Elliott Wave Corrective Patterns

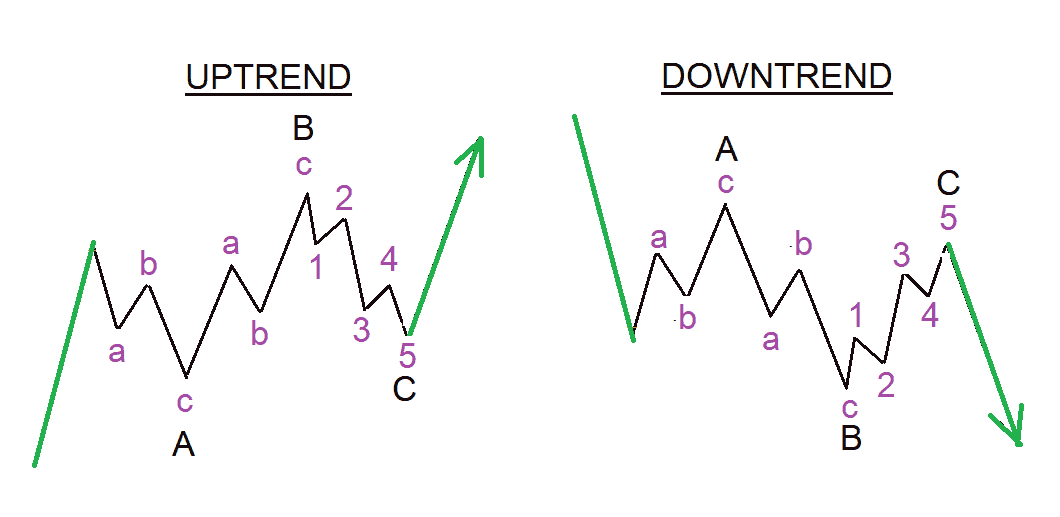

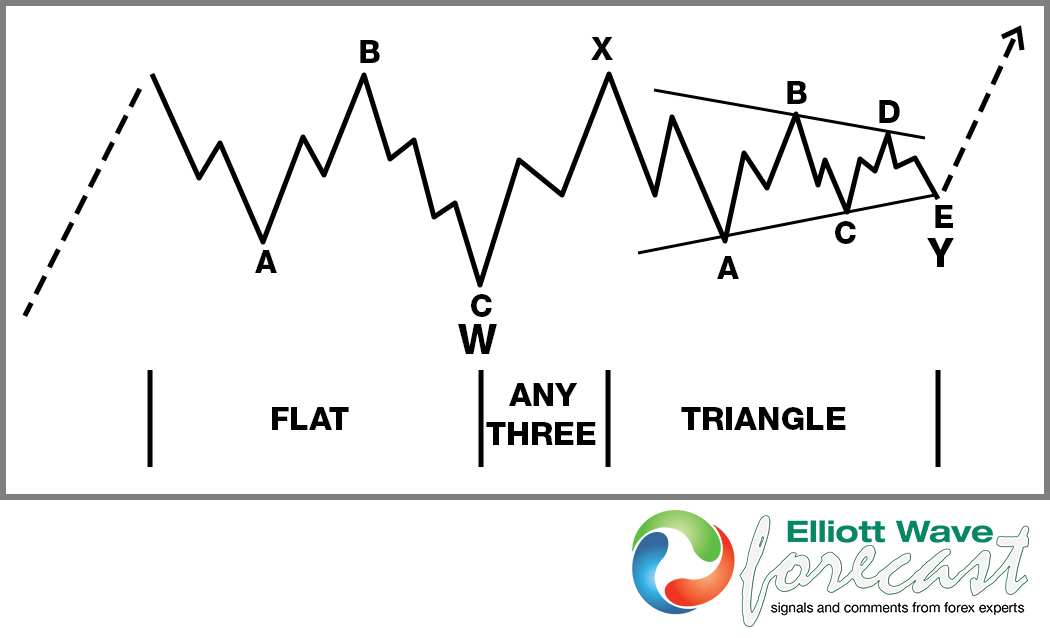

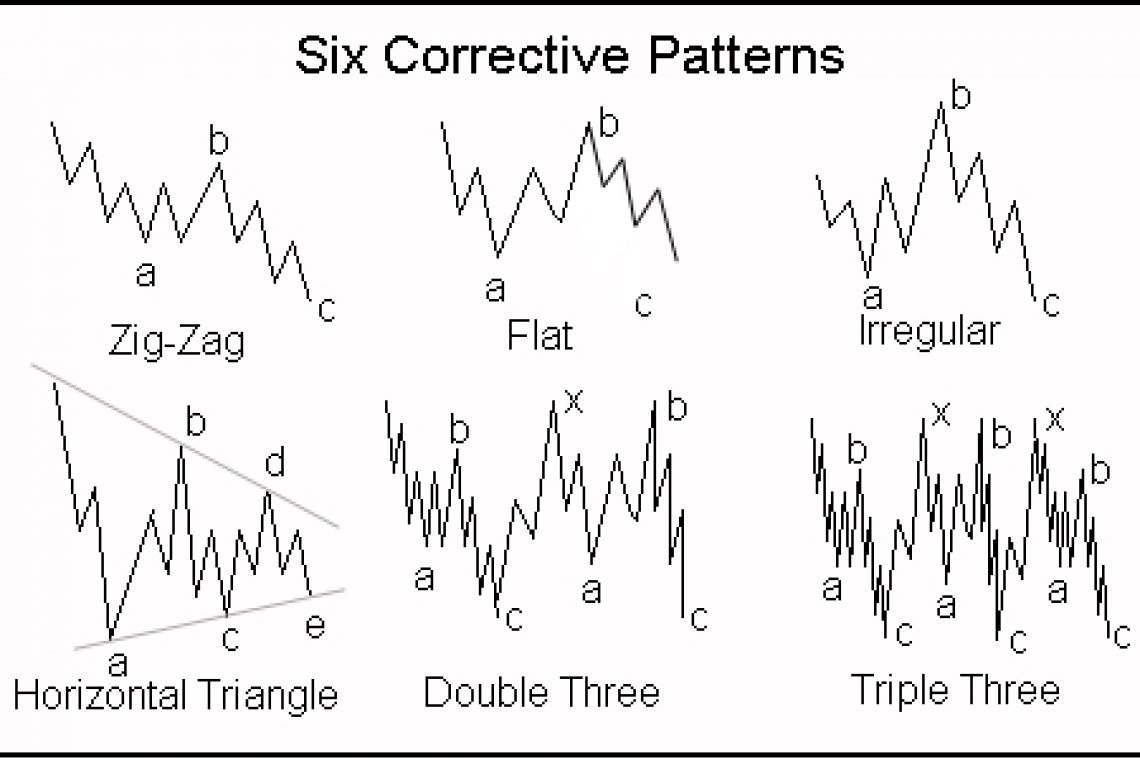

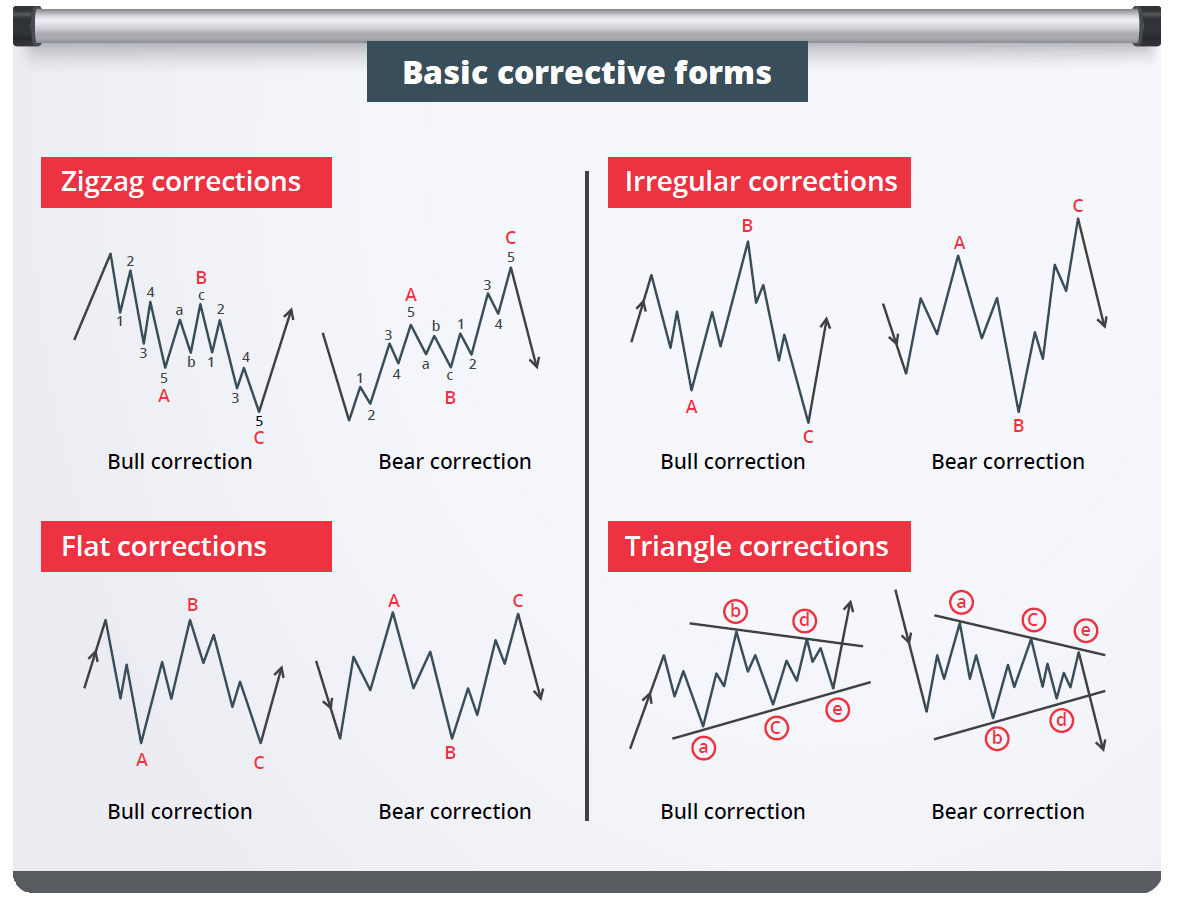

Elliott Wave Corrective Patterns - Corrections are movements against the larger trend. Waves 1, 2,3, 4 and 5 form an impulse wave, alternating between motive and corrective waves. The motive wave, which propels the market in the direction of the trend, and the corrective wave, which retraces the path against it. Th e pattern is continuous in that the end of one wave marks the beginning of the next wave. Impulse waves move in the direction of the main trend and consist of five smaller waves labeled 1, 2, 3, 4, and 5. Impulse waves and corrective waves. Web it is the most common motive wave and the easiest to spot in a market. Web elliot wave theory posits that security price movements are broken up into two types of waves: They're simple and complex correction patterns: Web download my entry strategy: Waves 1, 2,3, 4 and 5 form an impulse wave, alternating between motive and corrective waves. Elliott discovered that market price movements adhere to a certain pattern composed of what he called waves. So, when the correction is over, the larger trend should resume. They're simple and complex correction patterns: It moves against the trend of the next larger size. So, when the correction is over, the larger trend should resume. Web elliott first published his theory of the market patterns in the book titled the wave principle in 1938.in the language of children, movement in the direction of the trend is unfolding in 5 waves (called motive wave) while any correction against the trend is in three waves (called. These two types of waves can be used to discern price. Web the elliott wave principle, or elliott wave theory, is a form of technical analysis that financial traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology and price levels, such as highs and lows, by looking for patterns in prices. Web. Web the basic pattern elliott described consists of “motive waves” and “corrective waves.” a motive wave is composed of five subwaves. Impulse waves move in the direction of the main trend and consist of five smaller waves labeled 1, 2, 3, 4, and 5. Impulse waves (also known as motive waves) and corrective waves. The first two (a zigzag and. Unlike motive waves, corrections are more complicated and tricky structures. Web the structure of the elliott wave theory is built upon two fundamental wave forms: Web the elliott wave theory is focused on identifying a trend in financial market values and is based on the assumption that market patterns that have prevailed in the past might extrapolate in the. Impulse. The theory identifies impulse waves that establish a pattern and. The motive wave, which propels the market in the direction of the trend, and the corrective wave, which retraces the path against it. These two types of waves can be used to discern price. However, it has three unbreakable rules that define its formation. The great thing about elliott wave. Impulse waves (also known as motive waves) and corrective waves. Five waves in the direction of the main trend labeled 1,2 ,3 ,4 and 5, followed by three corrective waves labeled a, b and c. Black wave 5 of red wave 3. Web the elliott wave principle, or elliott wave theory, is a form of technical analysis that financial traders. The first two (a zigzag and a flat) are simple patterns, which are bricks of complex. Web beginner elementary intermediate. However, it has three unbreakable rules that define its formation. Black wave 5 of red wave 3. Web in markets, the elliott wave theory is interpreted as follows: It moves in the same direction as the trend of the next larger size. It reveals that mass psychology swings from pessimism to optimism and back in a natural sequence, creating specific and measurable patterns. Black wave 5 of red wave 3. So, when the correction is over, the larger trend should resume. Web beginner elementary intermediate. However, it has three unbreakable rules that define its formation. The theory identifies impulse waves that establish a pattern and. Elliott discovered that market price movements adhere to a certain pattern composed of what he called waves. Web the basic pattern elliott described consists of “motive waves” and “corrective waves.” a motive wave is composed of five subwaves. Web elliot. However, along with forecast it is important to get 2 stage confirmation as per neo wave as well. They're simple and complex correction patterns: Web the elliott wave principle is a detailed description of how groups of people behave. However, it has three unbreakable rules that define its formation. Web the elliott wave principle, or elliott wave theory, is a form of technical analysis that financial traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology and price levels, such as highs and lows, by looking for patterns in prices. Elliott discovered that market price movements adhere to a certain pattern composed of what he called waves. Web specific corrective patterns fall into three main categories: Web the elliott wave theory is a technical analysis of price patterns related to changes in investor sentiment and psychology. It reveals that mass psychology swings from pessimism to optimism and back in a natural sequence, creating specific and measurable patterns. Web elliott wave theory. Web according to elliott, there are 21 corrective abc patterns ranging from simple to complex. The great thing about elliott wave is you don’t have to be above the legal drinking age to trade it! Web nasdaq elliott wave analysis weekly chart. I can’t memorize all of that! Web it is the most common motive wave and the easiest to spot in a market. Five waves in the direction of the main trend labeled 1,2 ,3 ,4 and 5, followed by three corrective waves labeled a, b and c.

Visual Guide To Elliott Wave Trading UnBrick.ID

SIMPLE Elliott Wave Correction Patterns rules and guidelines

Elliott Wave Patterns Advanced Forex Strategies

Double Correction

SIMPLE Elliott Wave Correction Patterns rules and guidelines

Elliott Wave Corrective Patterns Candle Stick Trading Pattern

Corrective Elliott waves explanation investingchef

Elliott Wave Corrective Patterns Candle Stick Trading Pattern

Elliott Wave Intermediate Course Module Lionheart EWA

.png)

The Elliott wave rules corrective waves

Web The Basic Pattern Elliott Described Consists Of “Motive Waves” And “Corrective Waves.” A Motive Wave Is Composed Of Five Subwaves.

Web Elliott Found Three Types Of Simple Corrections.

It Moves In The Same Direction As The Trend Of The Next Larger Size.

These Two Types Of Waves Can Be Used To Discern Price.

Related Post: