Dwelling Policy Chart

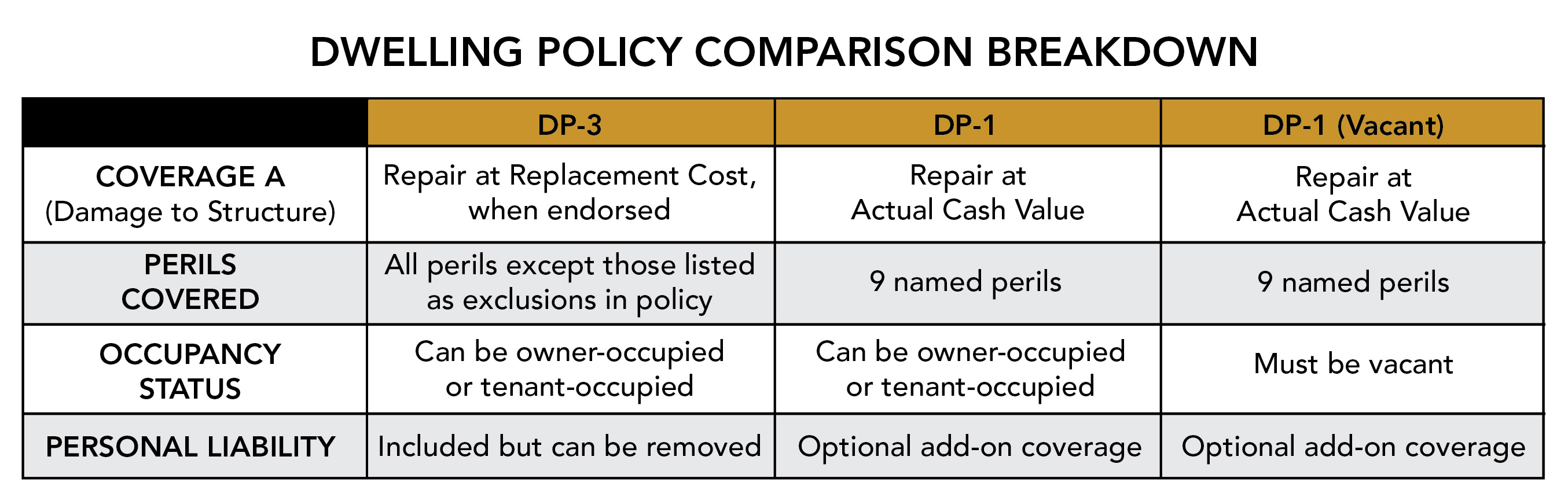

Dwelling Policy Chart - Web when choosing landlord insurance, you might be stumped on which dwelling policy to choose. Dwelling insurance will cover you. Web a dp3 policy is a type of dwelling fire insurance intended for rented residential homes (not commercial rentals). Web the dp1 insurance policy is the most (basic) insurance policy available for primary homes, secondary, camps, and rental properties, and covers losses at actual cash. Web dwelling coverage, sometimes called dwelling insurance, is the part of your homeowners insurance policy that may help pay for the rebuilding or the repair of the physical. Dwelling policies or dwelling fire policies are insurance coverages. What is home insurance dwelling coverage? Web the dp1 is the first, followed by the dp2 and the dp3. The following structures are those most commonly insured via dwelling policy: Dwelling coverage is a main component of a home. Most likely the highest coverage limit in your homeowners insurance policy, dwelling coverage pays to rebuild your home if it burns down, is. A homeowners insurance policy is more comprehensive and covers not only the physical structure but also the. Web the dp1 is the first, followed by the dp2 and the dp3. Web when choosing landlord insurance, you might. Web when choosing landlord insurance, you might be stumped on which dwelling policy to choose. Your dwelling is generally covered under an. It covers damage caused by the perils named in the. Web dwelling coverage, sometimes called dwelling insurance, is the part of your homeowners insurance policy that may help pay for the rebuilding or the repair of the physical.. Coverage b is for other structures; Web what is dwelling coverage? It contains no bells and no whistles. Web coverage a covers your dwelling; Web a dp3 policy is a type of dwelling fire insurance intended for rented residential homes (not commercial rentals). It contains no bells and no whistles. It covers the rental property structure and (optional) landlord. Coverage e is for personal liability and. Dwelling insurance will cover you. Web dwelling coverage is the part of a homeowners policy that pays to repair damage to the structure of your home, or to rebuild it if it’s destroyed. Coverage c is for personal property; Web dwelling policy insurance is an umbrella encompassing three different policies. Web a dwelling policy covers only the physical structure of the home. Learn about how much dwelling coverage you. It covers damage caused by the perils named in the. A homeowners insurance policy is more comprehensive and covers not only the physical structure but also the. The following structures are those most commonly insured via dwelling policy: Acv (can endorse to add replacement cost) acv (can endorse to. What is home insurance dwelling coverage? Web the dp1 is the first, followed by the dp2 and the dp3. Coverage b is for other structures; There also may be optional endorsements available, to include other. Web learn about the dwelling coverage portion of a homeowners insurance policy and how to choose the right amount. It covers the rental property structure and (optional) landlord. Web generally speaking, there are eight different types of homeowners insurance policies to choose from, depending. Web a dp3 policy is a type of dwelling fire insurance intended for rented residential homes (not commercial rentals). Web generally speaking, there are eight different types of homeowners insurance policies to choose from, depending on your coverage needs and property type. It covers damage caused by the perils named in the. Web dwelling coverage, sometimes called dwelling insurance, is. Web dwelling policy insurance is an umbrella encompassing three different policies. Web the dp1 insurance policy is the most (basic) insurance policy available for primary homes, secondary, camps, and rental properties, and covers losses at actual cash. Web a dp3 policy is a type of dwelling fire insurance intended for rented residential homes (not commercial rentals). Most likely the highest. Web dwelling policy insurance is an umbrella encompassing three different policies. Web dwelling coverage, sometimes called dwelling insurance, is the part of your homeowners insurance policy that may help pay for the rebuilding or the repair of the physical. Dwelling policies or dwelling fire policies are insurance coverages. Web a dwelling policy covers only the physical structure of the home.. Web what is dwelling coverage? There also may be optional endorsements available, to include other. The dp1 policy offers the most basic coverage of all the rental property policies. Web the dp1 is the first, followed by the dp2 and the dp3. The following structures are those most commonly insured via dwelling policy: Web dwelling coverage is the main part of a homeowners insurance policy and pays to repair or rebuild your home after a covered loss, such as fire or vandalism. Web dwelling coverage, sometimes called dwelling insurance, is the part of your homeowners insurance policy that may help pay for the rebuilding or the repair of the physical. Web dwelling policy insurance is an umbrella encompassing three different policies. Web coverage a covers your dwelling; Your dwelling is generally covered under an. It includes dp1, dp2, and dp3. Web generally speaking, there are eight different types of homeowners insurance policies to choose from, depending on your coverage needs and property type. Web dwelling insurance, or coverage a, is the portion of your home insurance policy that protects the structure of your home against damage from fires, wind, hail, falling objects. Dwelling coverage protects your home’s structure and is also known as coverage a in your home insurance policy. Web when choosing landlord insurance, you might be stumped on which dwelling policy to choose. Dwelling insurance will cover you.

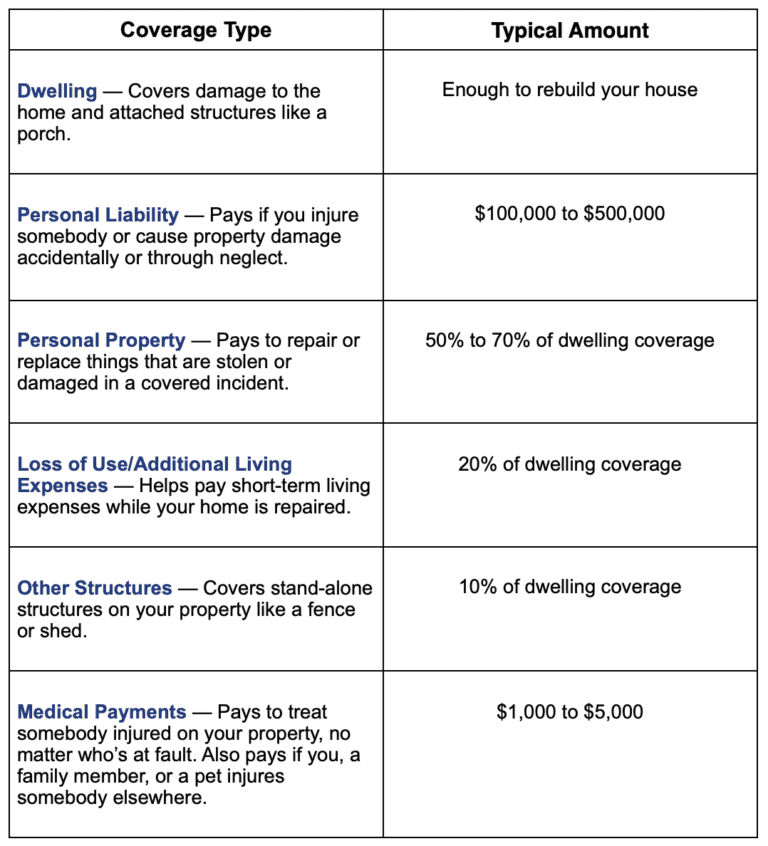

Home Coverages Explained Minnesota All Things Insurance

Dwelling and Landlord Insurance

What Is the Difference Between HO3 and HO5 Homeowners Policies?

8 Types of Homeowners Insurance You Need to Know Hippo

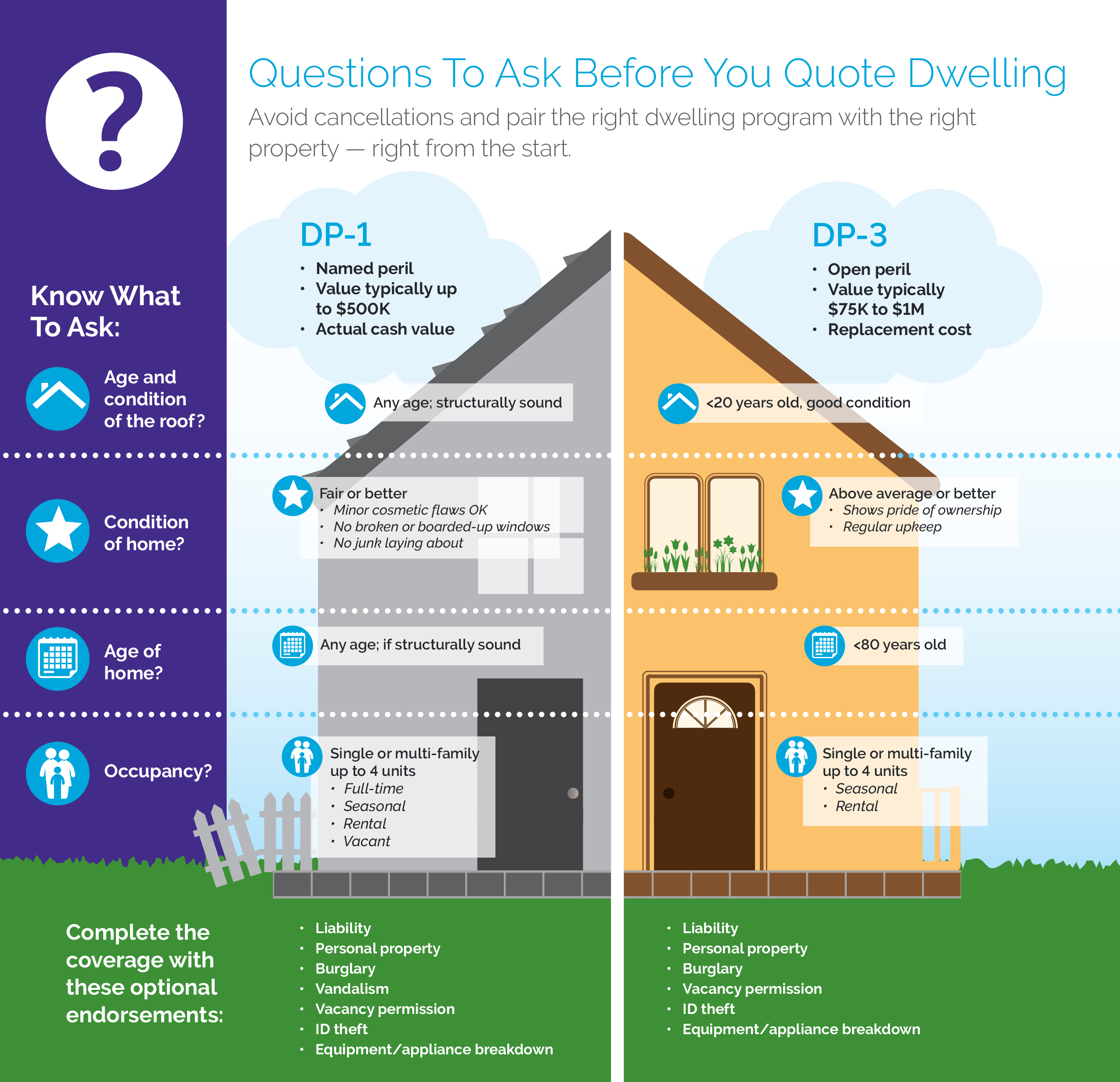

DP1 and DP3 comparison chart American Modern Insurance Agents

Rental or Seasonal Homeowners Insurance Florida AIIG AIITPA

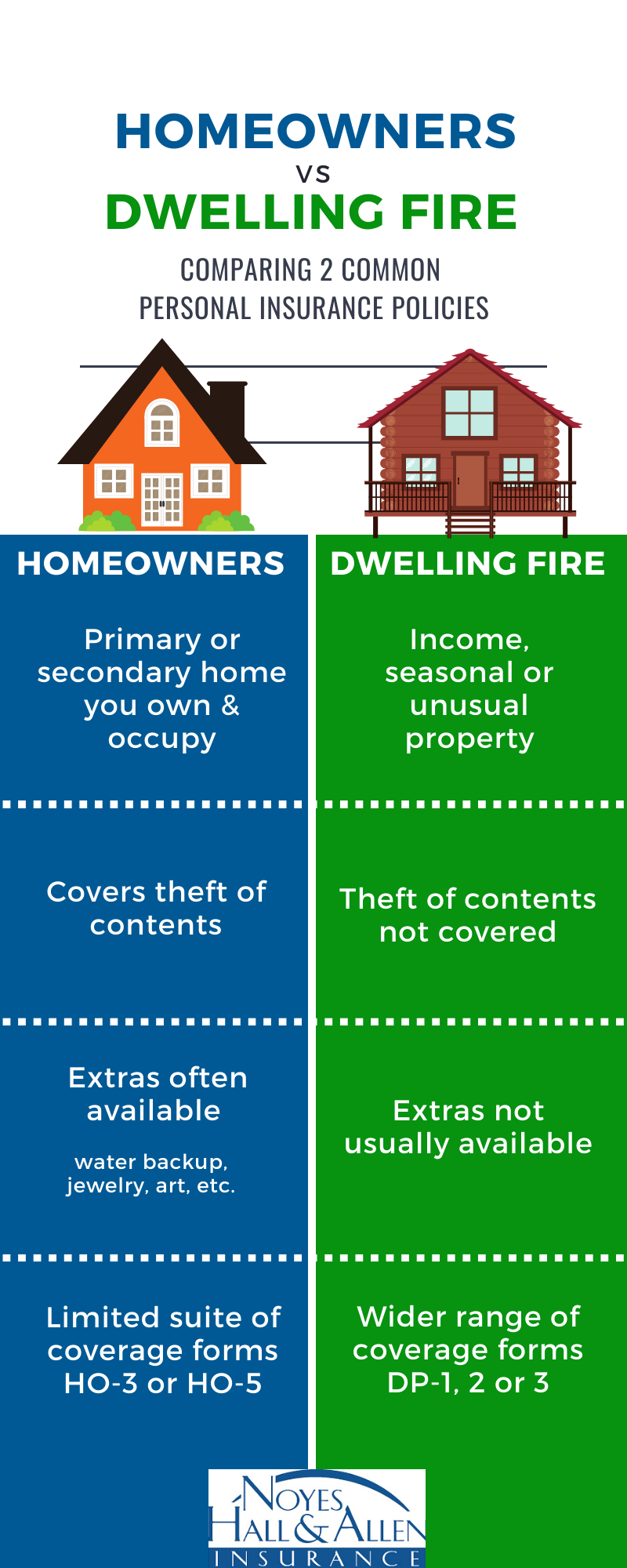

Homeowners and Dwelling Fire Policies What's the Difference

Great Lakes Mutual Insurance Dwelling Properties Insurance

Michelle Ferrigno, Insurance Agent Coverages Explained 'Landlord

Understanding Homeowners Insurance Liability Coverage In 2023

Acv (Can Endorse To Add Replacement Cost) Acv (Can Endorse To.

Most Likely The Highest Coverage Limit In Your Homeowners Insurance Policy, Dwelling Coverage Pays To Rebuild Your Home If It Burns Down, Is.

It Contains No Bells And No Whistles.

Dp1 Insurance Provides The Least Coverage And Is Cheaper.

Related Post: