Evening Star Candle Pattern

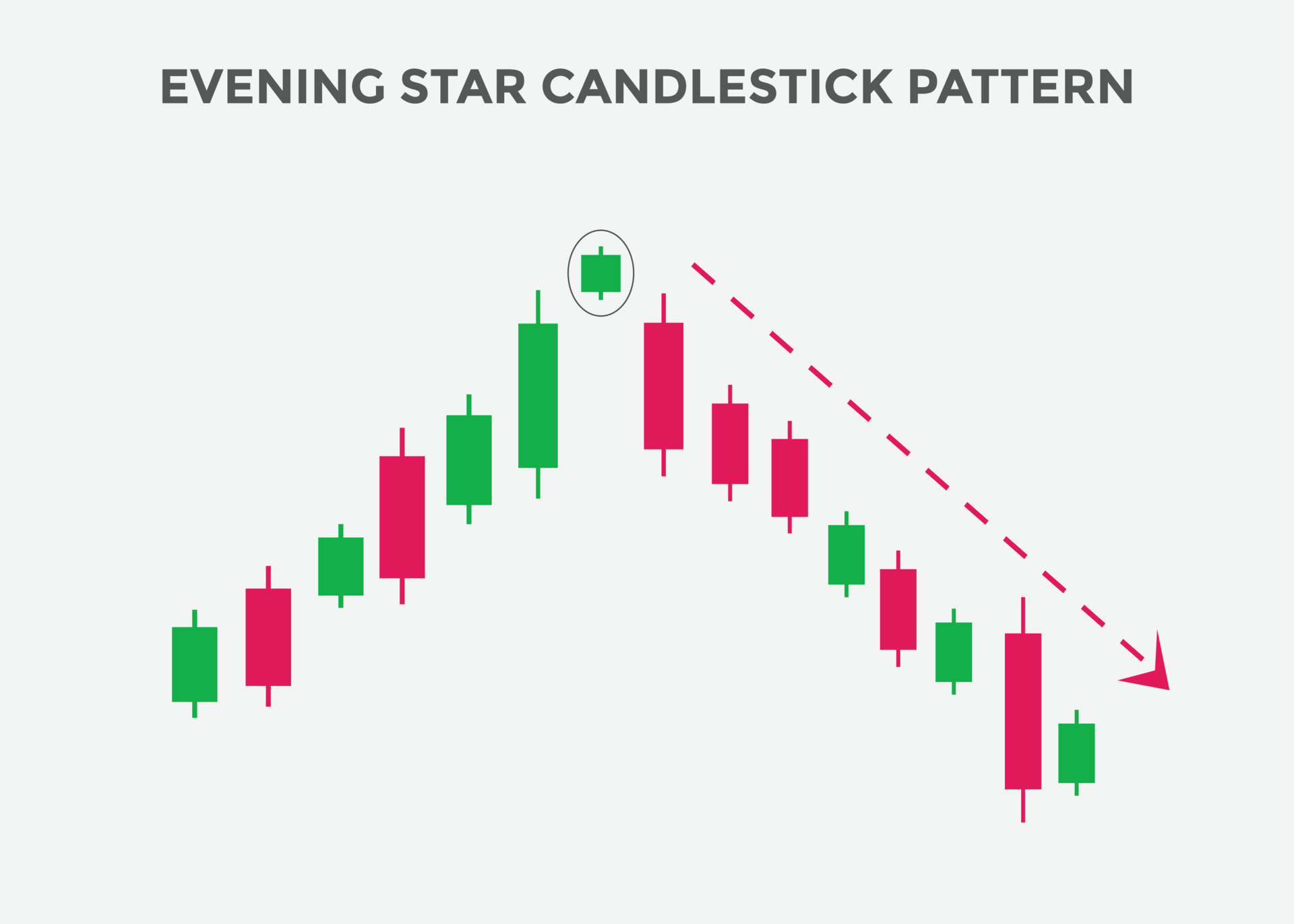

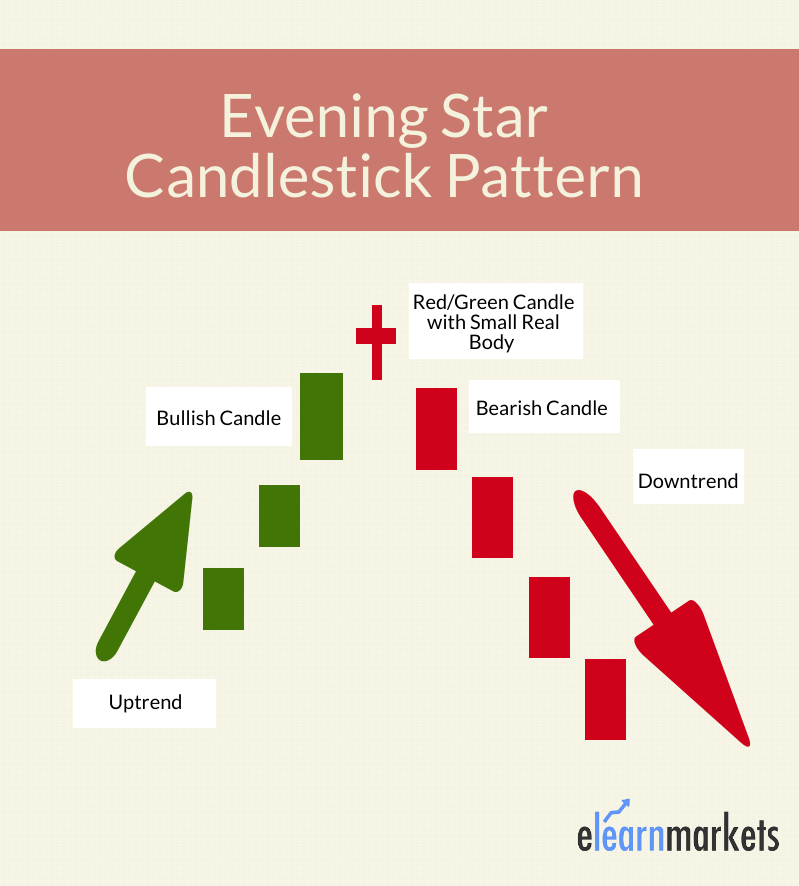

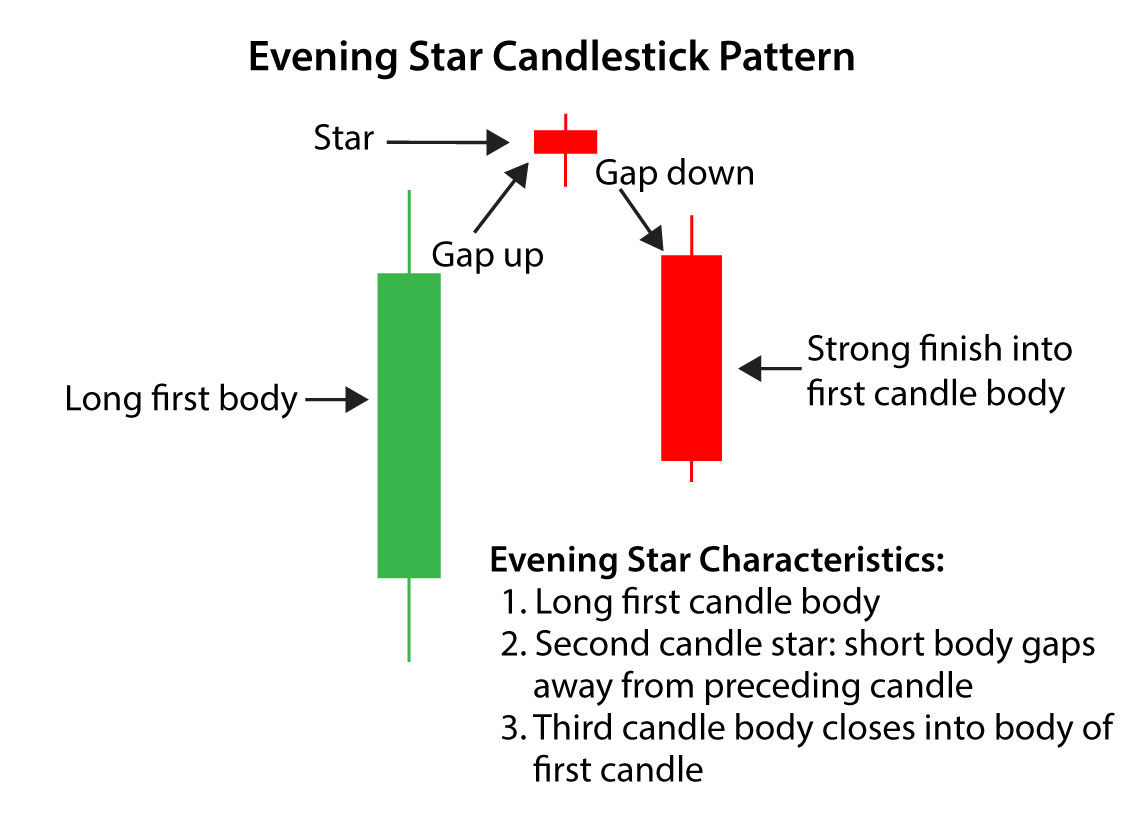

Evening Star Candle Pattern - However, as with everything in technical analysis, this is not. Millions of americans were able to see the magical glow of the northern lights on friday night when a powerful geomagnetic storm reached earth. Traders often use additional tools and indicators to confirm the presence of this pattern. Web 3 benefits of the evening star candlestick pattern; The color of the body of the second candle doesn’t matter, it can be either red or green (bearish or bullish). Web variants of the evening star candlestick pattern. A stop loss was placed above the second candle at 1.4250. For instance, when the pattern appears near a strong resistance level, there is always a strong likelihood that the price will correct from the. Web the evening star candlestick pattern was located. The evening star candlestick pattern may appear a little different on your charts. It may not even have a body, only small wicks above and below. The evening star candlestick pattern may appear a little different on your charts. For instance, there is always a high probability that the price will reverse from the prior uptrend and move lower when the pattern. It consists of three candles: Using additional technical indicators improves its. First of all it is formed at an. In fact, it was so strong that the close was the same as the high (very bullish sign). It consists of three candles: Here’s what it may look like on. Using additional technical indicators improves its ability to forecast bearish reversals. The evening star candlestick pattern may appear a little different on your charts. Web 3 benefits of the evening star candlestick pattern; A stop loss was placed above the second candle at 1.4250. Using additional technical indicators improves its ability to forecast bearish reversals. 4.2 three inside up and down; Web variants of the evening star candlestick pattern. Web the evening star candlestick pattern is one of the patterns of price action trading. 6 how to trade the evening star candlestick pattern in 7 steps. It may not even have a body, only small wicks above and below. The opposite of the evening star is the morning star pattern, which. For instance, there is always a high probability that the price will reverse from the prior uptrend and move lower when the pattern. Web an evening star is a bearish reversal candlestick pattern consisting of three candles: This pattern is considered a strong indication of a potential price reversal. For instance, when the pattern appears near a strong resistance level,. This pattern can help you make informed decisions and capture profitable trades correctly. Web evening star is a reliable bearish reversal candlestick pattern with a success rate of about 70.2%. 4.2 three inside up and down; However, day 2 was a doji, which is a candlestick signifying indecision. The color of the body of the second candle doesn’t matter, it. A profit target was located at 1.4100 according to a 1:1 risk vs. 5 importance of stock indicators. Day 2 continued day 1’s bullish sentiment by gapping up. A stop loss was placed above the second candle at 1.4250. 6 how to trade the evening star candlestick pattern in 7 steps. Web an evening star is a bearish reversal candlestick pattern consisting of three candles: This pattern is considered a strong indication of a potential price reversal. It consists of three candles: Web the evening star candle pattern is a bearish reversal signal in technical analysis, providing traders with potential insight into market momentum shifts. It acts as a bearish indicator. In fact, it was so strong that the close was the same as the high (very bullish sign). As such, it usually appears at the end of an uptrend and beginning of a downtrend. The pattern begins with a large bullish candle. Three candles make up the bearish candlestick pattern: Web 3 benefits of the evening star candlestick pattern; 4 evening star pattern example. A candle, or candlestick, is a type of price chart. Traders often use additional tools and indicators to confirm the presence of this pattern. Web the evening star candlestick pattern is a reliable bearish reversal pattern with a success rate of roughly about 70.2%. Web we see the evening star candlestick pattern on the tesla. Millions of americans were able to see the magical glow of the northern lights on friday night when a powerful geomagnetic storm reached earth. Technical analysts utilize the evening star pattern on stock price charts to determine when a trend is ready to change direction. Correctly spotting reversals is crucial when trading financial. A rising window pattern formed at a high trading volume is followed by an evening star pattern and the bears are in control pushing price downward. Although theoretically we deal with the evening star pattern, a long black candle occurrence itself is the most important candle on the chart in our example. The color of the body of the second candle doesn’t matter, it can be either red or green (bearish or bullish). Using additional technical indicators improves its ability to forecast bearish reversals. Web the evening star is a bearish reversal pattern in technical analysis that is identified by a tall bullish candle followed by a small candle that gaps above the first candle, and then a third candle that is bearish and closes below the midpoint of the first candle. As such, it usually appears at the end of an uptrend and beginning of a downtrend. Web the evening star candlestick pattern is a reliable bearish reversal pattern with a success rate of roughly about 70.2%. It consists of three candles: 4 evening star pattern example. Web the evening star pattern consists of three candles: 6 how to trade the evening star candlestick pattern in 7 steps. It may not even have a body, only small wicks above and below. Therefore, traders use it to either sell an existing long position or enter a new short position.

Evening Star Definition and Use Candlestick Pattern

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

What Is Evening Star Pattern Formation With Examples ELM

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

evening star chart candlestick pattern. Powerful bearish Candlestick

Evening Star Candlestick Pattern And How To Trade Forex Most

What Is Evening Star Pattern Formation With Examples ELM

Evening Star Candlestick pattern How to Identify Perfect Evening Star

Evening Star Candlestick Pattern How to Trade It in 7 Steps Timothy

A Sell Order Was Placed Beneath The Formation At 1.4175.

5 Importance Of Stock Indicators.

This Pattern Is Characterized By A Small Body That Gaps Down From A White Real Body (The Preceding Candle) In An Uptrend.

However, Day 2 Was A Doji, Which Is A Candlestick Signifying Indecision.

Related Post: