Falling Flag Pattern

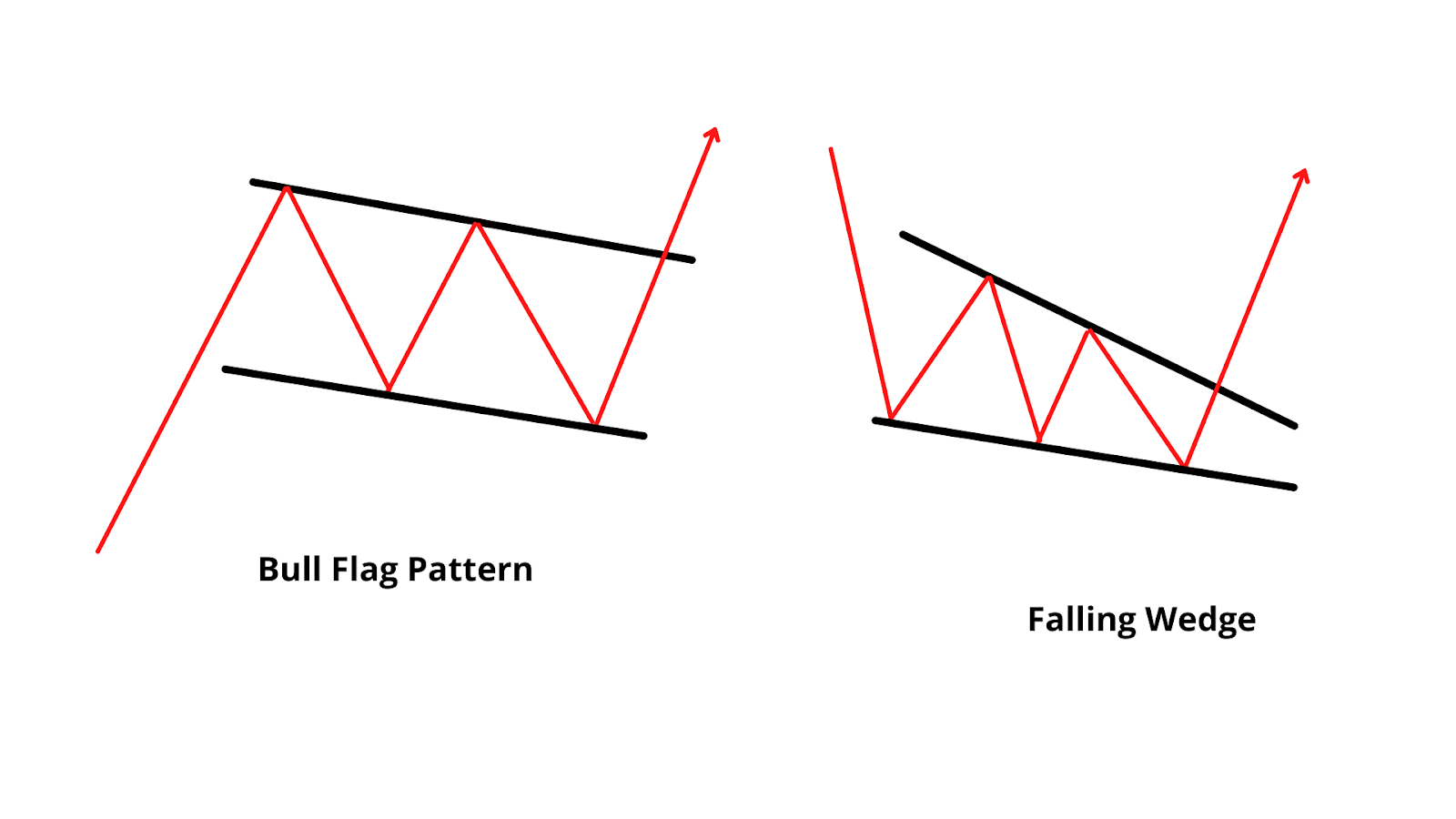

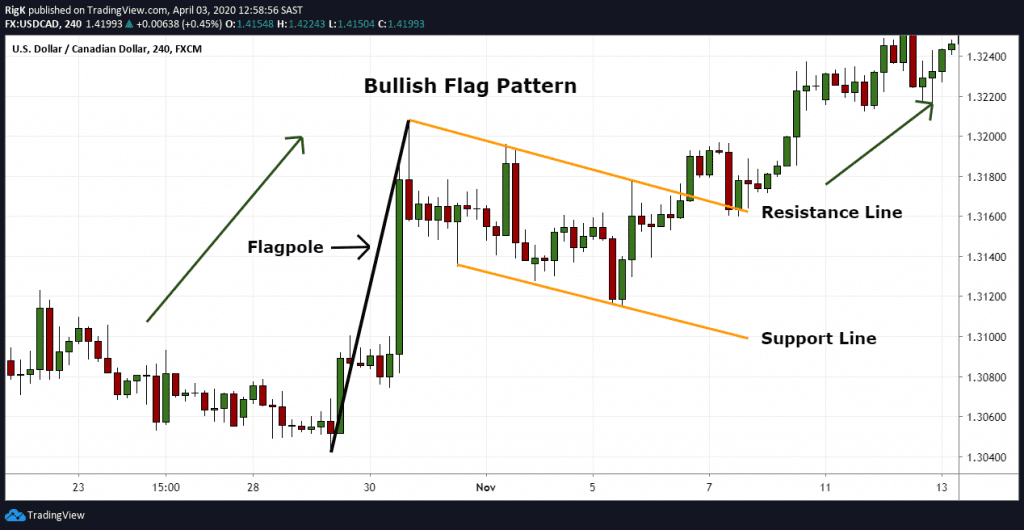

Falling Flag Pattern - We start by discussing what flag patterns are and how they are presented on a chart. The pattern consists of between five to twenty candlesticks. Web the falling flag (or bearish flag) pattern looks like a flag with the mast turned upside down (the mast points up). What is the bear flag pattern? The flag pattern is a simple but powerful chart pattern that i love to trade. Let’s dive a little deeper into the details of each now. Web a flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend line connecting a. What is a flag pattern? Web the falling flag pattern, a complex formation on the price charts, is a potent indicator of bearish continuation in a market. We start by discussing what flag patterns are and how they are presented on a chart. When the pattern occurs, it can be interpreted as a trend reversal or continuation pattern and can help traders find trading opportunities. Then, we explore the flag pattern indicators that show potential buy or sell signals. The flag is identified in short downtrends and. Let’s dive a little deeper into the details of each now. Web bear and bull flag patterns are two common motifs that can predict the continuation of a trend. Then, we explore the flag pattern indicators that show potential buy or sell signals. Web a flag pattern is a technical analysis chart pattern that can be observed in the price. Let’s dive a little deeper into the details of each now. They are called bull flags because the pattern resembles a flag on a pole. Then, we explore the flag pattern indicators that show potential buy or sell signals. Web bear and bull flag patterns are two common motifs that can predict the continuation of a trend. Know its meaning. Then, we explore the flag pattern indicators that show potential buy or sell signals. Let’s dive a little deeper into the details of each now. As simple as it sounds but, most traders get it wrong. Know its meaning with how to use and identify it on groww. Web the flag pattern is a powerful trend continuation chart pattern that. Then, we explore the flag pattern indicators that show potential buy or sell signals. Web a flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second. Web in simple terms, a flag pattern is a continuation chart pattern that occurs after a strong price movement, signaling a brief period of consolidation before the price resumes its previous direction. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. It is considered a continuation pattern, indicating that the prevailing. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. The flag pattern is a simple but powerful chart pattern that i love to trade. Each of these is the absolute opposite of the other. What is the bull flag pattern? Know its meaning with how to use and identify it on. How to trade flag patterns; As outlined earlier, falling wedges can be both a reversal and continuation pattern. Web the falling flag (or bearish flag) pattern looks like a flag with the mast turned upside down (the mast points up). Web a flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation. What is the pennant pattern? Web bear and bull flag patterns are two common motifs that can predict the continuation of a trend. Flag pattern is a type of pattern that forms when a sharply trending price abruptly halts and retraces a bit in a rectangular range. 201k views 5 years ago useful chart patterns. Once these patterns come to. Web the two forms of the wedge pattern are a rising wedge (which signals a bearish reversal) or a falling wedge (which signals a bullish reversal). 201k views 5 years ago useful chart patterns. Once these patterns come to an end, the resulting move can often be strong and reach your target quickly, which is why it is so popular. As simple as it sounds but, most traders get it wrong. We start by discussing what flag patterns are and how they are presented on a chart. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web the flag pattern is a powerful trend continuation chart pattern that appears in all markets and timeframes. They are called bull flags because the pattern resembles a flag on a pole. What is the bull flag pattern? These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a midpoint of the move. 201k views 5 years ago useful chart patterns. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. What is the pennant pattern? Let’s dive a little deeper into the details of each now. Comprising the flagpole that is initiated by a sharp decline in price, this pattern is essential to chart analysis for its predictive abilities. Web the falling flag pattern, a complex formation on the price charts, is a potent indicator of bearish continuation in a market. How to trade flag patterns; The flag is identified in short downtrends and provides traders with ideal exit price levels. Web bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns.

Introduction to Trading the Flag Pattern Action Forex

What Is Flag Pattern? How To Verify And Trade It Efficiently

XAOUSD Falling Wedge + Bullish Flag Pattern for FXXAUUSD by Anpu

What Is Flag Pattern? How To Verify And Trade It Efficiently

What Is Flag Pattern? How To Verify And Trade It Efficiently

Falling Wedge Patterns How to Profit from Slowing Bearish Momentum

Another early shout on bullish falling flag for OANDAUSDCHF by

Flag Pattern Full Trading Guide with Examples

EUR/NZD Price Action on Daily TMF , Flag Pattern Falling ! 🔔 for

What Is Flag Pattern? How To Verify And Trade It Efficiently

Each Of These Is The Absolute Opposite Of The Other.

Flag Pattern Is A Type Of Pattern That Forms When A Sharply Trending Price Abruptly Halts And Retraces A Bit In A Rectangular Range.

Web The Two Forms Of The Wedge Pattern Are A Rising Wedge (Which Signals A Bearish Reversal) Or A Falling Wedge (Which Signals A Bullish Reversal).

Know Its Meaning With How To Use And Identify It On Groww.

Related Post: