Free Printable Tax Deduction Worksheet

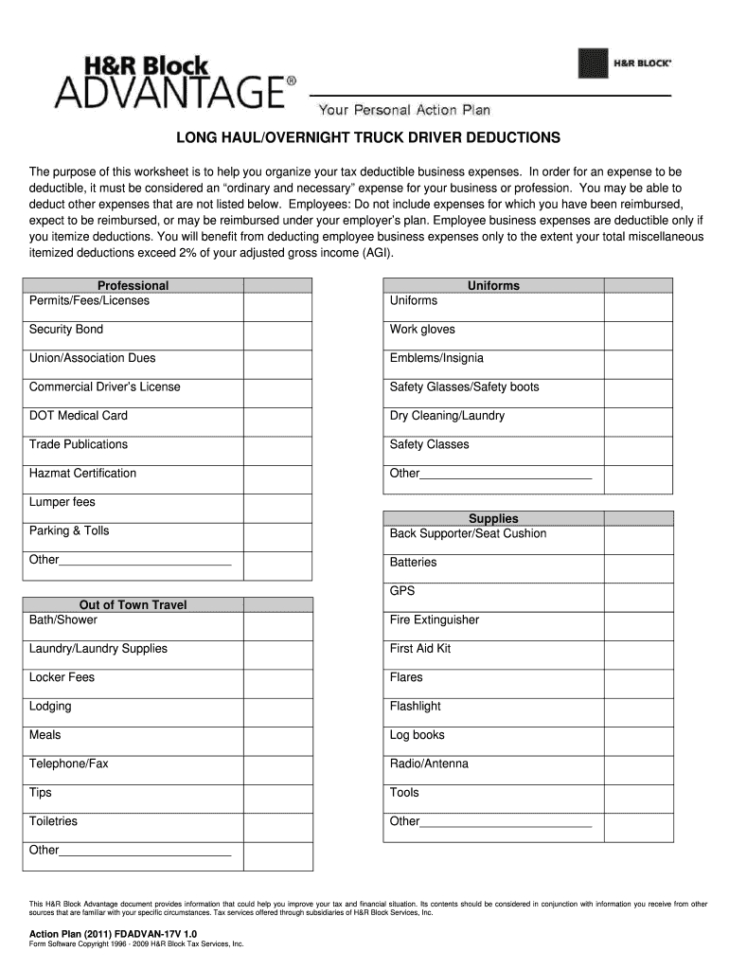

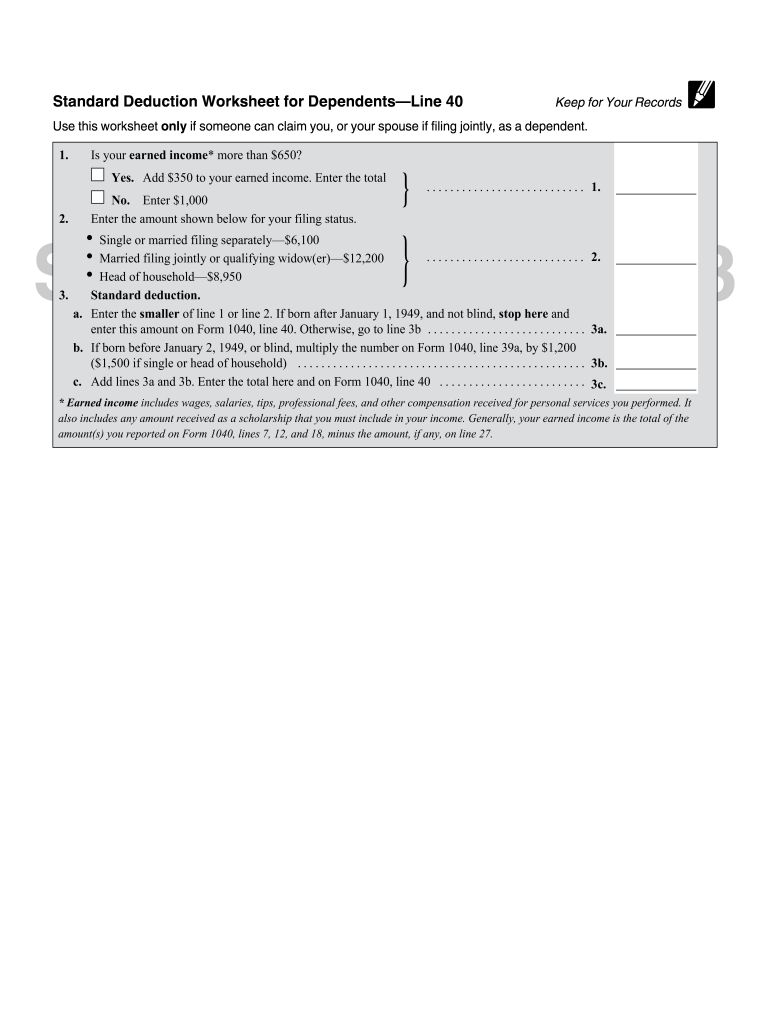

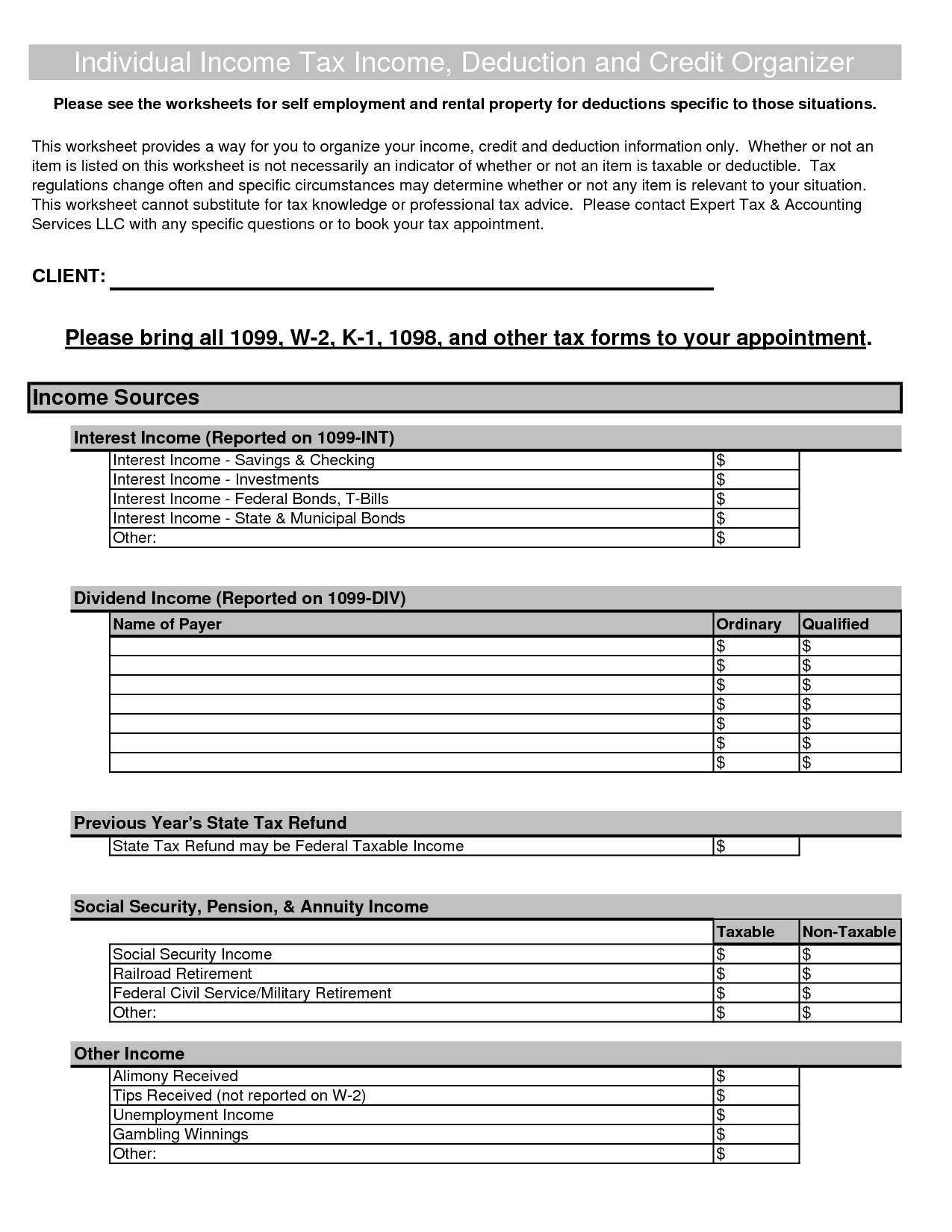

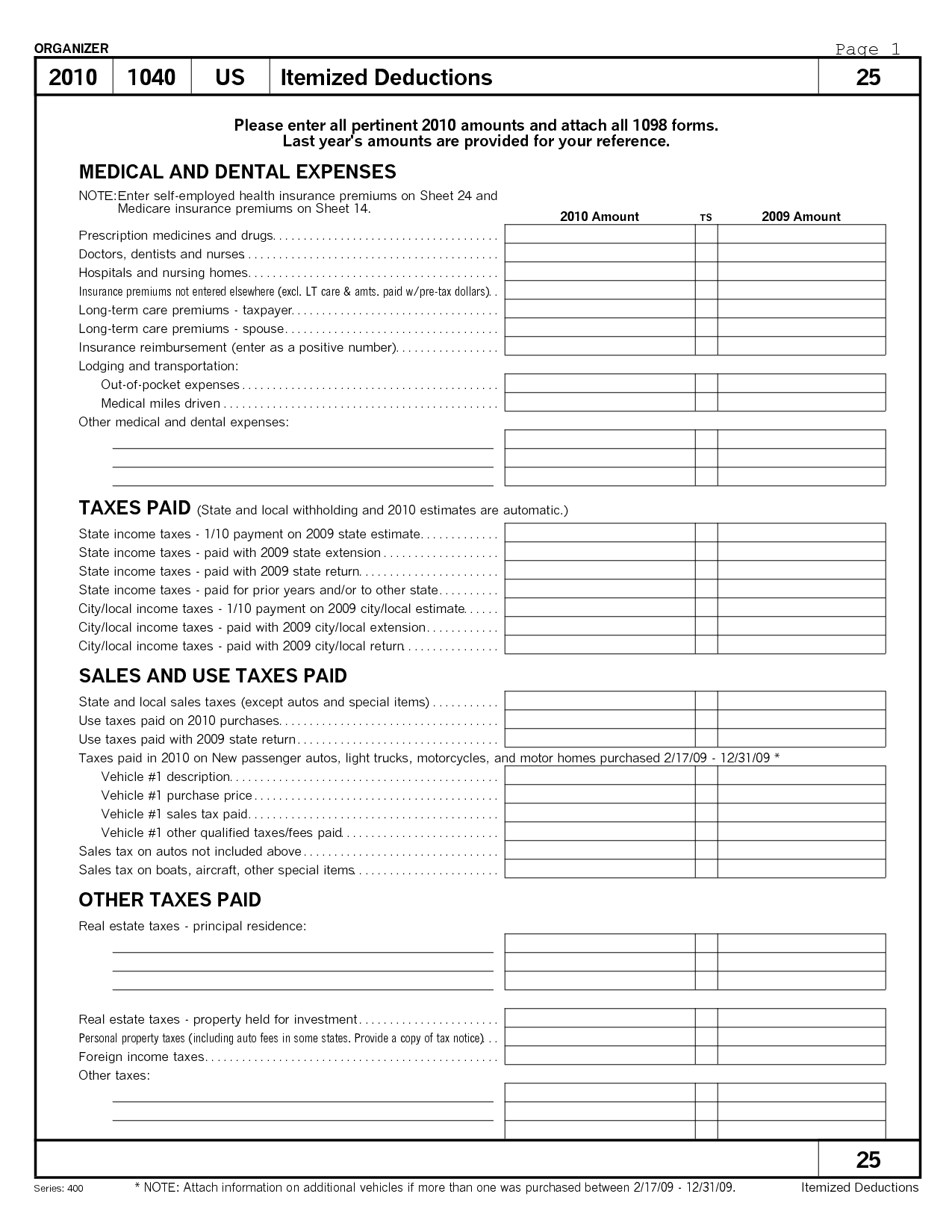

Free Printable Tax Deduction Worksheet - The home office deduction is one of the most significant tax benefits of running a small business out of your home. Tax table from instructions for form 1040 pdf. Was born before january 2, 1959 is. Web tax regulations change often and specific circumstances may determine whether or not any item is relevant to your situation. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you. 107 13 how to figure your tax. You may include other applicable. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. The purpose of this worksheet is to help you organize your tax deductible business expenses. Single (65+) $14,700 married (one 65+) $27,300 hoh (65+). Simply follow the instructions on this sheet and start lowering your social security. Single $13,850 married (filing joint) $27,700 single (65+) $15,700 married (one 65+) $29,200 married (both 65+). Please enter your 2023 information in the designated areas on the worksheets. Tax table from instructions for form 1040 pdf. Long haul trucker/overnight driver tax. Long haul trucker/overnight driver tax. You may include other applicable. Web the attached worksheets cover income, deductions, and credits, and will help in the preparation of your tax return by focusing attention on your special needs. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Was born before january 2, 1959 is. 107 13 how to figure your tax. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): The home office deduction is one of the most significant. Please enter your 2023 information in the designated areas on the worksheets. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Web download free pdf worksheets to organize your income tax data by topic, occupation, or year. 2023 instructions for schedule aitemized deductions. Long haul trucker/overnight driver tax. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Figuring your taxes, and refundable and nonrefundable credits. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re claiming all the. Web department of the treasury internal revenue. Web form 1040 pdf. Long haul trucker/otr driver deductible expenses worksheet. 107 14 child tax credit and credit for other dependents. I've put the contributions on schedule a but cannot get the. Web itemized deductions worksheet you will need: The home office deduction is one of the most significant tax benefits of running a small business out of your home. Trucker's income and expense worksheet. My client took the standard deduction in 2020 but still made some charitable deductions that i'm hoping to carry through to 1040 line 10b. Figuring your taxes, and refundable and nonrefundable credits. Single $13,850. 97 12 other itemized deductions. The purpose of this worksheet is to help you organize your tax deductible business expenses. In most cases, your federal income tax will be less if you take the larger of your itemized. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or. 2023 instructions for schedule aitemized deductions. Instructions for form 1040 pdf. Were born before january 2, 1959. Please enter your 2023 information in the designated areas on the worksheets. Figuring your taxes, and refundable and nonrefundable credits. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web tax regulations change often and specific circumstances may determine whether or not any item is relevant to your situation. Web form 1040 pdf. Web download free pdf worksheets to organize your income tax data. In order for an expense to be deductible, it must be considered an ordinary and necessary expense. Web itemized deductions worksheet you will need: 97 12 other itemized deductions. Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Figuring your taxes, and refundable and nonrefundable credits. My client took the standard deduction in 2020 but still made some charitable deductions that i'm hoping to carry through to 1040 line 10b. This worksheet cannot substitute for tax knowledge or professional tax advice. You as a dependent your spouse as a dependent. Web tax regulations change often and specific circumstances may determine whether or not any item is relevant to your situation. You may include other applicable. Use schedule a (form 1040) to figure your itemized deductions. Trucker's income and expense worksheet. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Single $13,850 married (filing joint) $27,700 single (65+) $15,700 married (one 65+) $29,200 married (both 65+).

Printable Tax Deduction Worksheet —

Printable Itemized Deductions Worksheet

Printable Real Estate Agent Tax Deductions Worksheets Printable

Standard Deduction Line Fill Online, Printable, Fillable, Blank

EXCEL of Tax Deduction Form.xlsx WPS Free Templates

Itemized Deductions Worksheet 2018 Printable Worksheets and

Itemized Deductions Form 1040 Schedule A Free Download Worksheet

18 Itemized Deductions Worksheet Printable /

8 Best Images of Monthly Bill Worksheet 2015 Itemized Tax Deduction

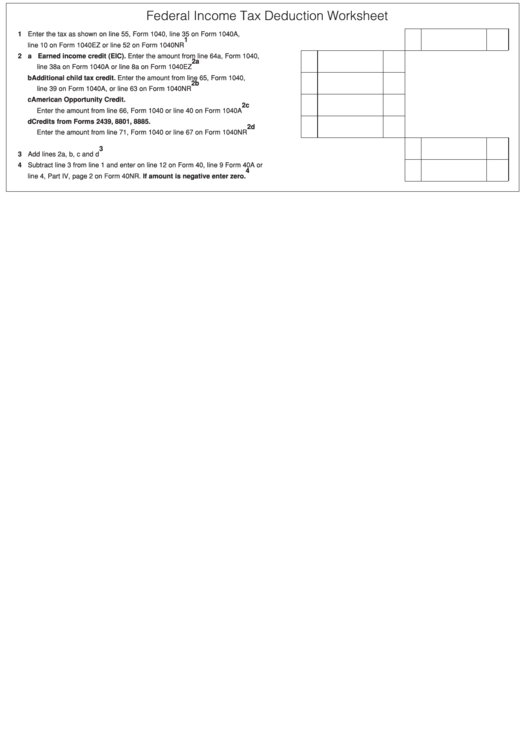

Federal Tax Deduction Worksheet Form printable pdf download

Was Born Before January 2, 1959 Is.

Web The Attached Worksheets Cover Income, Deductions, And Credits, And Will Help In The Preparation Of Your Tax Return By Focusing Attention On Your Special Needs.

Single $12,950 Married $25,900 Hoh $19,400.

107 14 Child Tax Credit And Credit For Other Dependents.

Related Post: