Double Tops Pattern

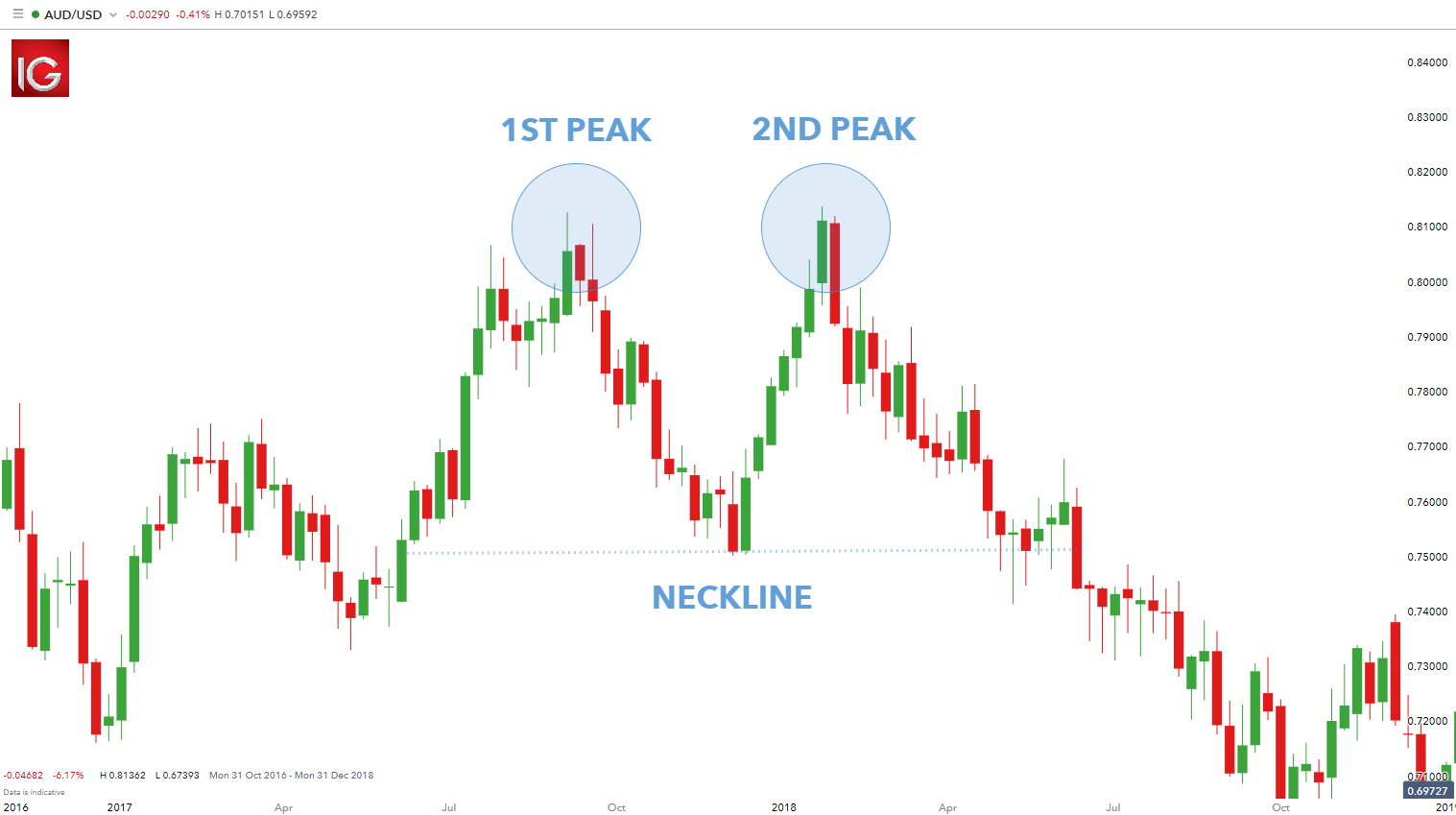

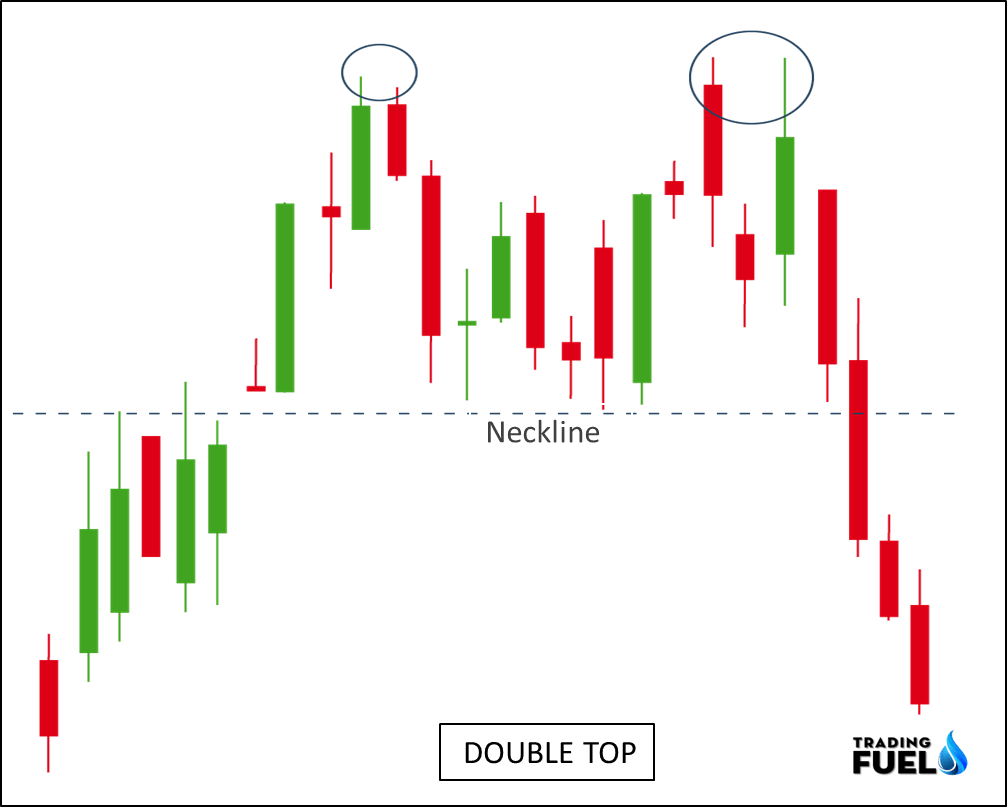

Double Tops Pattern - Pearl and lace trim (hobby lobby). Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. Both consist of three reversal points; The double top pattern is formed when two peaks are formed at approximately the same level and the price closes below this level on two consecutive occasions. You’re in the right place. What is a double top? Volume decreases on the second top Web a double top pattern is a bearish pattern indicating downward market prices, increasing bearish momentum, and declining bullish momentum. Usually, a double top pattern indicates a potential reversal in an upward trend. Web trading double tops and double bottoms is a common strategy in technical analysis used by traders to identify potential trend reversal points in financial markets. Web the double top pattern is a bearish reversal pattern that can be observed at the top of an uptrend and signals an impending reversal. The double top and its counterpart, double bottom, seem to be the simplest formations. Vintage pink lace overlay (stash, antique store). The double top pattern is formed when two peaks are formed at approximately the. Web double top pattern. The first peak is formed after a strong uptrend and then retraces back to the neckline. Double top comprises two peaks of nearly the same size and a bottom between them, hence the name of the pattern. They are formed by twin highs that can’t break above to form new highs. Web double top and double. They are formed by twin highs that can’t break above to form new highs. Web a double top is a frequently occurring chart pattern that signals a bearish trend reversal, usually at the end of an uptrend. Web the double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. Want to trade. You’re in the right place. Web a double top is a frequently occurring chart pattern that signals a bearish trend reversal, usually at the end of an uptrend. After hitting this level, the price will bounce off it slightly, but. Double top comprises two peaks of nearly the same size and a bottom between them, hence the name of the. Volume decreases on the second top Both consist of three reversal points; Web investopedia / laura porter. Web trading double tops and double bottoms is a common strategy in technical analysis used by traders to identify potential trend reversal points in financial markets. Web a double top is a frequently occurring chart pattern that signals a bearish trend reversal, usually. Equal distance in terms of time between highs; Typically, when the second peak forms, it can’t break above the first peak and causes a double top failure. Rounding tops can often be an indicator for. Web a double top is a reversal pattern that is formed after there is an extended move up. 166k views 2 years ago the moving. It’s a technical pattern that occurs when the price of a security reaches two peaks at approximately the same price level, and then falls. The double top and its counterpart, double bottom, seem to be the simplest formations. A double top pattern means that the market may reverse from bullish price action to bearish price action. Web a double top. What does a double top pattern mean in technical analysis? Rounding tops can often be an indicator for. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. Web a double top pattern is a bearish pattern indicating downward market prices, increasing bearish momentum, and declining bullish momentum. A double top is. The “tops” are peaks that are formed when the price hits a certain level that can’t be broken. Although these patterns appear almost daily, successfully identifying and trading the patterns is no easy task. What does a double top pattern mean in technical analysis? Web the double top pattern is a bearish reversal pattern that can be observed at the. Web trading double tops and double bottoms is a common strategy in technical analysis used by traders to identify potential trend reversal points in financial markets. A double top pattern means that the market may reverse from bullish price action to bearish price action. Web investopedia / laura porter. A double top pattern is formed from two consecutive rounding tops.. Double top comprises two peaks of nearly the same size and a bottom between them, hence the name of the pattern. This double top pattern is formed with two peaks above a support level which is also known as the neckline. Web a double top pattern consists of several candlesticks that form two peaks or resistance levels that are either equal or near equal height. Web the double top pattern is a bearish reversal pattern that can be observed at the top of an uptrend and signals an impending reversal. Both consist of three reversal points; White bridal satin, pink organza (fabric wholesale direct). There are a few requirements to classify a chart pattern as a double top: A double top pattern means that the market may reverse from bullish price action to bearish price action. Web double top and double bottom are reversal chart patterns observed in the technical analysis of financial trading markets of stocks, commodities, currencies, and other assets. Today i’m going to show you exactly how to trade double top chart patterns, including how to determine targets. It is made up of two peaks above a support level, known as the neckline. Web the double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. The double top and its counterpart, double bottom, seem to be the simplest formations. Unlike the double bottom formation that looks like the letter “w”, the double top chart pattern. A double top pattern is formed from two consecutive rounding tops. The double top pattern is formed when two peaks are formed at approximately the same level and the price closes below this level on two consecutive occasions.

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

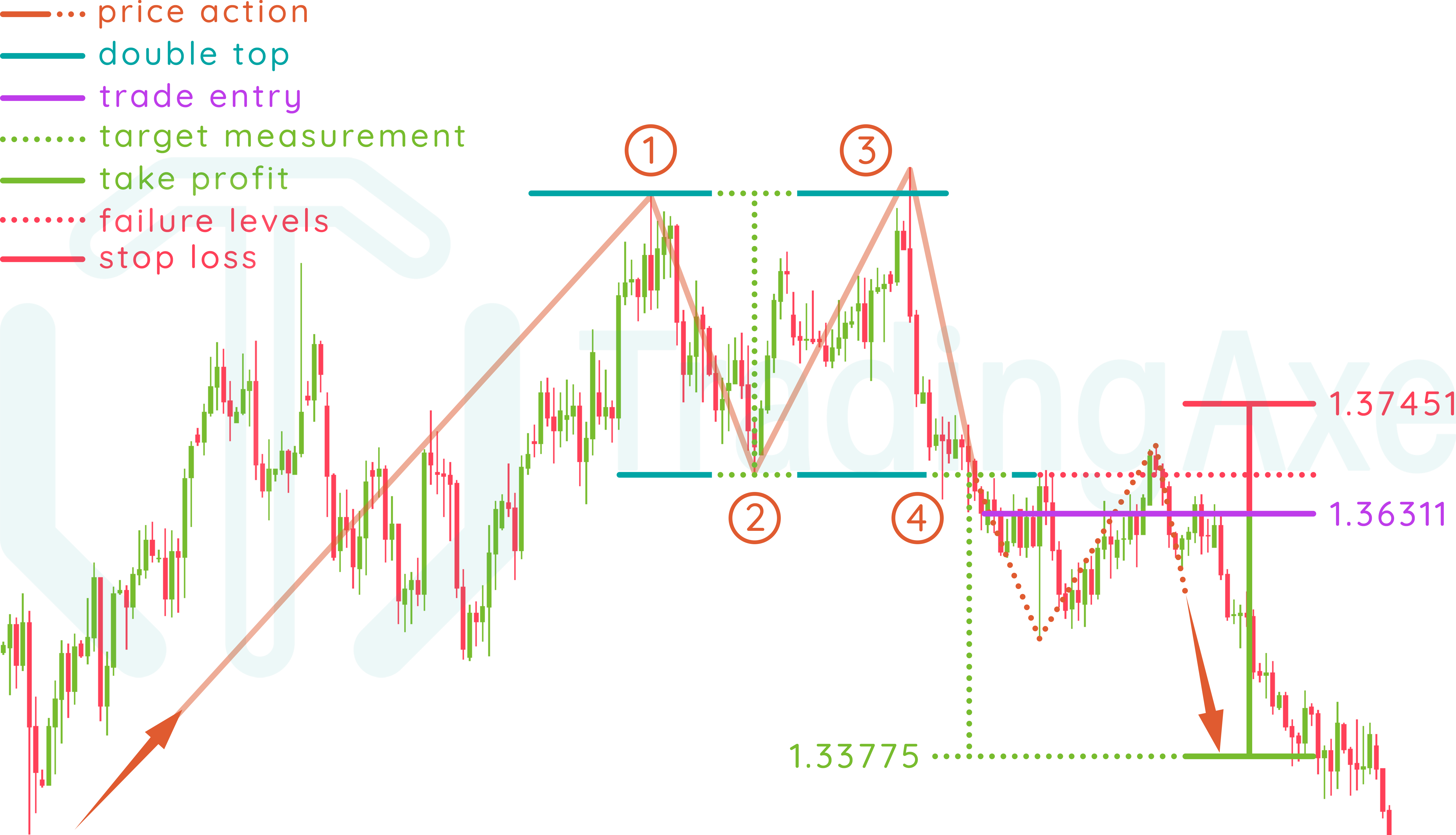

How To Trade Double Top Chart Pattern TradingAxe

Double Top Pattern Your Complete Guide To Consistent Profits

Double Top Pattern Your Complete Guide To Consistent Profits

What Is A Double Top Pattern? How To Trade Effectively With It

Double top patterns are some of the most common price patterns that

Double Top Pattern A Forex Trader’s Guide

The Double Top Trading Strategy Guide

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

Double Top Pattern Your Complete Guide To Consistent Profits

Web Double Top Pattern:

Vintage Pink Lace Overlay (Stash, Antique Store).

The “Tops” Are Peaks That Are Formed When The Price Hits A Certain Level That Can’t Be Broken.

These Patterns Can Occur In Various Timeframes And On Different Assets, Including Crypto, Stocks, Forex, And.

Related Post: