Flagpole Pattern

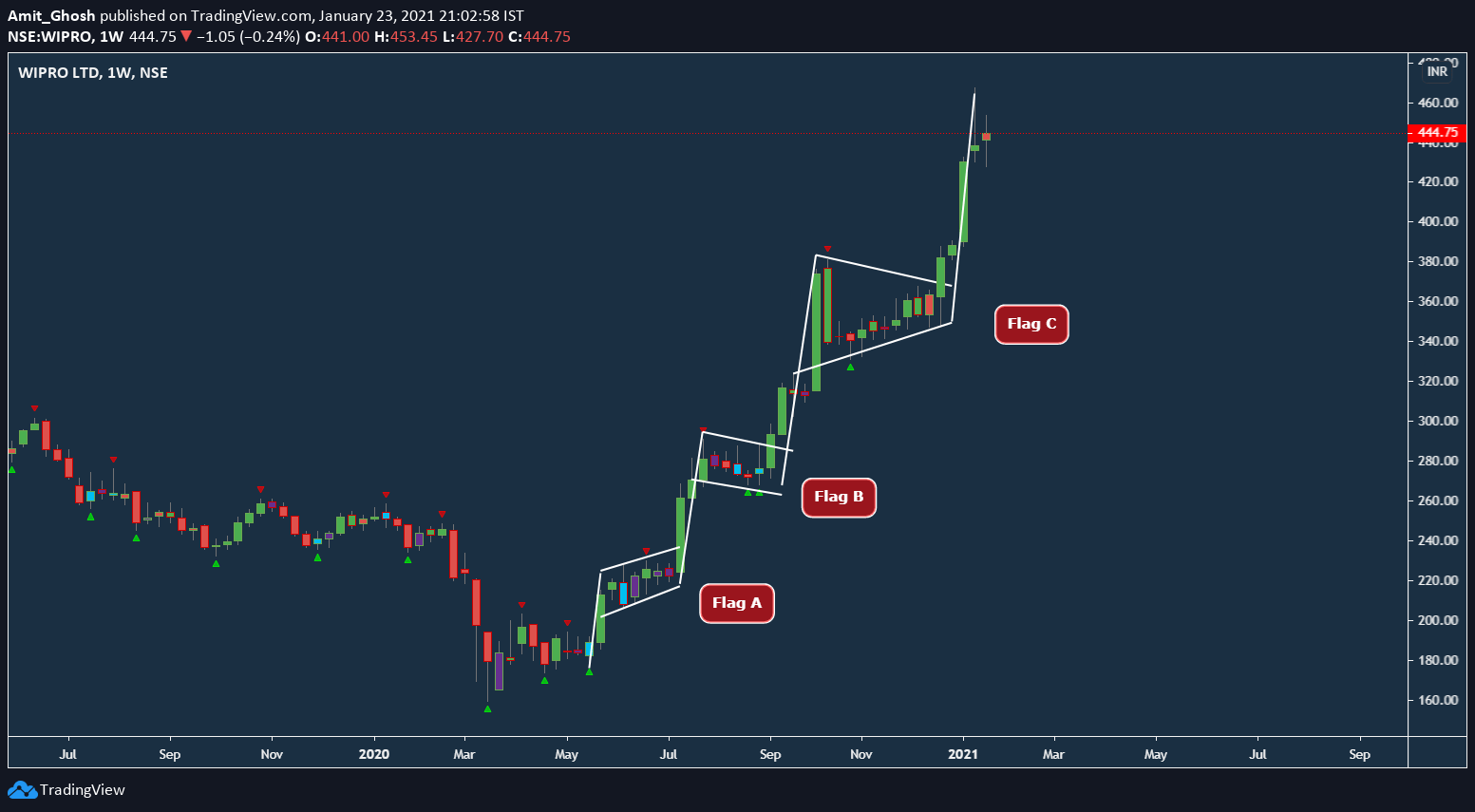

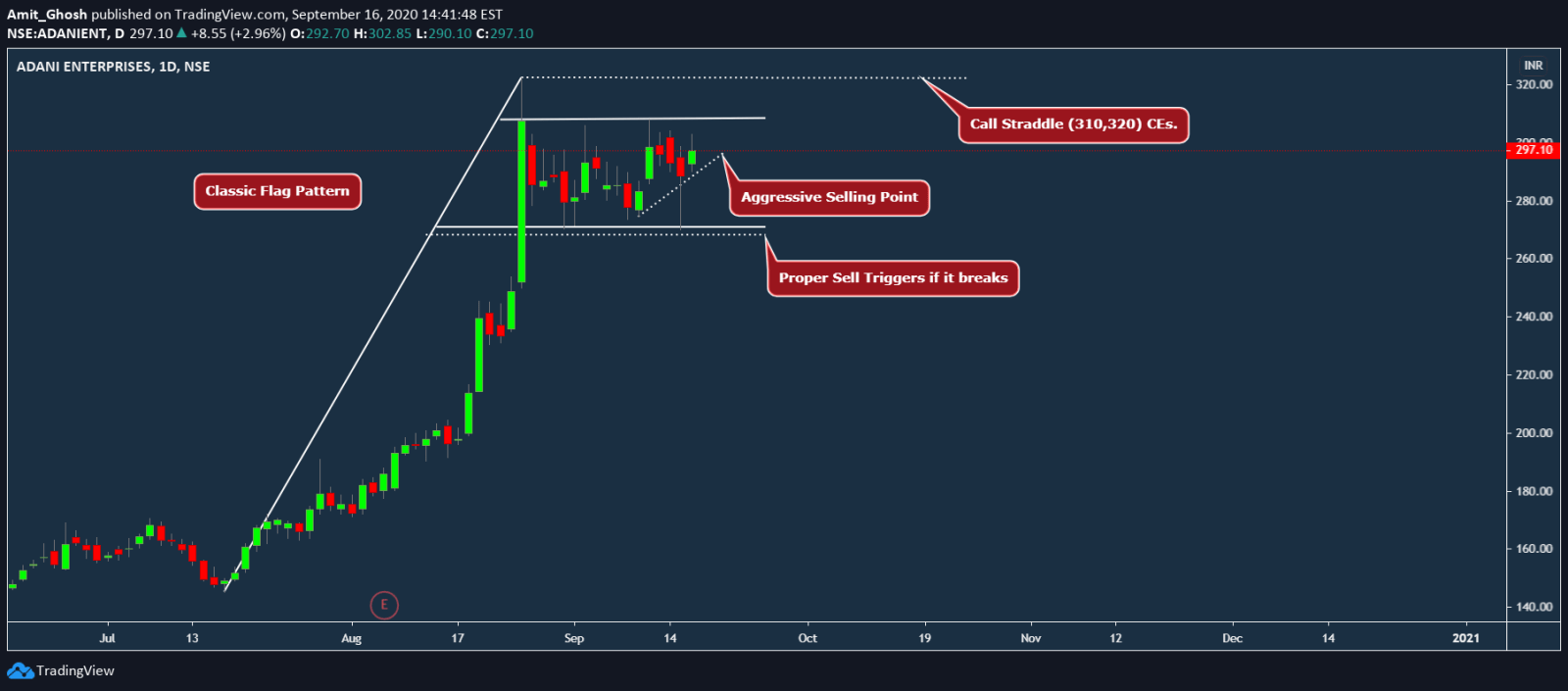

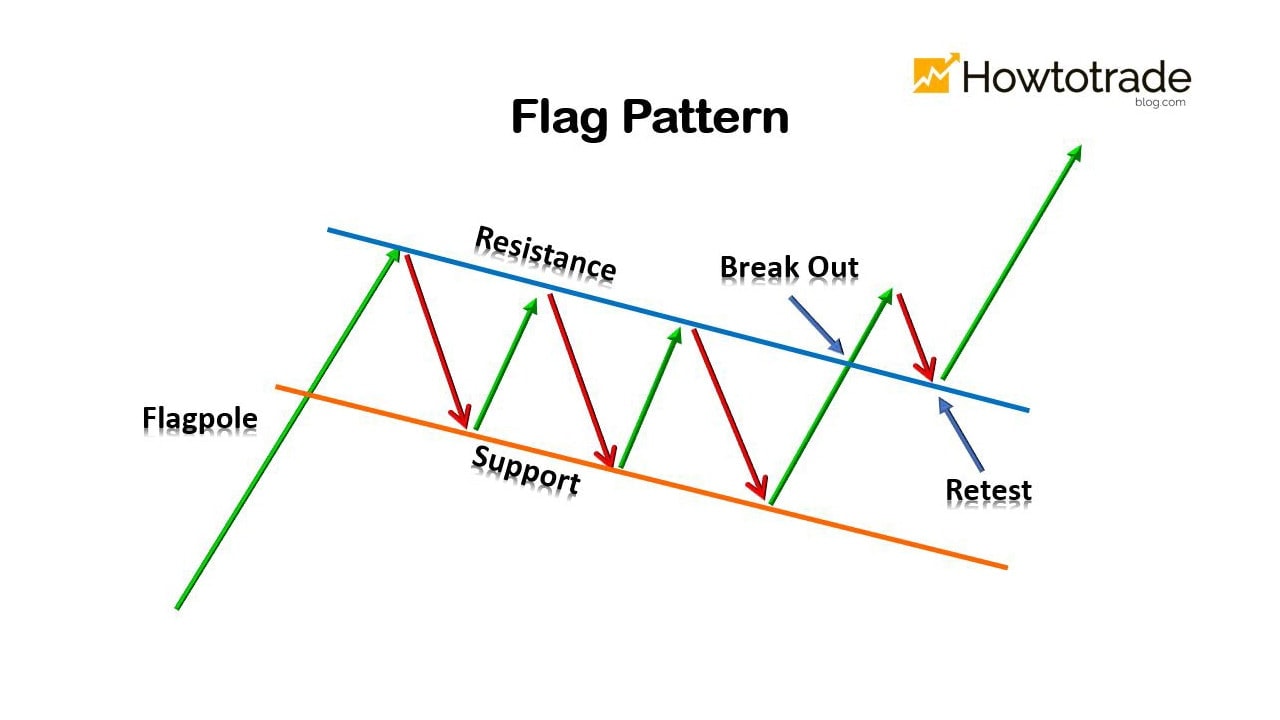

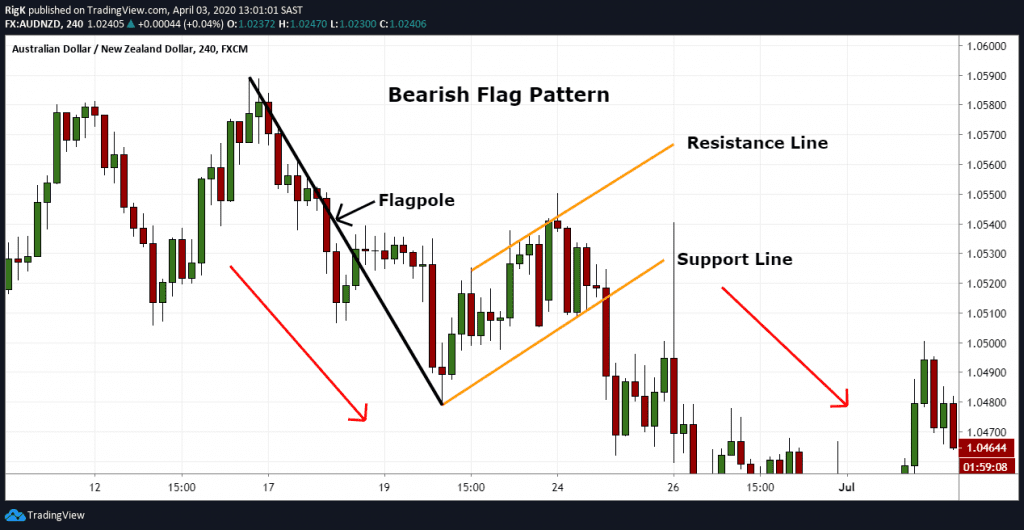

Flagpole Pattern - It shows a trend impulse on the chart. A line extending up from this break to the high of the flag/pennant forms the flagpole. Austin high school has already ordered. The first step in identifying a flag pattern is to locate the flagpole, which is the initial price movement that precedes the formation of the flag. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. Traders also use fibonacci retracement to qualify the ‘shape. Bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. As the flag pattern emerges, you will see a large impulse move, commonly known as the flag pole. This is a consolidation channel that forms the flag pattern. This strong and rapid price rise typically occurs over a short period. Web how do you identify bullish flag patterns? Web a flag and pole pattern describes a specific chart formation used to identify the continuation of a previous trend from a point at which the price moved against the same trend. The flagpole is the distance from the first resistance or support break to the high or low of the flag/pennant.. This is a consolidation channel that forms the flag pattern. Web a flag chart pattern is formed when the market consolidates in a narrow range after a sharp move. The bull flag pattern should typically form over a period of several days or weeks. The first step in identifying a flag pattern is to locate the flagpole, which is the. Let’s make it a bit simple, the flag pattern without the flagpole is a rectangle pattern. Web the flag pattern is one of the most famous technical analysis patterns that help traders identify potential trend continuation. Flag patterns can be bullish or bearish. The flagpole can be either an upward or downward movement, depending on the prevailing market trend. In. Bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. May 11, 2024 / 8:24 pm edt / cbs news. Web a bull or bullish flag pattern formed after a strong upward price movement (flagpole), there is a period of consolidation where the price trades within a channel sloping downwards. They are. In the last 30 years, the city has undergone a transformation to. A line extending up from this break to the. In this pattern, the price makes a sharp move in one direction, reminding the viewer of a pole on a flagpole. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts. Web the flag pole is the first component of the flag chart pattern. Web the flag pattern is a technical analysis chart pattern that has mainly 6 distinct characteristics such as strong trend, consolidation, parallel trendlines, volume, breakout, and target price. A line extending up from this break to the high of the flag/pennant forms the flagpole. Web the flag. Once these patterns come to an end, the resulting move can often be strong and reach your target quickly, which is why it is so popular amongst technical traders. This pattern is pretty easy to understand as the name itself suggests, it resembles a flagpole and a flag. In technical analysis, a pennant is a type of continuation pattern. Web. Ai looks for consumer mobile usage that suggests a company’s technology is catching on quickly, giving the firm an opportunity to invest in that company before others do. Any trending move can transition into a flag, meaning that every trend impulse can appear to be a flag pole. Web how do you identify bullish flag patterns? The flag portion of. Web one of the world’s leading investment firms, for example, has started to use ai to scan for certain patterns rather than scanning individual companies directly. It shows a trend impulse on the chart. The flagpole is the distance from the first resistance or support break to the high or low of the flag/pennant. In this pattern, the price makes. Web the flag pattern is one of the most famous technical analysis patterns that help traders identify potential trend continuation. Web key characteristics of the flag and pole pattern include a strong and steep price advance (pole), a flag pattern that represents a pause or consolidation, declining trading volume during the flag formation, and an expectation for the continuation of. Web the flag pattern is one of the most famous technical analysis patterns that help traders identify potential trend continuation. Web how do you identify bullish flag patterns? Austin high school has already ordered. Bull flags represent one of the most powerful and dynamic patterns in trading, signaling continuation in an uptrend. First, traders look for a sharp prior uptrend, known as the flag pole, followed by a consistent downward sloping correction. Once these patterns come to an end, the resulting move can often be strong and reach your target quickly, which is why it is so popular amongst technical traders. Web key characteristics of the flag and pole pattern include a strong and steep price advance (pole), a flag pattern that represents a pause or consolidation, declining trading volume during the flag formation, and an expectation for the continuation of the prior uptrend after the pattern completes. Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. In the last 30 years, the city has undergone a transformation to. Web one of the world’s leading investment firms, for example, has started to use ai to scan for certain patterns rather than scanning individual companies directly. This pattern is pretty easy to understand as the name itself suggests, it resembles a flagpole and a flag. The sharp advance (or decline) that forms the flagpole should break a trend line or resistance/support level. The flag should be a rectangular pattern that forms after the flagpole, characterized by lower trading volumes and a narrowing range of price movement. Currently, the market is poised within this bull flag pattern, and a decisive break above the $2,375. Any trending move can transition into a flag, meaning that every trend impulse can appear to be a flag pole. Ai looks for consumer mobile usage that suggests a company’s technology is catching on quickly, giving the firm an opportunity to invest in that company before others do.

SbinFlag pole pattern for NSESBIN by N50ANALYST — TradingView India

What Is Flag Pattern? How To Verify And Trade It Efficiently

FLAG PATTERNS. Flag patterns are a popular technical… by Princeedesco

Flag Patterns Part I The Basics of Flag Pattern Unofficed

What Is Flag Pattern? How To Verify And Trade It Efficiently

What Is Flag Pattern? How To Verify And Trade It Efficiently

Flag Patterns Part I The Basics of Flag Pattern Unofficed

What Is Flag Pattern? How To Verify And Trade It Efficiently

Flag Pattern Full Trading Guide with Examples

Chart pattern Flag & Pole YouTube

Web A Flag Chart Pattern Is Formed When The Market Consolidates In A Narrow Range After A Sharp Move.

Traders Also Use Fibonacci Retracement To Qualify The ‘Shape.

Web The Flag Pattern Is A Technical Analysis Chart Pattern That Has Mainly 6 Distinct Characteristics Such As Strong Trend, Consolidation, Parallel Trendlines, Volume, Breakout, And Target Price.

Identify A Clear Uptrend Followed By A.

Related Post: