Doji Candlestick Patterns

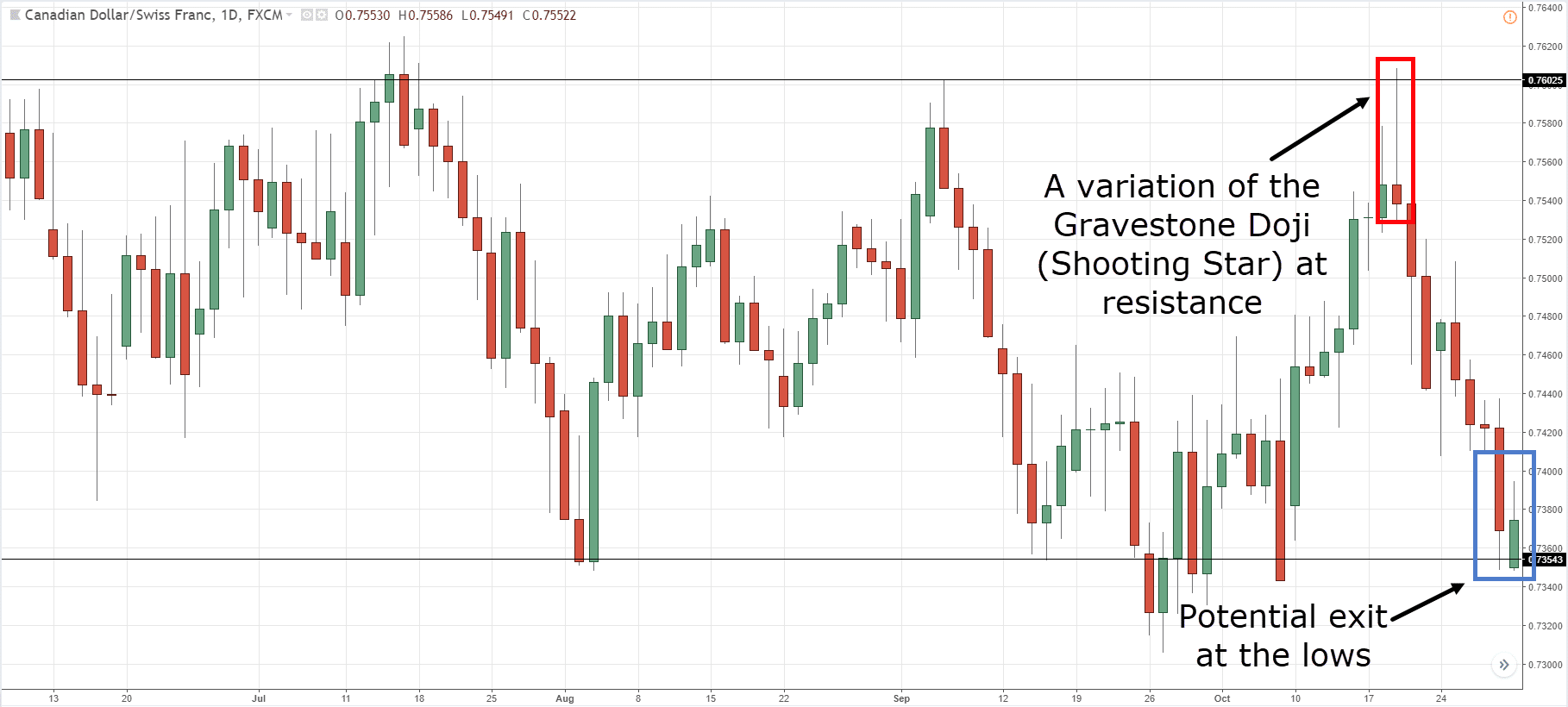

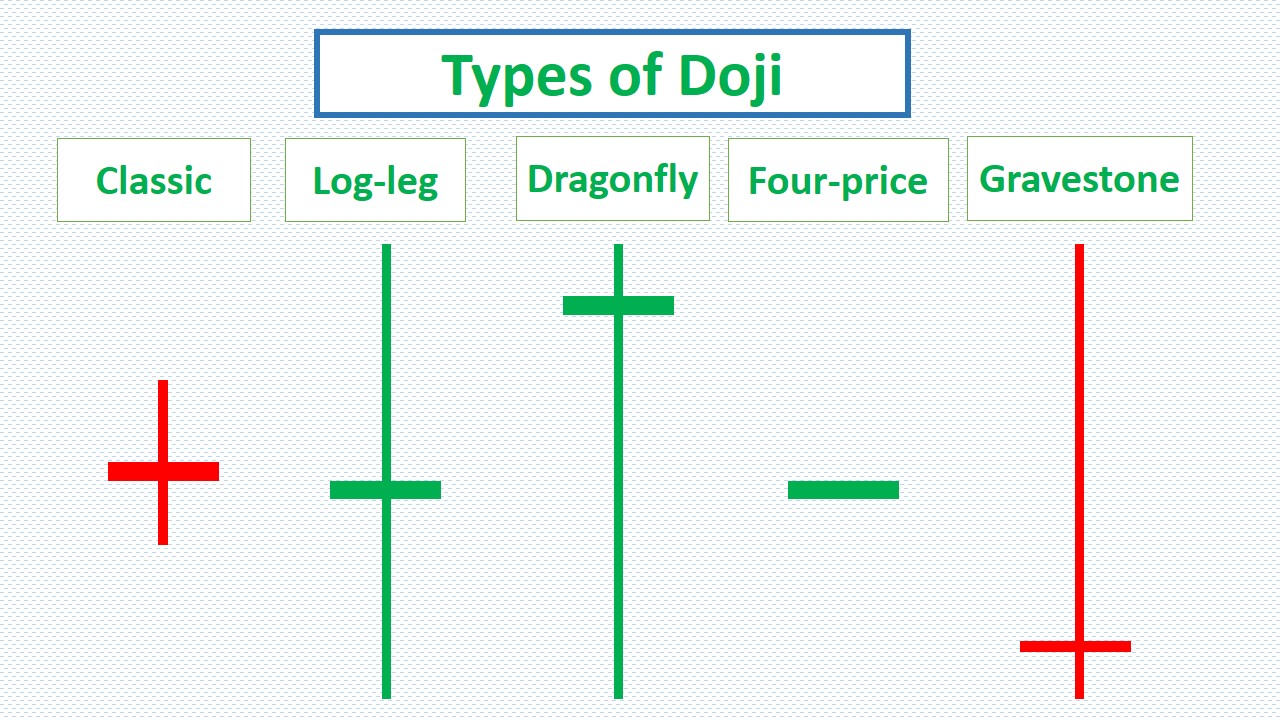

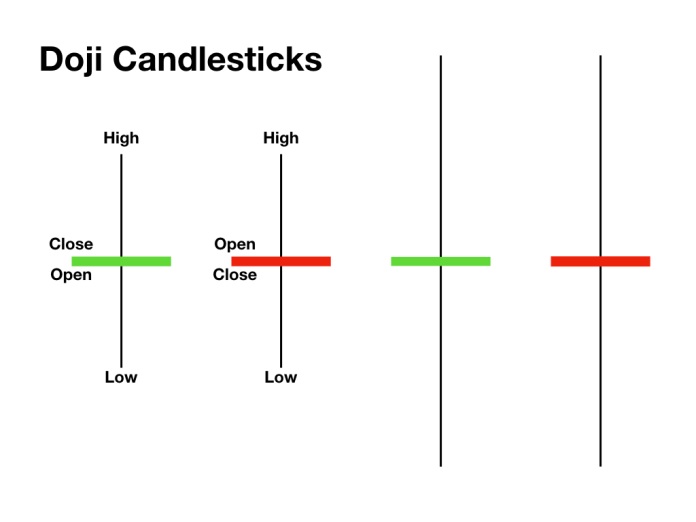

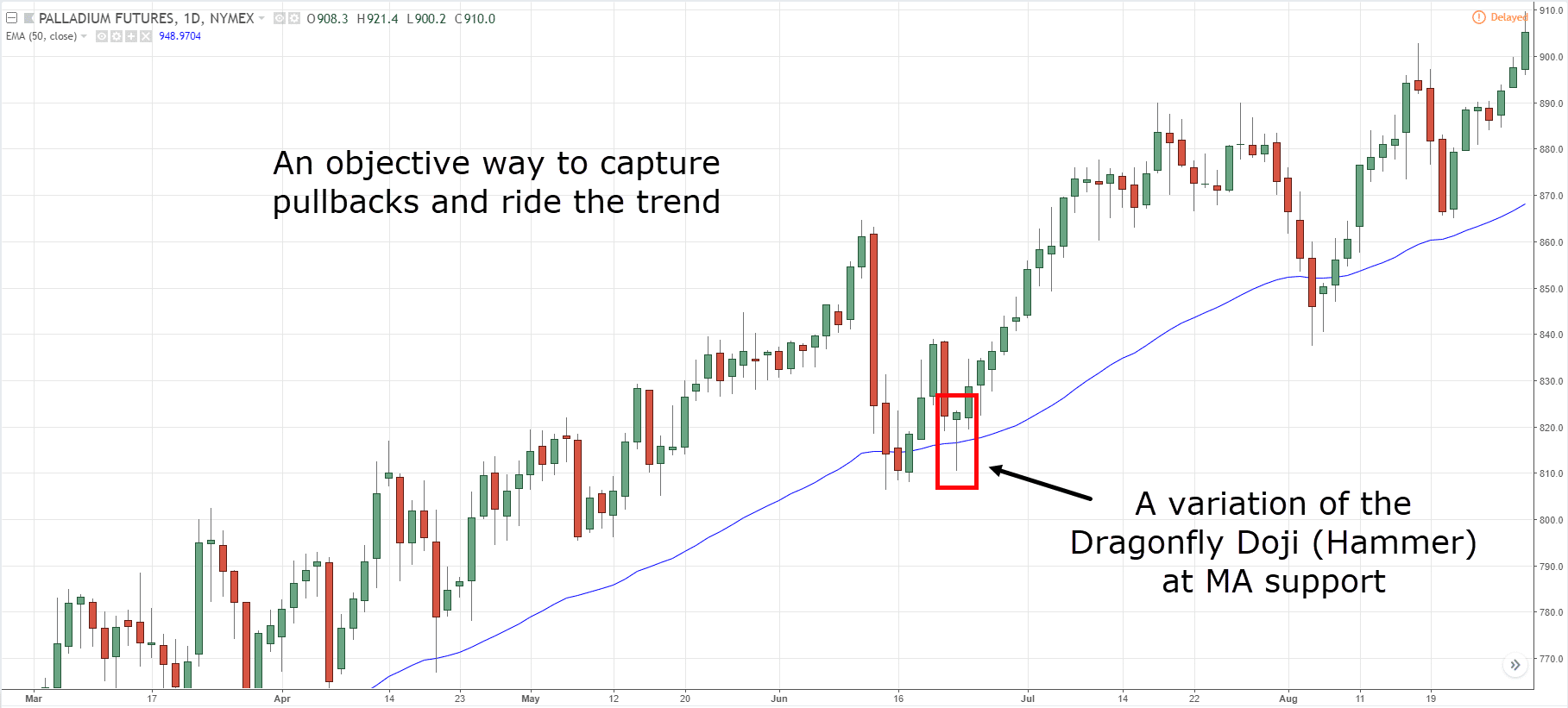

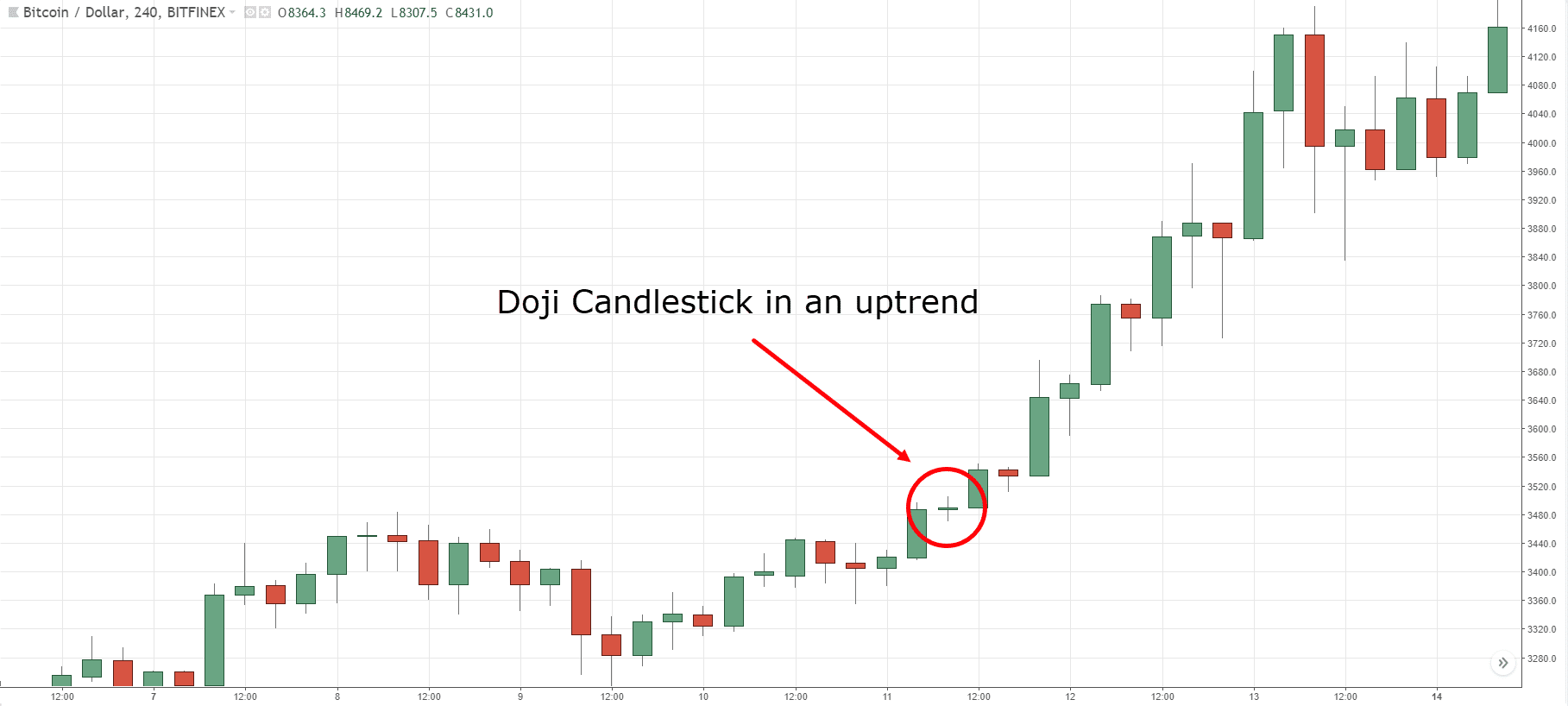

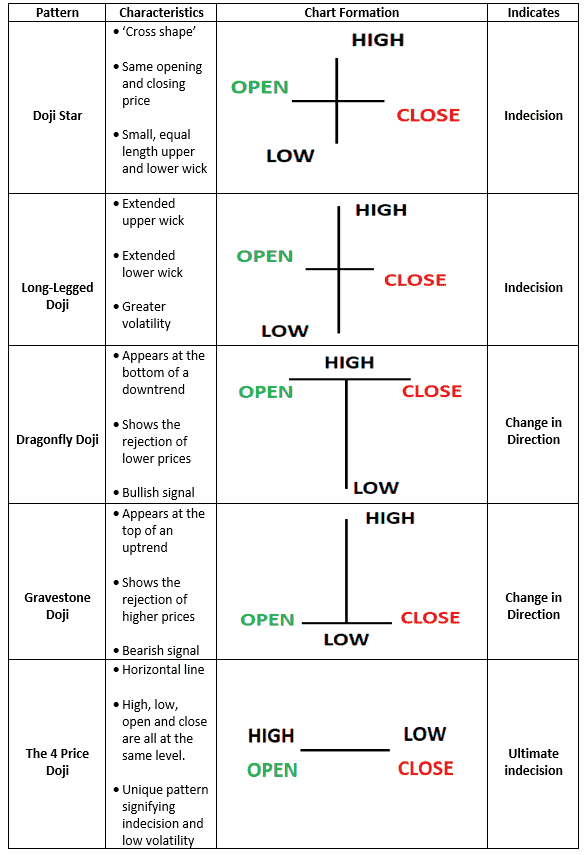

Doji Candlestick Patterns - The pattern shows indecision and is most. Candlestick patterns play a crucial role in technical analysis, especially in cryptocurrency trading. They can therefore be recognised by their much shorter body than typical japanese candlesticks. What is the doji candlestick pattern? Based on this shape, technical. Web japanese candlesticks with a long upper shadow, long lower shadow, and small real bodies are called spinning tops. Depending on the day’s price action, it. To understand what this candlestick means, traders observe the prior price action. It will also cover top strategies to trade using the doji. The doji candlestick by itself is a neutral pattern. Web a gravestone doji is a bearish reversal candlestick pattern that is formed when the open, low, and closing prices are all near each other with a long upper shadow. (most traders never figure this out) 2. Candlestick patterns play a crucial role in technical analysis, especially in cryptocurrency trading. Web a dragonfly doji is a type of candlestick pattern. Learn to identify over 50 candlestick chart patterns. Understand the significance of each pattern in market analysis. Find out why doji candlestick patterns are important in trading, and how forex markets can react. (most traders never figure this out) 2. Do you know there are 4 types of doji and each has a different meaning to it? Investing, market updates, trading news, trends. Web candlestick patterns are like building blocks in understanding how the stock market behaves and how prices might change. What is the doji candlestick pattern? Understand the significance of each pattern in market analysis. Dragonfly doji can be translated into turkish as dragonfly doji. Introduction to 35 candlestick patterns candlestick patterns are visual representations of price movements within a specific. Based on this shape, technical. To understand what this candlestick means, traders observe the prior price action. Dragonfly doji candlestick pattern refers to a candlestick where the opening and closing prices are very close to each other or the same. How is a doji. Dragonfly doji candlestick pattern refers to a candlestick where the opening and closing prices are very close to each other or the same. The doji candlestick by itself is a neutral pattern. Formation of a doji candlestick pattern is one of the clearest examples of the market’s indecision. Investing, market updates, trading news, trends. A standard doji is a single. It resembles a dragonfly in shape and thanks to this feature, it can be easily recognized when it forms. Bearish version is gravestone doji. Web find out why doji candlestick patterns are important in trading, and how forex markets can react. (most traders never figure this out) 2. Dragonfly doji can be translated into turkish as dragonfly doji. Web the doji candlestick pattern is a formation that occurs when a market’s open price and close price are almost exactly the same. The third candlestick is a black body. It resembles a dragonfly in shape and thanks to this feature, it can be easily recognized when it forms. Find out why doji candlestick patterns are important in trading, and. Web candlestick patterns are like building blocks in understanding how the stock market behaves and how prices might change. A doji candle is dominated by wicks with very small bodies or no bodies at all. Based on this shape, technical. The process involves prices moving above and below the opening level during the trading session, but closing at or near. Stay updated with the latest trends and insights in the finance world. Morning doji star candlestick pattern and evening doji star candlestick pattern. Do you know there are 4 types of doji and each has a different meaning to it? However, it’s special for two reasons: Knowing about these patterns can really help you make smarter decisions when trading. The spinning top pattern indicates the indecision between the buyers and sellers. The doji is one of the most misunderstood candlestick patterns. It resembles a dragonfly in shape and thanks to this feature, it can be easily recognized when it forms. First is a large white body candlestick followed by a doji that gaps above the white body. Types of. Depending on the day’s price action, it. Web like most patterns, the doji is a single candle; The doji candlestick by itself is a neutral pattern. The process involves prices moving above and below the opening level during the trading session, but closing at or near that opening price. However, it’s special for two reasons: Web a doji (dо̄ji) is a name for a trading session in which a security has open and close levels that are virtually equal, as represented by a candle shape on a chart. Stay updated with the latest trends and insights in the finance world. Find out why doji candlestick patterns are important in trading, and how forex markets can react. Web how is a doji candlestick pattern formed? It resembles a dragonfly in shape and thanks to this feature, it can be easily recognized when it forms. The spinning top pattern indicates the indecision between the buyers and sellers. Doji candles in determining risk vs. The pattern shows indecision and is most. A standard doji is a single candlestick that does not signify much on its own. Web a dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action. Bearish version is gravestone doji.

The Complete Guide to Doji Candlestick Pattern

All Doji Candlestick Patterns & How to Trade Them

Doji candlestick patterns How to identify and trade them in IQ Option

What Is Doji Candlestick? How To Use Doji Candlestick Patterns

The Complete Guide to Doji Candlestick Pattern

What Is Doji Candlestick? How To Use Doji Candlestick Patterns

What Is Doji Candlestick? How To Use Doji Candlestick Patterns

The Complete Guide to Doji Candlestick Pattern

Doji Candlestick Pattern ForexBoat Trading Academy

Doji Candlestick Pattern Meaning, Formation, Types, Limitation

Web A Doji Candlestick Pattern Is Considered To Be A Transitional Formation Since It Doesn’t Signal Either One Of A Continuation Or A Reversal Of The Trend.

Candlestick Patterns Play A Crucial Role In Technical Analysis, Especially In Cryptocurrency Trading.

So How Do I Use Doji To Place Trades?

It's Formed When The Asset's High,.

Related Post: