Dumb Money Vs Smart Money Chart

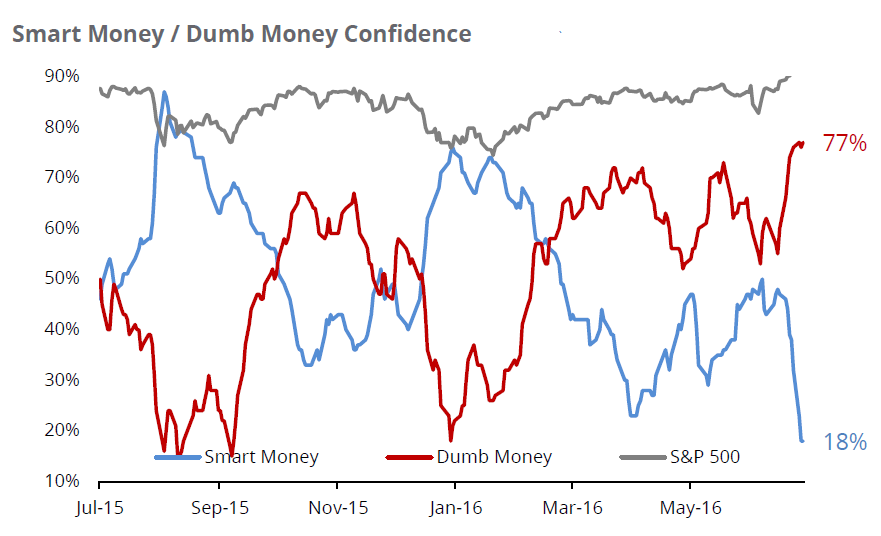

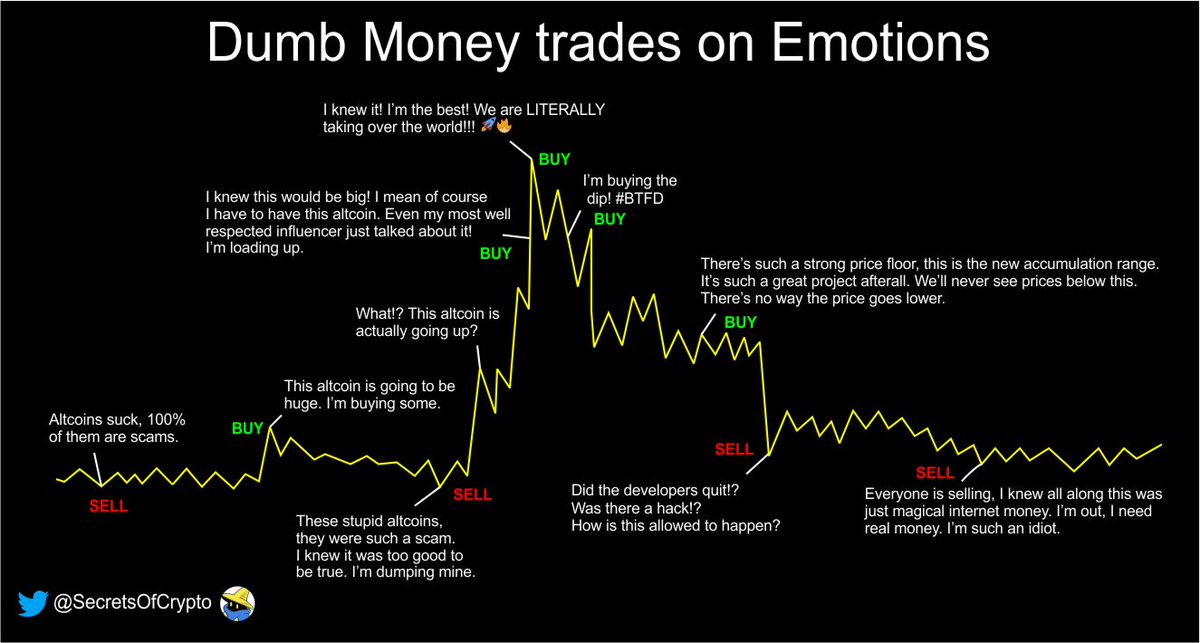

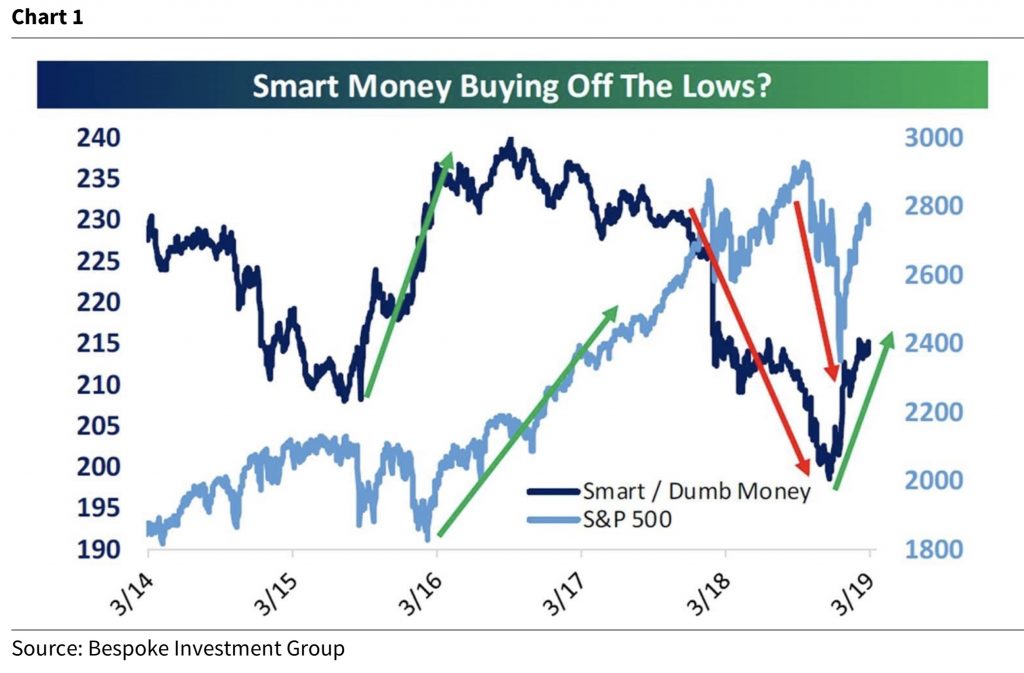

Dumb Money Vs Smart Money Chart - Look at the size of diis and fiis. Web trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this isn’t actually a slight against early day traders. Beware of bugs in the reality simulation is a common side effect. Or, they're just contrarian investors who prefer to sell into a rising market and. Retailers mostly do sips, so the money goes to mfs (i.e. Dumb money tends to buy and sell at the worst possible time. Web this means that i think it's supposed to be a certain amount of smart money and dumb money. Web in general, smart money indicators are used to assess institutional investors’ stock buying behavior for insight into their actions and approaches. This article appears courtesy of riskhedge. For example, consider the recent market turmoil triggered by the coronavirus pandemic. Web this means that i think it's supposed to be a certain amount of smart money and dumb money. Web trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this isn’t actually a slight against early day traders. Beware of bugs in the reality simulation. Retailers mostly do sips, so the money goes to mfs (i.e. Diis) which is smart money. Or, they're just contrarian investors who prefer to sell into a rising market and. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge underlying positions. Web. For example, consider the recent market turmoil triggered by the coronavirus pandemic. Web as you can see from the chart above, the dumb money confidence (orange line) is at a high and smart money confidence (blue line) is at a low despite the good performance of the s&p 500 (green line). Web uncover the secrets behind smart money and dumb. Web trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this isn’t actually a slight against early day traders. Retailers don't have enough money even if they don't do sip in mfs. Web the smart money vs. The smart money flow index (smfi) is calculated. This article appears courtesy of riskhedge. Web this means that i think it's supposed to be a certain amount of smart money and dumb money. Retailers don't have enough money even if they don't do sip in mfs. Look at the size of diis and fiis. Web trades made at the beginning of the day are labeled the “dumb money,”. Retailers don't have enough money even if they don't do sip in mfs. Web trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this isn’t actually a slight against early day traders. Web as a result, the typical individual investor suffers from extremely poor performance.. The smart money flow index is based on the concept of don hays’ smart money index (smi), but uses a more efficient formula to. Web trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this isn’t actually a slight against early day traders. Web dumb. Web the smart money flow index (smfi) is an indicator used to identify the buying behavior of smart versus dumb money in the u.s. For example, consider the recent market turmoil triggered by the coronavirus pandemic. Dumb money tends to buy and sell at the worst possible time. Insider trading activity, a telltale sign of smart money, can be deciphered. Retailers mostly do sips, so the money goes to mfs (i.e. Web as a result, the typical individual investor suffers from extremely poor performance. We go over how they are calculated, how to read the charts, and what is smart vs. Web in this video, you will learn the basics of the smart/dumb money confidence indicators. Web in general, smart. Retailers don't have enough money even if they don't do sip in mfs. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge underlying positions. Retailers mostly do sips, so the money goes to mfs (i.e. Web with the volatility in stocks this. Web the terms “smart money” and “dumb money” are used to describe different groups of market participants. Web uncover the secrets behind smart money and dumb money in trading with our faqs, empowering you to navigate the markets like a seasoned investor! Dumb money chart provides a visual representation, yet interpreting it requires skill and expertise. Shortly after the opening and within the last hour of trading. The smart money flow index (smfi) is calculated according to a proprietary formula by measuring the action of the dow during two key periods: Diis) which is smart money. Web in this video, you will learn the basics of the smart/dumb money confidence indicators. The smart money flow index is based on the concept of don hays’ smart money index (smi), but uses a more efficient formula to. Retailers don't have enough money even if they don't do sip in mfs. Dumb money tends to buy and sell at the worst possible time. For example, consider the recent market turmoil triggered by the coronavirus pandemic. Web as you can see from the chart above, the dumb money confidence (orange line) is at a high and smart money confidence (blue line) is at a low despite the good performance of the s&p 500 (green line). Web the smart money flow index (smfi) is an indicator used to identify the buying behavior of smart versus dumb money in the u.s. Web trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this isn’t actually a slight against early day traders. Insider trading activity, a telltale sign of smart money, can be deciphered by those adept at reading between the lines. Retailers mostly do sips, so the money goes to mfs (i.e.

Smart Money/Dumb Money The Joseph Group

Smart money vs dumb money divergences for AMEXHYG by Roral — TradingView

A Dumb vs Smart Money Index (and how to get on the smart side)

Secrets on Twitter "5/ Dumb Money vs. Smart Money Comparison Why is it

Smart Money / Dumb Money Sentiment Indicators ValueTrend

Smart Money vs. Dumb Money? A Quick Look at a Unique Sentiment

Here Is An important Look At What The “Smart Money” And “Dumb Money

DUMB MONEY VS SMART MONEY ) for FXSPX500 by 001011001010001110110

Smart Money Versus Dumb Money Which are You?

Smart Money Versus Dumb Money Which are You?

Or, They're Just Contrarian Investors Who Prefer To Sell Into A Rising Market And.

Web The Smart Money Vs.

Web Dumb Money (Last 0.56) Smart Money Confidence Is A Model That Aggregates Indicators Reflecting Sentiment Among Investors That Tend To Use The Stock Market To Hedge Underlying Positions.

Web This Means That I Think It's Supposed To Be A Certain Amount Of Smart Money And Dumb Money.

Related Post: