Easy Invoice Factoring

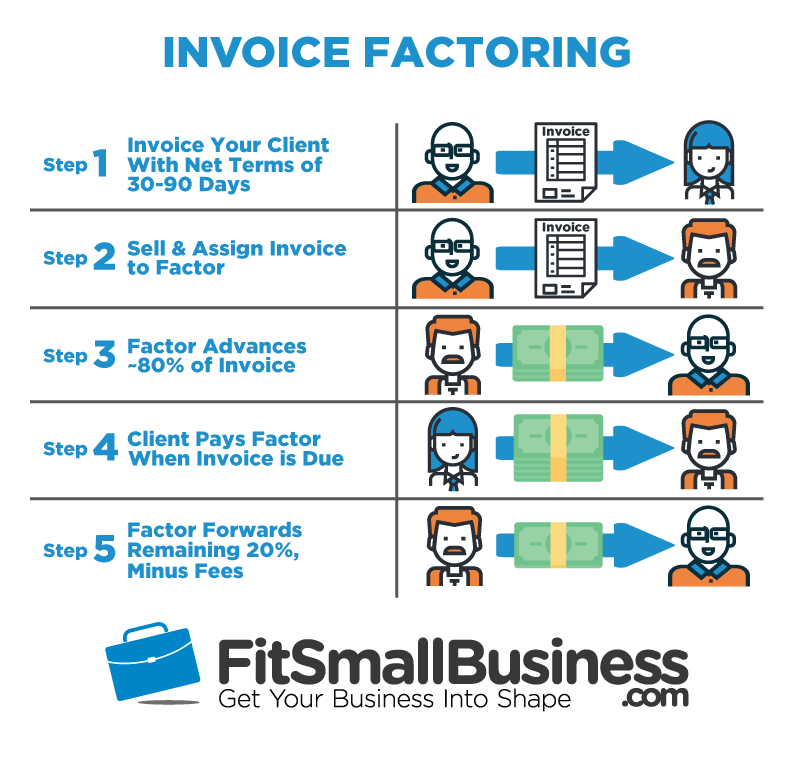

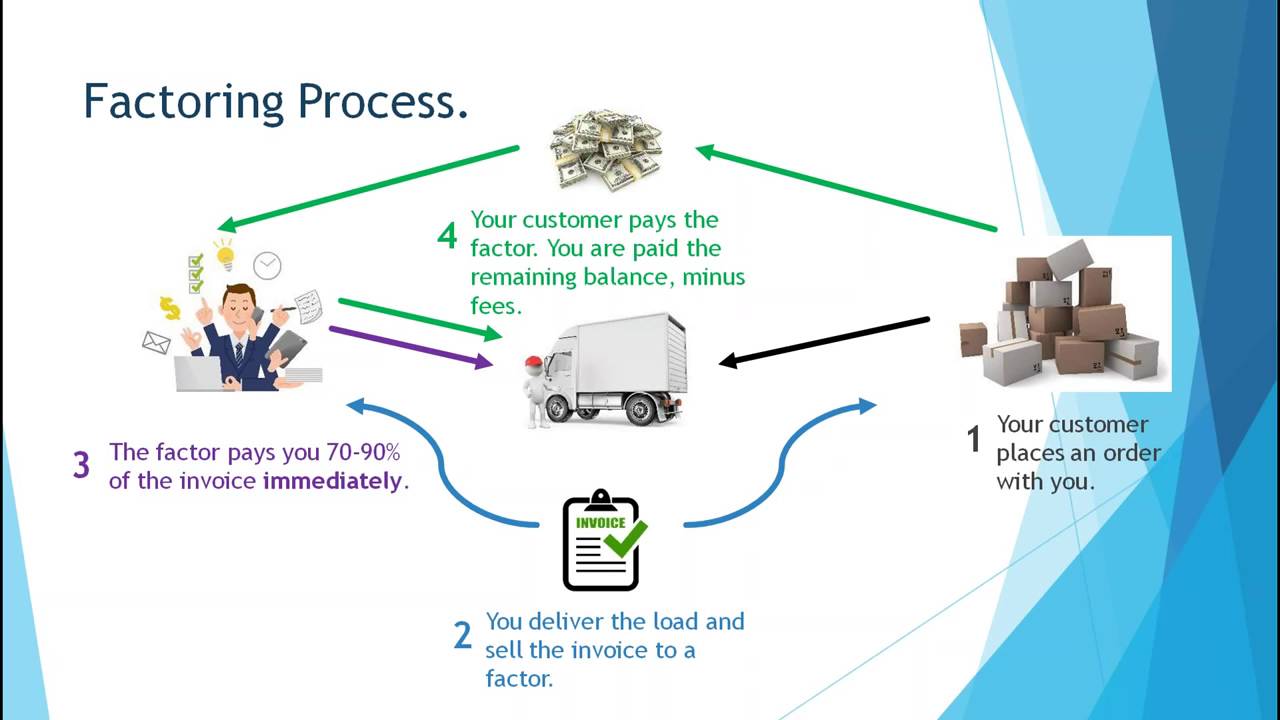

Easy Invoice Factoring - Invoice factoring helps with this. Invoice factoring starts off with a simple transaction when a business sells outstanding invoices to a factoring company. Once the customer pays, the factoring company releases the remaining balance to the business, minus a small factoring fee. Unlike most bank loans, invoice factoring does not involve a long or complex application process. Web invoice factoring is a financial transaction in which a business sells its accounts receivables (invoices) at a discount to an external financing company, known as a factor or factoring company. Web invoice factoring is a way to cushion some of the effects of delayed payments and the cash flow problems they may create. However, the business won’t get the full cash amount of their invoices. Once the customer pays the invoice, the factoring company will give you the remaining percentage, minus any fees. Of at least 660 fico at the time of application. Web invoice factoring is secured by the invoices owed to you, not by your property, equipment, or personal credit. Web step 1you sell your invoice to a factoring company. Web what is invoice factoring? You send your factoring company the invoice; Once the customer pays, the factoring company releases the remaining balance to the business, minus a small factoring fee. Small businesses typically factor invoices as a. That said, you no longer own the invoices once sold. Web in short, invoice factoring is a form of accounts receivable financing in which you sell your outstanding invoice from customers to a factoring company—sometimes called a factor—at a discount. Factoring is a flexible business financing option that instantly lets you receive cash based on your outstanding accounts receivables. Web. Invoice factoring, or invoice financing, allows you to borrow money from a lender using unpaid invoices as collateral. Web in essence, invoice factoring is basically just a financial transaction where your business sells any of the outstanding invoices you've got to a third party, known as a factoring company, instead of dealing with them yourself. Web fortunately, invoice factoring solutions,. The best invoice factoring companies will have competitive rates and the ability to advance at least 90% of the amount of invoices owed to you from your customers. Factoring is a flexible business financing option that instantly lets you receive cash based on your outstanding accounts receivables. You do a job and send an invoice. Web fortunately, invoice factoring solutions,. If yes, this article is for you. Once the customer pays the invoice, the factoring company will give you the remaining percentage, minus any fees. We understand that choosing an invoice factoring company can be a complicated process. These companies should also be able to fund in less than three days. How to choose the right invoice factoring company. These companies should also be able to fund in less than three days. What does factoring invoices or invoice financing mean? The benefit is that you get paid sooner, giving you working capital to pay your bills. The business that buys your invoice debt is called a factor. You do a job and send an invoice. Factoring is a flexible business financing option that instantly lets you receive cash based on your outstanding accounts receivables. Step 3factoring company collects repayment from your. Web invoice factoring is a cash advance you can get by selling your unpaid invoices to factoring companies. It's typically done to bridge cash flow gaps. Once you’re set up, you can expect to. What does factoring invoices or invoice financing mean? Web invoice factoring is a cash advance you can get by selling your unpaid invoices to factoring companies. These invoices represent completed services or delivered goods awaiting payment from the customer. But then, you wait a long time to get paid. The benefit is that you get paid sooner, giving you working. However, the business won’t get the full cash amount of their invoices. Learn more about turning your invoices into same day cash. Web export factoring is when a financial firm buys a company’s receivables and advances them the majority of the invoice amount up front in cash (up to 90% in some cases). Web invoice factoring is the act of. The approach is most often used by startups and growing companies that are trying to act quickly and may not want to go through the conventional bank loan application process. Web how freight factoring works. Web ideal invoices are no more than 90 days late and are owned by creditworthy customers. Learn more about turning your invoices into same day. Wherever a business is in its growth cycle or just needs some extra capital, fundthrough can help bridge critical cash flow gaps with fast and easy invoice factoring services. Web invoice factoring is secured by the invoices owed to you, not by your property, equipment, or personal credit. By selling a select number of unpaid invoices to a factor for less than what is due, a business can use invoice factoring to get the extra cash it needs. This type of funding can also include credit protection and collections services. How to choose the right invoice factoring company. The best invoice factoring companies will have competitive rates and the ability to advance at least 90% of the amount of invoices owed to you from your customers. You do the work, you sell us the invoice, we advance you up to 100 percent of the invoice immediately, and we. It's typically done to bridge cash flow gaps. We’re going to talk about something called invoice factoring. Learn more about turning your invoices into same day cash. In exchange for your invoices, you receive funds from the factoring company almost immediately, instead of having to wait. Web fortunately, invoice factoring solutions, commonly referred to as accounts receivable financing, make it easier to pay your bills on time, allowing you to focus on the other tasks you need to get done. But then, you wait a long time to get paid. Freight factoring helps trucking companies get paid on their loads — fast. That said, you no longer own the invoices once sold. Web invoice factoring is the act of selling the debt on one or more outstanding invoices to another business.

What Is Invoice Factoring How Does Invoice Factoring Work

What Is the Importance of Invoice Factoring? Jeju Media Get

How Does Invoice Factoring Work? 5 Easy Steps ei Funding

Infographic Invoice Factoring Interstate Capital

Invoice Factoring Guide for Small Business ReliaBills

How Invoice Factoring Works

What is Invoice Factoring and How Does It Work? altLINE

Invoice Factoring How Factor Finance Works, Including Pros & Cons

.jpg)

Invoice Factoring Made Easy Get Funded Now

Invoice Factoring 101 YouTube

Web Invoice Factoring Companies Connect Businesses With The Cash They Need By Purchasing Their Outstanding Invoices And Assuming Responsibility For Collections.

Invoice Factoring Starts Off With A Simple Transaction When A Business Sells Outstanding Invoices To A Factoring Company.

Web Export Factoring Is When A Financial Firm Buys A Company’s Receivables And Advances Them The Majority Of The Invoice Amount Up Front In Cash (Up To 90% In Some Cases).

This Waiting Can Be Hard For Your Business.

Related Post: