Engulfing Pattern Bullish

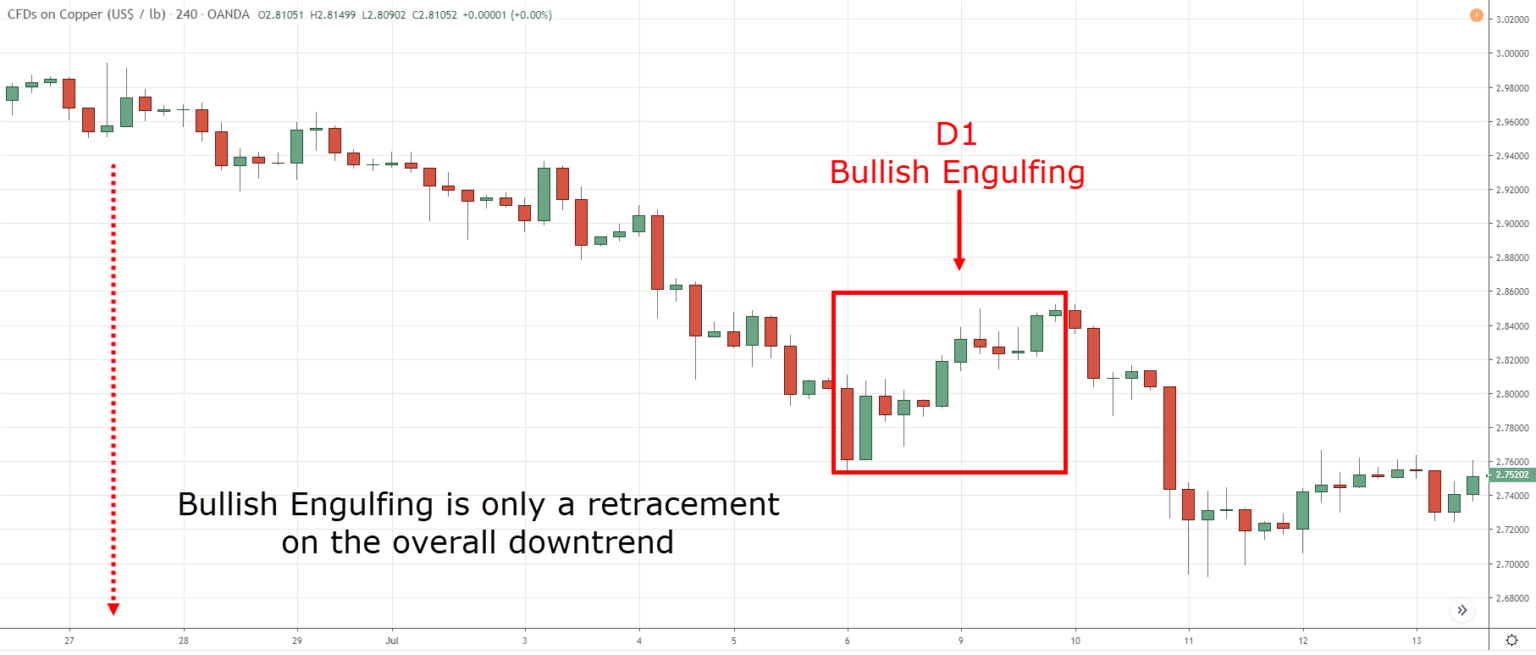

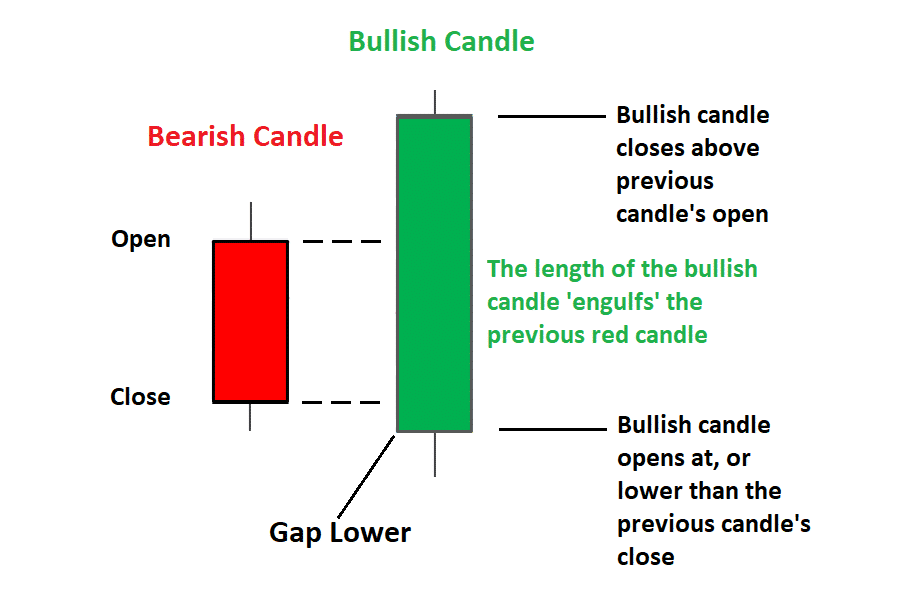

Engulfing Pattern Bullish - The pattern at the bottom warns that the price is about to reverse. Potential reversal signal after significant market movements support or resistance levels (support at the low end of the bullish. What sets this pattern apart is the white candle’s complete coverage of the previous day’s candle, signifying a. Following the bullish analysis, cryptojelle stated that btc “is looking good.” per his post, the cryptocurrency. A bullish engulfing pattern is a chart pattern that forms when a small black candlestick is followed by a large white candlestick that completely eclipses or engulfs. Web a bullish engulfing candlestick pattern occurs at the end of a downtrend. As seen in the illustration above. Web the bullish engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow candle. A bearish engulfing pattern is a chart pattern that consists of a small white candlestick with short shadows or tails followed by a large black candlestick that eclipses. The bullish engulfing pattern loses money in most markets when traditionally traded. Web this is the modified version of the engulfing candles indicator: That is, the bulls show their strength and open large purchases of the asset. Thus, it is a bullish candlestick pattern in this context. Web a bullish engulfing candlestick pattern occurs at the end of a downtrend. The pattern at the bottom warns that the price is about to. This script serves as the 'engulfing candles v2' indicator in tradingview. Bullish engulfing and bearish engulfing. It emphasizes a development in which buying pressure increases and selling pressure becomes difficult. Web a bullish engulfing pattern is a candlestick pattern that forms when a little black candle is followed the next day by a massive white candle whose body completely overlaps. Web engulfing bull formation. And here’s what a bullish engulfing pattern means…. Before jumping into a scanner, learning the basics of bullish engulfing patterns is important. A bullish engulfing pattern is a chart pattern that forms when a small black candlestick is followed by a large white candlestick that completely eclipses or engulfs. Web there are two types of engulfing. Engulfing bearish line consists of a small white body that is contained within the following large black candlestick. Web it is considered a bullish pattern when preceded by a downtrend. A bullish engulfing pattern occurs in the candlestick chart of a security. Web bullish engulfing pattern: Thus, it is a bullish candlestick pattern in this context. Bullish engulfing candle formations can be said to be a harbinger of a trend reversal. The first candle has a lower close. The pattern at the bottom warns that the price is about to reverse. A small bearish (red or black) candlestick and a larger bullish (green or white) candlestick that engulfs or covers the entire body of the previous. The second candle completely ‘engulfs’ the real body of the. A bullish engulfing pattern occurs after a downtrend in the area of low prices. As to its appearance, the first bar of the bullish engulfing pattern is bearish and is followed by a bullish candle, which body completely engulfs the first bearish candle. The pattern at the bottom warns that. This script serves as the 'engulfing candles v2' indicator in tradingview. Bullish engulfing and bearish engulfing. Web how to trade the bullish engulfing pattern. As the name indicates, it is a bullish reversal pattern that signals a potential beginning of an upward swing. Web bullish engulfing pattern: The bullish engulfing pattern loses money in most markets when traditionally traded. Web it is considered a bullish pattern when preceded by a downtrend. Web the bullish engulfing pattern is an easy to identify price action tool that can be used with any forex or stock trading strategy. Only the real body is important in this formation; This is a. This pattern signifies that there is a lot of buying. Web the bullish engulfing pattern is a bullish reversal candlestick that forms after a decline in price. Define the pattern and support/resistance levels. This tool is also helpful for learning patterns. Web there are two types of engulfing patterns: Web the bullish engulfing pattern, a potent tool in technical analysis, unfolds when a small black (or red) candlestick—indicating a bearish trend—is followed by a larger white (or green) candlestick, marking a bullish shift. Web a bullish engulfing candlestick pattern occurs at the end of a downtrend. Thus, it is a bullish candlestick pattern in this context. This pattern signifies. Only the real body is important in this formation; Web a bullish engulfing pattern is a pattern in which the second ascending candle engulfs the first bearish candle. The first type occurs when the current candle's close is higher than its open and higher than the previous candle's high, and the second. The bullish engulfing pattern loses money in most markets when traditionally traded. Web this is the modified version of the engulfing candles indicator: Web btc's curl pattern developing. It is considered a reversal signal when preceded by a downtrend. The second candle is always the opposite color of the first. Here’s how to recognize one: Web a bullish engulfing pattern is a candlestick pattern that forms when a little black candle is followed the next day by a massive white candle whose body completely overlaps or engulfs the body of the previous day’s candle.there must be a preceding trend to form a bullish engulfing pattern. As seen in the illustration above. Define the pattern and support/resistance levels. Trendspider is an awesome tool when you are comfortable as a trader. A bearish engulfing pattern is a chart pattern that consists of a small white candlestick with short shadows or tails followed by a large black candlestick that eclipses. Web the bullish engulfing pattern is an easy to identify price action tool that can be used with any forex or stock trading strategy. A bullish engulfing pattern occurs in the candlestick chart of a security.

What Is Bullish Engulfing Candle Pattern? Meaning And Strategy

Bullish Engulfing Pattern What is it? How to use it?

Trading the Bullish Engulfing Candle

Bullish Engulfing Candlestick Pattern PDF Guide

Trading the Bullish Engulfing Candle

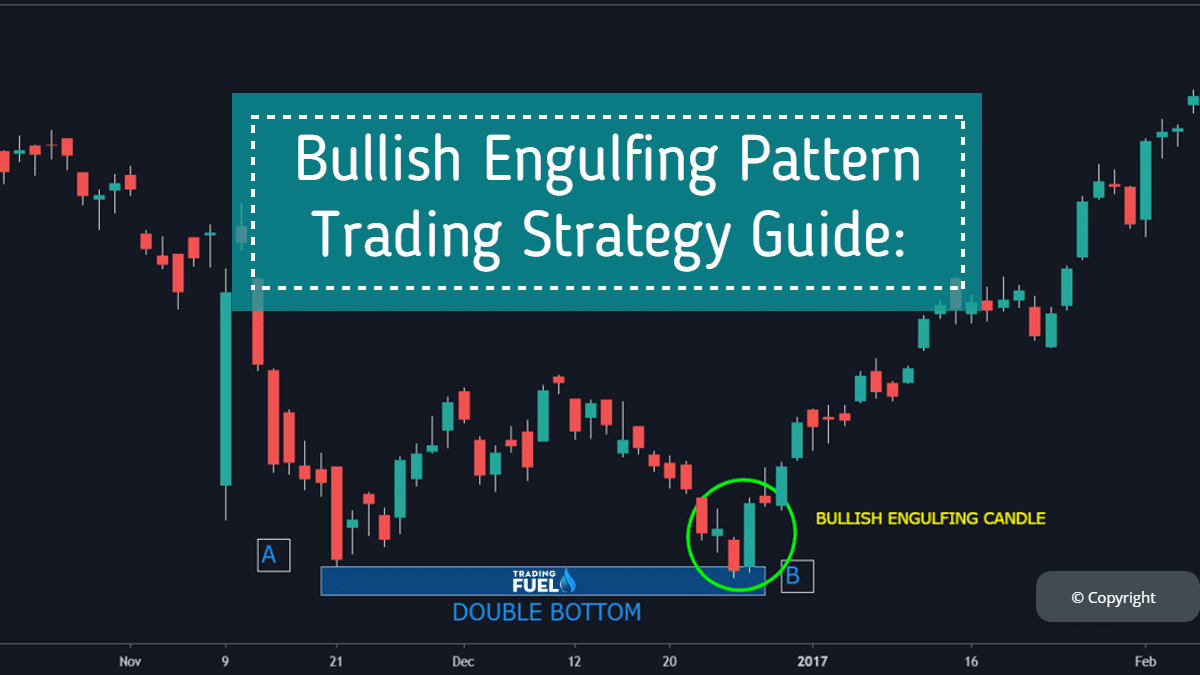

Bullish Engulfing Pattern Trading Strategy Guide (Pro's Guide)

:max_bytes(150000):strip_icc()/BullishEngulfingPatternDefinition2-5f046aee5fe24520bfd4e6ad8abaeb74.png)

Bullish Engulfing Pattern Definition, Example, and What It Means

Bullish Engulfing Pattern Trading Strategy Guide

A Complete Guide To Bullish Engulfing Pattern InvestoPower

Bullish Engulfing Pattern An Important Technical Pattern

Web Engulfing Bull Formation.

The Timeframe Used To Analyze Engulfing Patterns Can Significantly Affect The Reliability Of The Pattern.

Before Jumping Into A Scanner, Learning The Basics Of Bullish Engulfing Patterns Is Important.

Web The Bullish Engulfing Pattern Indicates A Potential Reversal Of Investor Sentiment And Is Suggestive Of A Stock Having Reached Its Minimum Value Over A Given Time Period.

Related Post: