Falling Wedge Stock Pattern

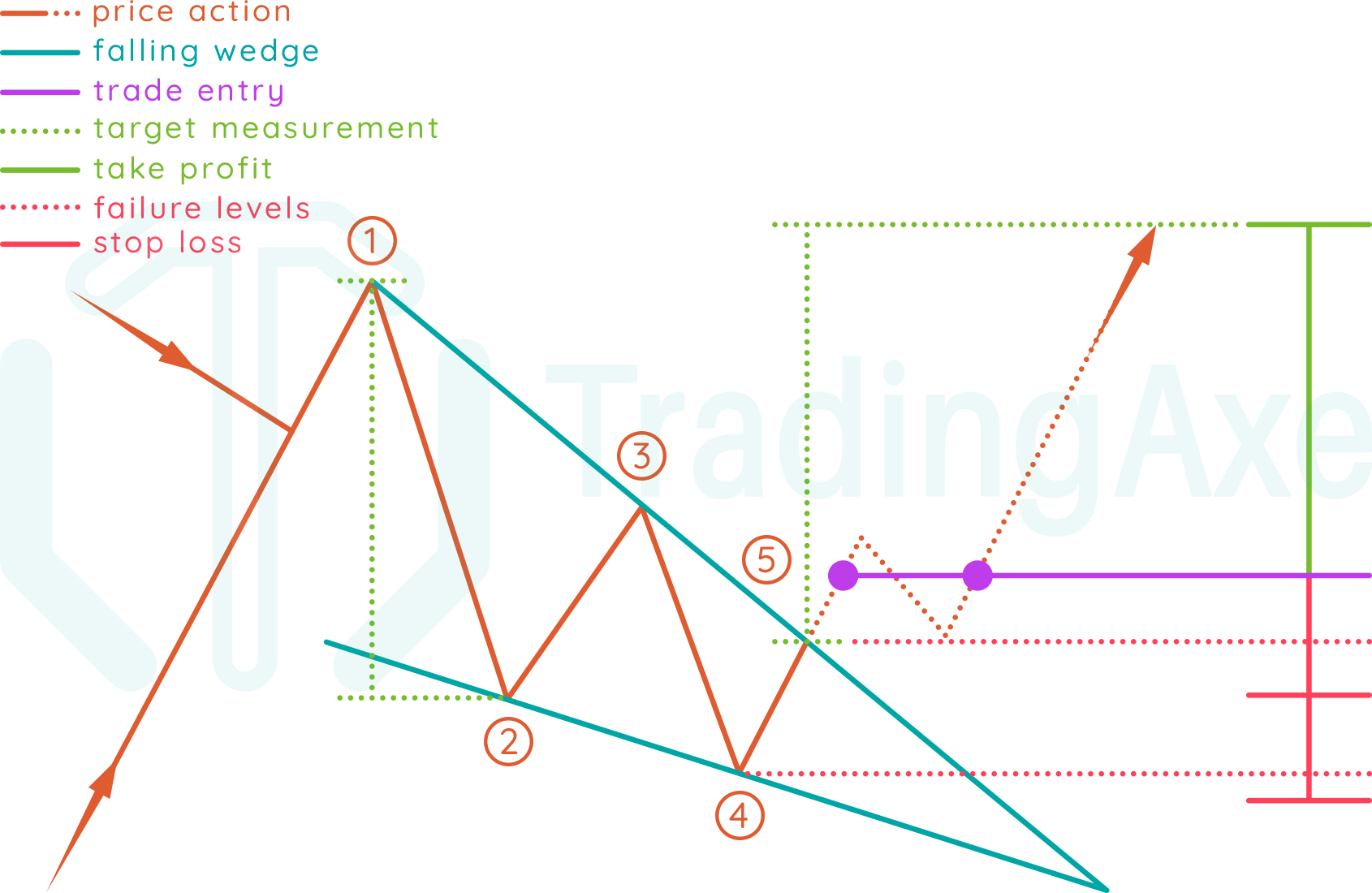

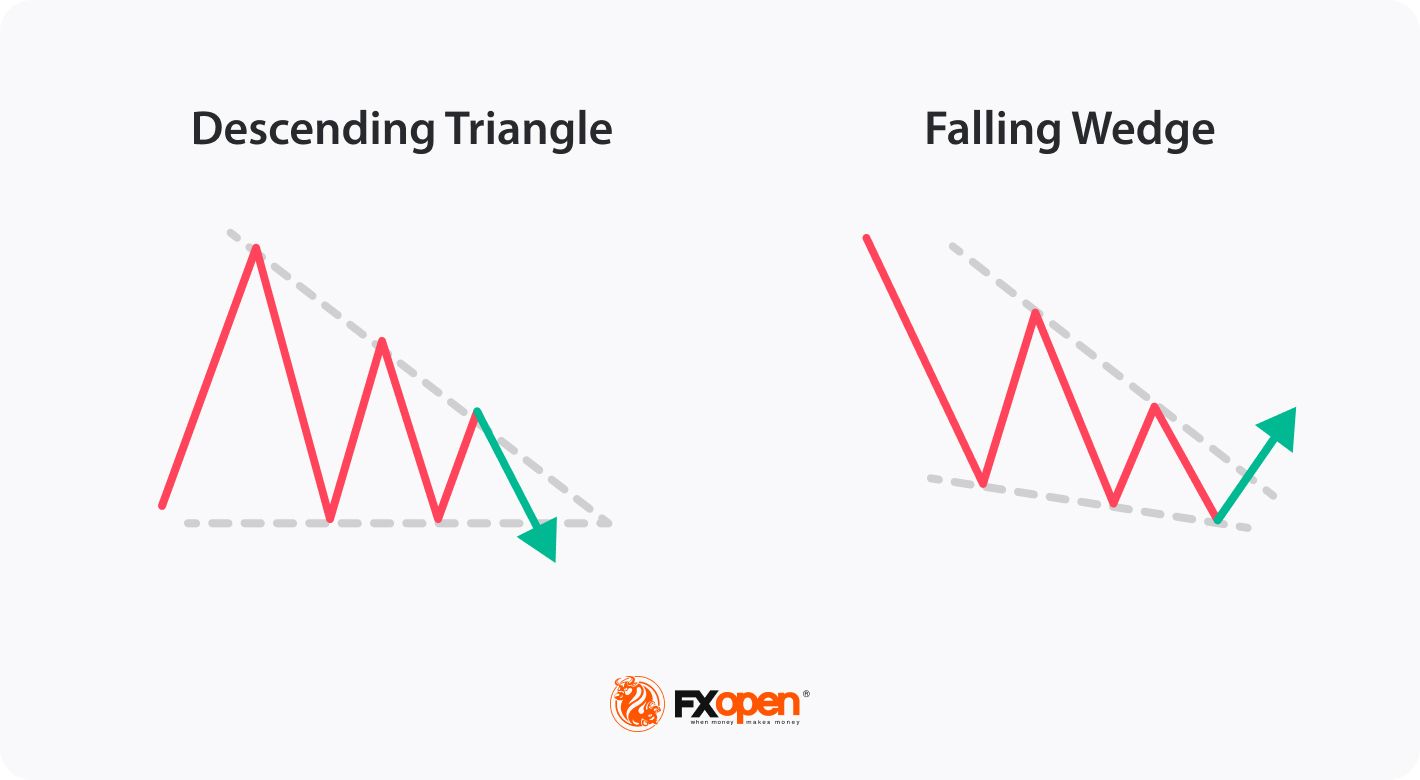

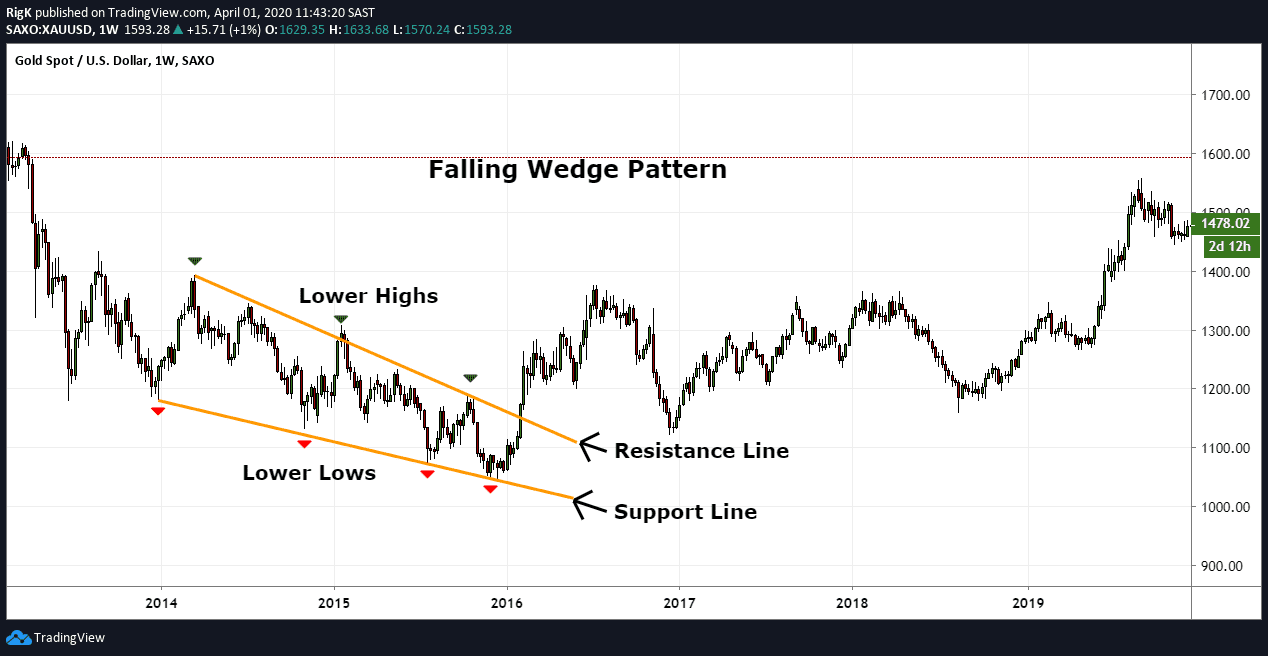

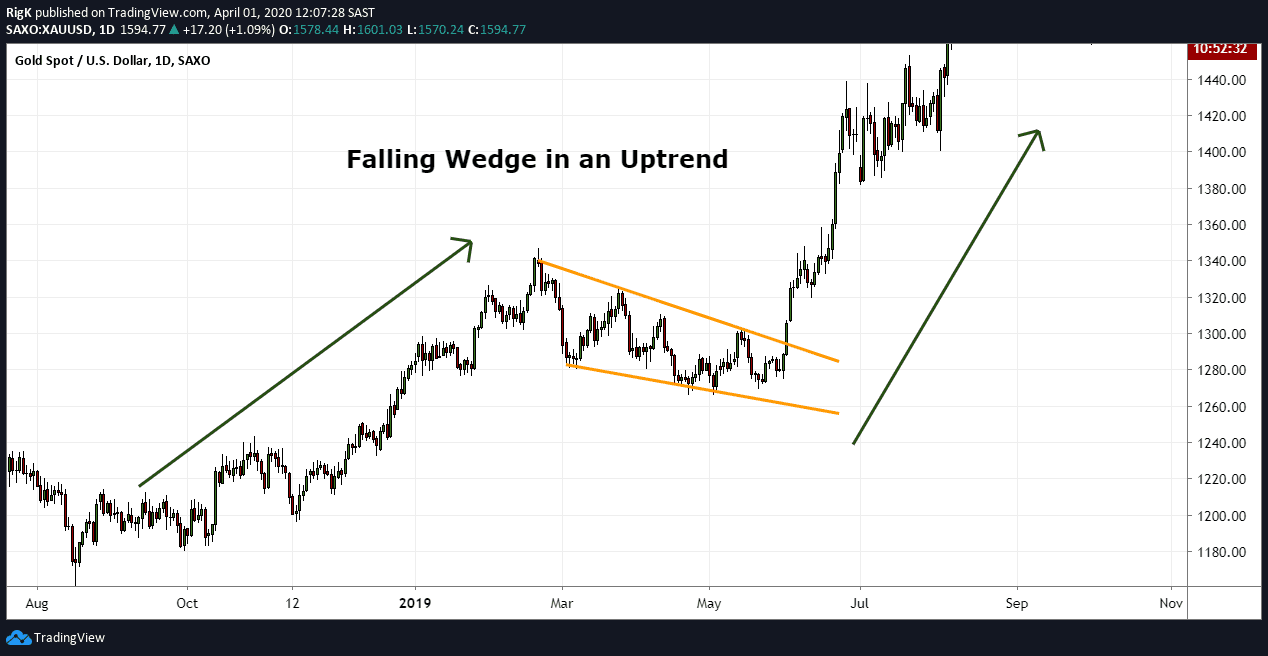

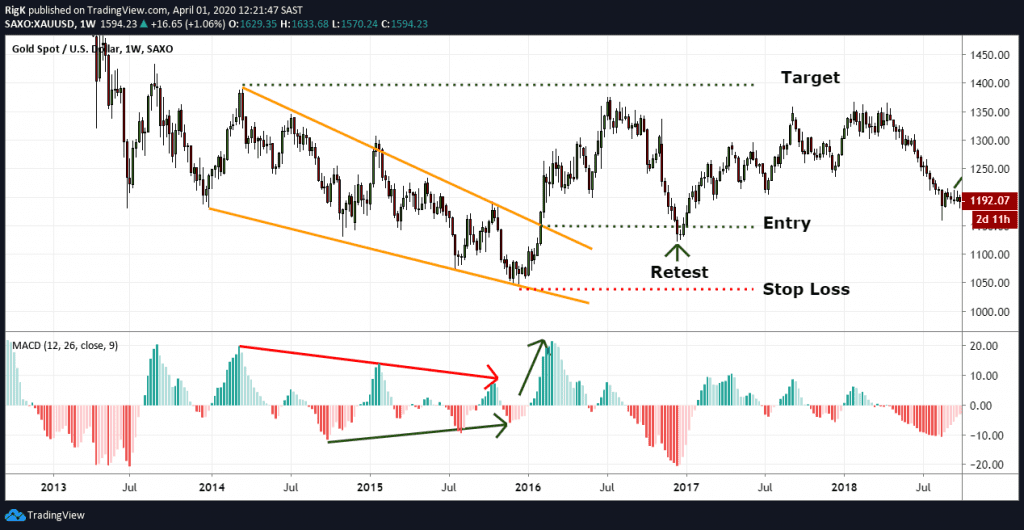

Falling Wedge Stock Pattern - This lesson shows you how to. Web february 28, 2024. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an uptrend or a reversal of a downtrend. Below are some common conditions that occur in the market that generate a falling wedge pattern. Web a falling wedge is a very powerful bullish pattern. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Also called the downward or descending wedge, this pattern results in an overall downward price. It is considered a bullish chart formation. Web when a falling wedge is a reversal pattern, the widest portion of the wedge may be added to the breakout level to determine the upside move which follows. Web the falling wedge pattern is a continuation pattern that forms when the price oscillates between two trendlines sloping downward and converging. It is considered a bullish chart formation. Web a falling wedge is a very powerful bullish pattern. In many cases, when the market. Rising and falling wedges are a technical chart pattern used to predict trend continuations and. Web a falling wedge is a very powerful bullish pattern. This lesson shows you how to. Web february 28, 2024. Stock wedge patterns constitute inflection points where trends reverse, breakouts bloom, or breakdowns begin. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. It is considered a bullish chart formation. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Web the falling wedge pattern is a bullish chart pattern that. According to published research, the falling wedge pattern has a 74% success rate in bull markets with an average potential profit of +38%. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. In many cases, when the market. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. They develop when a narrowing trading range has a. Web february 28, 2024. Web when a falling wedge is a reversal pattern, the widest portion of the wedge may be added to the. It shows a grid with a list of. It is considered a bullish chart formation. Web but they share one thing in common: Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an uptrend or a reversal of a downtrend. Stock wedge patterns constitute inflection points where trends reverse, breakouts bloom, or. In many cases, when the market. Also called the downward or descending wedge, this pattern results in an overall downward price. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Web the falling wedge pattern is a continuation pattern that forms when. They develop when a narrowing trading range has a. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Below are some common conditions. Web when a falling wedge is a reversal pattern, the widest portion of the wedge may be added to the breakout level to determine the upside move which follows. According to published research, the falling wedge pattern has a 74% success rate in bull markets with an average potential profit of +38%. Web the falling (or descending) wedge can also. It shows a grid with a list of. It is considered a bullish chart formation. Web the falling wedge is the exact opposite of the upward wedge. They develop when a narrowing trading range has a. Below are some common conditions that occur in the market that generate a falling wedge pattern. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. In many cases, when the market. They develop when a narrowing trading range has a. Falling wedges are the inverse of rising wedges and are always considered bullish signals. Web a falling wedge is a very powerful bullish pattern. Below are some common conditions that occur in the market that generate a falling wedge pattern. Web february 28, 2024. Also called the downward or descending wedge, this pattern results in an overall downward price. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. According to published research, the falling wedge pattern has a 74% success rate in bull markets with an average potential profit of +38%. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an uptrend or a reversal of a downtrend. Web but they share one thing in common: It is considered a bullish chart formation. Web the falling wedge pattern is a continuation pattern that forms when the price oscillates between two trendlines sloping downward and converging. Web when a falling wedge is a reversal pattern, the widest portion of the wedge may be added to the breakout level to determine the upside move which follows. Web the falling wedge is the exact opposite of the upward wedge.

Falling Wedge Pattern Definition, Formation, Examples, Screener

How To Trade Falling Wedge Chart Pattern TradingAxe

Trading the Falling Wedge Pattern

What Is the Falling Wedge Trading Pattern? Market Pulse

The Falling Wedge Pattern Explained With Examples

Simple Wedge Trading Strategy For Big Profits

The Falling Wedge Pattern Explained With Examples

The Falling Wedge Pattern Explained With Examples

Falling Wedge Chart Pattern Trading charts, Trading quotes, Stock

Falling Wedge Patterns How to Profit from Slowing Bearish Momentum

Rising And Falling Wedges Are A Technical Chart Pattern Used To Predict Trend Continuations And Trend Reversals.

It Shows A Grid With A List Of.

Web The Falling (Or Descending) Wedge Can Also Be Used As Either A Continuation Or Reversal Pattern, Depending On Where It Is Found On A Price Chart.

Stock Wedge Patterns Constitute Inflection Points Where Trends Reverse, Breakouts Bloom, Or Breakdowns Begin.

Related Post: