación armónica y de Gartley 222 Rankia

Web The Gartley Pattern Is One Of The Most Traded Harmonic Patterns And Can Be Applied To Many Markets And Timeframes.

Gartleys Are Patterns That Include The Basic Abcd Pattern We’ve Already Talked About, But Are Preceded By A Significant High Or Low.

The Gartley Pattern Is A Harmonic Chart Pattern, Because It Uses Fibonacci Numbers To Attempt To Identify Precise Price Points At Which A Trend Will Either Breakout Or Retrace.

Bc Should Be Either 38.2% Or.

Related Post: