Engulfing Pattern Bearish

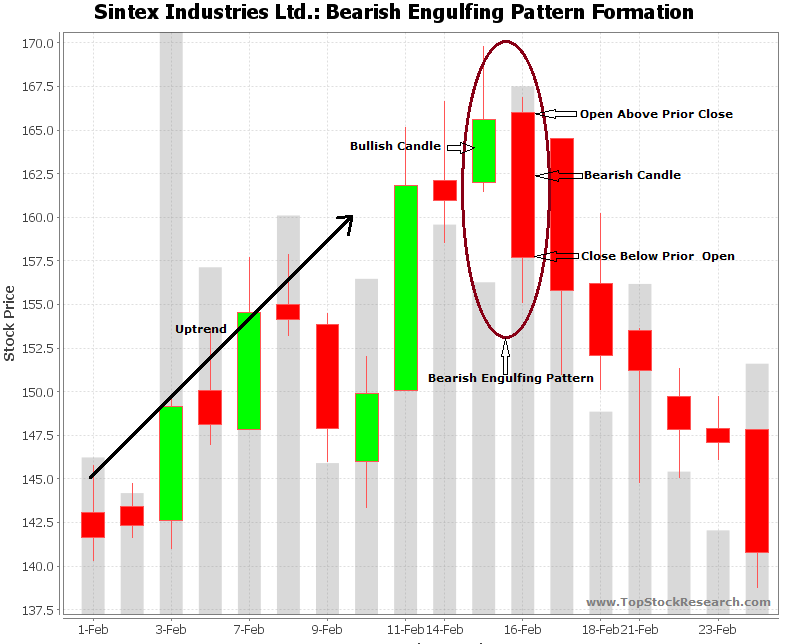

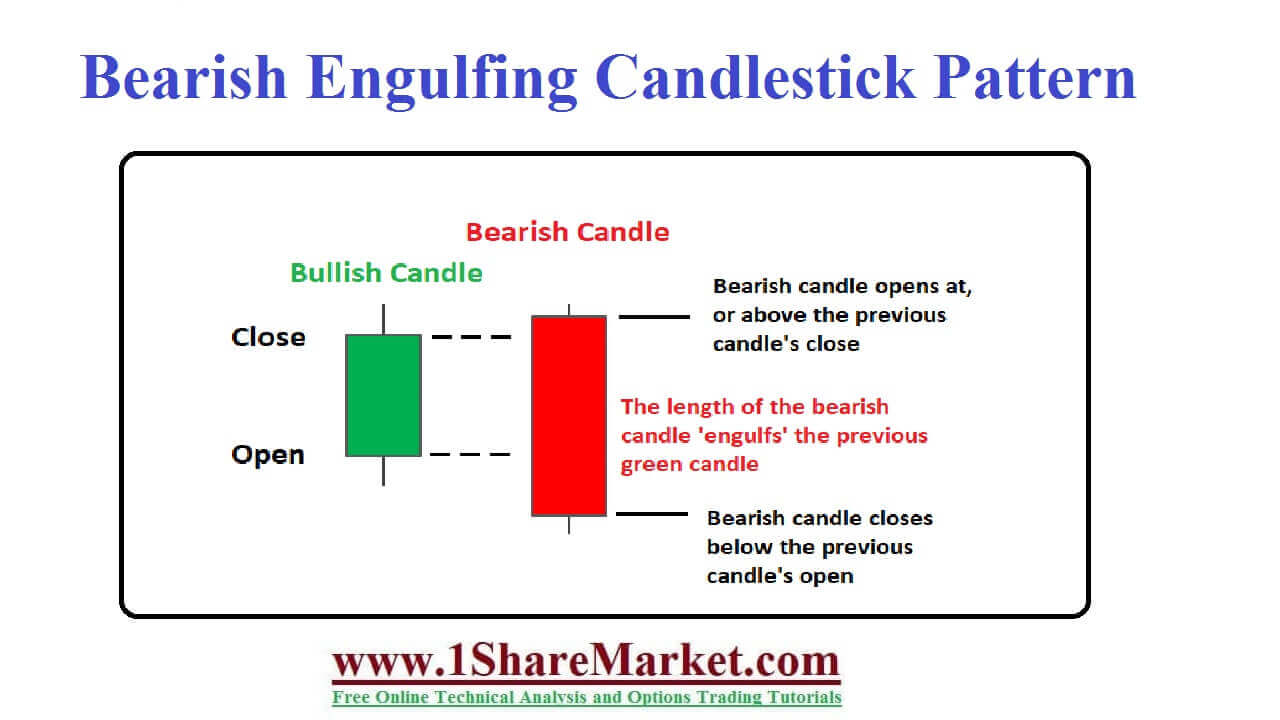

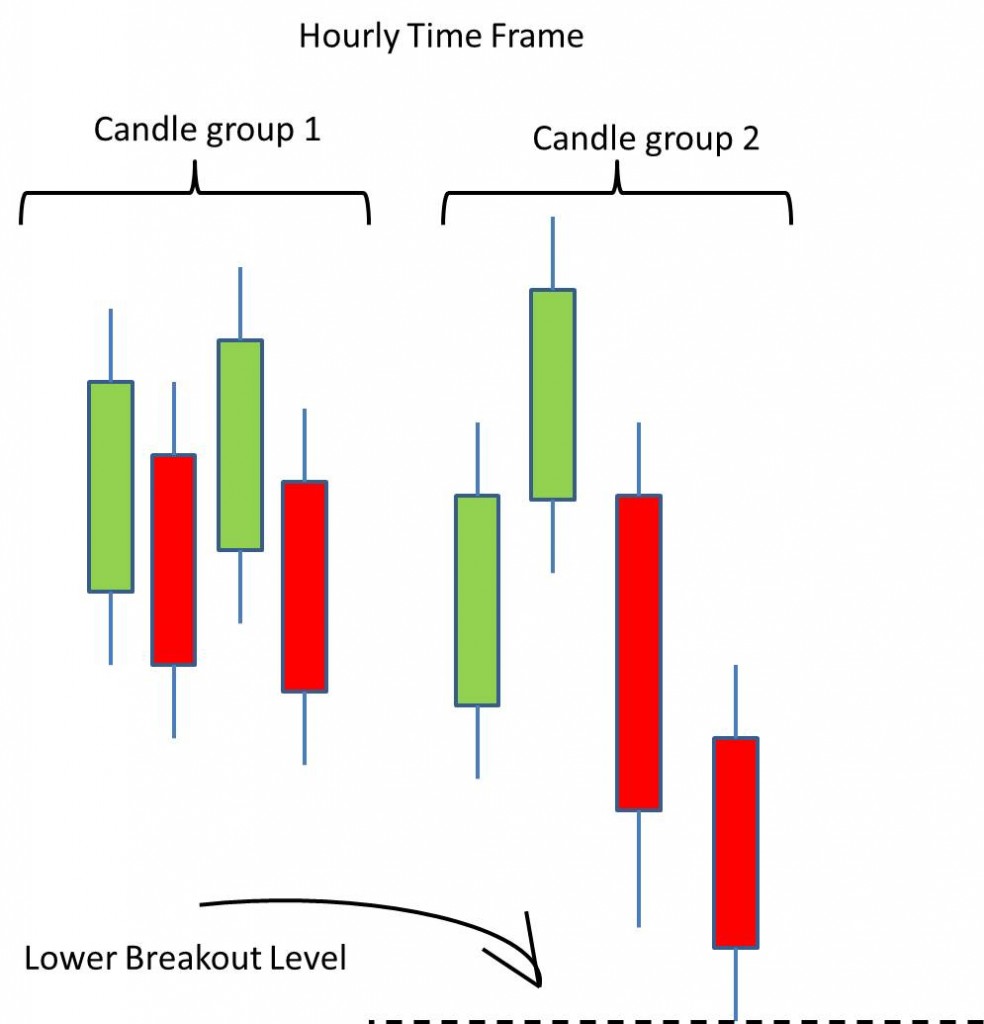

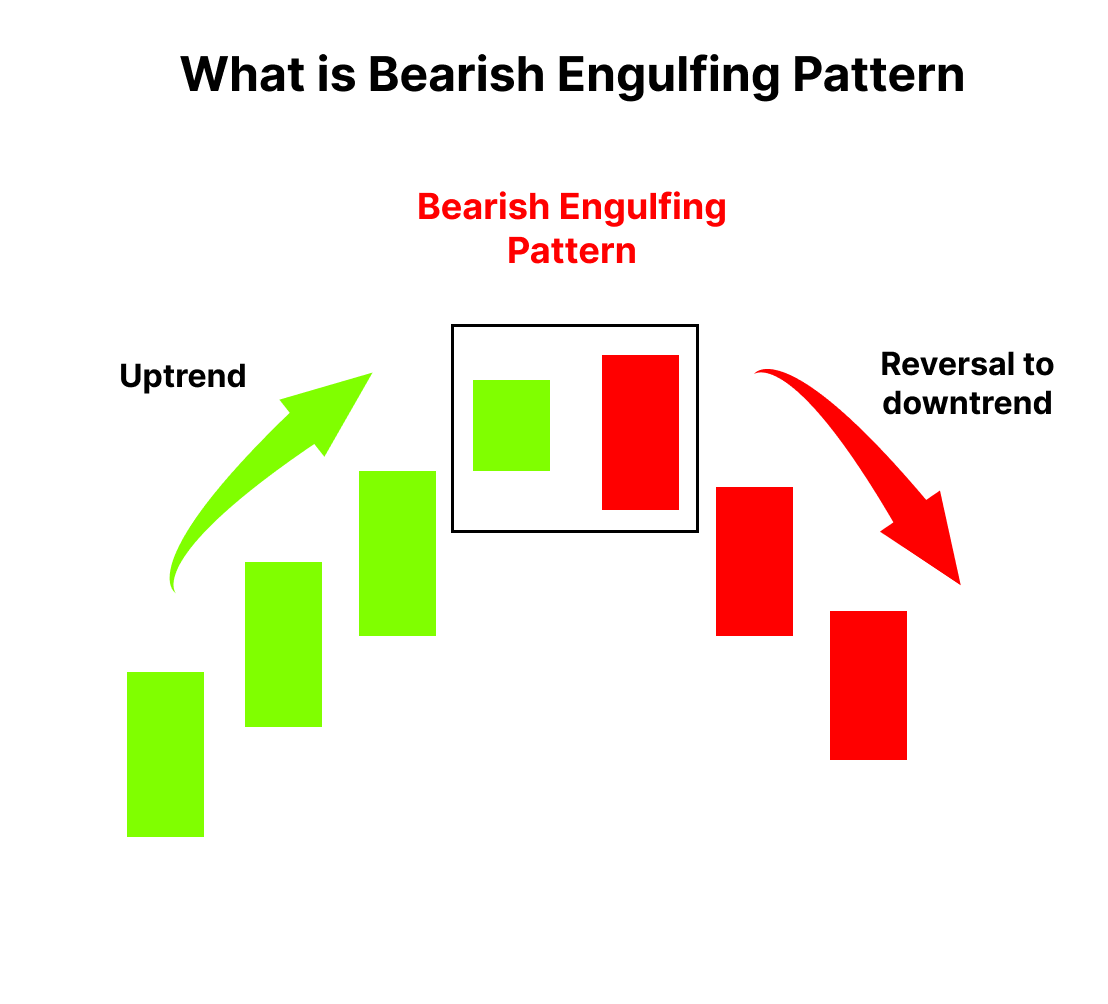

Engulfing Pattern Bearish - The first is white and the second black. Engulfing bearish pattern is a reversal pattern usually found at the end of a given uptrend and consists of two candles. The appearance of a bearish engulfing pattern after an uptrend. #bearishengulfing#chartpattern#trading#chartpattern#nse#bse#stockmarket bearish engulfing candlestick pattern. The pattern is created by. Web furthermore, friday’s nfp bearish engulfing day was on relatively low volume, meaning bears lacked conviction on the day. They are commonly formed by the opening, high,. Therefore, my bias is for the us dollar to pop higher from here and potentially see a false break above friday’s high, before bearish momentum returns and prices head for at least 104.50, the bullish trendline or. The engulfing pattern most likely signals a trend reversal. Web the bearish engulfing pattern consists of two candlesticks: Web this is the modified version of the engulfing candles indicator: They are commonly formed by the opening, high,. In a bearish pattern, a red candle forms after the green one appears and absorbs it. The engulfing candlestick pattern is a chart pattern consisting of green and red candles. Web the bearish engulfing pattern is a two candle formation local. The first type occurs when the current candle's close is higher than its open and higher than the previous candle's high, and. The engulfing candlestick pattern is a chart pattern consisting of green and red candles. Web a bearish engulfing pattern occurs after a price moves higher and indicates lower prices to come. Web the bearish engulfing pattern is a. The second candle’s body completely “engulfs” the first candle’s body and indicates a strong shift in investor sentiment towards a bearish bias. The first line can be any white basic candle, appearing both as a long or a short line. Web the bearish engulfing pattern indicates a sudden shift in market sentiment when the sellers have overtaken the buyers. It. Web a bearish engulfing pattern occurs after a price moves higher and indicates lower prices to come. It consists of a positive candlestick (green) followed by a more significant negative candle (red) that completely encapsulates or. Here’s the pattern deconstructed into its key elements: Web by leo smigel. Web the aspects of a candlestick pattern. Who likes losing money in every market? Web the bearish engulfing pattern is a two candle formation local to japanese candlestick price charts. Web this is the modified version of the engulfing candles indicator: #bearishengulfing#chartpattern#trading#chartpattern#nse#bse#stockmarket bearish engulfing candlestick pattern. Candlesticks are graphical representations of price movements for a given period of time. Candlesticks are graphical representations of price movements for a given period of time. Web this is the modified version of the engulfing candles indicator: Web bullish and bearish engulfing candlestick patterns are powerful reversal formations that generate a signal of a potential reversal. It is then followed by a day where the candle body fully overtakes the body from the. Engulfing bearish pattern is a reversal pattern usually found at the end of a given uptrend and consists of two candles. The second candle’s body completely “engulfs” the first candle’s body and indicates a strong shift in investor sentiment towards a bearish bias. The bearish engulfing pattern is a crucial technical analysis tool used in predicting a forthcoming reversal of. Typically, when the second smaller candle engulfs the first, the price fails and causes a bearish reversal. Therefore, my bias is for the us dollar to pop higher from here and potentially see a false break above friday’s high, before bearish momentum returns and prices head for at least 104.50, the bullish trendline or. #bearishengulfing#chartpattern#trading#chartpattern#nse#bse#stockmarket bearish engulfing candlestick pattern. The. Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a potential. The appearance of a bearish engulfing pattern after an uptrend. Web the bearish engulfing pattern is formed when the market trades higher than the previous day’s high, only for prices. Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a potential. The pattern consists of two candlesticks: In a bearish pattern, a red candle forms after the green one appears and absorbs it. Here’s the pattern deconstructed into its key elements:. Web the bearish engulfing pattern indicates a potential reversal of investor sentiment and is suggestive of a stock having reached the upper limits of its value. Web what is a bearish engulfing pattern? These patterns indicate a potential trend reversal from an uptrend to a downtrend and are characterized by bearish candlestick formations. They are commonly formed by the opening, high,. Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a potential. Typically, when the second smaller candle engulfs the first, the price fails and causes a bearish reversal. Web a bearish engulfing pattern occurs after a price moves higher and indicates lower prices to come. Web the bearish engulfing candlestick pattern is considered to be a bearish reversal pattern, usually occurring at the top of an uptrend. It is then followed by a day where the candle body fully overtakes the body from the day before it and closes in the trend’s opposite direction. It consists of a positive candlestick (green) followed by a more significant negative candle (red) that completely encapsulates or. Web what is a bearish engulfing pattern? Web the bearish engulfing pattern consists of two candlesticks: The size of the white candlestick is relatively unimportant, but it should not be a doji, which would be relatively easy to engulf. This script serves as the 'engulfing candles v2' indicator in tradingview. Web the bearish engulfing pattern is a two candle formation local to japanese candlestick price charts. Web the bearish engulfing pattern is a powerful candlestick pattern that traders use to identify potential reversals in the market.

What is a Bearish Engulfing Pattern YouTube

What Is Bearish Engulfing Candle Pattern? Meaning And Trading Strategy

Bearish Engulfing Candlestick Pattern Example 9

Bearish engulfing candlestick pattern with Advantages and limitation

How To Trade Blog How To Trade Forex With The Bearish Engulfing

How To Trade The Bearish Engulfing Candle

Bearish Engulfing Candle Stick Pattern

Bearish Engulfing Candlestick Pattern PDF Guide

Bullish & Bearish Engulfing Bars (Part III) FXMasterCourse

Bearish Engulfing Pattern Meaning, Example & Limitations Finschool

Consequently, The Stock May Experience A Downward, Or Bearish, Movement In.

In A Bearish Pattern, A Red Candle Forms After The Green One Appears And Absorbs It.

Candlesticks Are Graphical Representations Of Price Movements For A Given Period Of Time.

The Second Candle’s Body Completely “Engulfs” The First Candle’s Body And Indicates A Strong Shift In Investor Sentiment Towards A Bearish Bias.

Related Post: