Elliott Wave Patterns

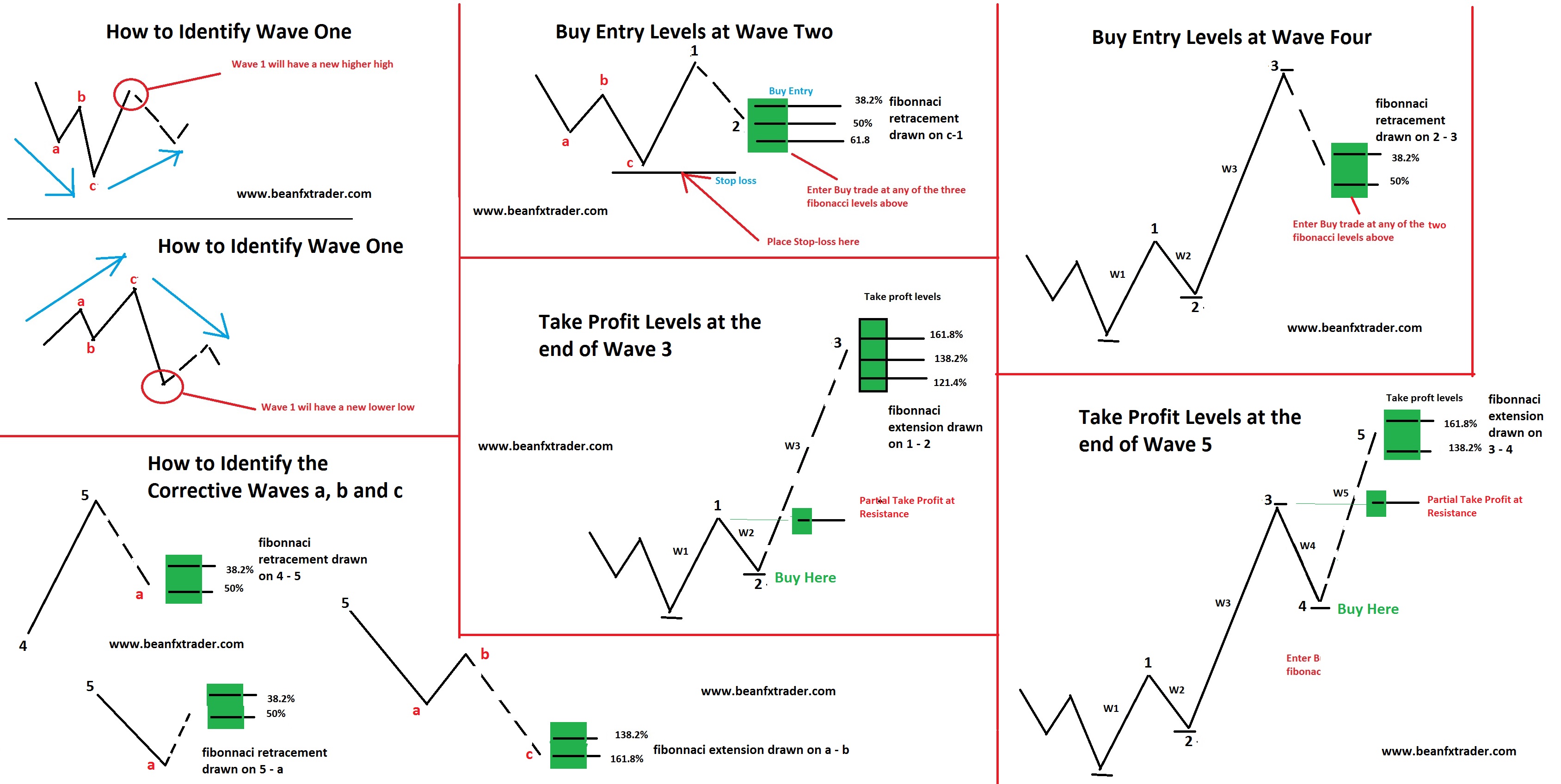

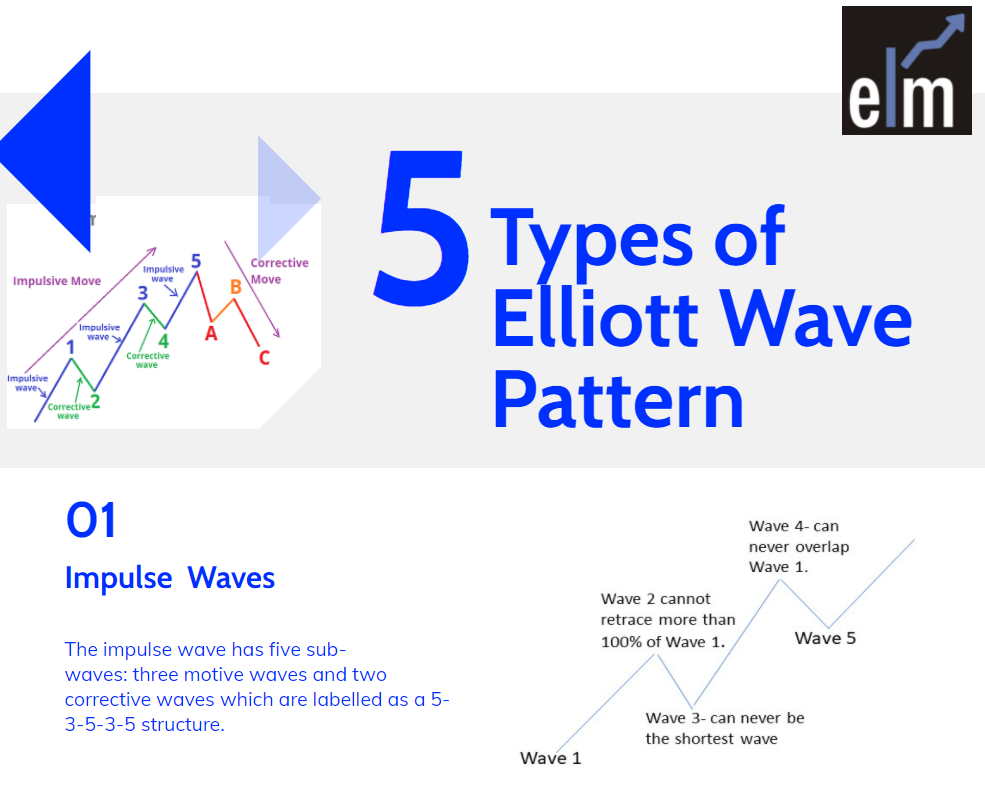

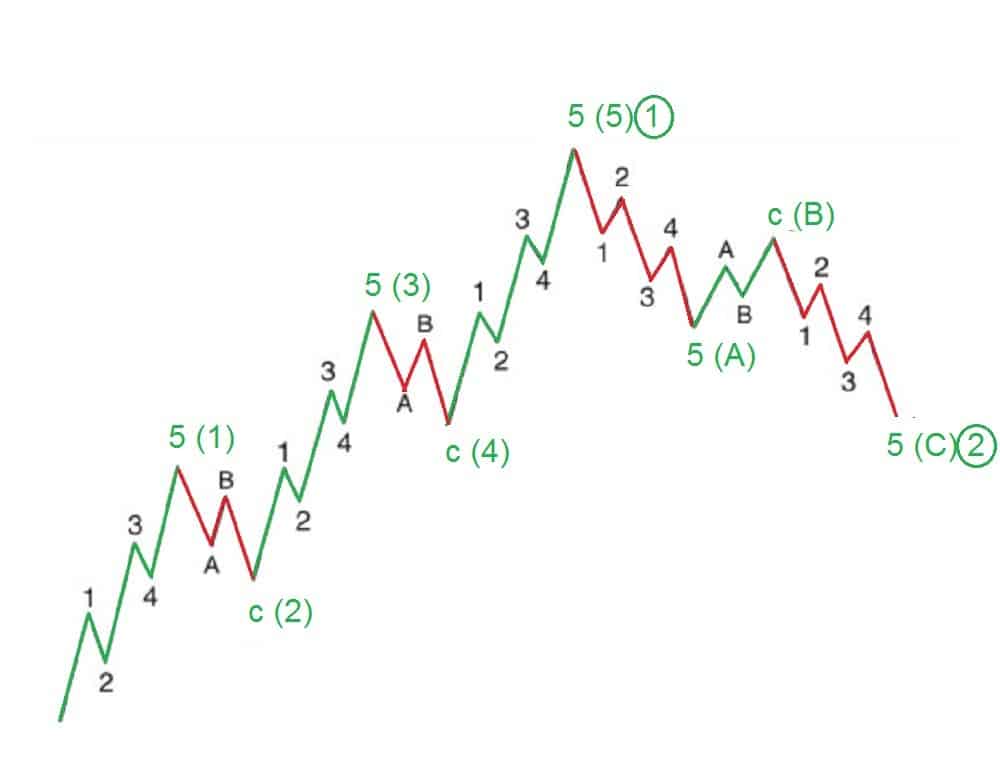

Elliott Wave Patterns - The impulse wave is the type of wave we have used so far to illustrate how the structure of elliott wave is put together. Waves 1, 2,3, 4 and 5 form an impulse wave, alternating between motive and corrective waves. Web in markets, the elliott wave theory is interpreted as follows: I'm going to show you how to identify, and navigate them using the elliott wave rules, in this guide. Learn finance easily.learn at no cost.free animation videos.learn more. We’re gearing up for a crucial week ahead. Web the movement in the direction of the trend is labelled as 1, 2, 3, 4, and 5. Ideally, smaller patterns can be identified within bigger patterns. Web specific corrective patterns fall into three main categories: The theory identifies impulse waves that establish a pattern and. Web the elliott wave theory, also known as elliott wave principle, is a technical analysis tool that aims to identify predictable patterns in financial markets. Technical analysis in general is a method of market forecasting, based on pattern recognition. It moves against the trend of the next larger size. The three wave correction is labelled as a, b, and c.. I’m a big fan of trading triangles you can often recognize them around the middle of a pattern. Ideally, smaller patterns can be identified within bigger patterns. The theory identifies impulse waves that establish a pattern and. Web may 13, 2024. Elliott wave count | i’m a big fan of trading triangles 😍🔺 👆 you can often recognize them around. These patterns can be seen in long term as well as short term charts. I’m a big fan of trading triangles you can often recognize them around the middle of a pattern. Hey everyone, hope you enjoyed the weekend. Web the elliott wave theory, also known as elliott wave principle, is a technical analysis tool that aims to identify predictable. 5 the fibonacci sequence and the elliott wave theory. Although the fed currently maintains a restrictive policy, the latest us jobs. The theory identifies impulse waves that establish a pattern and. It moves in the same direction as the trend of the next larger size. Web in markets, the elliott wave theory is interpreted as follows: These patterns can be seen in long term as well as short term charts. The three wave correction is labelled as a, b, and c. It is the most common motive wave and the easiest to spot in a market. Every impulse consists of 5 waves. The elliott wave principle is a more specific method, which uses its own patterns,. Web the movement in the direction of the trend is labelled as 1, 2, 3, 4, and 5. We’re gearing up for a crucial week ahead. Web the basic pattern elliott described consists of “motive waves” and “corrective waves.” a motive wave is composed of five subwaves. A diagonal is a motive pattern with two corrective characteristics. Web 2.1 elliott. 3 how does elliott waves theory work? I'm going to show you how to identify, and navigate them using the elliott wave rules, in this guide. The impulse wave is the type of wave we have used so far to illustrate how the structure of elliott wave is put together. Web elliott wave patterns. However, the diagonal triangle is the. I'm going to show you how to identify, and navigate them using the elliott wave rules, in this guide. Web the basic pattern elliott described consists of “motive waves” and “corrective waves.” a motive wave is composed of five subwaves. When you spot an ending diagonal (the most common type of diagonal), be ready for a fast and sharp reversal.. When you spot an ending diagonal (the most common type of diagonal), be ready for a fast and sharp reversal. Elliott wave count | i’m a big fan of trading triangles 😍🔺 👆 you can often recognize them around the middle of a pattern. Web elliott wave theory is a method of market analysis, based on the idea that the. Below are the 5 main types of elliott wave patterns. Web diagonal waves in elliott wave cheat sheet is a motive pattern, but not an impulse. It moves in the same direction as the trend of the next larger size. Three motive waves and two corrective waves. Web in markets, the elliott wave theory is interpreted as follows: Each level of such timescales is called the degree of the wave, or price pattern. These patterns provide clues as to what might happen next in the market. Five waves in the direction of the main trend labeled 1,2 ,3 ,4 and 5, followed by three corrective waves labeled a, b and c. It moves in the same direction as the trend of the next larger size. Web may 13, 2024. It is the most common motive wave and the easiest to spot in a market. Web elliott wave is fractal and the underlying pattern remains constant. They can form different patterns such as ending diagonals , expanded flats , zigzag corrections and triangles. — (bloomberg financial series) includes index. Below are the 5 main types of elliott wave patterns. A corrective wave is divided into three subwaves. By understanding these patterns, traders can gain insights into future price movements, enabling them to make informed investment decisions. Web 2.1 elliott waves are based on human psychology. Web the elliott wave principle enables you to properly decipher the wave patterns unfolding in each stock market and then make predictions on which wave patterns are most likely to occur next — this is the basis of elliott wave analysis. This allows you to prepa.. Elliott wave analysts use chart patterns and technical indicators to identify these patterns and determine the.

Elliott Wave Cheat Sheet All You Need To Count Trading charts, Wave

Trading Elliott Waves Winning Strategies UnBrick.ID

5 TYPES OF ELLIOTT WAVE PATTERNS for BINANCEBTCUSDT by CRYPTOMOJO_TA

Elliott Wave Patterns Advanced Forex Strategies

ELLIOTT WAVE PRINCIPLE FX & VIX Traders Blog

Visual Guide To Elliott Wave Trading UnBrick.ID

Elliott Wave Pattern 5 Powerful Elliott Waves Pattern

/elliott-wave-tricks-to-improve-trading-4153295_FINAL-3500ecb730a84818b040c75f73a1fa98.png)

Elliott Wave Tricks That Will Improve Your Trading

:max_bytes(150000):strip_icc()/ElliottWaveTheory-b46a288b1cfe42c69bdbf3b502849b2c.png)

Elliott Wave Theory Definition

Awesome Traders Guide to Elliott Wave + a Simple Trading strategy!

Web Diagonal Waves In Elliott Wave Cheat Sheet Is A Motive Pattern, But Not An Impulse.

Web The Elliott Wave Theory, Also Known As Elliott Wave Principle, Is A Technical Analysis Tool That Aims To Identify Predictable Patterns In Financial Markets.

7 Additional Resources To Expand Your Learning On Elliott Wave Analysis.

The Three Wave Correction Is Labelled As A, B, And C.

Related Post: