Divergence Pattern

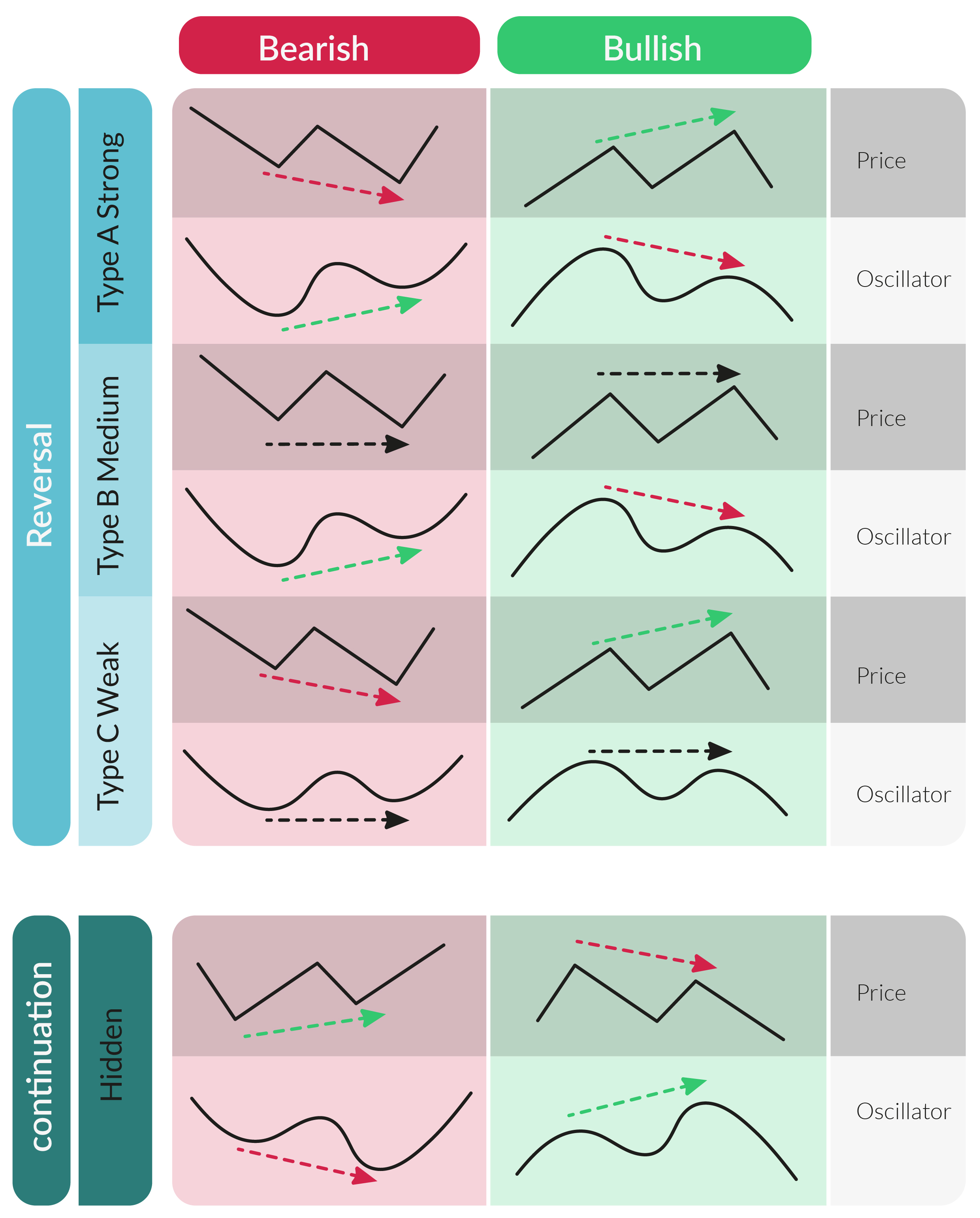

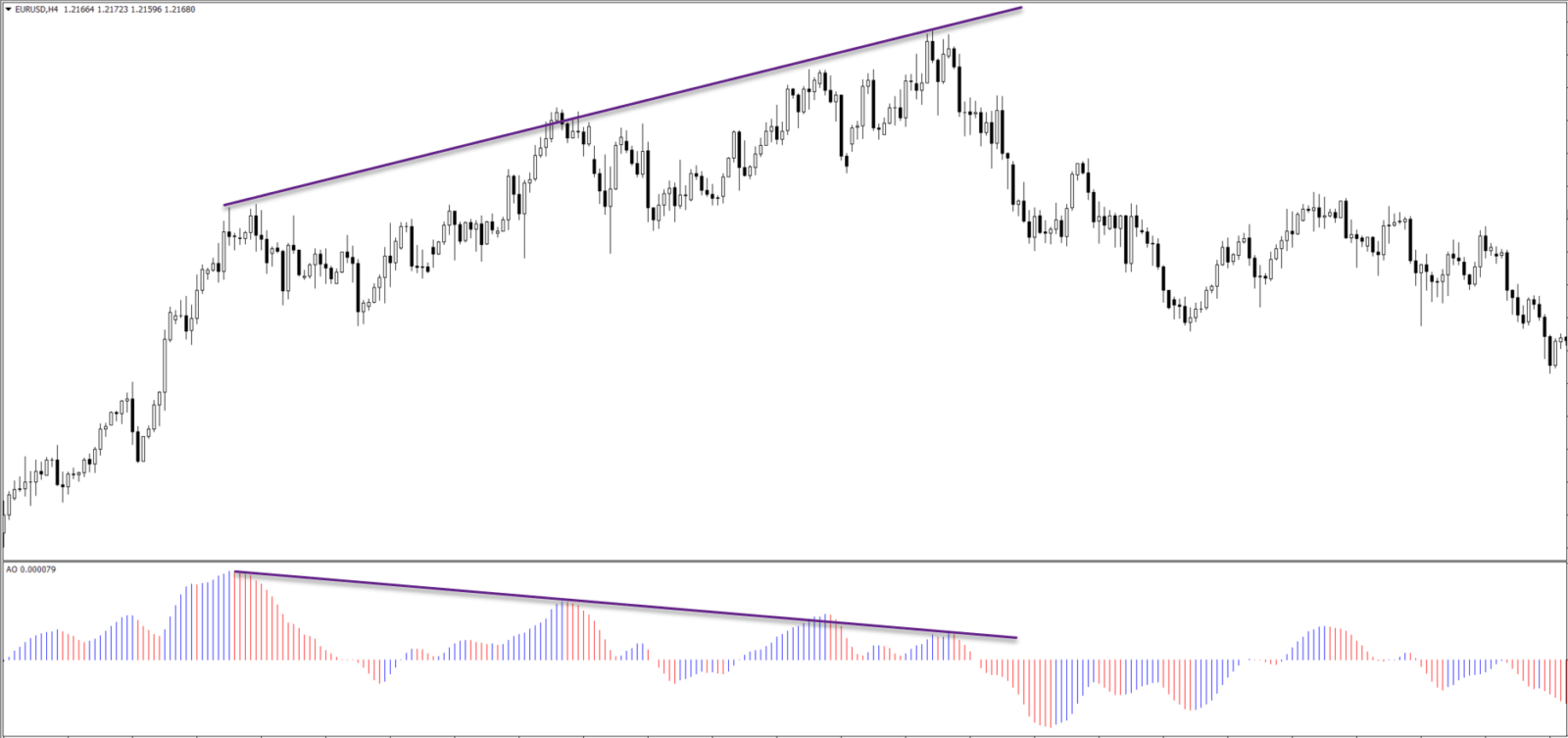

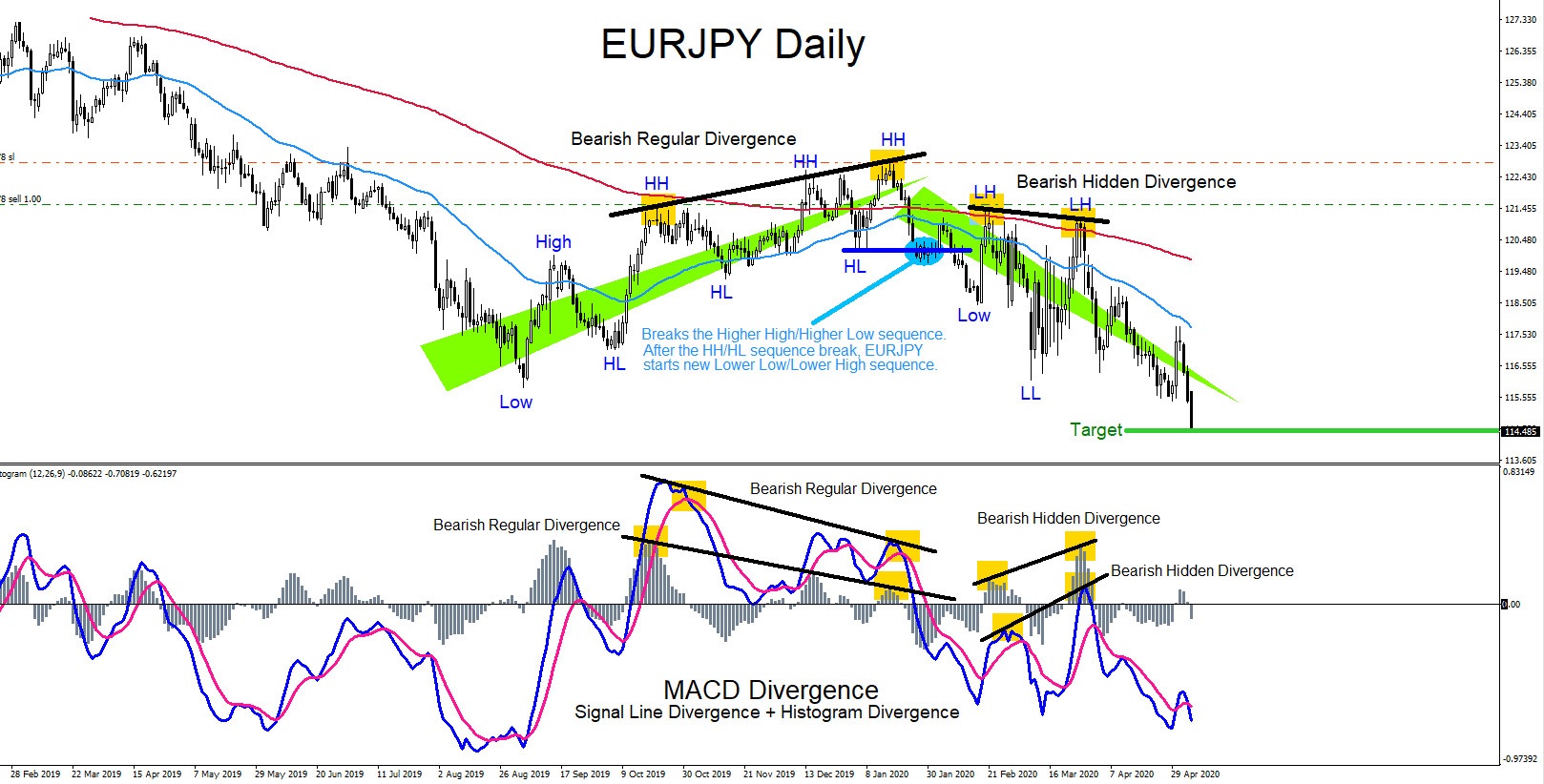

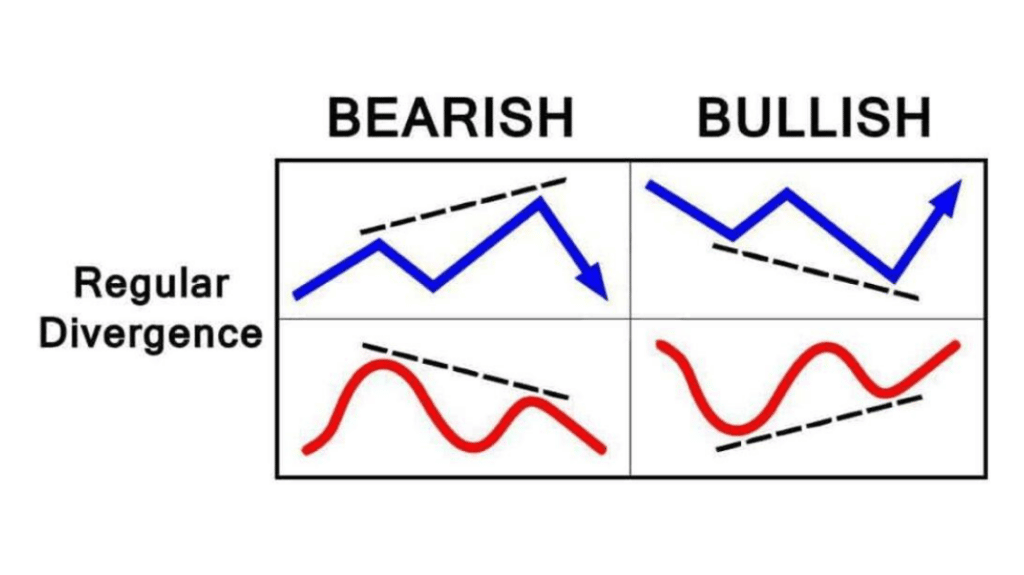

Divergence Pattern - Being able to spot these types of. Web divergence in trading refers to scenarios where the price of an asset and its momentum, as measured by an indicator such as rsi or macd, do not confirm. Web divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation. Divergence is a very useful tool to help traders spot trend reversals or continuation patterns. Web in technical analysis, divergence refers to the phenomenon when the price and a technical indicator (like the rsi) display conflicting signals. By becoming a member, you'll instantly unlock access to 244 exclusive posts. Divergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Before you head out there and start. Web divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. Bullish and bearish trends can be spotted before they start affecting the price. Web eur/usd looks to test 200 sma resistance around 1.08. Web rsi divergence occurs when the relative strength index indicator starts reversing before price does. Divergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Divergent urban development patterns and the. Divergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Web eur/usd looks to test 200 sma resistance around 1.08. Bullish and bearish trends can be spotted before they start affecting the price. While hidden divergence is observed at the end.. While hidden divergence is observed at the end. There are two types of. Web in particular, divergence is used to read momentum and is generally considered a reliable signal that the current price trend is weakening and that a reversal. Being able to spot these types of. Divergence is a pattern type that can be seen on cryptocurrency price charts. Web divergence in trading refers to scenarios where the price of an asset and its momentum, as measured by an indicator such as rsi or macd, do not confirm. By becoming a member, you'll instantly unlock access to 244 exclusive posts. There are two types of. Web the divergence in rsi is clear on this rsi only chart. Web divergences. Web divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. While hidden divergence is observed at the end. Since indicators themselves are based on price action, if the. Web divergence in trading refers to scenarios where the price of an asset and its momentum, as measured by. Web a divergence pattern is a technical indicator that suggests a trend reversal. A spatial distribution of cities with three different development. Bullish and bearish trends can be spotted before they start affecting the price. Web a bullish divergence pattern refers to a situation when the price drops to new lows but the indicator does not follow and signals something. Web in particular, divergence is used to read momentum and is generally considered a reliable signal that the current price trend is weakening and that a reversal. Web divergence is a popular concept in technical analysis that describes when the price is moving in the opposite direction of a technical indicator. Being able to spot these types of. Since indicators. Web the best indicator for divergence patterns is the awesome oscillator (chris’s favorite), but there are also others like macd.pro (nenad’s favorite), the rsi,. Divergent urban development patterns and the associated anomalies in spatial rainfall patterns. Before you head out there and start. Web rsi divergence occurs when the relative strength index indicator starts reversing before price does. Web the. Since indicators themselves are based on price action, if the. Web updated 28 jul 2022. While hidden divergence is observed at the end. Web divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. Web divergence in stock trading is the contradiction between price action and indicators on. Divergence is a pattern type that can be seen on cryptocurrency price charts that denotes a potential trend change. A bearish divergence consists of an overbought rsi. Web divergence in trading refers to scenarios where the price of an asset and its momentum, as measured by an indicator such as rsi or macd, do not confirm. Web in particular, divergence. Web a bullish divergence pattern refers to a situation when the price drops to new lows but the indicator does not follow and signals something different. Divergent urban development patterns and the associated anomalies in spatial rainfall patterns. Web in particular, divergence is used to read momentum and is generally considered a reliable signal that the current price trend is weakening and that a reversal. Web updated 28 jul 2022. Web divergence occurs when the price of an asset and an indicator, such as the relative strength index (rsi), move in opposite directions. A spatial distribution of cities with three different development. Web divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation. Bullish and bearish trends can be spotted before they start affecting the price. Web the divergence in rsi is clear on this rsi only chart. Web the best indicator for divergence patterns is the awesome oscillator (chris’s favorite), but there are also others like macd.pro (nenad’s favorite), the rsi,. Web rsi divergence occurs when the relative strength index indicator starts reversing before price does. While hidden divergence is observed at the end. Divergence is a pattern type that can be seen on cryptocurrency price charts that denotes a potential trend change. Web eur/usd looks to test 200 sma resistance around 1.08. Eur/usd dollar is holding steady at 1.0775 in quiet trade and amid a cautious market mood ahead of. A bearish divergence consists of an overbought rsi.

The New Divergence Indicator and Strategy 3rd Dimension

What Is RSI Divergence? Learn How To Spot It

Learn How Divergence Patterns Help Indicate Reversals

Fisher Divergence Forex Trading Strategy The Ultimate Guide To Business

Divergence Trading Patterns

A comprehensive guide to divergence patterns in FX

How To Trade Divergence Pattern

Trading strategy with Divergence chart patterns Trading charts, Forex

Get to Know the Divergence Pattern, Here's the Explanation!

How To Trade an RSI Divergence Complete Guide Living From Trading

Since Indicators Themselves Are Based On Price Action, If The.

Divergence Is When The Price Of An Asset Is Moving In The Opposite Direction Of A Technical Indicator, Such As An Oscillator, Or Is Moving Contrary To Other Data.

There Are Two Types Of.

Divergence Warns That The Current Price Trendmay Be Weakening, And In Some Cases May Lead To The Price Changing Direction.

Related Post: