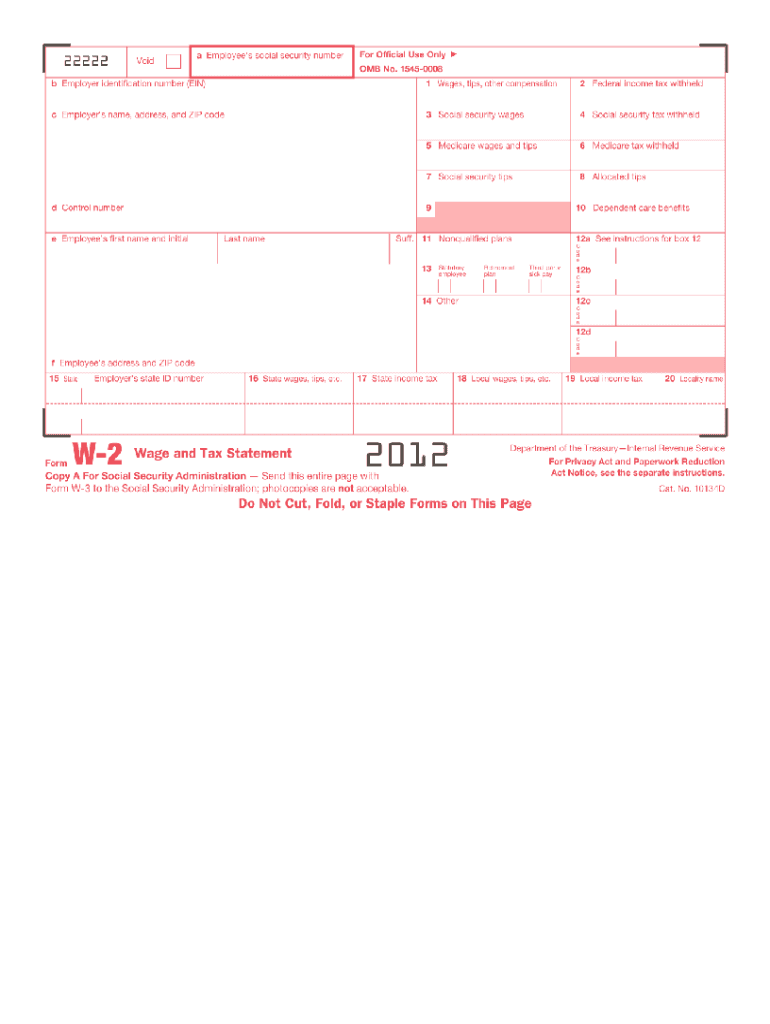

Form W2 Printable

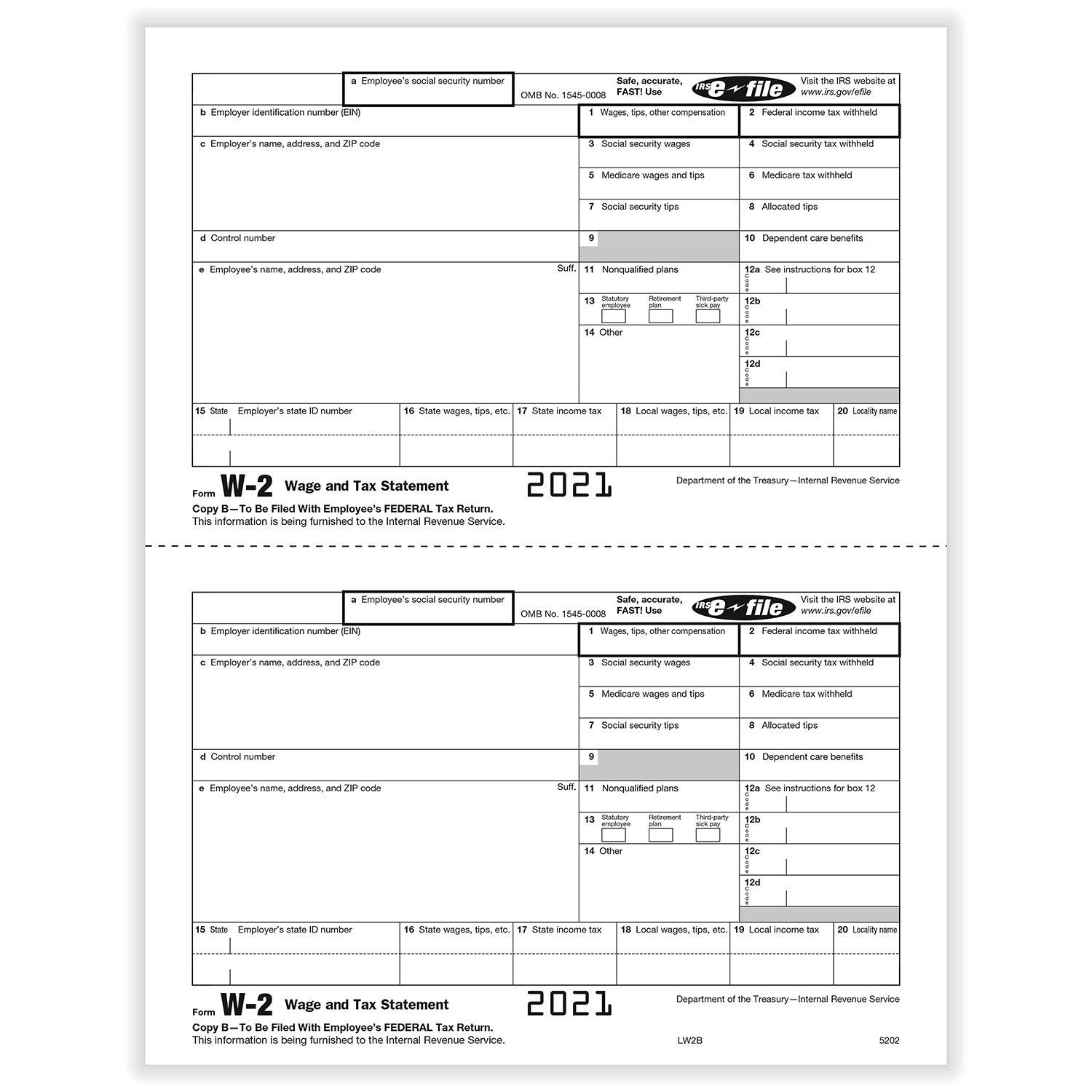

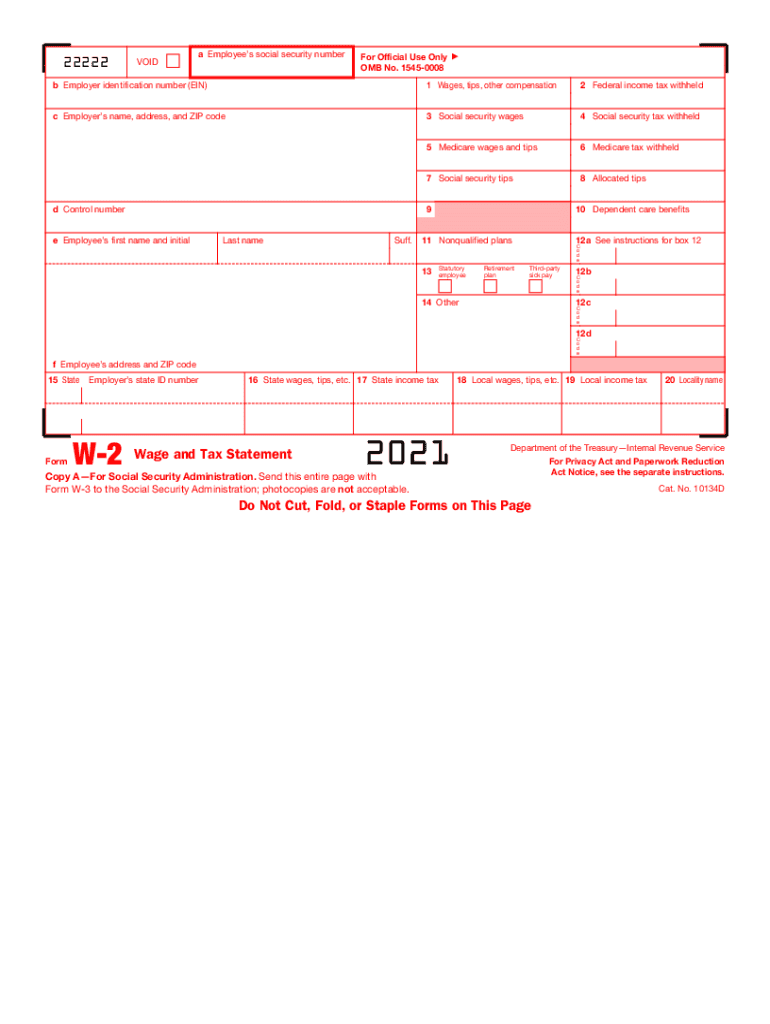

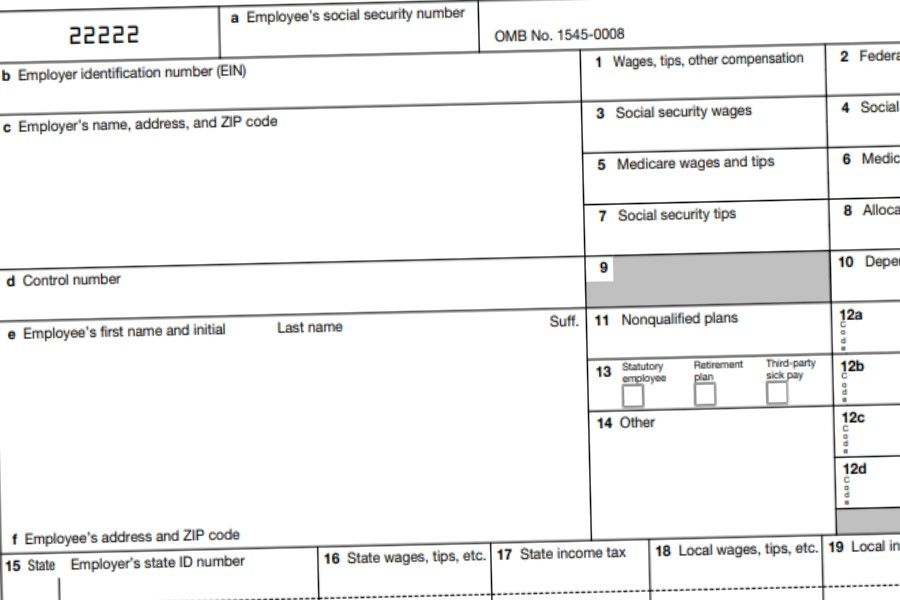

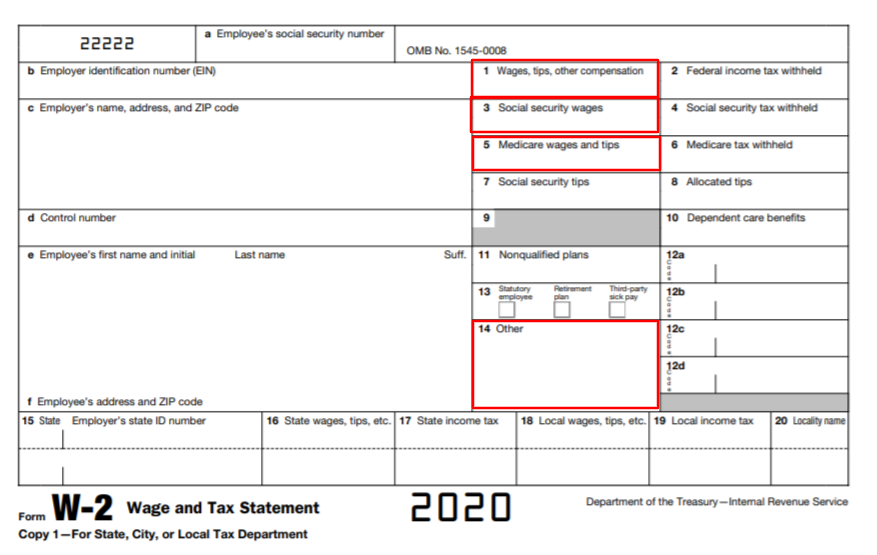

Form W2 Printable - Compare amounts on this form with those reported on your income tax return. If you have filed an income tax return for the year shown, you may have to file an amended return. Copy b—to be filed with employee’s federal tax return. Department of the treasury—internal revenue service. Copy 1, if required, to your state, city, or local tax department;. This information is being furnished to the internal revenue service. Web the 150th running of the illustrious horse race is set to occur saturday, with the 20 horses taking their posts at approximately 6:57 p.m. Ensure all copies are legible. Personal information for each employee, including name, address, and social security number. Used for payments made to the employees in 2022. Wage and tax statement | printable pdf. The secure 2.0 act allows for additional features in various employer retirement plans to encourage use of these plans. Personal information for each employee, including name, address, and social security number. Copy 1, if required, to your state, city, or local tax department;. Most requests will be processed within 10 business days from. If you have filed an income tax return for the year shown, you may have to file an amended return. Ensure all copies are legible. Web 1 answer a few simple questions. Compare amounts on this form with those reported on your income tax return. Wage and tax statement | printable pdf. Send copy a to the ssa; Wage and tax statement | printable pdf. Copy b—to be filed with employee’s federal tax return. The secure 2.0 act allows for additional features in various employer retirement plans to encourage use of these plans. The irs may be able to provide wage and income transcript information for up to 10 years. Used for payments made to the employees in 2022. Send copy a to the ssa; Total amount of wages and/or tips paid for each employee. But there is a fee of $126 per request if you need them for an unrelated reason. Department of the treasury—internal revenue service. Written by josh sainsbury | reviewed by. Department of the treasury—internal revenue service. Compare amounts on this form with those reported on your income tax return. The secure 2.0 act allows for additional features in various employer retirement plans to encourage use of these plans. Personal information for each employee, including name, address, and social security number. Find out how to get and. Personal information for each employee, including name, address, and social security number. Web 1 answer a few simple questions. The irs may be able to provide wage and income transcript information for up to 10 years. Most requests will be processed within 10 business days from the irs received date. This information is being furnished to the internal revenue service. Send copy a to the ssa; Personal information for each employee, including name, address, and social security number. Web the 150th running of the illustrious horse race is set to occur saturday, with the 20 horses taking their posts at approximately 6:57 p.m. Most requests will be processed within 10. Web 1 answer a few simple questions. Used for payments made to the employees in 2022. Ensure all copies are legible. Department of the treasury—internal revenue service. Send copy a to the ssa; The secure 2.0 act allows for additional features in various employer retirement plans to encourage use of these plans. Copy 1, if required, to your state, city, or local tax department;. Written by josh sainsbury | reviewed by. Send copy a to the ssa; This information is being furnished to the internal revenue service. Copy b—to be filed with employee’s federal tax return. Wage and tax statement | printable pdf. Web 1 answer a few simple questions. Ensure all copies are legible. The secure 2.0 act allows for additional features in various employer retirement plans to encourage use of these plans. But there is a fee of $126 per request if you need them for an unrelated reason. Ensure all copies are legible. Web the 150th running of the illustrious horse race is set to occur saturday, with the 20 horses taking their posts at approximately 6:57 p.m. Used for payments made to the employees in 2022. Wage and tax statement | printable pdf. Copy b—to be filed with employee’s federal tax return. Find out how to get and. Most requests will be processed within 10 business days from the irs received date. The irs may be able to provide wage and income transcript information for up to 10 years. Compare amounts on this form with those reported on your income tax return. The secure 2.0 act allows for additional features in various employer retirement plans to encourage use of these plans. Department of the treasury—internal revenue service. Send copy a to the ssa; Copy 1, if required, to your state, city, or local tax department;. This information is being furnished to the internal revenue service. Total amount of wages and/or tips paid for each employee.W2 Form (What It Is And How It Works All You Need To Know)

How to fill out IRS W2 form PDF 20222023 PDF Expert

IRS W2 2012 Fill and Sign Printable Template Online US Legal Forms

Printable W2 Form For Employees

2021 Form IRS W2 Fill Online, Printable, Fillable, Blank pdfFiller

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png)

Printable W 2 Form In English Printable Forms Free Online

W2 Printable Form 2020

Form W2 Explained William & Mary

Printable 2021 W2 Form Printable Form 2024

W2 Reporting Requirements W2 Changes for 2020 Forms

Personal Information For Each Employee, Including Name, Address, And Social Security Number.

Written By Josh Sainsbury | Reviewed By.

Web 1 Answer A Few Simple Questions.

If You Have Filed An Income Tax Return For The Year Shown, You May Have To File An Amended Return.

Related Post: