Diamond Trading Pattern

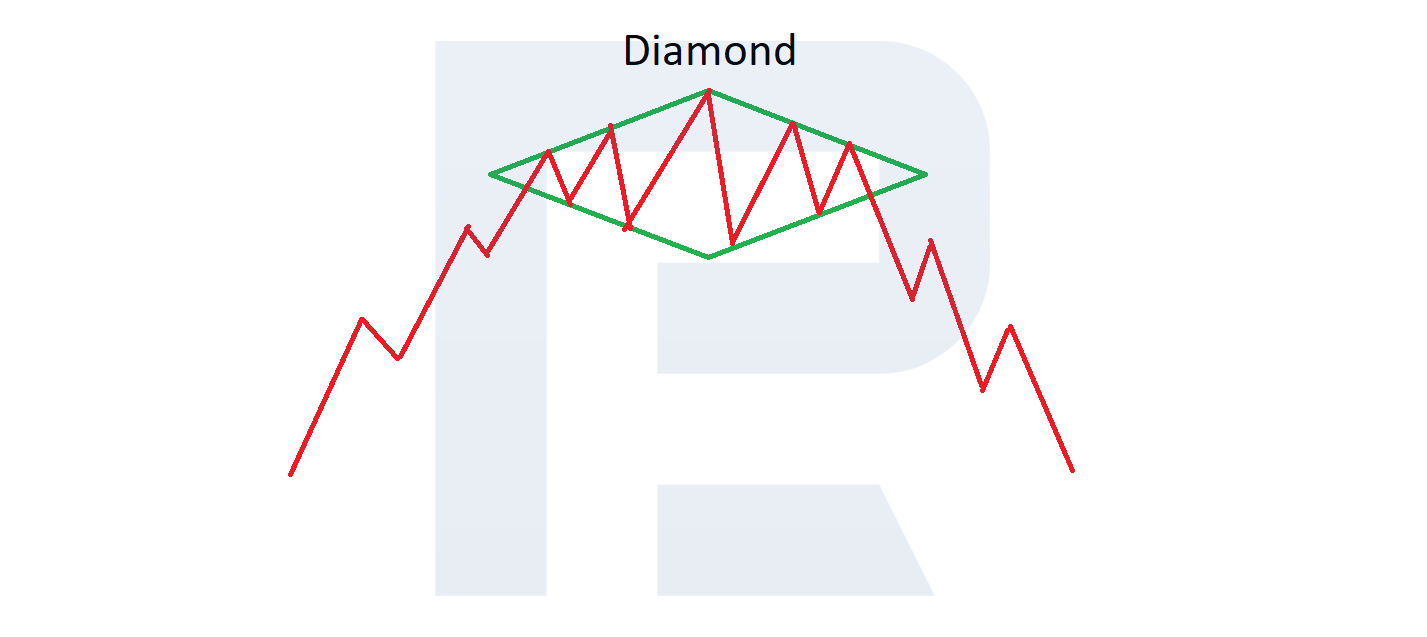

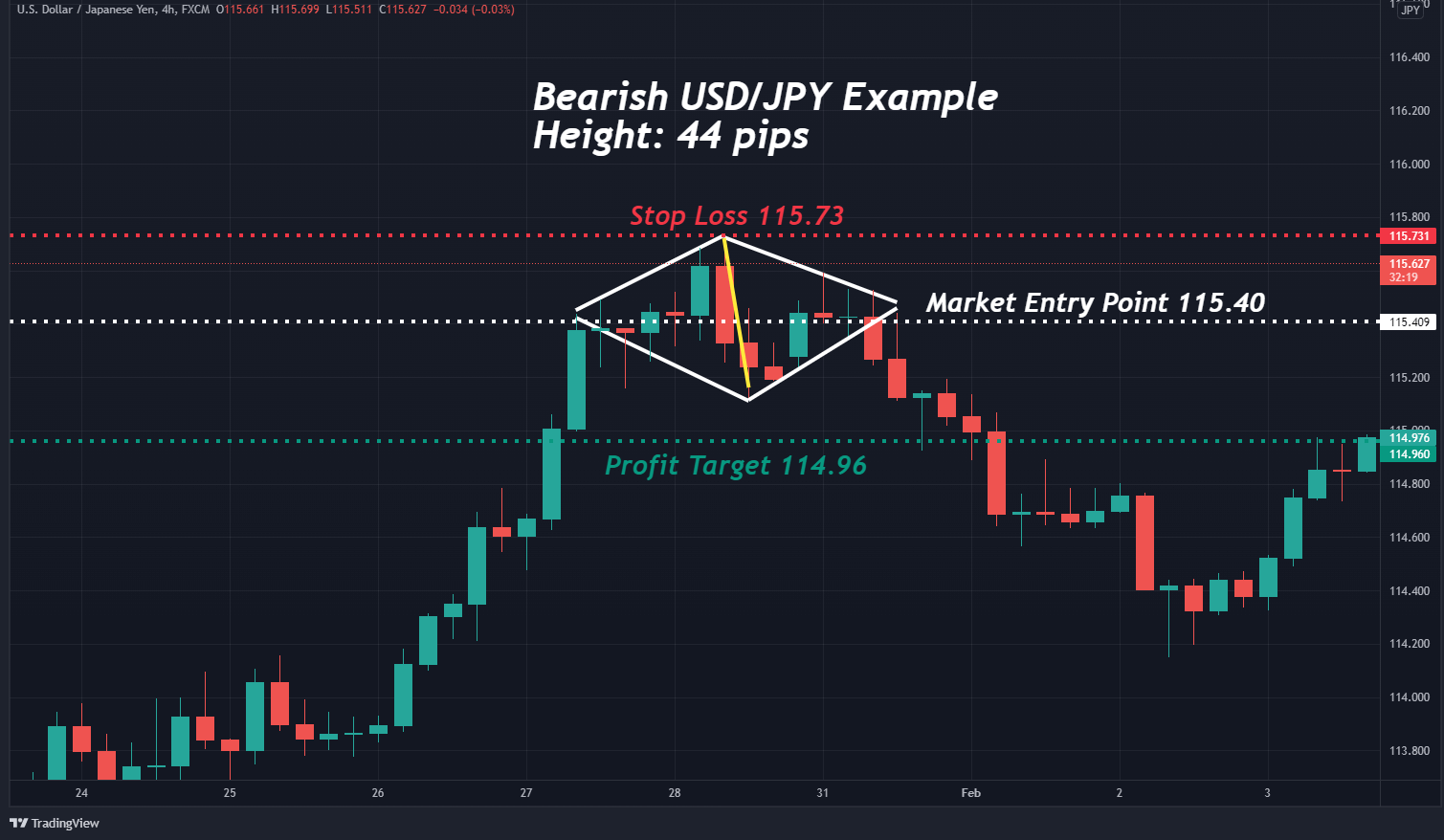

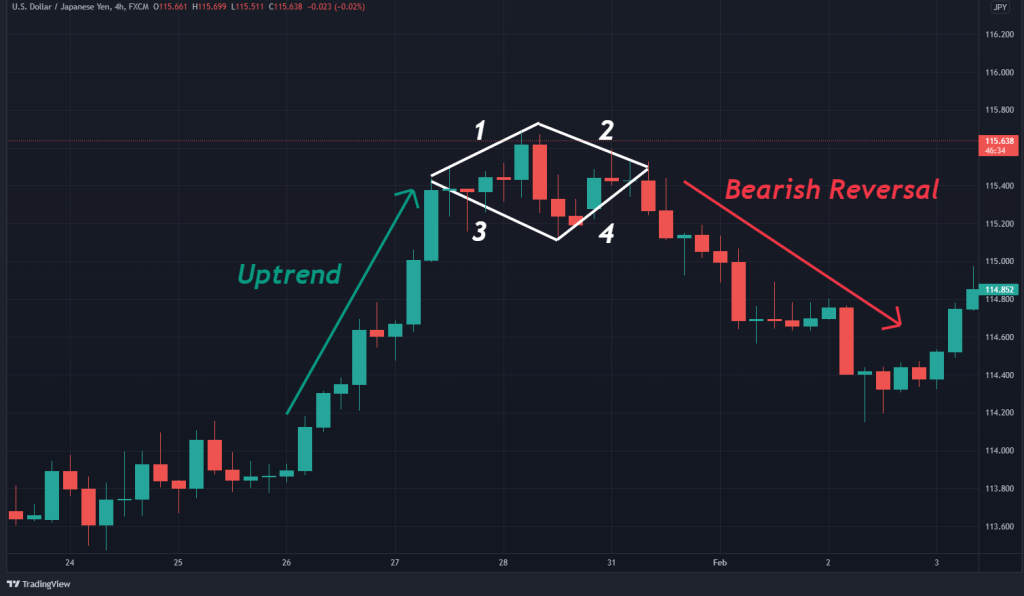

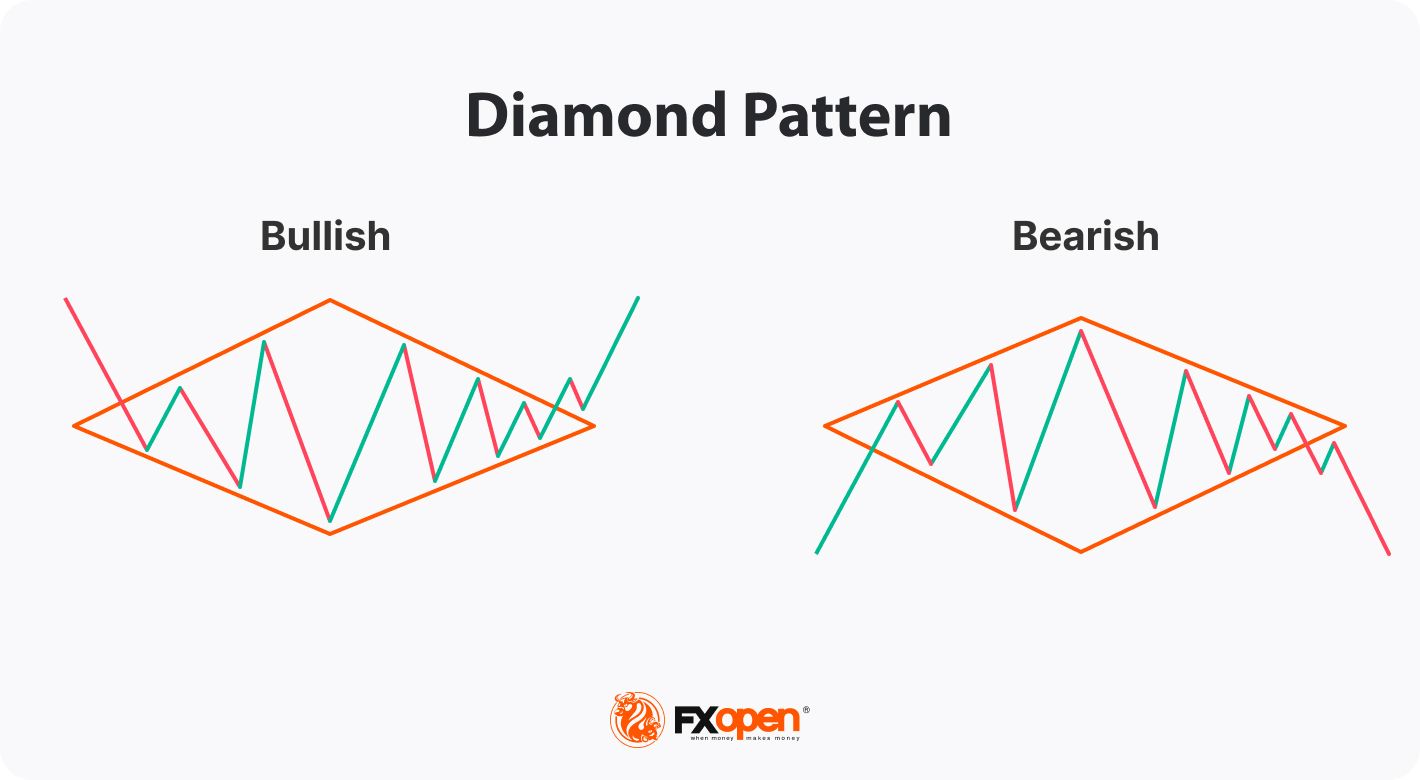

Diamond Trading Pattern - Place a 10 exponential moving average overlay on the chart where the diamond top forms. Web while trading diamond patterns, look for increasing volume on the last portion of the pattern, signaling a potential breakout. A stop loss can generally be placed a few. With the order level set, add the stop loss level at either of the following levels: If the shape is more vertical than horizontal, then you are probably looking at a head and shoulders chart pattern. Web the diamond pattern is an advanced chart formation that occurs in the financial markets. You can spot the diamond pattern in crypto*, stock, currency, and commodity charts. Diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. However, like any other trading tool, this formation has pitfalls, and traders should be aware of them before entering the live market. Web first, a diamond top pattern happens when the asset price is in a bullish trend. This pattern looks at a very specific way of thinking that factors into how the stock behaves. Web diamond recognition trading revolves around investor psychology, as most patterns do. With the breakout candlestick confirming the move, it’s time to enter the trade by setting up an order level. A stop loss can generally be placed a few. This causes the. Scan the daily timeframe candlestick price charts of u.s. A bottom one, on the other hand, happens when the asset’s price is moving in a bearish trend. With the breakout candlestick confirming the move, it’s time to enter the trade by setting up an order level. By this time, the trader should already have a plan for entering the trade. It is one that is less well known to technical traders and investors alike. In this lesson, we will dive into the specifics of recognizing and trading the diamond pattern. With the order level set, add the stop loss level at either of the following levels: This relatively uncommon pattern is found by identifying a period in which the price.. Place a 10 exponential moving average overlay on the chart where the diamond top forms. With the breakout candlestick confirming the move, it’s time to enter the trade by setting up an order level. This bearish reversal pattern expands into a high and contracts after a low into a narrower range, until price breaks out below the. The diamond formation. The diamond formation is a classic chart pattern. Web the diamond pattern is a popular technical analysis tool used in trading to identify potential trend reversals. These patterns form on a chart at or near the peaks or valleys of a move, their sharp reversals forming the shape of a diamond. Similar to the checkerboard pattern, the crisscross pattern also.. Web the diamond pattern is an advanced chart formation that occurs in the financial markets. This decrease in volume signifies a decrease in market participation and is a characteristic feature of the pattern. Check for candlestick patterns like dojis or pin bars that signal indecision and reversal. The firm has earnings coming up pretty soon, and events are shaping up. Diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. However, technical traders should become familiar with this pattern as it provides a good trading. The firm has earnings coming up pretty soon, and events are shaping up quite nicely for their report. With the order level set, add the stop loss level at either. Diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. Web diamond recognition trading revolves around investor psychology, as most patterns do. The diamond formation is a classic chart pattern. Web diamond or crisscross patterns are essentially the runway models of the lawn patterns — chic, mesmerizing, and always in vogue. In technical analysis, the. There aren’t many opportunities to trade the diamond chart pattern. A bottom one, on the other hand, happens when the asset’s price is moving in a bearish trend. 50% of the diamond chart pattern’s range; Web diamond pattern trading is a technical analysis strategy used by traders and investors to identify potential trend reversals in financial markets. This pattern, resembling. The diamond top pattern is not a common formation but is considered a strong bearish reversal pattern amongst technical analysts. This decrease in volume signifies a decrease in market participation and is a characteristic feature of the pattern. Web diamond top formation: Make sure the pattern is more horizontal, rather than vertical. Web the diamond pattern is a popular technical. A broadening wedge happens when the peaks of the price are higher and the troughs are. A bottom one, on the other hand, happens when the asset’s price is moving in a bearish trend. In technical analysis, the diamond pattern is a formation that can. A diamond bottom is formed by two juxtaposed symmetrical triangles, so forming a diamond. Web diamond or crisscross patterns are essentially the runway models of the lawn patterns — chic, mesmerizing, and always in vogue. All you need to do is determine market entry, locate your stop loss, and select a viable profit target. The diamond chart pattern is actually two patterns — diamond tops and diamond patterns. Web one useful price pattern in the currency markets is the bearish diamond top formation. Web first, a diamond top pattern happens when the asset price is in a bullish trend. Diamond patterns are chart patterns that are used for detecting reversals in an asset’s trending value, which when traded with properly can lead to great returns. In this lesson, we will dive into the specifics of recognizing and trading the diamond pattern. Use indicators like moving averages, macd, or rsi to confirm the prior trend is weakening. Enter the bullish trade diamond. If the shape is more vertical than horizontal, then you are probably looking at a head and shoulders chart pattern. Bdtx may be one such company. A diamond top can be.

Diamond Chart Pattern Trading Reversal Graphic Formations R Blog

How to Trade the Diamond Chart Pattern (In 3 Easy Steps)

How to Trade the Diamond Chart Pattern (In 3 Easy Steps)

Diamond Chart Pattern Explained Forex Training Group

![Diamond Chart Pattern Explained [Example Included]](https://srading.com/wp-content/uploads/2022/12/diamond-chart-pattern-top.jpg)

Diamond Chart Pattern Explained [Example Included]

Diamond Pattern Trading How to Identify and Use The FX Post

Diamond Pattern Trading Explained

How to Trade the Diamond Chart Pattern Market Pulse

Diamond Pattern Trading How to Identify and Use The FX Post

Diamond Chart Pattern Explained Forex Training Group

Web Diamond Chart Patterns In Trading.

This Causes The First Round Of Consolidation.

This Pattern Marks The Exhaustion Of The Selling Current And Investor Indecision.

A Stop Loss Can Generally Be Placed A Few.

Related Post: