Down Wedge Pattern

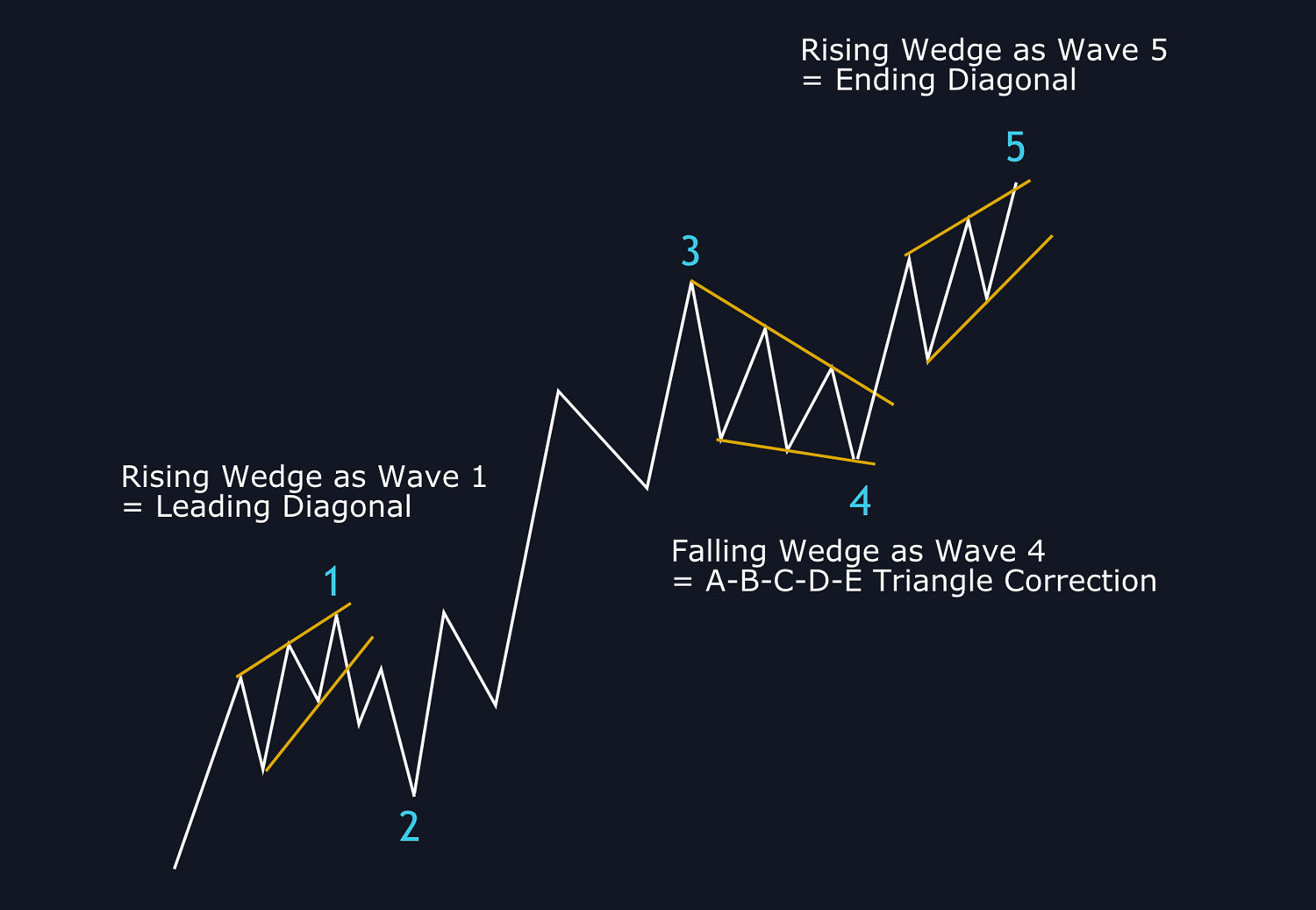

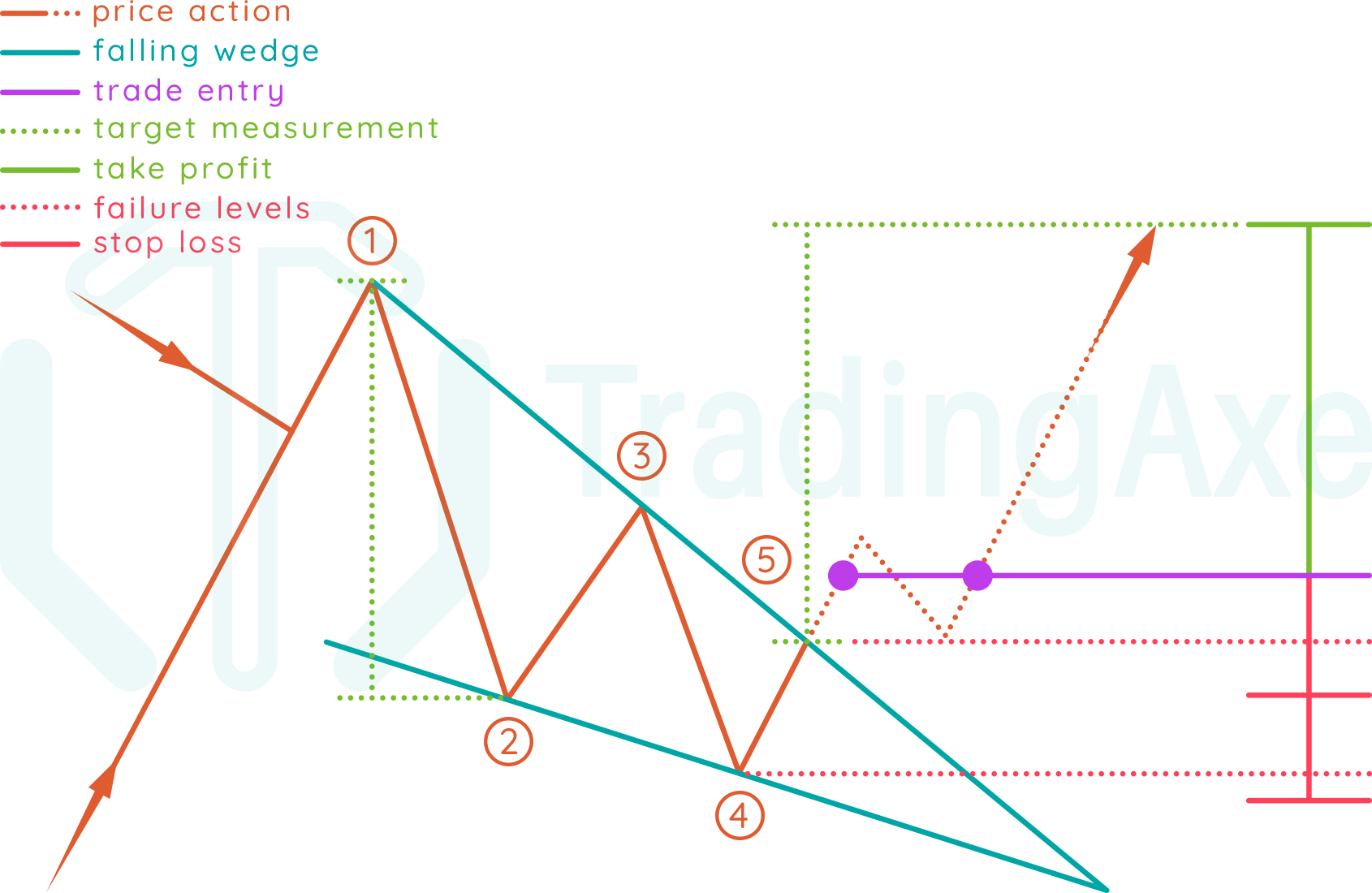

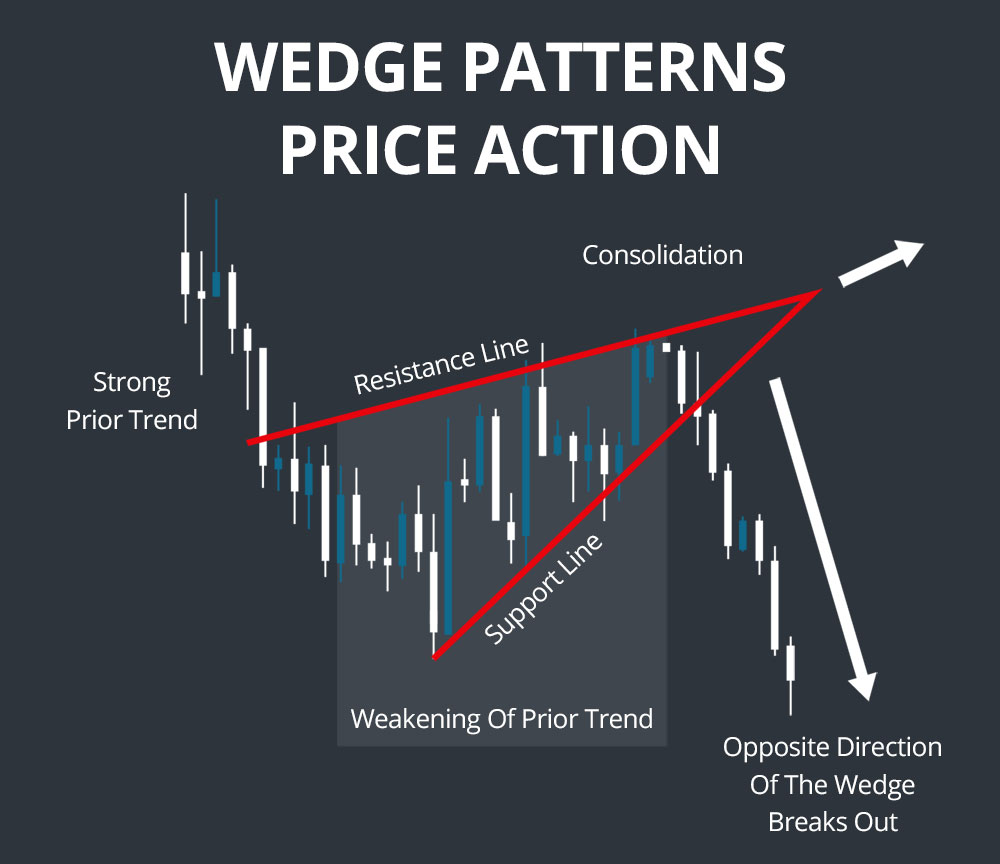

Down Wedge Pattern - Falling wedge aka descending wedge. Web the falling wedge pattern is characterized by a chart pattern which forms when the market makes lower lows and lower highs with a contracting range. This is a form of recovery or accumulation of price after a strong trend. It is considered a bullish chart formation but can indicate both reversal and continuation patterns. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an uptrend or a reversal of a downtrend. When this pattern is found in a downward trend, it is considered a reversal pattern, as the contraction of the range indicates the downtrend is losing steam. The angled lines resemble the sides of a wedge or a slice of pie. As outlined earlier, falling wedges can be both a reversal and continuation pattern. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. Web the falling wedge pattern is characterized by a chart pattern which forms when the market makes lower lows and lower highs with a contracting range. Web a falling wedge can be defined by a set of lower lows (support) and lower highs (resistance) that slope downwards and contract into a narrower range before price finally breaks above the resistance. There are 2 types of wedges indicating price is in consolidation. This lesson shows you how to identify the pattern and how you can use it to look for possible buying opportunities. Web 4.1 trade forex. Web the falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum. Web the falling wedge. Web a falling wedge can be defined by a set of lower lows (support) and lower highs (resistance) that slope downwards and contract into a narrower range before price finally breaks above the resistance line and a change in trend direction occurs. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an. There are 2 types of wedges indicating price is in consolidation. This is a form of recovery or accumulation of price after a strong trend. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. Web the falling wedge pattern is characterized by a chart pattern which forms when the market makes lower lows. These patterns can be extremely difficult to recognize and interpret on a chart since they bear much resemblance to triangle patterns and do not always form cleanly. The angled lines resemble the sides of a wedge or a slice of pie. The resistance line has to be steeper than the support line. Whether the price reverses the prior trend or. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Web a rising wedge formed after an uptrend usually leads to a reversal (downtrend) while a rising wedge formed during a downtrend typically results in a continuation (downtrend). Web the rising wedge is. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. The pattern is characterized by two converging trendlines that slope downward, gradually narrowing the. 4.2 trade binary options. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. The angled lines resemble the sides of a wedge or a slice of pie. It is created when a market consolidates between two converging support and resistance lines. Web 4.1 trade forex. Web the falling wedge pattern is characterized by. Whether the price reverses the prior trend or continues in the same direction depends on the breakout direction from the wedge. Web the falling (or descending) wedge can also be used as either a continuation or reversal pattern, depending on where it is found on a price chart. These patterns can be extremely difficult to recognize and interpret on a. It is created when a market consolidates between two converging support and resistance lines. 4.2 trade binary options with a wedge pattern. Identifying the falling wedge pattern in a downtrend The angled lines resemble the sides of a wedge or a slice of pie. A falling wedge pattern is regarded as a bullish chart formation, it can also signify continuation. Web a falling wedge pattern is an exact mirror image of the rising wedge. It is created when a market consolidates between two converging support and resistance lines. A falling wedge pattern is regarded as a bullish chart formation, it can also signify continuation or reversal patterns depending on where it appears in the trend. In essence, both continuation and reversal scenarios are inherently bullish. There are 2 types of wedges indicating price is in consolidation. A wedge emerges on charts when there is a conflict between directional price movement and contracting volatility. It is defined by two trendlines drawn through peaks and bottoms, both headed downward. Web a pattern wedge refers to a specialized chart formation where trend lines converge, indicating an area of struggle between buyers and sellers. This lesson shows you how to identify the pattern and how you can use it to look for possible buying opportunities. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. These patterns can be extremely difficult to recognize and interpret on a chart since they bear much resemblance to triangle patterns and do not always form cleanly. Falling wedge aka descending wedge. The falling wedge pattern is the opposite of the rising wedge: Web the falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. Web the falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines.

Wedge Pattern Reversal and Continuation Financial Freedom Trading

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Wedge Patterns How Stock Traders Can Find and Trade These Setups

How To Trade Falling Wedge Chart Pattern TradingAxe

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Simple Wedge Trading Strategy For Big Profits

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

It Is Considered A Bullish Chart Formation But Can Indicate Both Reversal And Continuation Patterns.

The Patterns May Be Considered Rising Or Falling Wedges Depending On Their Direction.

The Pattern Is Characterized By Two Converging Trendlines That Slope Downward, Gradually Narrowing The.

Identifying The Falling Wedge Pattern In A Downtrend

Related Post: