Dragonfly Candle Pattern

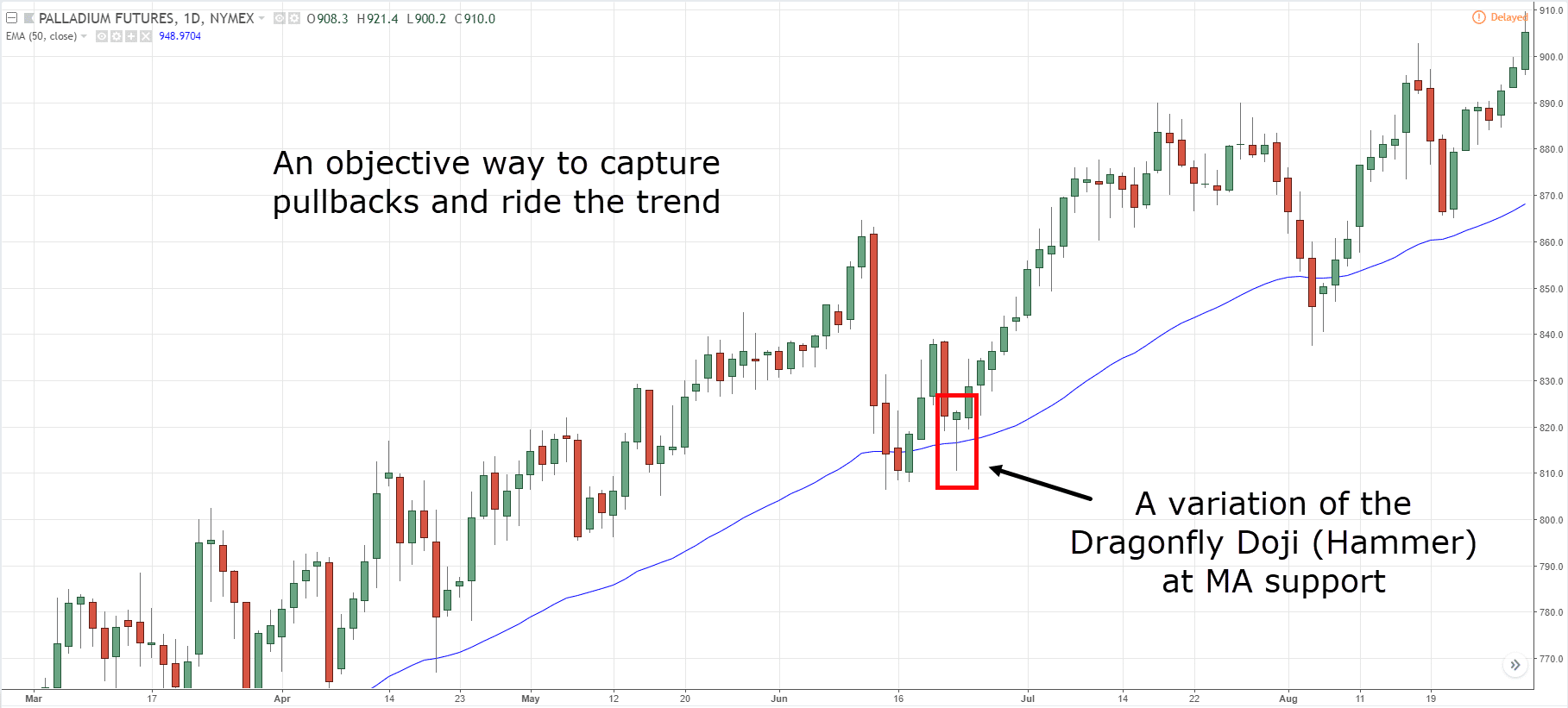

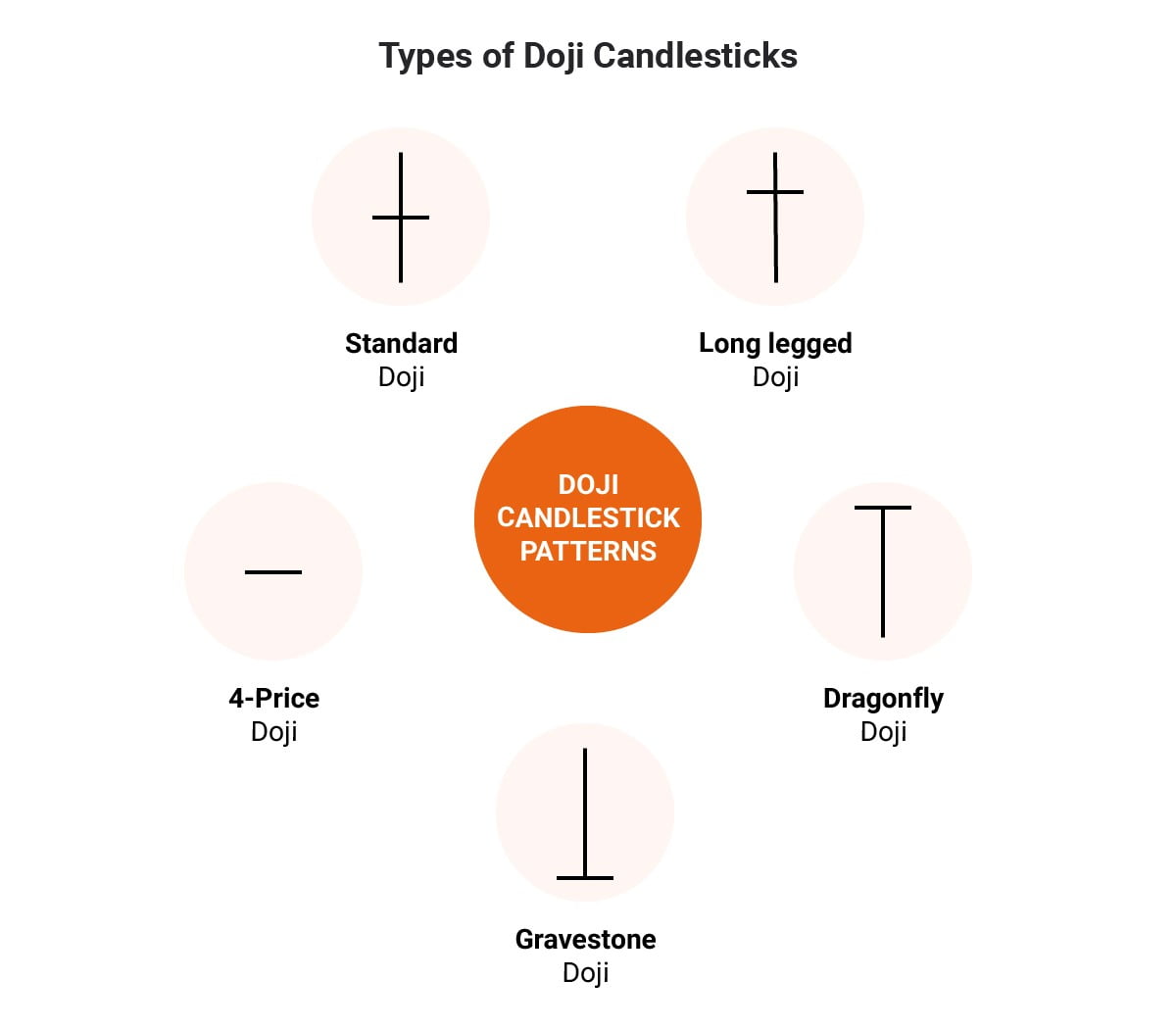

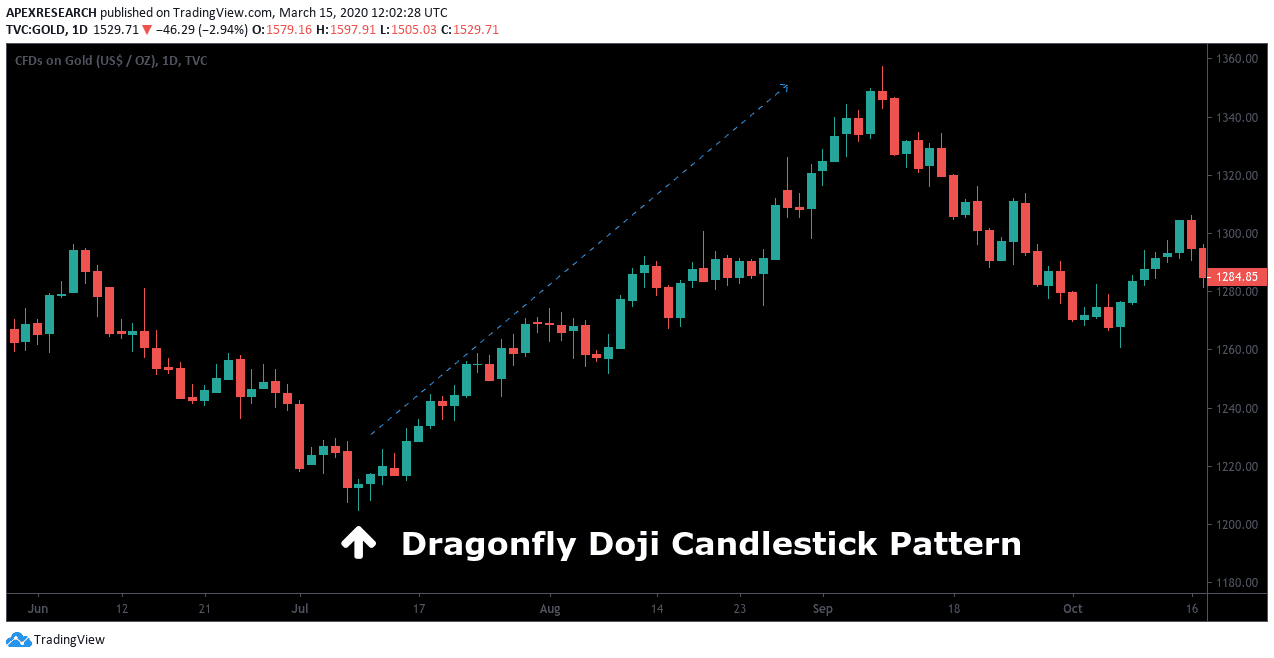

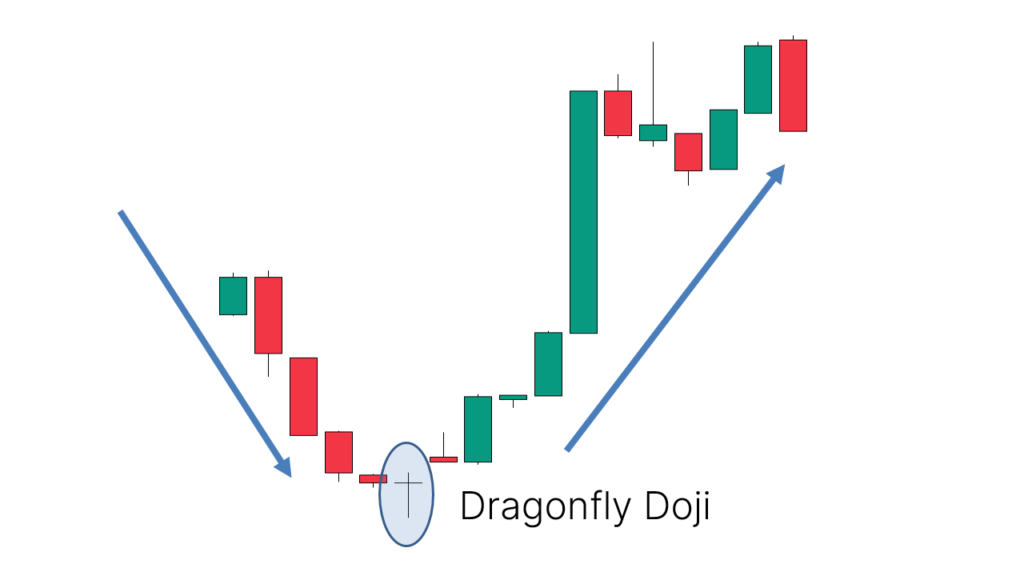

Dragonfly Candle Pattern - Web the dragonfly doji is a japanese candlestick pattern consisting of only one candle. They look like a hammer candlestick but have much thinner real bodies. Understanding and utilizing this pattern enhances traders’ ability to identify better. It means it signals an important reversal. Web the dragonfly doji candlestick pattern can provide traders with potential bullish reversal signals, offering valuable insights into market sentiment and entry points. Web the dragonfly doji is a specific type of doji candlestick pattern that occurs when the opening and closing prices are almost identical and at the high of the trading session. The dragonfly doji often takes center stage as a potent indicator of potential trend reversals on candlestick charts. Data on these organisms will help us track their populations in order to better protect them and may provide additional support for the protection of wetland areas. This pattern resembles the shape of a. Web what are dragonfly doji candlestick patterns? Web a dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. Web a dragonfly doji is a candlestick pattern that signals a possible price reversal. This pattern resembles the shape of a. Web in illinois there is one federally endangered dragonfly, the hines emerald (somatochlora hineana), and one state threatened species, the elfin. The dragonfly pattern typically forms when the asset's high, open, and close prices are the same. Web a dragonfly doji is a candlestick pattern characterized by a long lower shadow, little to no upper shadow, and a small body at the top of the candlestick with the opening and closing prices near the high of the period. The candle is. Web the dragonfly doji is a japanese candlestick pattern consisting of only one candle. Web the dragonfly doji candlestick pattern can provide traders with potential bullish reversal signals, offering valuable insights into market sentiment and entry points. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Data on these organisms will help. Data on these organisms will help us track their populations in order to better protect them and may provide additional support for the protection of wetland areas. Web the dragonfly doji pattern occurs when a stock's opening and closing prices are the same as the high for the day: It is used as a technical indicator that signals a potential. This pattern is the most uncommon candlestick. They look like a hammer candlestick but have much thinner real bodies. Web the dragonfly doji is a japanese candlestick pattern consisting of only one candle. This pattern resembles the shape of a. A dragonfly doji pattern does not appear constantly. A dragonfly doji pattern does not appear constantly. Web the dragonfly doji is a candlestick pattern that can signal a potential trend reversal. Web a dragonfly doji is a candlestick pattern that signals a possible price reversal. It means it signals an important reversal. Web a dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom. Web interpreting the dragonfly doji candlestick pattern. Web the dragonfly doji is a japanese candlestick pattern consisting of only one candle. Web a dragonfly doji is a candlestick pattern that signals a possible price reversal. Learn what they are, how to identify them and how to apply them in your trading. In this article, we’re going to have a closer. The red or green dragonfly doji is a candlestick pattern that forms when the opening, closing, and high prices of an asset are equal or almost equal. This pattern resembles the shape of a. The candle is composed of a long lower shadow and an open, high, and close price that equal each other. The dragonfly doji often takes center. Learn what they are, how to identify them and how to apply them in your trading. It works with the main purpose of depicting the equilibrium situation of supply and demand. This article tells you how to recognize this pattern, what it means, and how to use it. Web what does a dragonfly doji mean? Web a dragonfly doji candlestick. Data on these organisms will help us track their populations in order to better protect them and may provide additional support for the protection of wetland areas. The dragonfly doji often takes center stage as a potent indicator of potential trend reversals on candlestick charts. It is used to identify reversal patterns after a bearish price trend. Web a dragonfly. This pattern resembles the shape of a. The candle is composed of a long lower shadow and an open, high, and close price that equal each other. Web a dragonfly doji candlestick is a candlestick pattern with the open, close, and high prices of an asset at the same level. A dragonfly doji pattern does not appear constantly. It means it signals an important reversal. Web in illinois there is one federally endangered dragonfly, the hines emerald (somatochlora hineana), and one state threatened species, the elfin skimmer (nanothemis bella). It occurs when the asset’s high, open, and close prices are uniform. It signals indecision between buyers and sellers and is considered a. Web the dragonfly doji is a candlestick pattern that can signal a potential trend reversal. The dragonfly doji often takes center stage as a potent indicator of potential trend reversals on candlestick charts. It has a long lower wick, a short or absent upper wick, and closes and opens at roughly the same price. Web a dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. Web a dragonfly doji candlestick pattern is formed when a candlestick has the same high, open, and closing prices. It creates a long lower shadow, indicating that buyers have been in control during the session, pushing the price down. It is used to identify reversal patterns after a bearish price trend. Web what does a dragonfly doji mean?

Dragonfly Doji How to Spot and Trade Candlestick Patterns Freedom

The Complete Guide to Doji Candlestick Pattern

Candlestick Patterns The Definitive Guide (2021)

dragonfly doji candlestick patter with real trading examples & charts

Dragonfly Doji Candlestick Pattern All You Need to Know About

Dragonfly Doji Candlestick Pattern (Explained With Examples)

:max_bytes(150000):strip_icc()/dotdash_Final_Dragonfly_Doji_Candlestick_Definition_and_Tactics_Nov_2020-01-eb0156a30e9745b687c8a65e93f54b07.jpg)

Dragonfly Doji Candlestick Definition

Dragonfly Doji Candlestick Pattern What Is And How To Trade Living

:max_bytes(150000):strip_icc()/dragonfly-doji.asp-final-c5af384063774dfc96bc4bfdd10089f8.png)

Doji Dragonfly Candlestick What It Is, What It Means, Examples

Dragonfly Doji Candlestick Pattern, Technical Analysis, Episode 3

Learn What They Are, How To Identify Them And How To Apply Them In Your Trading.

Web The Dragonfly Doji Pattern Occurs When A Stock's Opening And Closing Prices Are The Same As The High For The Day:

Web Dragonfly Doji Is A Candle Pattern With No Real Body And A Long Downward Shadow.

Web Interpreting The Dragonfly Doji Candlestick Pattern.

Related Post: