Evening Star Candlestick Pattern

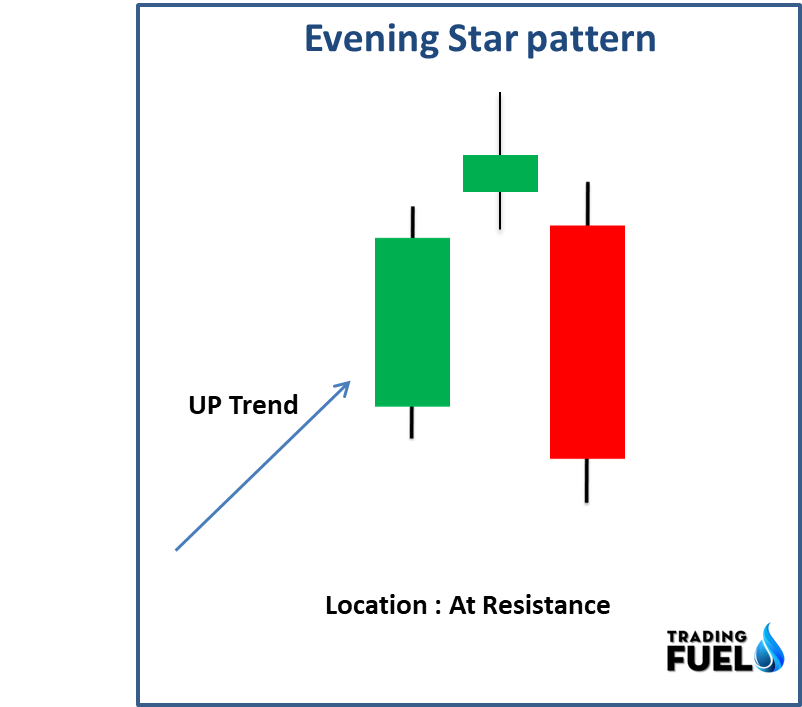

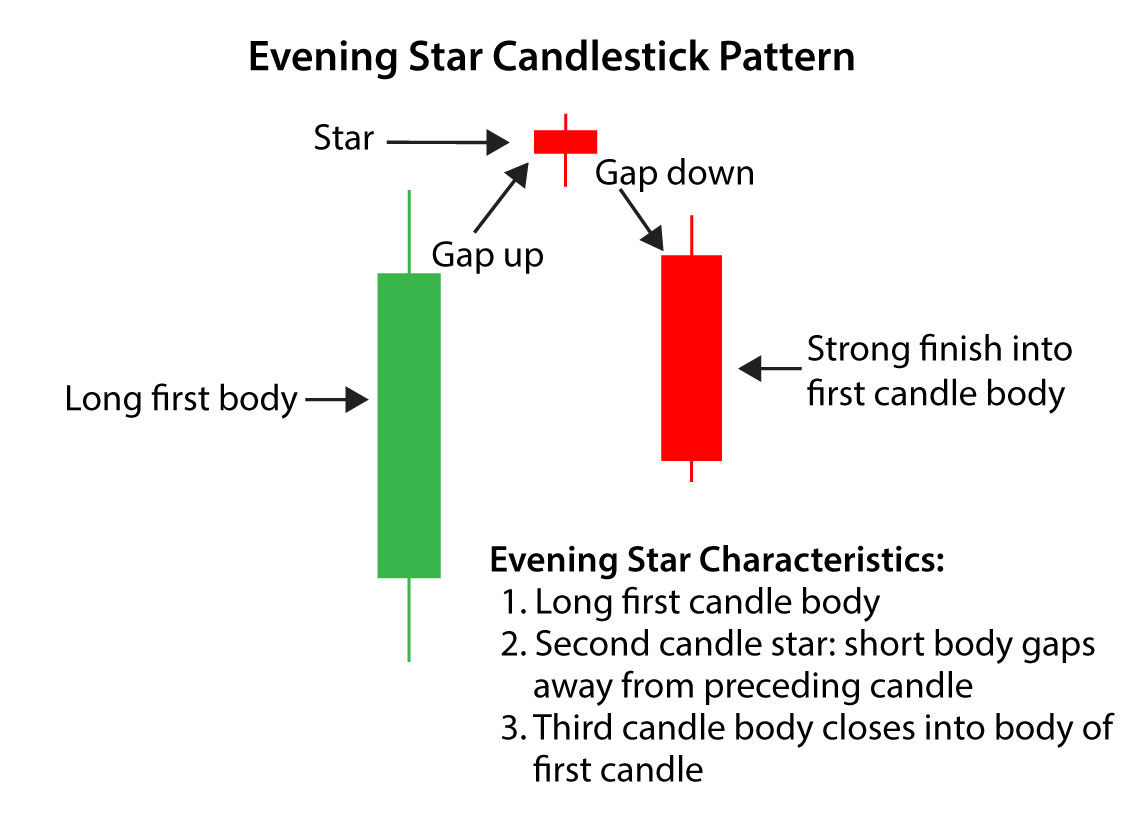

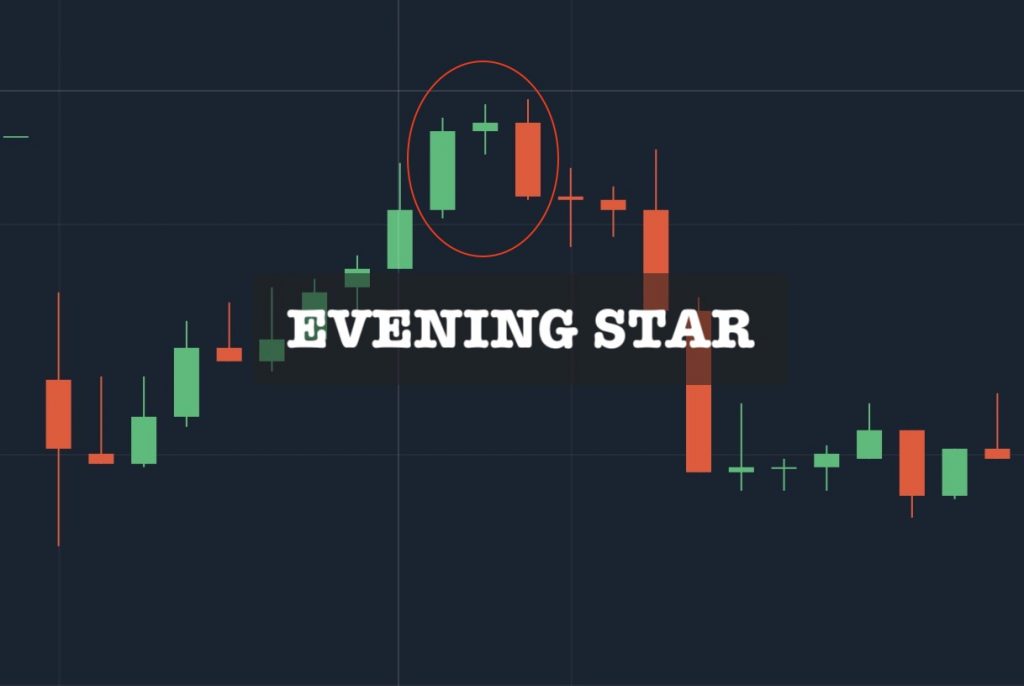

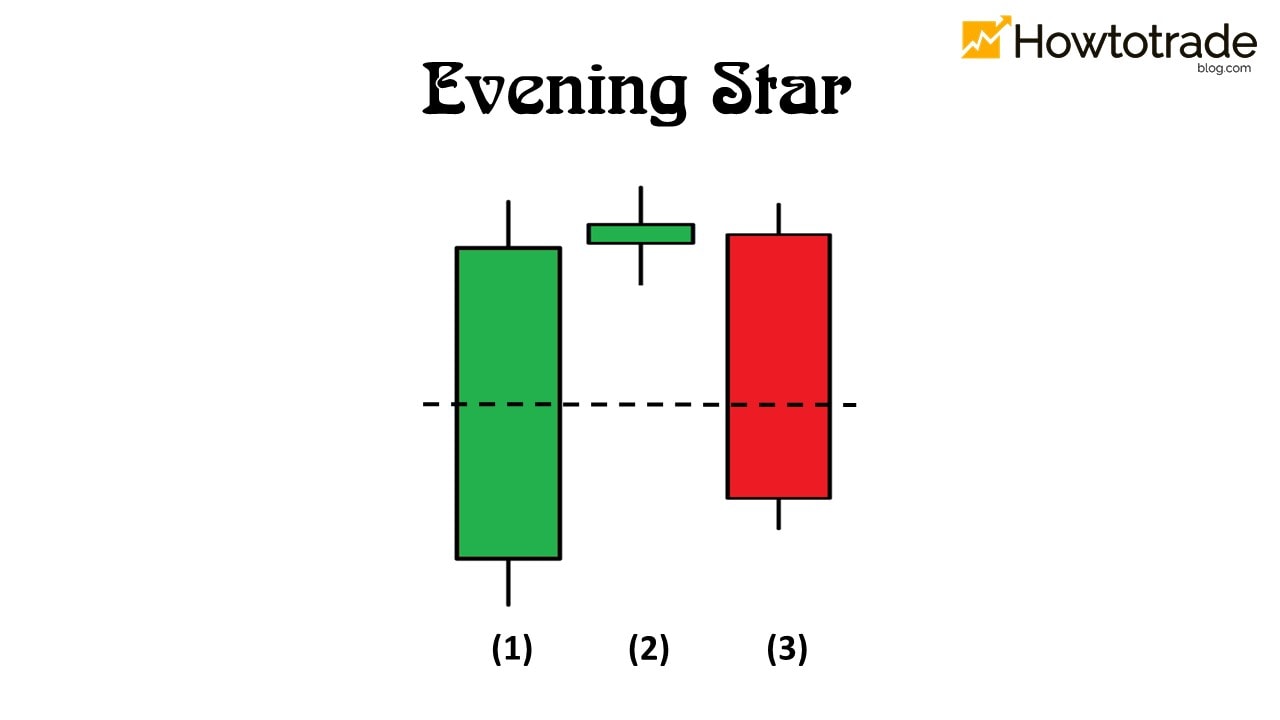

Evening Star Candlestick Pattern - The pattern begins with a large bullish candle. The first bar is a large white candlestick located. Correctly spotting reversals is crucial when trading financial. The three candlesticks are typically found at important market highs, and the pattern forms when you see a green candlestick moving higher, followed by a second candlestick with a much smaller body (which could be. Web the evening star candlestick formation is the reverse of the morning star. 5 importance of stock indicators. Consisting of three candles, the pattern usually forms at the end of an uptrend, suggesting a possible downturn in the market. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. 4.1 three white soldiers and black crows; Trading the evening star with rsi divergences. Web an evening doji star pattern is identified by three specific candlesticks: Trading the evening star with resistance levels. Web we see the evening star candlestick pattern on the tesla (tsla) november 23rd, 2021, daily chart. The low of the preceding candle is higher than the low of the current session, and this gap is filled on the opening of.. Web the evening star candlestick pattern holds significant importance in technical analysis for several reasons: For instance, there is always a high probability that the price will reverse from the prior uptrend and move lower when the pattern. But in the end, it’s trading we are talking about, so either you can make a profit or a loss. A rising. Web the evening star candlestick is a bearish reversal pattern that often forms at the end of an uptrend. Web the evening star is a bearish reversal pattern in technical analysis that is identified by a tall bullish candle followed by a small candle that gaps above the first candle, and then a third candle that is bearish and closes. The opposite of the evening star is the morning star pattern, which is viewed. Trading the evening star with moving averages. Consisting of three candles, the pattern usually forms at the end of an uptrend, suggesting a possible downturn in the market. As such, it usually appears at the end of an uptrend and beginning of a downtrend. Web the. Web the evening star pattern consists of three candlesticks, unlike a singular candlestick pattern like the doji or hammer, for example. Web we see the evening star candlestick pattern on the tesla (tsla) november 23rd, 2021, daily chart. 5 importance of stock indicators. Web evening star is a reliable bearish reversal candlestick pattern with a success rate of about 70.2%.. Web the evening star candlestick formation is the reverse of the morning star. Web the evening star candlestick pattern holds significant importance in technical analysis for several reasons: The pattern begins with a large bullish candle. Web the evening star candlestick pattern is a reliable bearish reversal pattern with a success rate of roughly about 70.2%. The opposite of the. However, as with everything in technical analysis, this is not. Evening star patterns appear at the top of a price uptrend, signifying that the uptrend is nearing its end. This pattern typically indicates a potential reversal from an uptrend to a downtrend. Web evening star is a reliable bearish reversal candlestick pattern with a success rate of about 70.2%. The. First of all it is formed at an. Web evening star is a reliable bearish reversal candlestick pattern with a success rate of about 70.2%. Web the evening star candlestick formation is the reverse of the morning star. The first bar is a large white candlestick located. However, as with everything in technical analysis, this is not. Web an evening doji star pattern is identified by three specific candlesticks: Web the evening star candlestick pattern is a powerful bearish reversal pattern that traders can use to identify a potential trend change at the top of an uptrend. Its success rate in predicting bearish reversal is enhanced by using other technical indicators. Web in financial technical analysis, a. Web the evening star is a bearish reversal pattern in technical analysis that is identified by a tall bullish candle followed by a small candle that gaps above the first candle, and then a third candle that is bearish and closes below the midpoint of the first candle. The pattern begins with a large bullish candle. It signals a more. Aptly named because it appears just before darkness sets in, the evening star is a bearish signal. For instance, when the pattern appears near a strong resistance level, there is always a strong likelihood that the price will correct from the. This pattern can help you make informed decisions and capture profitable trades correctly. It consists of three candles: Web the evening star candlestick is a bearish reversal pattern that often forms at the end of an uptrend. Web we see the evening star candlestick pattern on the tesla (tsla) november 23rd, 2021, daily chart. Trading the evening star with moving averages. Web the evening star pattern is a bearish candlestick pattern used in technical analysis to predict a potential reversal in a bullish market. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. The opposite of the evening star is the morning star pattern, which is viewed. 6 how to trade the evening star candlestick pattern in 7 steps. Web the evening star candlestick pattern holds significant importance in technical analysis for several reasons: Web the evening star candle pattern is a bearish reversal signal in technical analysis, providing traders with potential insight into market momentum shifts. It signals a more bearish trend than the evening star pattern because of the doji that has appeared between the two bodies. Using additional technical indicators improves its ability to forecast bearish reversals. Therefore, traders use it to either sell an existing long position or enter a new short position.

Evening Star Candlestick Pattern Trading Fuel

Evening Star Candlestick Pattern How to Trade It in 7 Steps Timothy

Evening Star Definition and Use Candlestick Pattern

Evening Star Candlestick pattern How to Identify Perfect Evening Star

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

Evening Star Definition and Use Candlestick Pattern

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

Evening Star Candlestick Pattern And How To Trade Forex Most

4.2 Three Inside Up And Down;

The First Bar Is A Large White Candlestick Located.

The Pattern Begins With A Large Bullish Candle.

A Large Bullish Candle, Followed By A Doji Candle That Gaps Up, And Then A Large Bearish Candle That Opens Below The Doji And Closes Into The Body Of The First Candle.

Related Post: