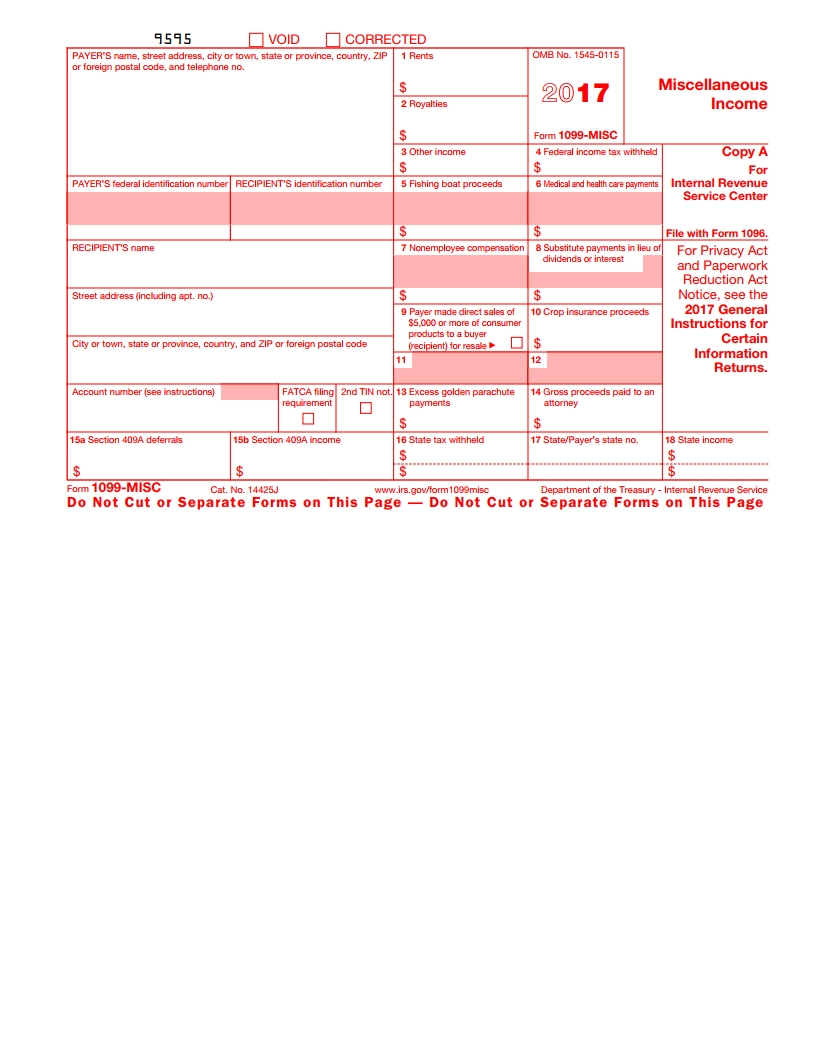

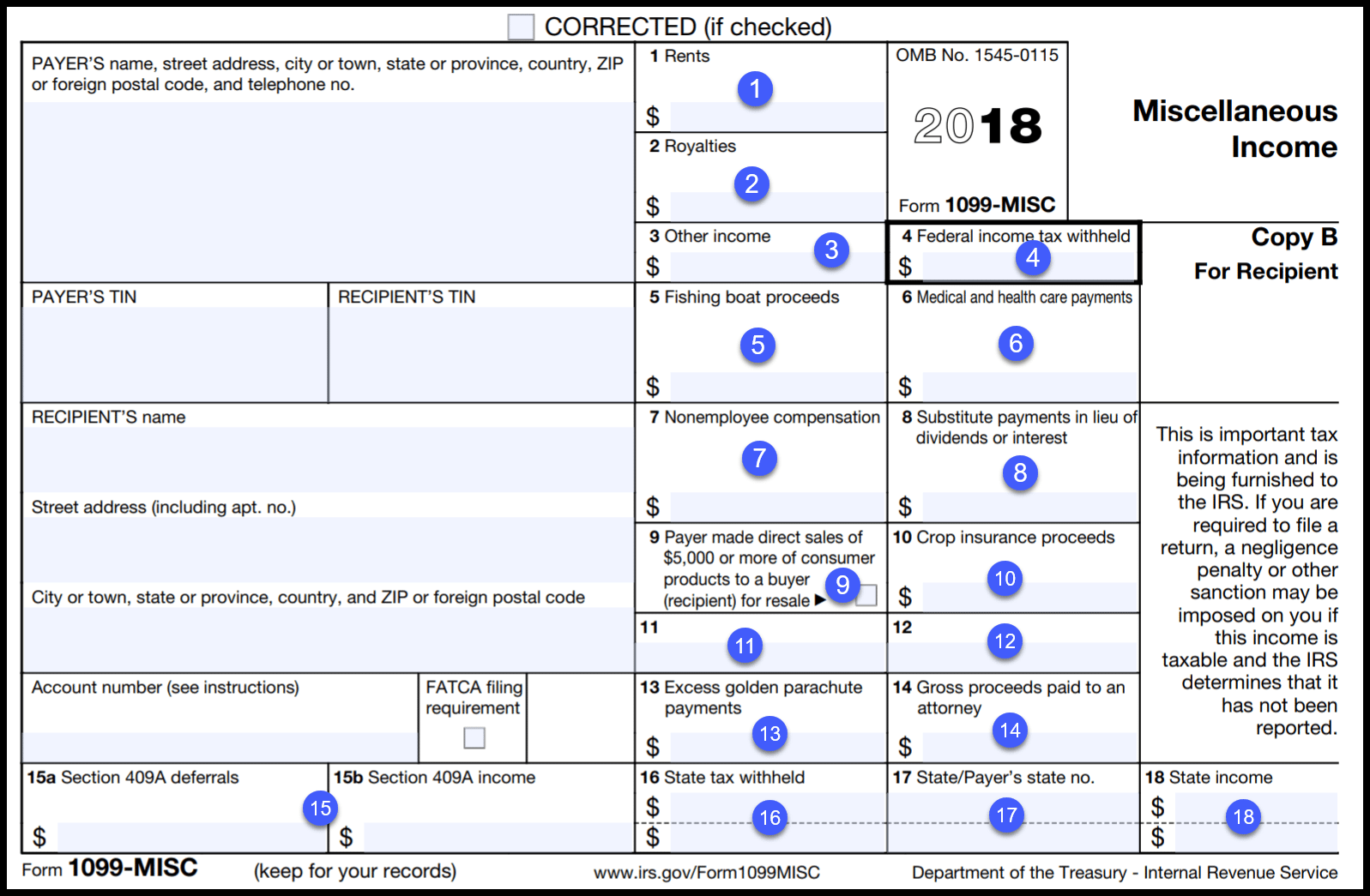

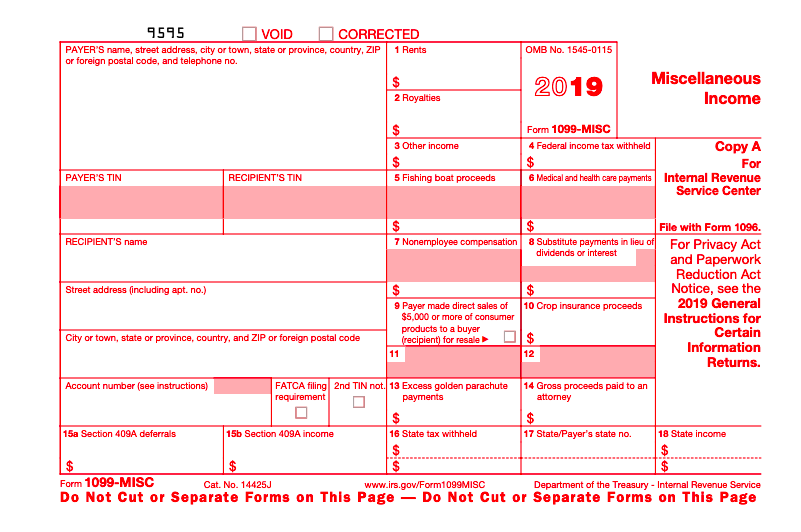

Free Printable 1099

Free Printable 1099 - 3 simple stepscheck pricing detailsdownload our mobile app Find out who gets a 1099, when to file, and how to get paper copies. Gather information for all of your payees. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. If you paid an independent contractor more than $600 in a. Web isaiah mccoy, cpa. This free electronic filing service is secure, accurate and requires no special software. The information returns intake system (iris) taxpayer portal is a system that provides a no cost online method for you to electronically file forms 1099. Paperless solutionstrusted by millions30 day free trialmoney back guarantee Learn how to fill out, file, and report different types of payments on this form. Their full legal name and address. File to download or integrate. 1099 forms can report different types of incomes. This free electronic filing service is secure, accurate and requires no special software. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Find out who gets a 1099, when to file, and how to get paper copies. The information returns intake system (iris) taxpayer portal is a system that provides a no cost online method for you to electronically file forms 1099. This free electronic filing service is secure, accurate and requires no special software. Receipts, invoices and any other payment information.. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Paperless solutionstrusted by millions30 day free trialmoney back guarantee Web what is a 1099? File to download or integrate. 3 simple stepscheck pricing detailsdownload our mobile app File to download or integrate. 1099 forms can report different types of incomes. Paperless solutionstrusted by millions30 day free trialmoney back guarantee Web isaiah mccoy, cpa. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. File your 1099 with the irs for free. Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. File to download or integrate. Gather information for all of your payees. The payer fills out the 1099 and sends copies to you and the irs. File your 1099 with the irs for free. Paperless solutionstrusted by millions30 day free trialmoney back guarantee Receipts, invoices and any other payment information. 1099 forms can report different types of incomes. 3 simple stepscheck pricing detailsdownload our mobile app Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. Web what is a 1099? 1099 forms can report different types of incomes. The information returns intake system (iris) taxpayer portal is a system that provides a no cost online method for you to electronically file forms 1099. This free electronic filing. 3 simple stepscheck pricing detailsdownload our mobile app Their full legal name and address. Receipts, invoices and any other payment information. Learn how to fill out, file, and report different types of payments on this form. Paperless solutionstrusted by millions30 day free trialmoney back guarantee What it is, how it works. 1099 forms can report different types of incomes. This free electronic filing service is secure, accurate and requires no special software. If you paid an independent contractor more than $600 in a. Web isaiah mccoy, cpa. This free electronic filing service is secure, accurate and requires no special software. Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. Their full legal name and address. Learn how to fill out, file, and report different types of payments on this form. If you paid an independent contractor more than. The information returns intake system (iris) taxpayer portal is a system that provides a no cost online method for you to electronically file forms 1099. The payer fills out the 1099 and sends copies to you and the irs. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. What it is, how it works. 3 simple stepscheck pricing detailsdownload our mobile app File to download or integrate. 1099 forms can report different types of incomes. Their full legal name and address. Receipts, invoices and any other payment information. Web isaiah mccoy, cpa. Gather information for all of your payees. Find out who gets a 1099, when to file, and how to get paper copies. A 1099 form is a record that an entity or person other than your employer gave or paid you money. If you paid an independent contractor more than $600 in a. Web what is a 1099? Web form 1099 is a collection of forms used to report payments that typically aren't from an employer.![]()

Printable 1099 Form Pdf Free Printable Download

1099 Form Template. Create A Free 1099 Form Form.

1099 Employee Form Printable

Free Printable 1099 Misc Forms Free Printable

1099 S Fillable Form Printable Forms Free Online

1099 Irs Form Printable Printable Forms Free Online

Free Fillable And Printable 1099 Forms

1099 Printable Forms

1099MISC Form The Ultimate Guide for Business Owners

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

File Your 1099 With The Irs For Free.

This Free Electronic Filing Service Is Secure, Accurate And Requires No Special Software.

Learn How To Fill Out, File, And Report Different Types Of Payments On This Form.

Paperless Solutionstrusted By Millions30 Day Free Trialmoney Back Guarantee

Related Post: