Divergence Patterns

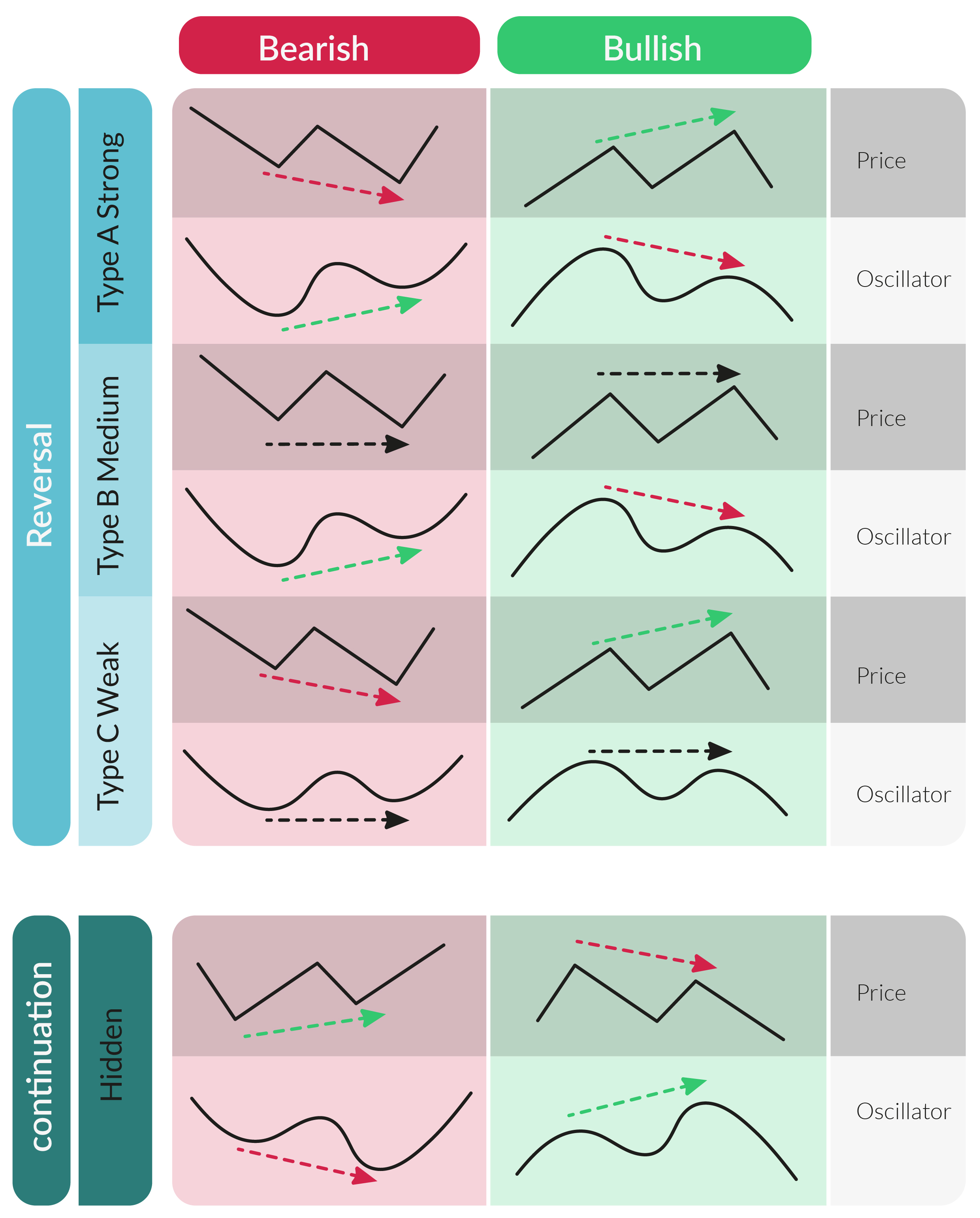

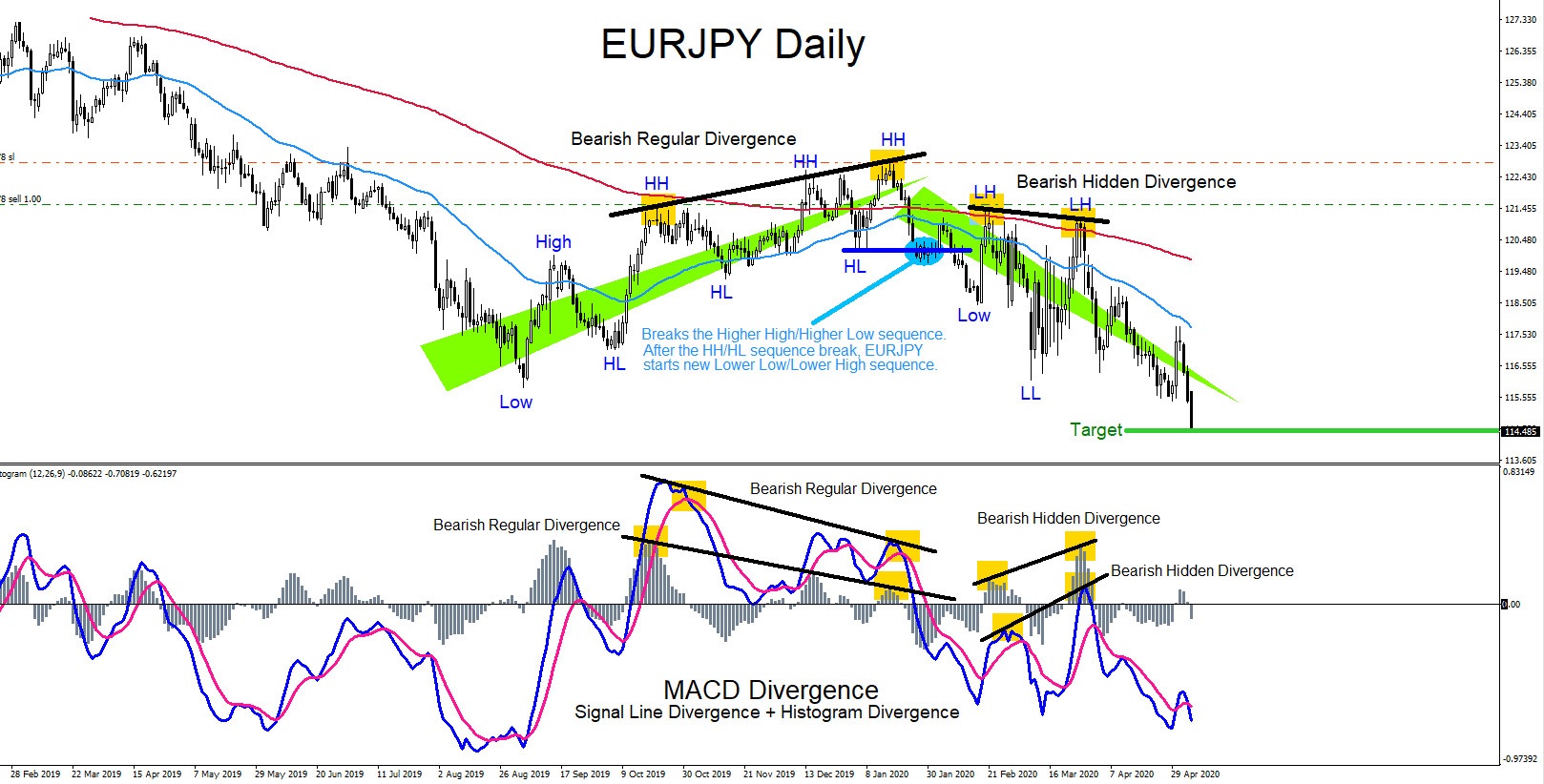

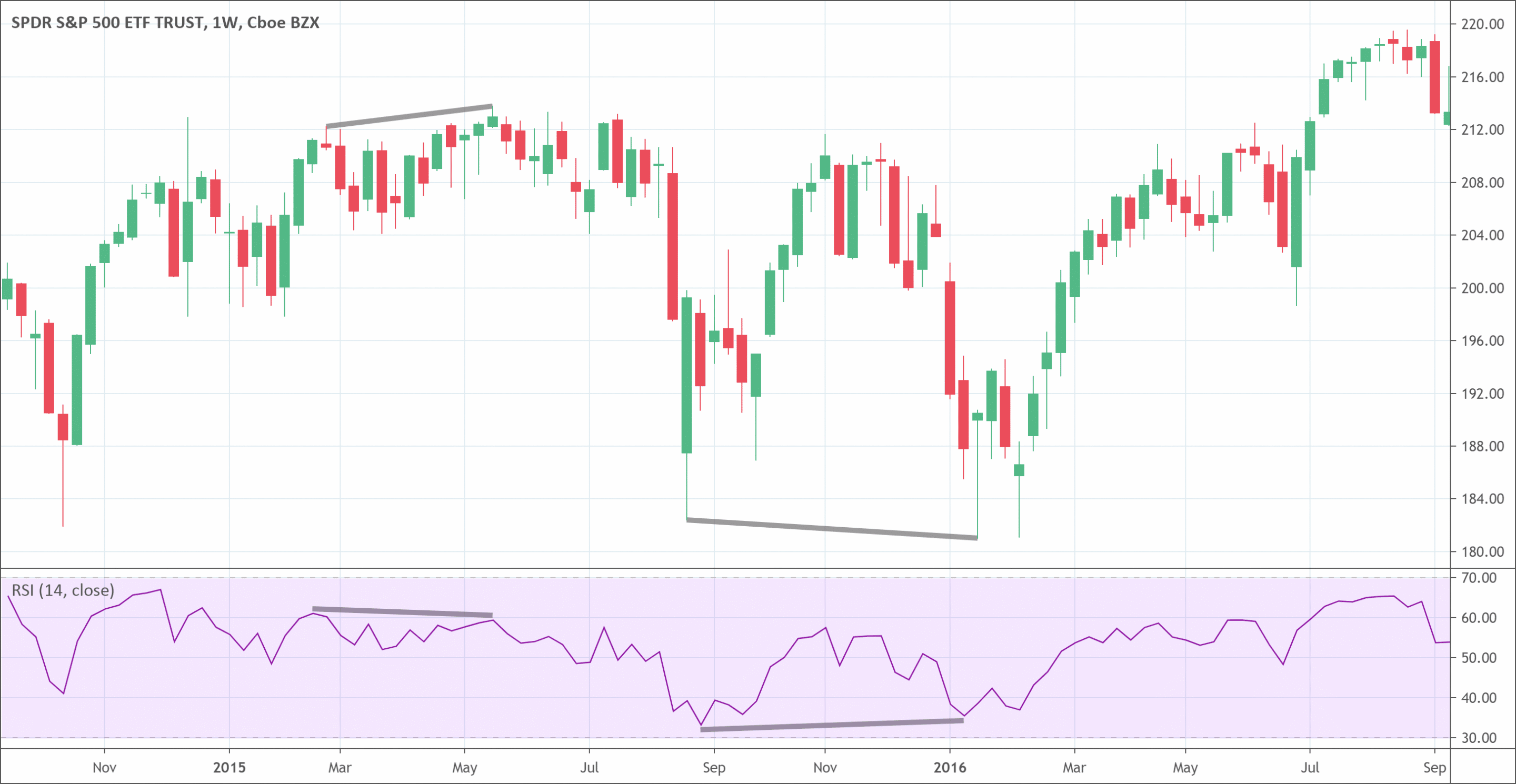

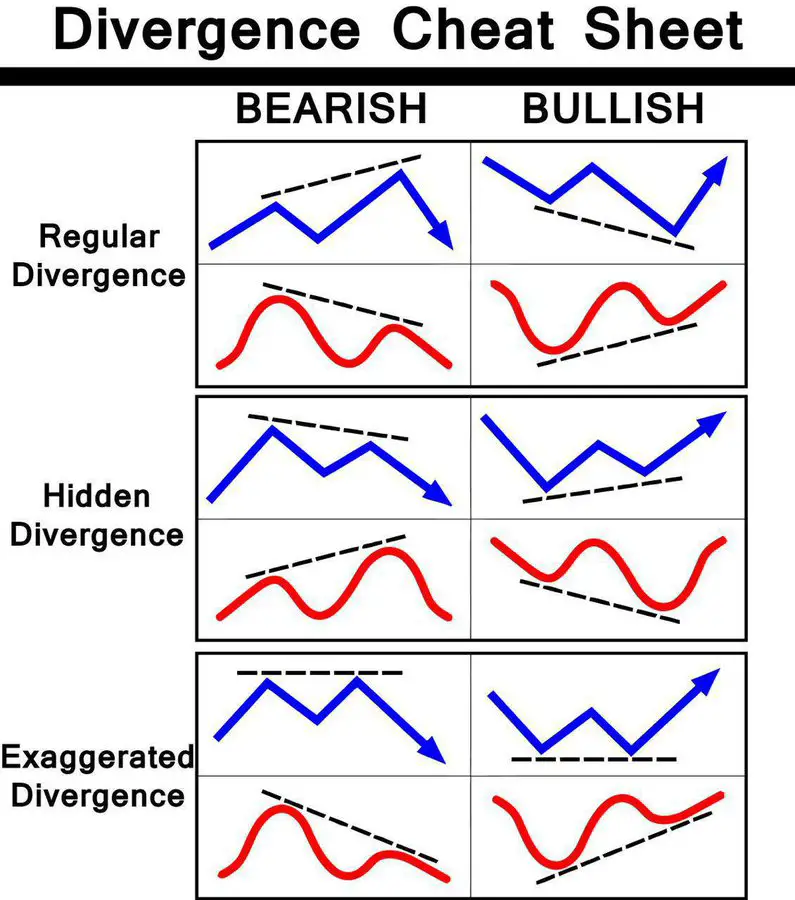

Divergence Patterns - Web how to spot bullish and bearish divergence patterns. Thinkmarkets > learn to trade > indicators & patterns > general patterns > divergence patterns. In the pursuit of making informed market decisions, astute traders harness the analytical power of divergence chart patterns. “woah, what the *beep* is a divergence!” Divergence is a pattern type that can be seen on cryptocurrency price charts that denotes a potential trend change. Web divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation. Web developed in 1978 by j. Bullish and bearish trends can be spotted before they start affecting the price. Web a divergence pattern is a technical indicator that suggests a trend reversal. This pattern provides valuable insights into potential price reversals or changes in trends. Web how to spot bullish and bearish divergence patterns. Web divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. A divergence signal is formed if the price is. “woah, what the *beep* is a divergence!” While hidden divergence is observed at the end of a trend consolidation,. Web april 10, 2024 by finnegan s. Web the best indicator for divergence patterns is the awesome oscillator (chris’s favorite), but there are also others like macd.pro (nenad’s favorite), the rsi,. Welles wilder, the relative strength index (rsi) is a momentum oscillator indicator that measures the speed and price changes. Web trading divergences is a common strategy focusing on finding. Welles wilder, the relative strength index (rsi) is a momentum oscillator indicator that measures the speed and price changes. Web the contrasting rainfall patterns across three city groups persist in different climate zones, indicating little impacts of background climate on divergent rainfall. Web how to spot bullish and bearish divergence patterns. Divergence is a pattern type that can be seen. This pattern provides valuable insights into potential price reversals or changes in trends. Web divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. Thinkmarkets > learn to trade > indicators & patterns > general patterns > divergence patterns. Web the three common types of divergences seen in. Web a divergence pattern is a technical indicator that suggests a trend reversal. Thinkmarkets > learn to trade > indicators & patterns > general patterns > divergence patterns. This pattern provides valuable insights into potential price reversals or changes in trends. Web trading divergences is a common strategy focusing on finding a miscorrelation between the asset’s price and a technical. Bullish and bearish trends can be spotted before they start affecting the price. A divergence signal is formed if the price is. Web divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. Web the contrasting rainfall patterns across three city groups persist in different climate zones, indicating. If you’ve been following other traders’ technical analysis for a while… you’ve most likely heard alien terms like bullish divergence, hidden divergence, reversal divergence, and bearish divergence. Bullish and bearish trends can be spotted before they start affecting the price. Web in trading, divergence means that the price swings and the indicator (oscillator) movement are not in phase. Web the. Thinkmarkets > learn to trade > indicators & patterns > general patterns > divergence patterns. A divergence signal is formed if the price is. Web relative strength index (rsi) divergence is a technical analysis tool used by traders to identify potential trend reversals in the market. If you’ve been following other traders’ technical analysis for a while… you’ve most likely. Web the best indicator for divergence patterns is the awesome oscillator (chris’s favorite), but there are also others like macd.pro (nenad’s favorite), the rsi,. Before you head out there and start. In the pursuit of making informed market decisions, astute traders harness the analytical power of divergence chart patterns. This is when price creates higher tops on the chart, while. Welles wilder, the relative strength index (rsi) is a momentum oscillator indicator that measures the speed and price changes. This is when price creates higher tops on the chart, while your indicator is giving you lower. Web trading divergences is a common strategy focusing on finding a miscorrelation between the asset’s price and a technical indicator. Web a divergence pattern. If you’ve been following other traders’ technical analysis for a while… you’ve most likely heard alien terms like bullish divergence, hidden divergence, reversal divergence, and bearish divergence. Web this type of regular divergence pattern comes in two forms: Web the contrasting rainfall patterns across three city groups persist in different climate zones, indicating little impacts of background climate on divergent rainfall. Web trading divergences is a common strategy focusing on finding a miscorrelation between the asset’s price and a technical indicator. Web the three common types of divergences seen in trading are hidden divergence, reverse divergence and bearish divergence. Divergence is a pattern type that can be seen on cryptocurrency price charts that denotes a potential trend change. Web the best indicator for divergence patterns is the awesome oscillator (chris’s favorite), but there are also others like macd.pro (nenad’s favorite), the rsi,. Web divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation. Before you head out there and start. Web a bullish divergence pattern refers to a situation when the price drops to new lows but the indicator does not follow and signals something different. A divergence signal is formed if the price is. This pattern provides valuable insights into potential price reversals or changes in trends. In the pursuit of making informed market decisions, astute traders harness the analytical power of divergence chart patterns. Web divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. Thinkmarkets > learn to trade > indicators & patterns > general patterns > divergence patterns. Web april 10, 2024 by finnegan s.

The New Divergence Indicator and Strategy 3rd Dimension

The Ultimate Divergence Cheat Sheet A Comprehensive Guide for Traders

Divergence Trading Patterns

Divergence Everything Traders Should Know PatternsWizard

How To Trade an RSI Divergence Complete Guide Living From Trading

Learn How Divergence Patterns Help Indicate Reversals

What Is RSI Divergence? Learn How To Spot It

Learn How Divergence Patterns Help Indicate Reversals

Trading strategy with Divergence chart patterns Trading charts, Forex

Divergence Cheat Sheet New Trader U

Bullish And Bearish Trends Can Be Spotted Before They Start Affecting The Price.

Welles Wilder, The Relative Strength Index (Rsi) Is A Momentum Oscillator Indicator That Measures The Speed And Price Changes.

Web In Trading, Divergence Means That The Price Swings And The Indicator (Oscillator) Movement Are Not In Phase.

Web Developed In 1978 By J.

Related Post: