Fppa Retirement Chart

Fppa Retirement Chart - Are you in a crisis? Web use the chart below to calculate a normal, early or vested retirement benefit using the member’s age at retirement and years of service. Saving, health care, naming and updating your beneficiaries, social security implications, and much more. Web take control of your retirement planning with this brief handout about; Web statewide retirement plan funding level: Compare the rates and ratios for differen… 9.21% 2023 srp benefit adjustment: Here's one example of what the chart. Learn more about the features and benefits of each plan option, such as. Web november 26, 2020 by ryan woodhouse. Web use the chart below to calculate a normal, early or vested retirement benefit using the member’s age at retirement and years of service. Here's one example of what the chart. Fppa collects, invests, administers and disburses funds for the fire & police members’ investment fund that was established under colorado state statutes. Web in 2021, fppa made a total. Compare the rates and ratios for differen… Are you in a crisis? Separate retirement account funds will transfer to fidelity in january 2021. 9.21% 2023 srp benefit adjustment: Enter your information below to create benefit projections for both components simultaneously and then see. 988 suicide & crisis lifeline. This represents a relatively small decrease (0.8%) from 2020. Benefit percentages are accrued at different rates. Compare the rates and ratios for differen… 9.21% 2023 srp benefit adjustment: 9.21% 2023 srp benefit adjustment: The member account portal is a. Web in fppa’s ongoing effort to streamline the retirement process for our members, we are pleased to announce the launch of our online retirement application. This represents a relatively small decrease (0.8%) from 2020. Struggling emotionally and need to talk to someone? Find out the current and projected contribution rates and funded ratios for fppa's retirement and death & disability plans. Enter your information below to create benefit projections for both components simultaneously and then see. Web statewide retirement plan funding level: Web partial entry benefit estimate summary. Web not sure which fppa defined benefit component is best for you? Are you in a crisis? Web statewide retirement plan funding level: Find out the current and projected contribution rates and funded ratios for fppa's retirement and death & disability plans. Web benefit percentage charts (compared to page one of the plan brochure) for eligible retirees will vary based upon individual circumstances. Web using the chart on page 1 of your. Fppa collects, invests, administers and disburses funds for the fire & police members’ investment fund that was established under colorado state statutes. Learn more about the features and benefits of each plan option, such as. Benefit percentages are accrued at different rates. The benefit estimate summary below is intended for use by members of social security departments that are interested. Here's one example of what the chart. Web in fppa’s ongoing effort to streamline the retirement process for our members, we are pleased to announce the launch of our online retirement application. Web fppa rules and regulations codified september 28, 2023 to be effective january 1, 2024. Web fppa uses the formula below to calculate our members' estimated monthly pension. Compare the rates and ratios for differen… Web benefit percentage charts (compared to page one of the plan brochure) for eligible retirees will vary based upon individual circumstances. Find out the current and projected contribution rates and funded ratios for fppa's retirement and death & disability plans. Separate retirement account funds will transfer to fidelity in january 2021. Web statewide. This represents a relatively small decrease (0.8%) from 2020. Fppa collects, invests, administers and disburses funds for the fire & police members’ investment fund that was established under colorado state statutes. Web benefit percentage charts (compared to page one of the plan brochure) for eligible retirees will vary based upon individual circumstances. Web in 2021, fppa made a total of. Web in fppa’s ongoing effort to streamline the retirement process for our members, we are pleased to announce the launch of our online retirement application. 9.21% 2023 srp benefit adjustment: Web if you are a fidelity netbenefits user, you can transfer your funds between different plan options online. Web using the chart on page 1 of your selected plan's brochure, determine your benefit percentage based upon years of service (service credits) and age at retirement Web in 2021, fppa made a total of $281,795,676 in benefit payments to 10,681 different recipients. Here's one example of what the chart. Are you in a crisis? Web use the chart below to calculate a normal, early or vested retirement benefit using the member’s age at retirement and years of service. Learn more about the features and benefits of each plan option, such as. Web november 26, 2020 by ryan woodhouse. Saving, health care, naming and updating your beneficiaries, social security implications, and much more. This represents a relatively small decrease (0.8%) from 2020. Compare the rates and ratios for differen… Call the 988 suicide and crisis lifeline or chat online. Find out the current and projected contribution rates and funded ratios for fppa's retirement and death & disability plans. Web statewide retirement plan funding level:

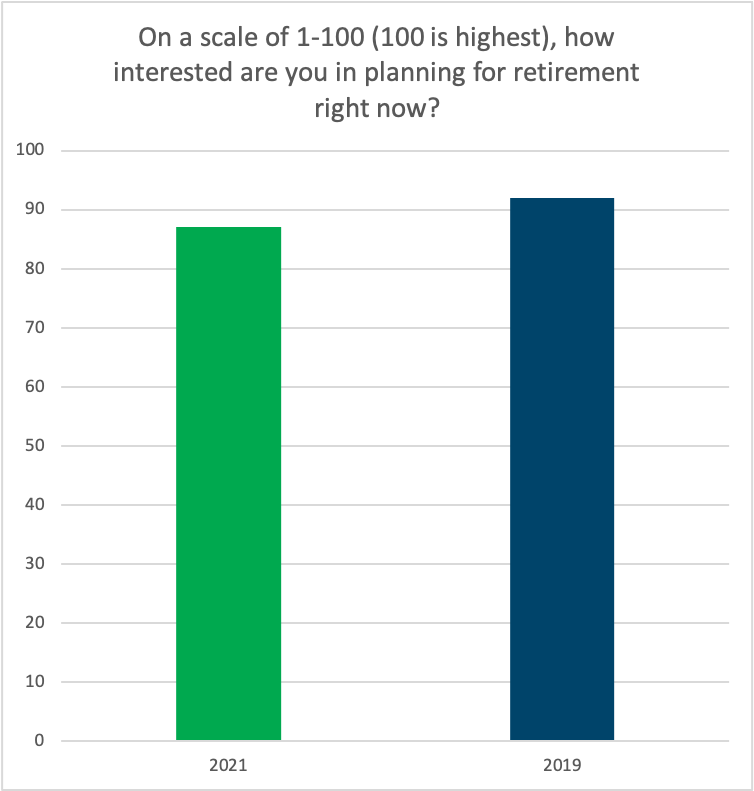

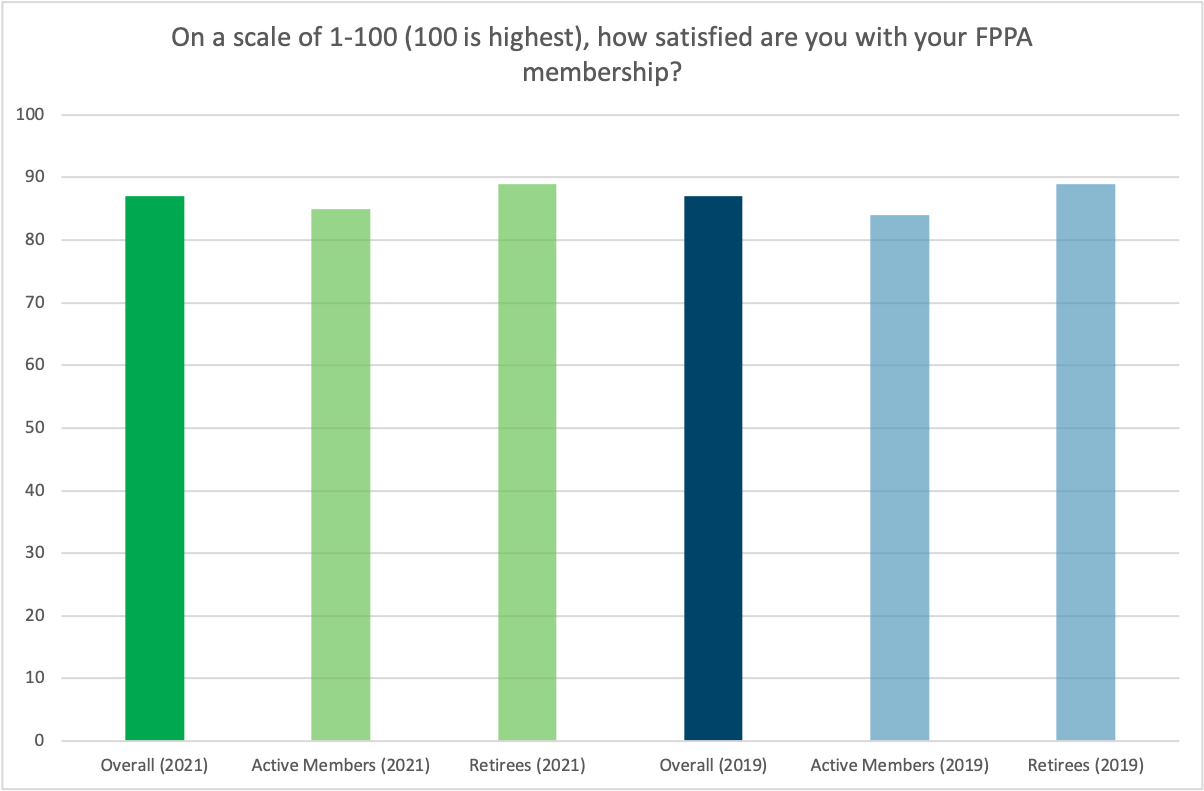

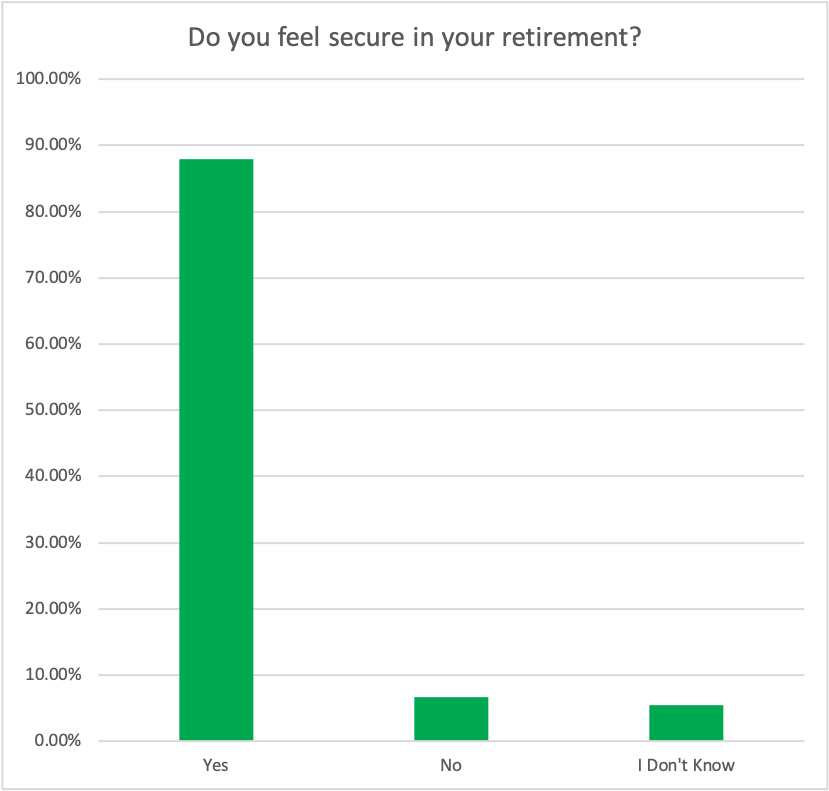

Results From FPPA’s Member Survey PensionCheck Online FPPA

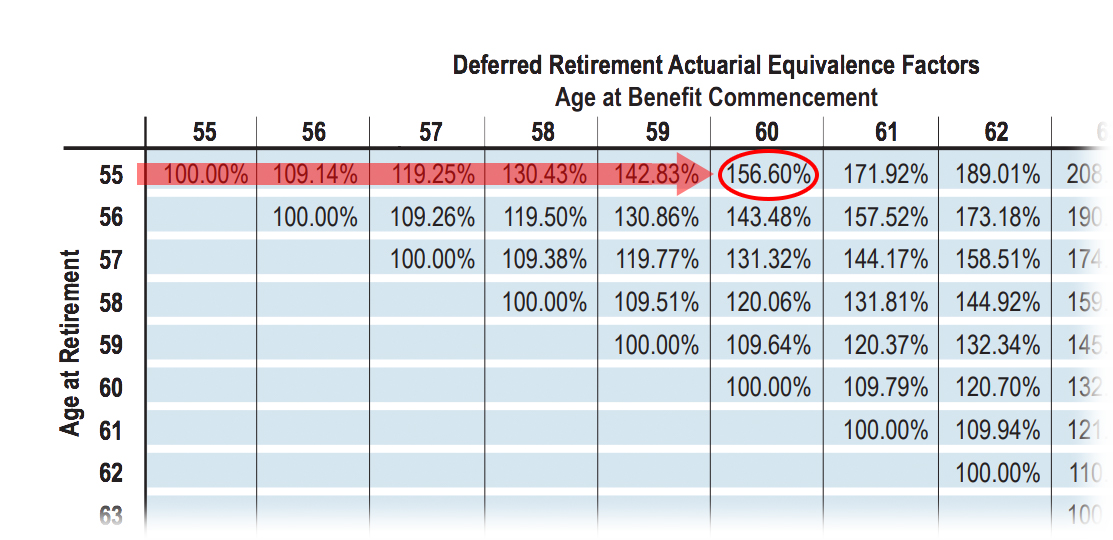

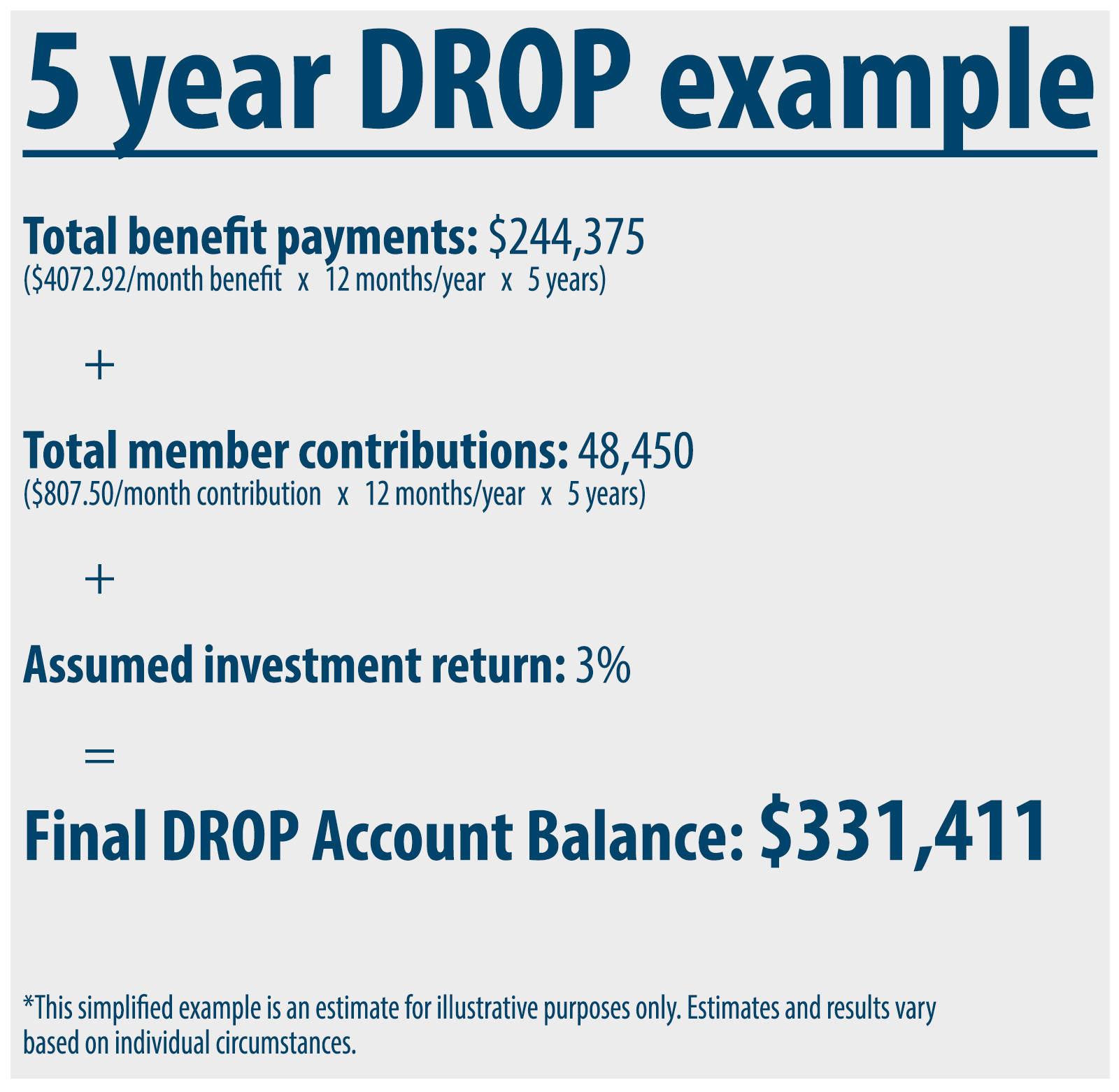

DROP vs. Deferred Retirement PensionCheck Online FPPA

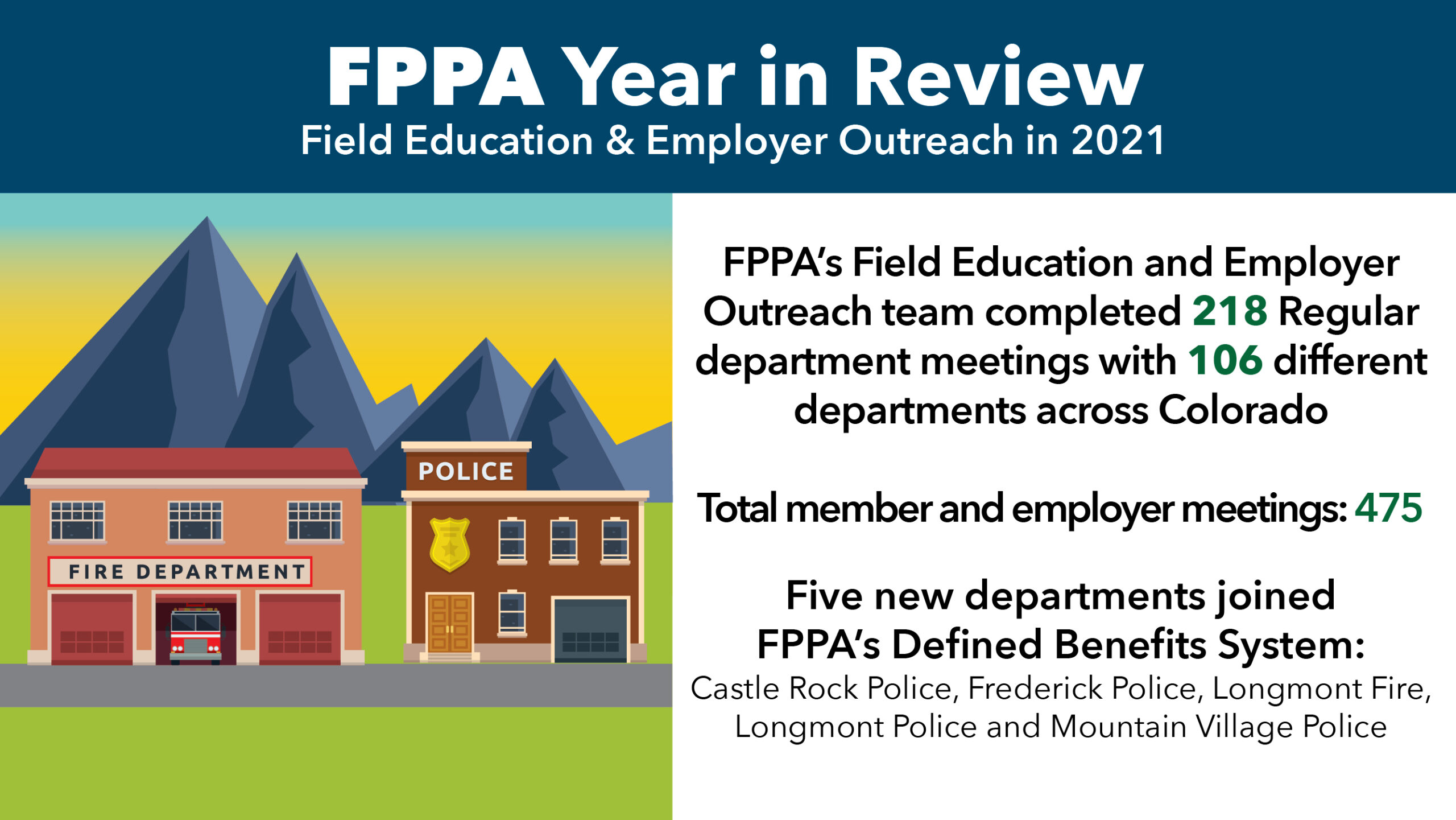

FPPA's 2021 Year in Review PensionCheck Online FPPA

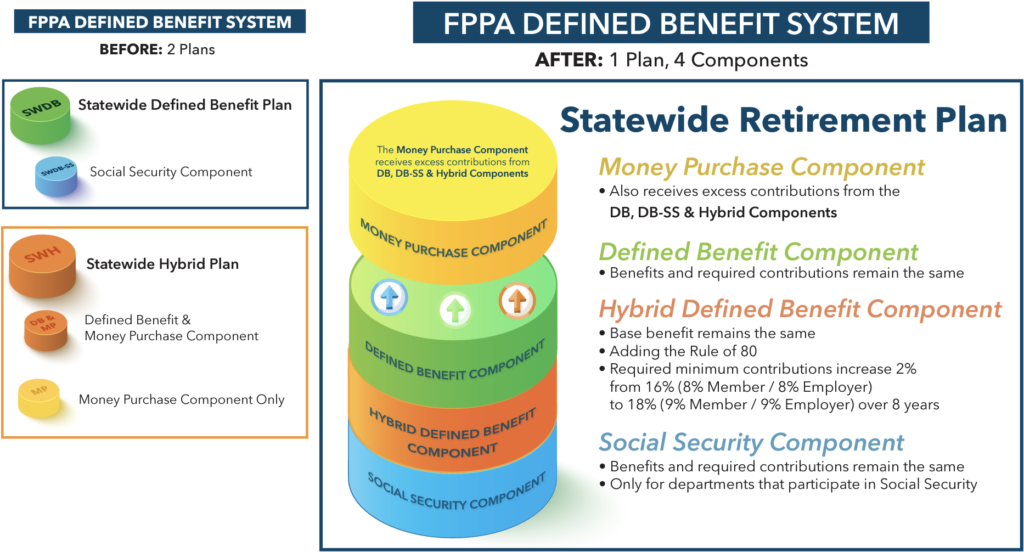

FPPA Statewide Retirement Plan Defined Benefit Component

Looking Forward to the New Statewide Retirement Plan PensionCheck

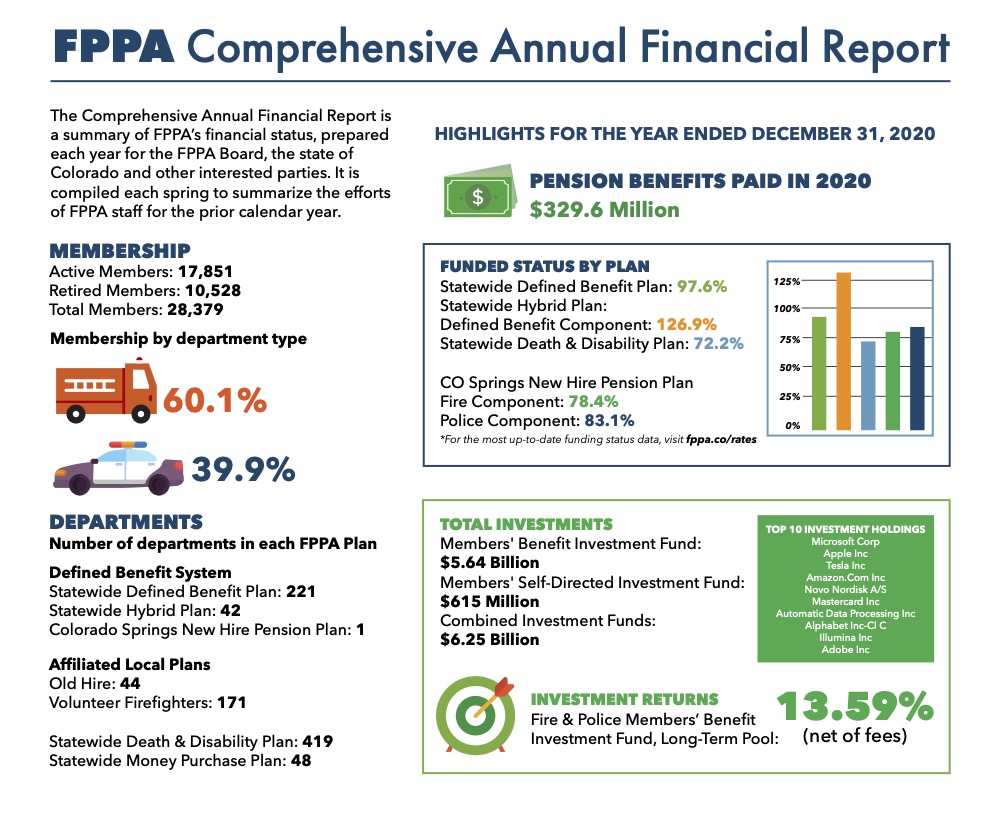

Highlights from FPPA’s Comprehensive Annual Financial Report

Results From FPPA’s Member Survey PensionCheck Online FPPA

Join FPPA About FPPA

Results From FPPA’s Member Survey PensionCheck Online FPPA

DROP vs. Deferred Retirement PensionCheck Online FPPA

988 Suicide & Crisis Lifeline.

Enter Your Information Below To Create Benefit Projections For Both Components Simultaneously And Then See.

Separate Retirement Account Funds Will Transfer To Fidelity In January 2021.

Web The Chart Below Shows The Estimated Percentage Factor Used To Calculate The Retirement Benefit At Each Age And For Each Year Of Service.

Related Post: