Diamond Pattern Stock

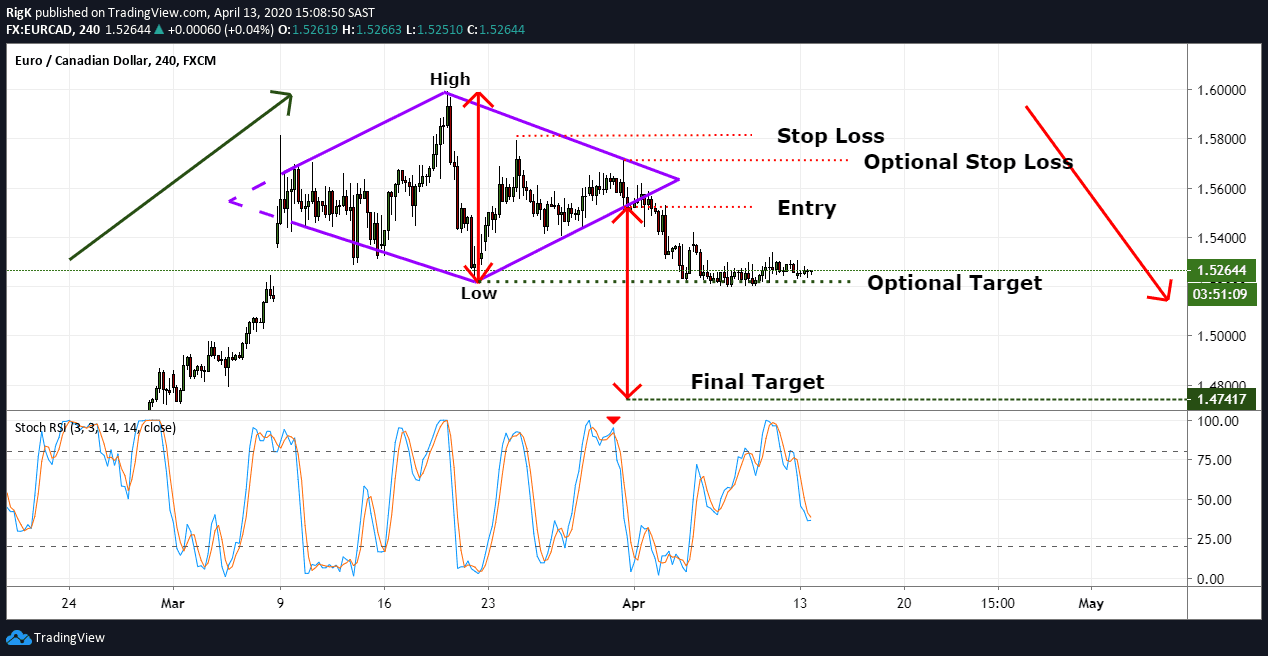

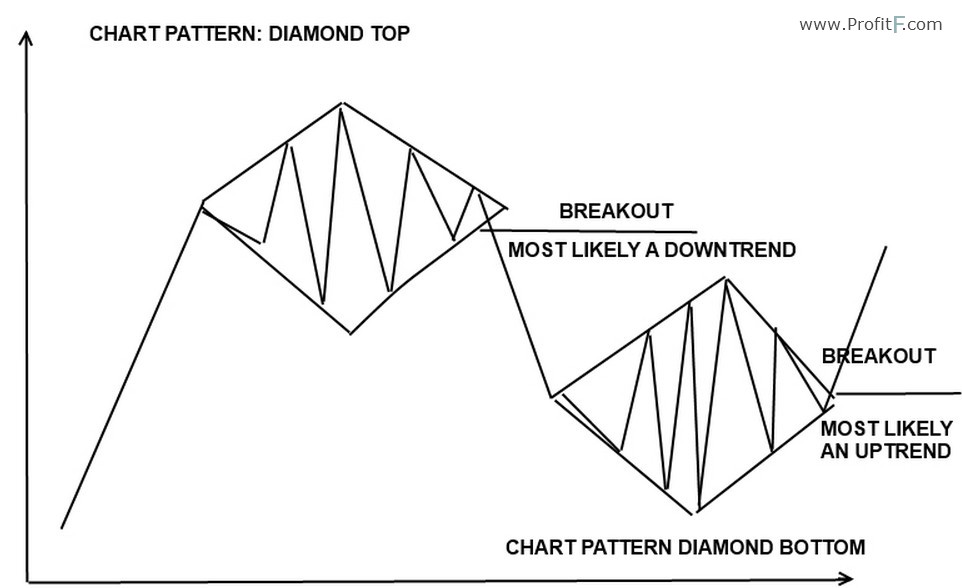

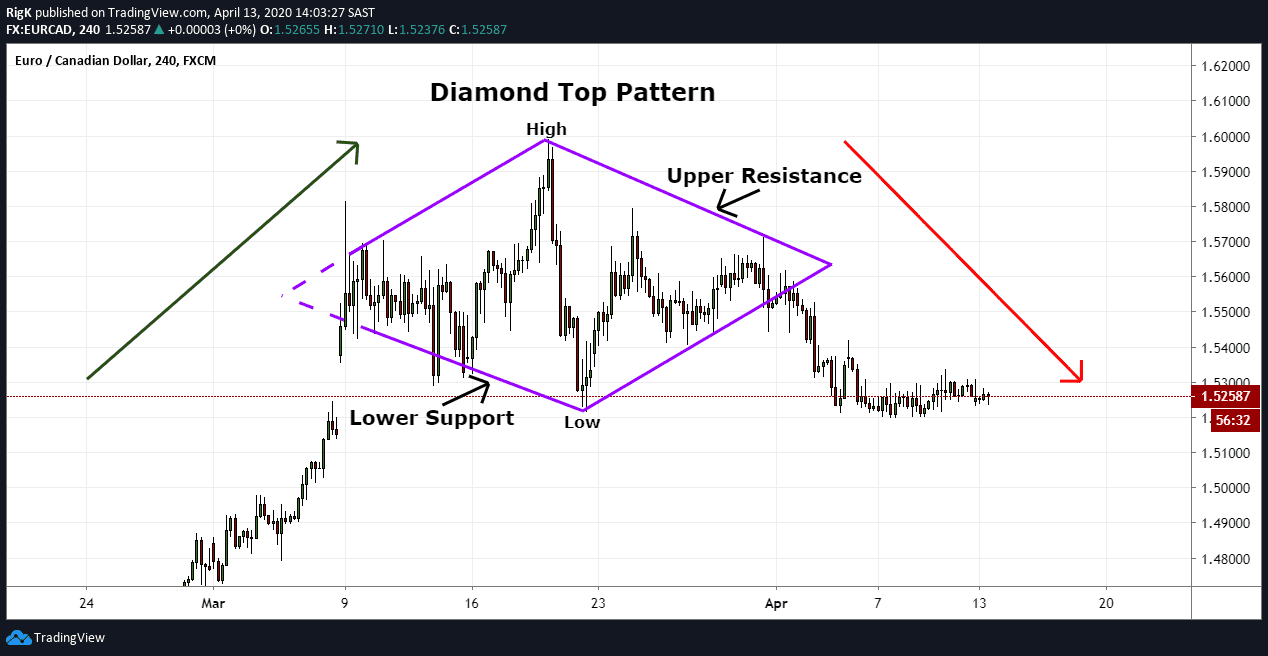

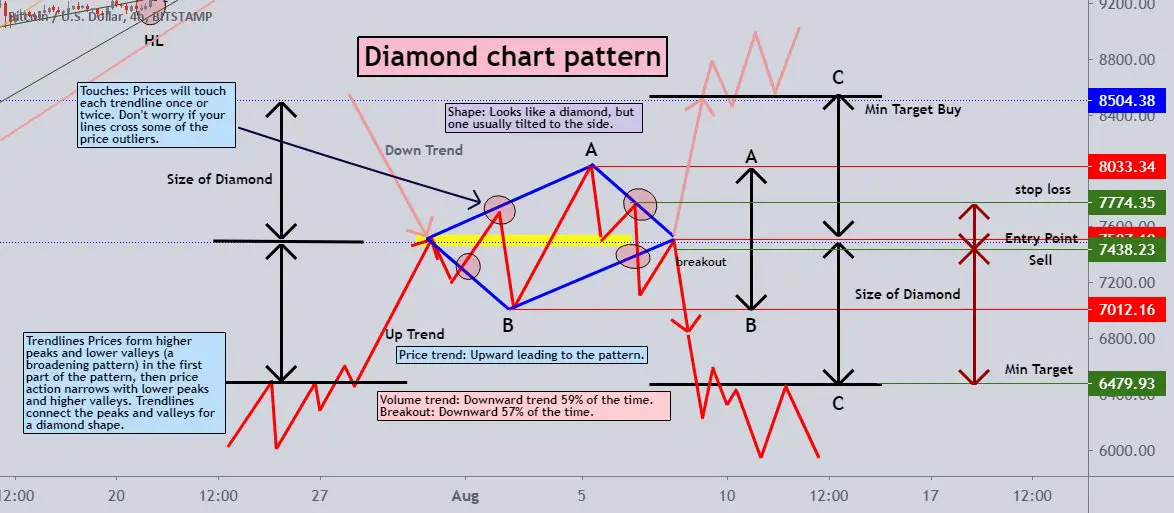

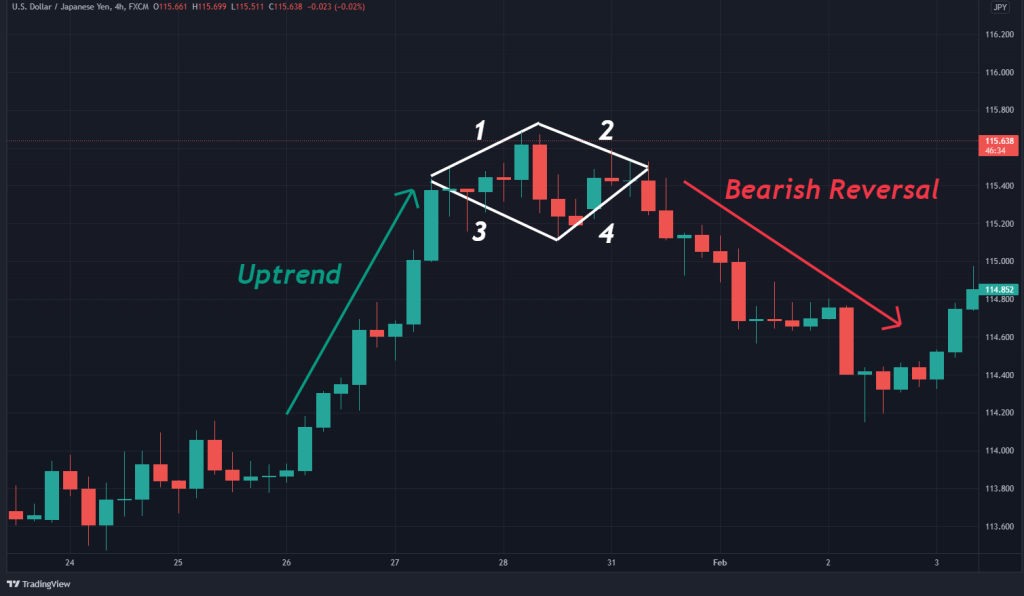

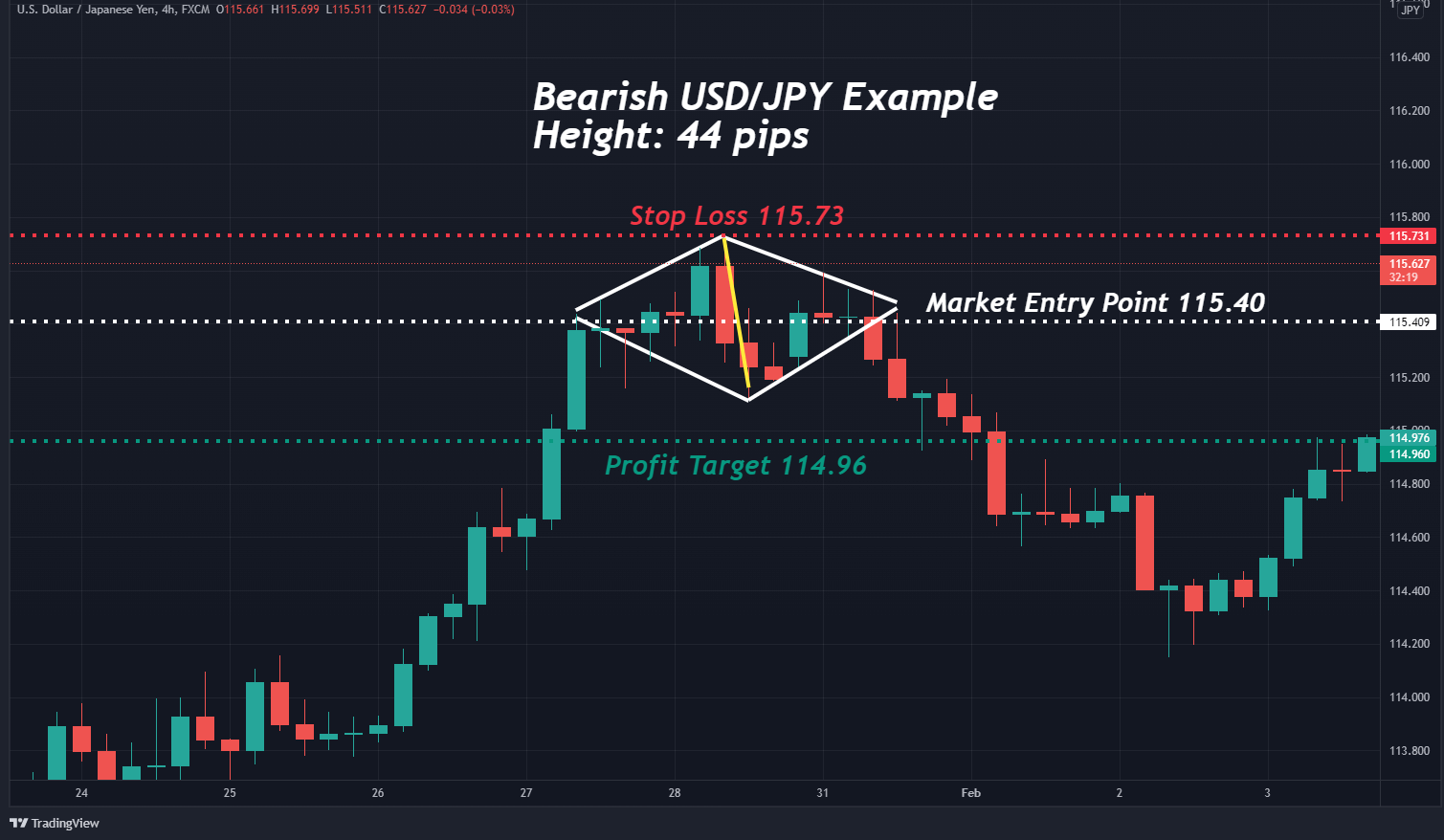

Diamond Pattern Stock - One places a stop loss above the diamond top pattern. Web the diamond pattern has a reversal characteristic: Diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. These patterns form on a chart at or near the peaks or valleys of a move, their sharp reversals forming the shape of a diamond. The diamond bottoms are rare. A broadening wedge happens when the peaks of the price are higher and the troughs are. The diamond pattern indicates a period of indecision and consolidation, as neither buyers nor sellers are in. Web set diamond bottom price target order. Web one useful price pattern in the currency markets is the bearish diamond top formation. Diamond patterns are chart patterns that are used for detecting reversals in an asset’s trending value, which when traded with properly can lead to great returns. Diamond patterns are chart patterns that are used for detecting reversals in an asset’s trending value, which when traded with properly can lead to great returns. Web in this way, you can take long or short positions using diamond patterns. The first diamond bottom pattern trading step is to identify the diamond bottom in a market. A technical analysis reversal. One places a stop loss above the diamond top pattern. Web diamond top formation: Second, the price will form what seems like a broadening wedge pattern. This is done as follows: The diamond top signals impending shortfalls and retracements with accuracy and ease. A technical analysis reversal pattern that is used to signal the end of an uptrend. Second, the price will form what seems like a broadening wedge pattern. Identify the diamond bottom on a price chart. One places a stop loss above the diamond top pattern. Web diamond top formation: This pattern resembles a diamond shape on the chart. Generally, one locates the stop loss above the upper or below the lower extreme of the diamond pattern. A bottom one, on the other hand, happens when the asset’s price is moving in a bearish trend. The diamond bottoms are rare. The diamond chart pattern is actually two patterns — diamond. Bullish diamond pattern (diamond bottom) bearish diamond pattern (diamond top) in stock trading, the bearish diamonds on the top of bullish trends are more common. A diamond top can be. Web first, a diamond top pattern happens when the asset price is in a bullish trend. Web updated 9/17/2023 20 min read. Web set diamond bottom price target order. The diamond top pattern is not a common formation but is considered a strong bearish reversal pattern amongst technical analysts. A broadening wedge happens when the peaks of the price are higher and the troughs are. Web the diamond pattern has a reversal characteristic: This relatively uncommon pattern is found by identifying a period in which the price. Web set. A technical analysis reversal pattern that is used to signal the end of an uptrend. One places a stop loss below the diamond bottom pattern. Web updated 9/17/2023 20 min read. The diamond chart pattern is actually two patterns — diamond tops and diamond patterns. One places a stop loss above the diamond top pattern. This pattern resembles a diamond shape on the chart. This is done as follows: Diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. The diamond bottoms are rare. A broadening wedge happens when the peaks of the price are higher and the troughs are. Generally, one locates the stop loss above the upper or below the lower extreme of the diamond pattern. This bearish reversal pattern expands into a high and contracts after a low into a narrower range, until price breaks out below the. Second, the price will form what seems like a broadening wedge pattern. Web diamond top formation: Identify the diamond. A bottom one, on the other hand, happens when the asset’s price is moving in a bearish trend. One places a stop loss above the diamond top pattern. Web the diamond top pattern explained. Second, the price will form what seems like a broadening wedge pattern. Generally, one locates the stop loss above the upper or below the lower extreme. It has four trendlines, consisting of two support lines and two resistance. A diamond top can be. One places a stop loss above the diamond top pattern. The first diamond bottom pattern trading step is to identify the diamond bottom in a market. Generally, one locates the stop loss above the upper or below the lower extreme of the diamond pattern. Web one useful price pattern in the currency markets is the bearish diamond top formation. Diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. Web in this way, you can take long or short positions using diamond patterns. The diamond pattern indicates a period of indecision and consolidation, as neither buyers nor sellers are in. Diamond patterns are chart patterns that are used for detecting reversals in an asset’s trending value, which when traded with properly can lead to great returns. A broadening wedge happens when the peaks of the price are higher and the troughs are. These patterns form on a chart at or near the peaks or valleys of a move, their sharp reversals forming the shape of a diamond. This relatively uncommon pattern is found by identifying a period in which the price. A bottom one, on the other hand, happens when the asset’s price is moving in a bearish trend. The diamond bottoms are rare. This is done as follows:

Diamond Top Pattern Definition & Examples (2023 Update)

Diamond Reversal Chart Pattern in Forex technical analysis

Stock Market Chart Analysis DIAMOND pattern of S&P 500

What Are Chart Patterns? (Explained)

Diamond Pattern Trading Explained

Diamond Pattern Explained New Trader U

Stock Market Chart Analysis NIFTY Diamond pattern

Stock Market Chart Analysis S&P 500 with a diamond pattern

How to Trade the Diamond Chart Pattern (In 3 Easy Steps)

How to Trade the Diamond Chart Pattern (In 3 Easy Steps)

When You Trade A Bearish Diamond Chart Pattern, You Should Comply With The Following.

Web Diamond Top Formation:

Second, The Price Will Form What Seems Like A Broadening Wedge Pattern.

Identify The Diamond Bottom On A Price Chart.

Related Post: