Double Bottom Stock Pattern

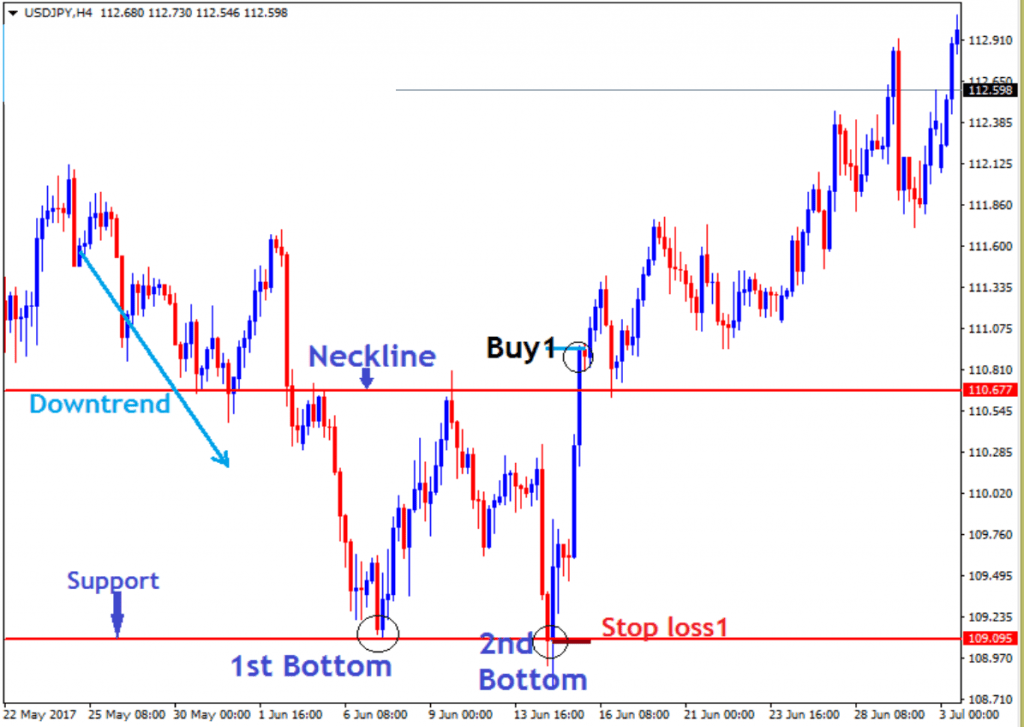

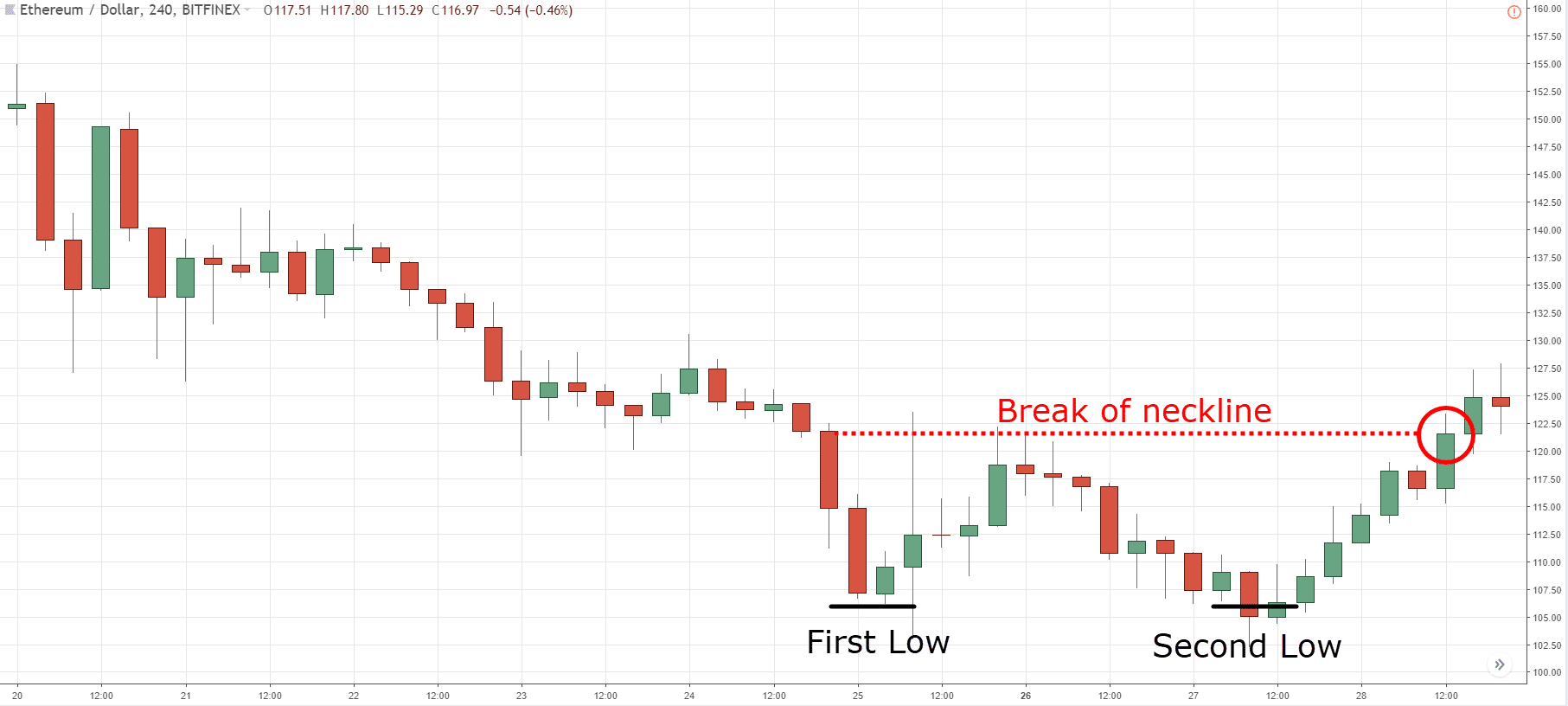

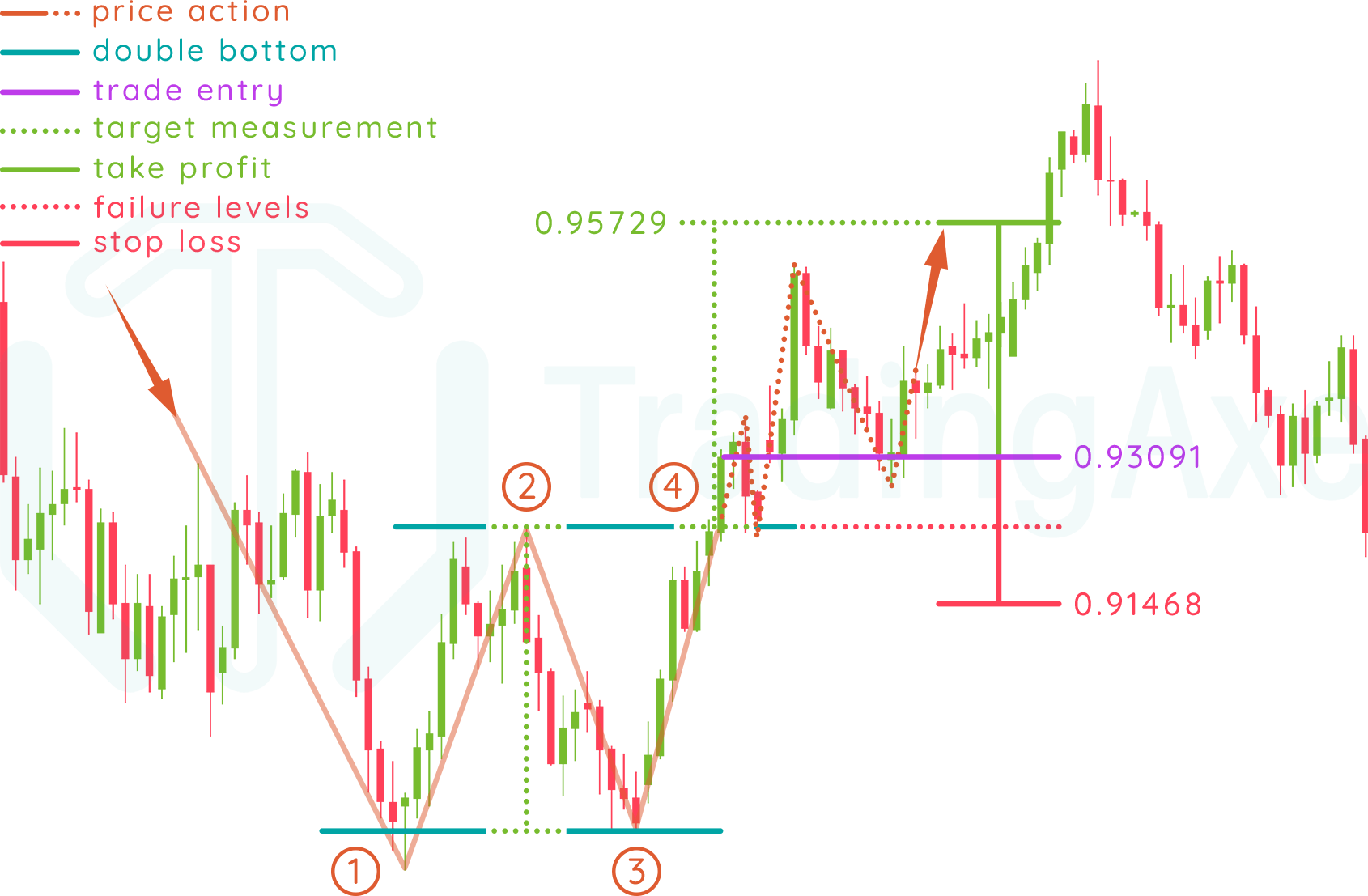

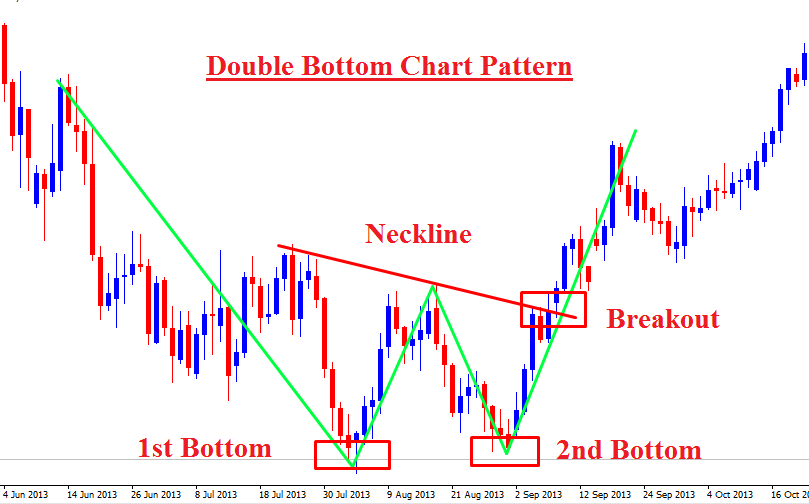

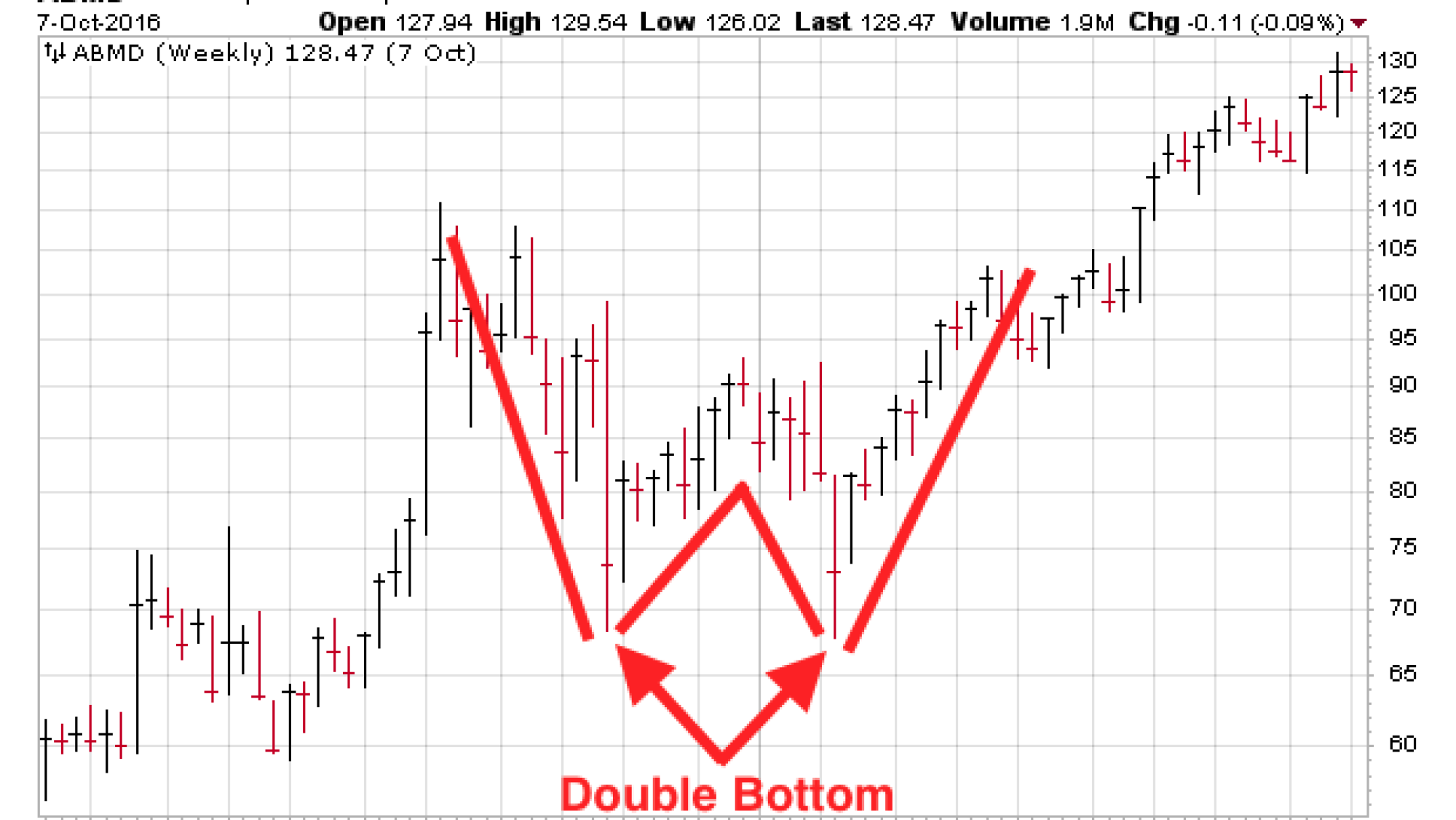

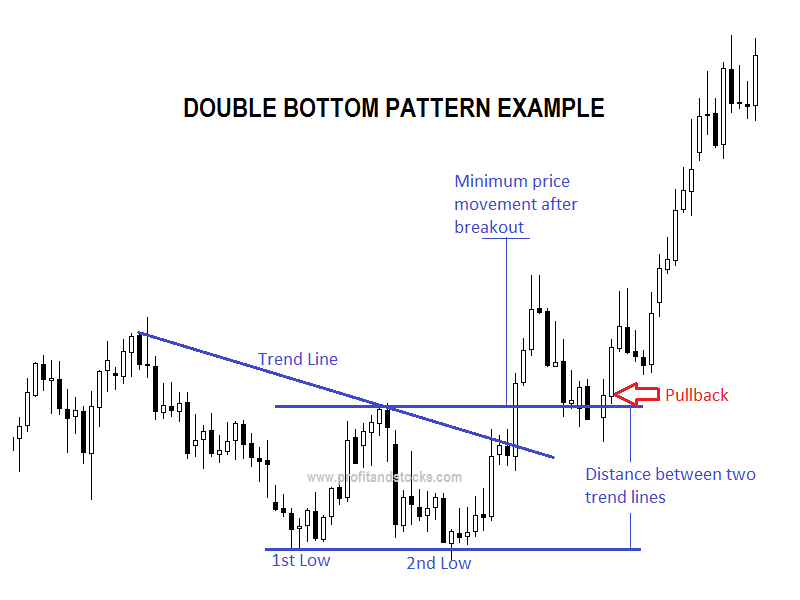

Double Bottom Stock Pattern - Double bottoms are among the most reliable chart patterns, although timing can vary tremendously among stock charts. Run queries on 10 years of financial data. Showing page 1 of 1. It describes the drop of a stock or index, a rebound, another drop to the same or similar level as the original. The double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. Chart patterns in which the quote for the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). Web create a stock screen. Usually, a double bottom pattern signals a price reversal. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Web the double bottom reversal is a bullish reversal pattern typically found on bar charts, line charts, and candlestick charts. Web stock screener for investors and traders, financial visualizations. Web technical analysis relies on charting to essentially “read” a security’s movements. Though the difference between the two bottoms can. Run queries on 10 years of financial data. When the price breaks through resistance, it has an average 50% price increase. It resembles a w, and has a choppy, seesaw look to it. Web double bottom technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Usually, a double bottom pattern signals a price reversal. Web. Firstly, the market pulls back up to 10% to 20% and creates a neckline. The formation of the pattern begins after a prolonged downtrend. The dynamic world of stock trading is filled with uncertainties and challenges, but with the right knowledge, skills, and tools, traders can enhance their ability to seize opportunities and achieve. Web zacks equity research may 10,. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks, forex markets, or cryptocurrencies. Double bottom patterns may also have handles, but this is not essential. While the stock has lost 5.8% over the past week, it could witness a trend reversal as a hammer chart.. Web a double bottom pattern is a classic technical analysis charting formation that signals a potential reversal in the price trend of a security. The pattern indicates the end of a downtrend and is confirmed by two failed. See prices and trends of over 10,000 commodities. While the stock has lost 24.3% over the past week, it could witness a. Note that a double bottom reversal on a bar or line chart is completely different from double. Web technical analysis relies on charting to essentially “read” a security’s movements. Web double bottom vs. Run queries on 10 years of financial data. The formation of the pattern begins after a prolonged downtrend. Double bottoms are among the most reliable chart patterns, although timing can vary tremendously among stock charts. Web 📍 what is the double bottom pattern? Web double top and bottom: Chart patterns in which the quote for the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). Showing page 1 of 1. Note that a double bottom reversal on a bar or line chart is completely different from double. Web 📍 what is the double bottom pattern? Run queries on 10 years of financial data. Double bottoms are among the most reliable chart patterns, although timing can vary tremendously among stock charts. A double bottom is a charting pattern used in technical. Firstly, the market pulls back up to 10% to 20% and creates a neckline. Double bottom is a type of price reversal pattern. The formation of the pattern begins after a prolonged downtrend. The pattern is shaped like a w with 2 deep bottoms of equal prices and a top in the middle. After the formation of the first bottom,. Web characteristics and common types. Usually, a double bottom pattern signals a price reversal. Showing page 1 of 1. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks, forex markets, or cryptocurrencies. Chart patterns in which the quote for the underlying investment moves in a. Run queries on 10 years of financial data. Web stock screener for investors and traders, financial visualizations. Web zacks equity research may 10, 2024. Web double bottom vs. Web create a stock screen. Browse, filter and set alerts for announcements. While the stock has lost 24.3% over the past week, it could witness a trend reversal as a hammer chart pattern was formed. The pattern is shaped like a w with 2 deep bottoms of equal prices and a top in the middle. Web double bottom technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. It is a warning signal to investors that prices will rise in the future. Web the double bottom reversal is a bullish reversal pattern typically found on bar charts, line charts, and candlestick charts. Not surprisingly, double bottoms typically form when the stock. Firstly, the market pulls back up to 10% to 20% and creates a neckline. Web a downtrend has been apparent in definitive healthcare corp. Though the difference between the two bottoms can. The double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts.

Double Bottom Pattern A Trader’s Guide

How to Trade Forex DOUBLE BOTTOM PATTERN ForexCracked

The Double Bottom Pattern Trading Strategy Guide

Forex Double Bottom How To Trade The Double Bottom Chart Pattern Fx

How To Trade Double Bottom Chart Pattern TradingAxe

Double Bottom Chart Pattern Forex Trading

What Is A Double Bottom Pattern? How To Use It Effectively How To

Double Bottom Chart Pattern 101 Should You Invest? Cabot Wealth Network

What Is A Double Bottom Pattern? How To Use It Effectively How To

Double Bottom Chart Pattern Profit and Stocks

Web Technical Analysis Relies On Charting To Essentially “Read” A Security’s Movements.

A Double Top Pattern Is The Reverse Of A Double Bottom Pattern.

Similar To The Double Top Pattern, It Consists Of Two Bottom Levels Near A Support Line Called The Neckline.

It Often Appears At The End Of A Downtrend.

Related Post: