Falling Channel Pattern

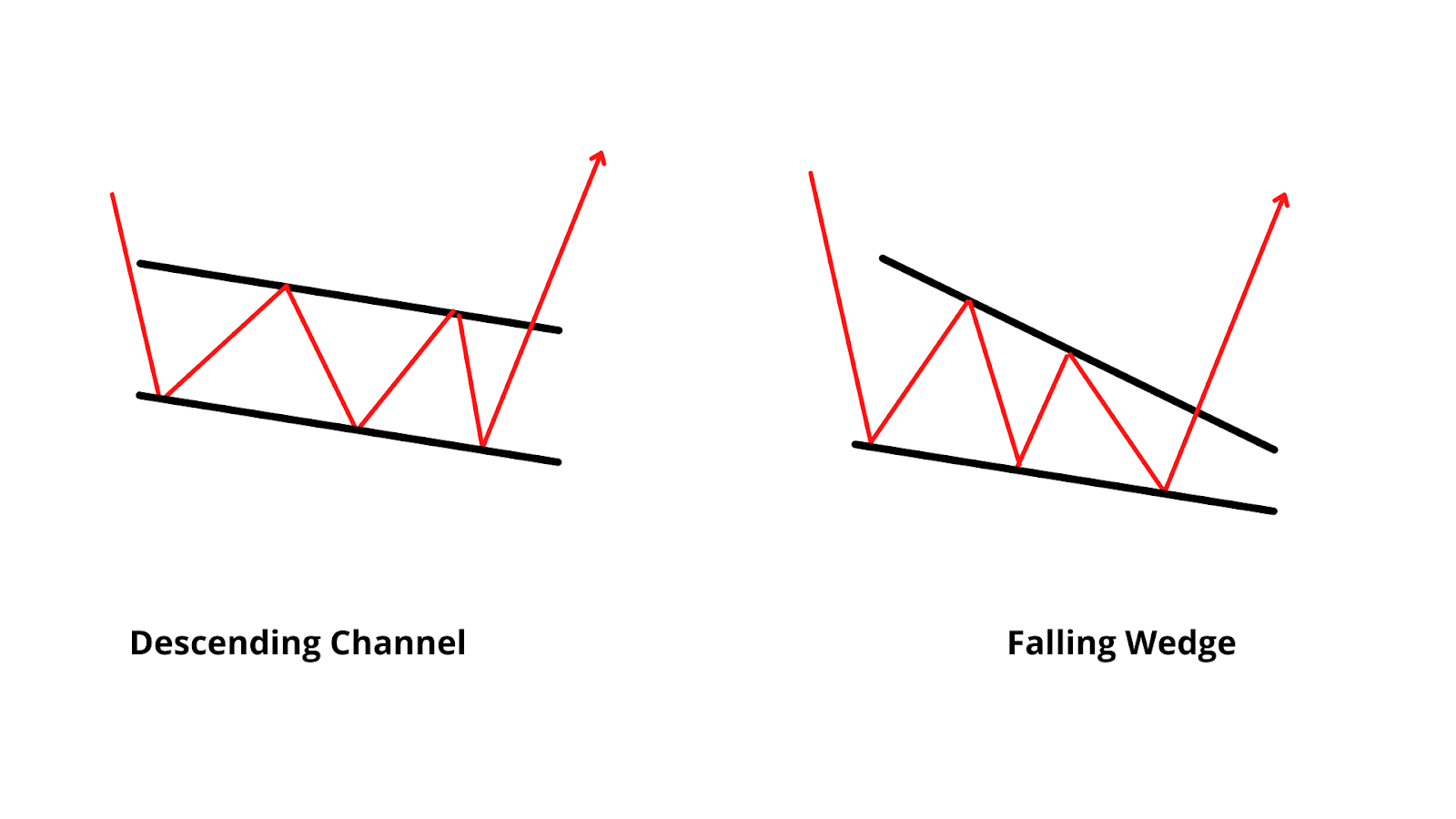

Falling Channel Pattern - In essence, both continuation and reversal scenarios are inherently bullish. The setups shared here represent potential technical patterns and are intended for experienced traders who are capable of making their own trading decisions. The descending channel pattern is also known as a “falling channel” or “channel down“. A falling wedge is confirmed/valid if it has a good oscillation between the two falling straight lines. You'll also learn what time of day works best for certain setups. Web the channel pattern is a technical analysis pattern that capitalizes on the trending tendencies of the market. Web the descending channel pattern is a bearish chart formation used in technical analysis to identify potential downtrends in the market. Rising channels in an uptrend. Channels come in two primary forms: Web a descending channel is a chart pattern formed from two downward trendlines drawn above and below a price representing resistance and support levels. Web the channel down pattern is identified when there are two parallel lines, both moving down to the right across respective peaks (upper line) and bottoms (lower line). That confirmation can happen in 2 ways: The setups shared here represent potential technical patterns and are intended for experienced traders who are capable of making their own trading decisions. Learn how. Traders also use channels to identify potential buy and sell. It is also called a falling or downward channel as it characterizes a falling price moving downwards. Channels come in two primary forms: Web an ascending channel is the price action contained between upward sloping parallel lines. The upper line is the resistance line; Channels come in two primary forms: Trading channels can be drawn on charts to help see uptrends and downtrends in a stock, commodity, etf, or forex pair. Web today, we delve into the world of channel chart patterns. It is also known as price channel. A bullish channel appears as a descending pattern, resembling a falling. Falling channels in a downtrend. It is also called a falling or downward channel as it characterizes a falling price moving downwards. We can see downside hereon. Trading channels can be drawn on charts to help see uptrends and downtrends in a stock, commodity, etf, or forex pair. The upper trend line marks resistance and the lower trend line marks. It can be a rising channel or a falling channel. Web the descending channel pattern is a bearish chart formation used in technical analysis to identify potential downtrends in the market. Web the channel pattern is a technical analysis pattern that capitalizes on the trending tendencies of the market. Web the falling wedge (also known as the descending wedge) is. Web a descending channel is a pattern that forms when an asset is consistently trending lower over time. Web read this article and learn how to trade a descending channel & key aspects of this pattern. Stock is around the resistance of falling channel. Web channel pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts,. Rising channels in an uptrend. Web the descending channel pattern is a bearish chart formation used in technical analysis to identify potential downtrends in the market. It is also called a falling or downward channel as it characterizes a falling price moving downwards. Price channels with negative slopes (down) are considered bearish and those with positive slopes (up) bullish. Web. Understanding these patterns is essential. It is also called a falling or downward channel as it characterizes a falling price moving downwards. Are you looking to skyrocket your trading profits? Making a lower low on the. Level channels during consolidation periods. Web the descending channel pattern is a bearish chart formation used in technical analysis to identify potential downtrends in the market. Learn how to spot the falling wedge and how to trade it. We can see downside hereon. The falling wedge pattern is generally considered as a bullish pattern in both continuation and reversal situations. The upper trend line marks. Channels come in two primary forms: Are you looking to skyrocket your trading profits? The upper line is identified first, as running along the lows: Learn how to spot the falling wedge and how to trade it. Moreover, the delayed approval of the spot ethereumetf by the securities and exchange commission (sec) has been one of the. Web the channel pattern is a technical analysis pattern that capitalizes on the trending tendencies of the market. It is also called a falling or downward channel as it characterizes a falling price moving downwards. Web ethereum fails to breakout of its falling channel pattern: As outlined earlier, falling wedges can be both a reversal and continuation pattern. Making a lower low on the. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. Falling channel on major support. Web not only do we see a bullish divergence, the divergence is happening in a falling channel. Channels come in two primary forms: Web the channel down pattern is identified when there are two parallel lines, both moving down to the right across respective peaks (upper line) and bottoms (lower line). In essence, both continuation and reversal scenarios are inherently bullish. The falling wedge pattern is generally considered as a bullish pattern in both continuation and reversal situations. The only thing missing is a third confirmation of this bullish divergence. The lower line is the support line. A falling wedge is confirmed/valid if it has a good oscillation between the two falling straight lines. It is drawn by connecting the lower highs and lower lows of a security's price with parallel trendlines.

Descending Channel Pattern Trading Strategies with Examples

Falling Channel Pattern Indicator for MT4/MT5

Two Most Effective Ways to Trade With Channel Pattern How To Trade Blog

FALLING CHANNEL / BEARISH CHANNEL / PRICE CHANNEL / CHART PATTERNS

Topic 42 Falling Channel Neutral Chart Pattern Basic Share Market

Falling Channel + Wedge Pattern COMBO ! for NSEBBTC by headymuk

Two Most Effective Ways to Trade With Channel Pattern How To Trade Blog

21. Continuation Pattern with Price Trading Inside Falling Channel

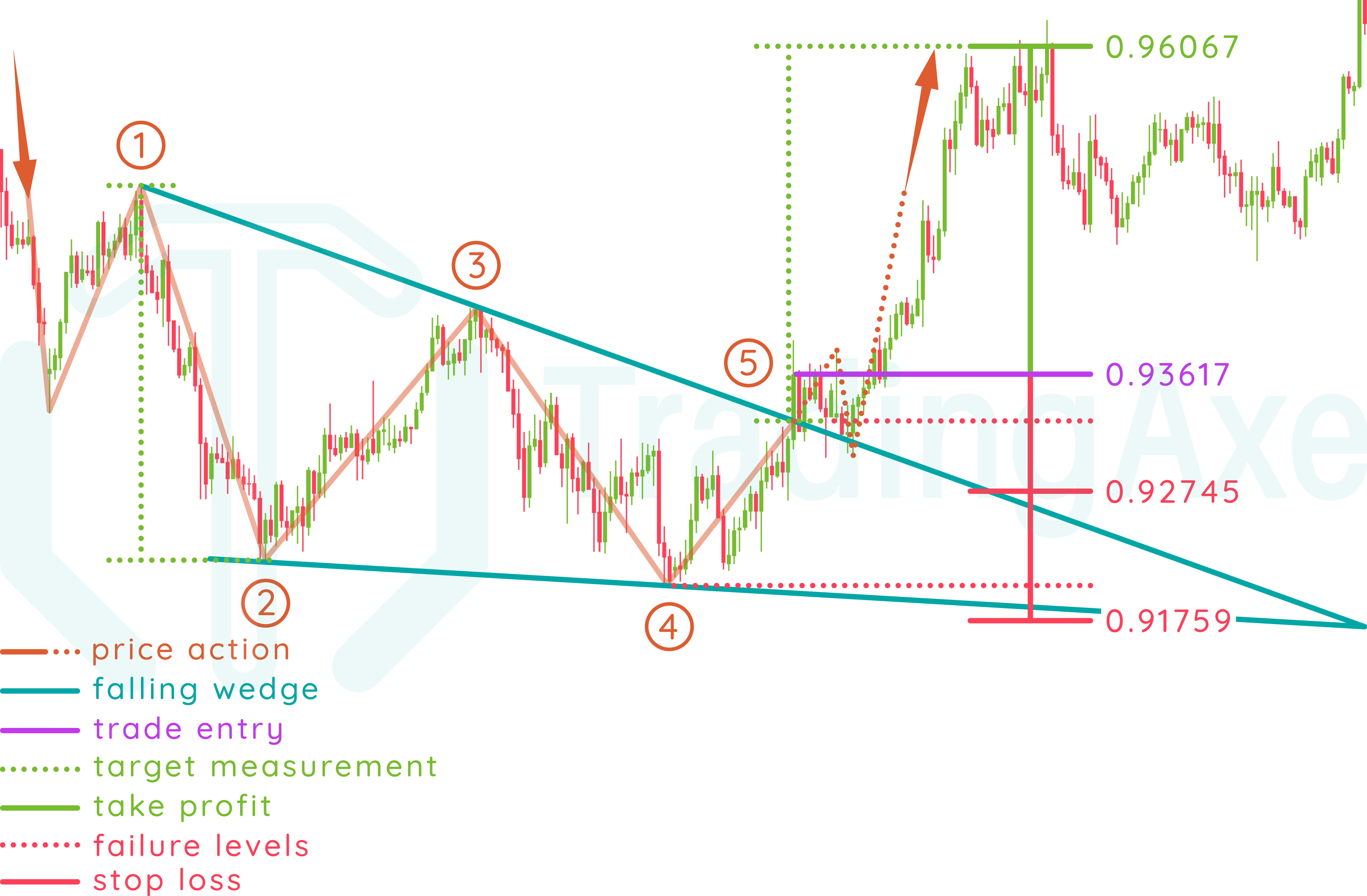

How To Trade Falling Wedge Chart Pattern TradingAxe

Falling Wedge Patterns How to Profit from Slowing Bearish Momentum

Web A Falling Wedge Is A Bullish Chart Pattern (Said To Be Of Reversal).

Traders Also Use Channels To Identify Potential Buy And Sell.

Web A Descending Channel Is A Pattern That Forms When An Asset Is Consistently Trending Lower Over Time.

We Can See Downside Hereon.

Related Post: