Diamond Bottom Pattern

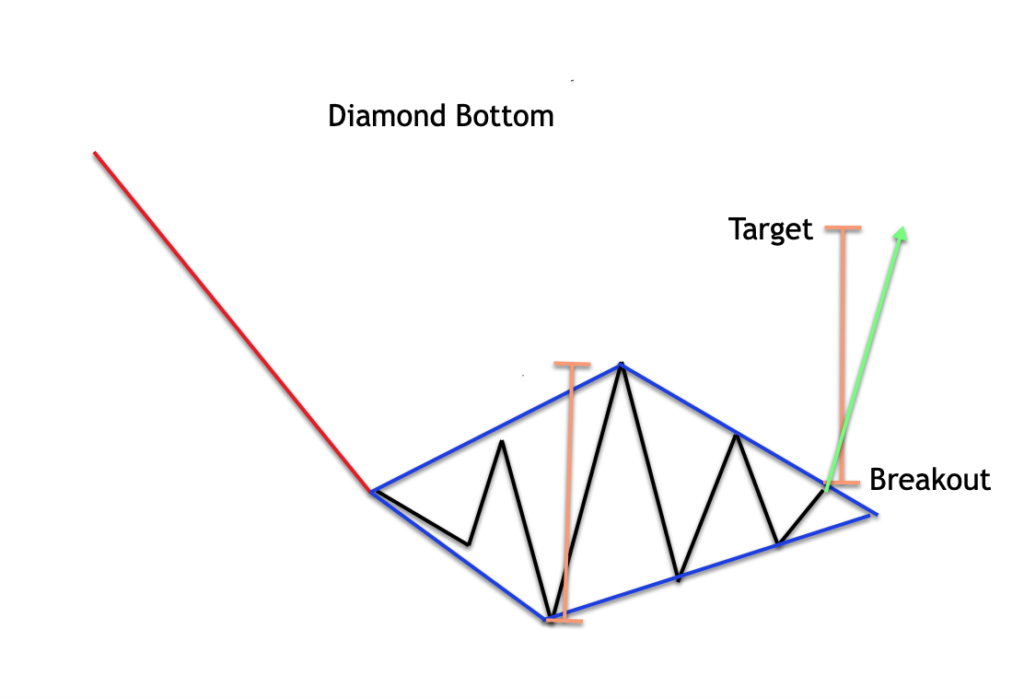

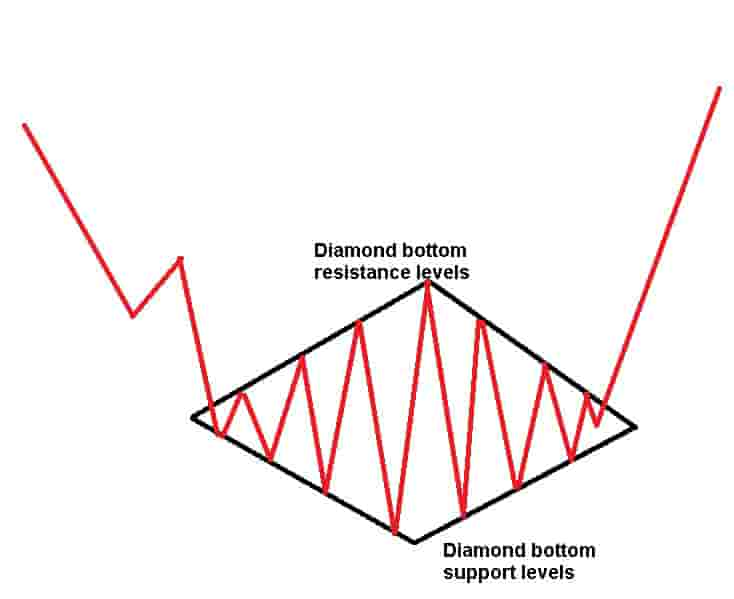

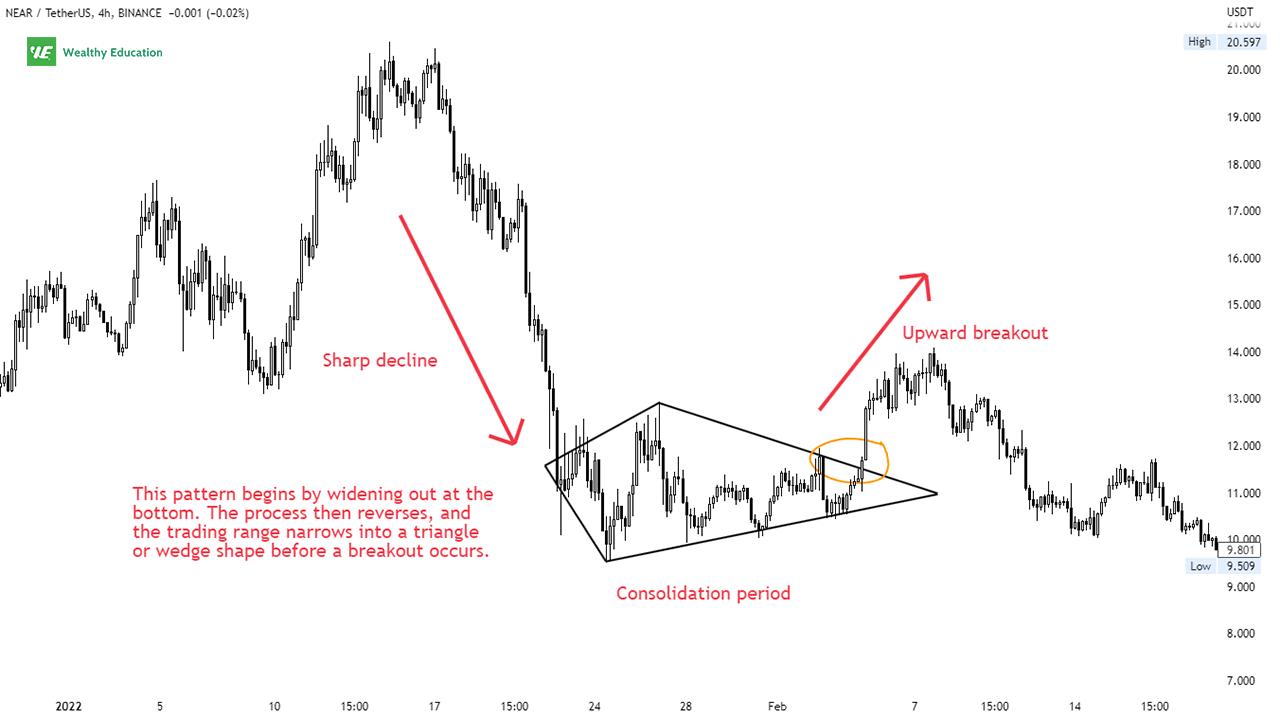

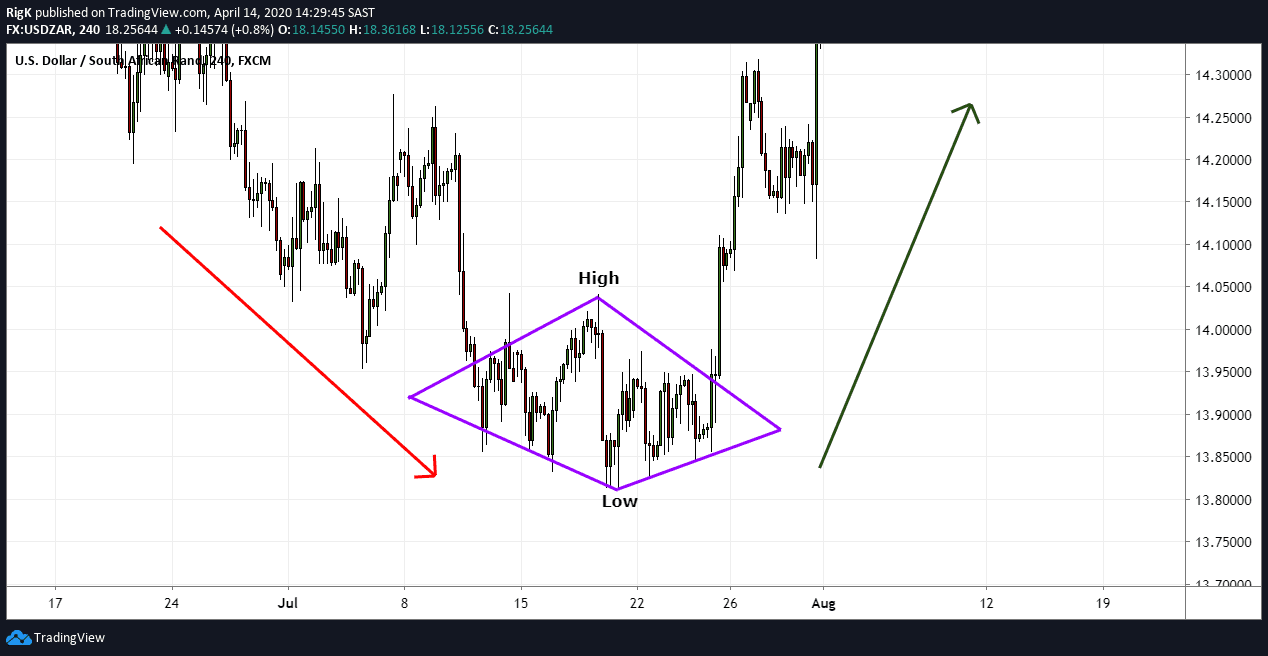

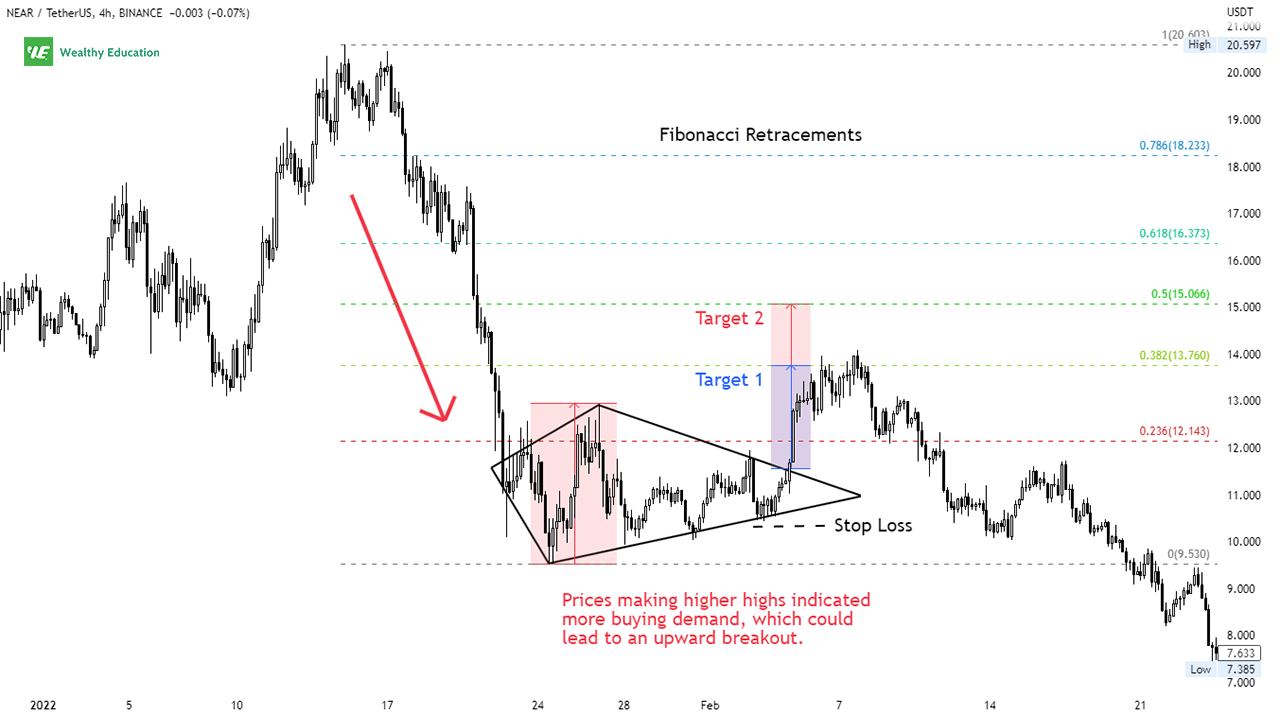

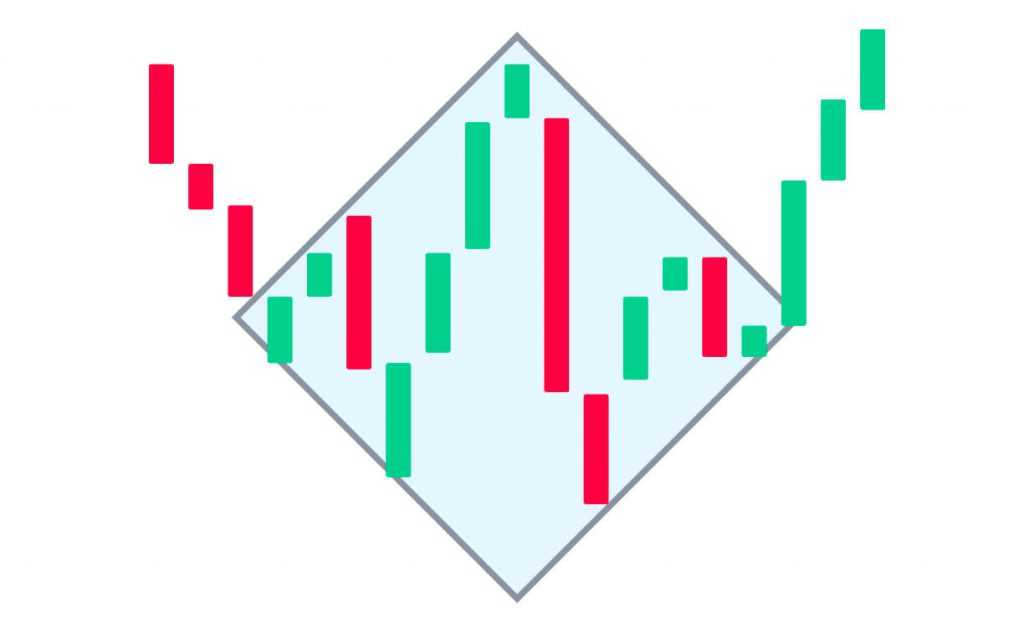

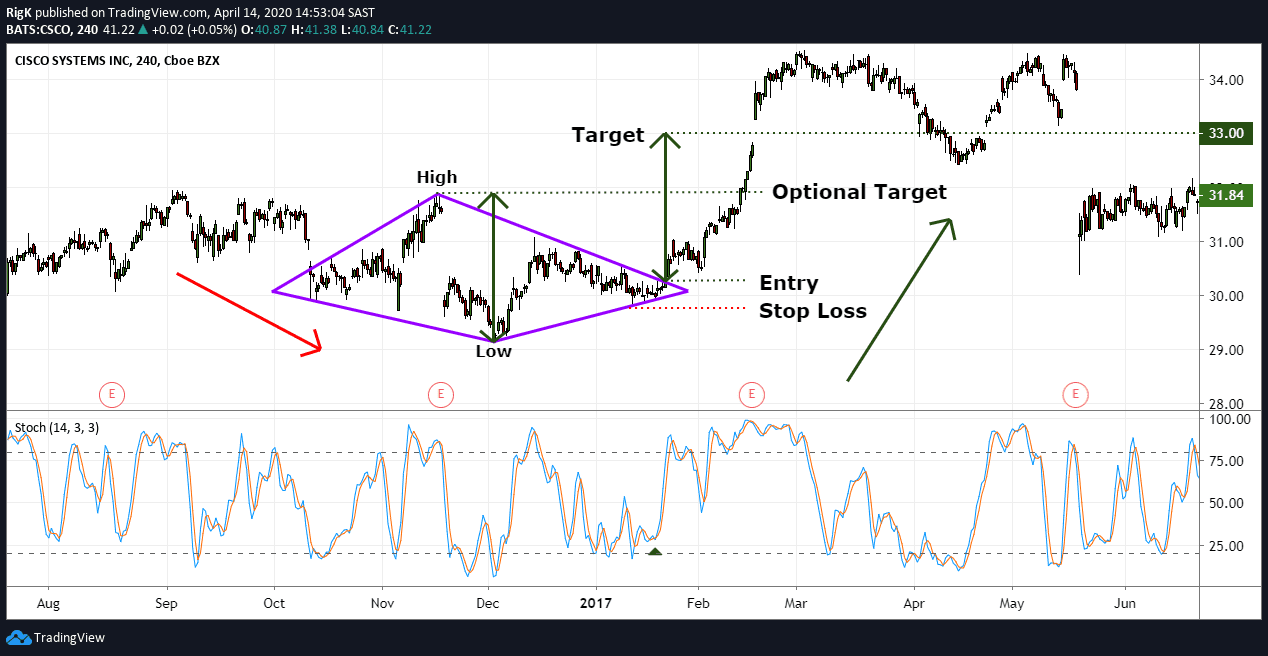

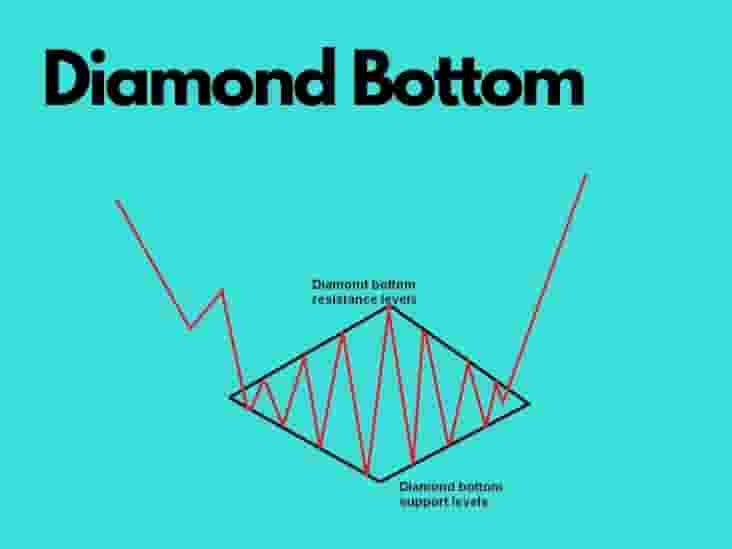

Diamond Bottom Pattern - A diamond bottom is formed by two juxtaposed symmetrical triangles, so forming a diamond. Web a diamond bottom is a bullish, trend reversal chart pattern. Web written by timothy sykes. Many times the diamond chart pattern is skewed or pushed to one side, making diamonds difficult to spot. What is a diamond bottom pattern? Let’s take a closer look at the illustration below which details the structure of. The diamond top and bottom chart patterns are classic reversal patterns used in technical analysis to predict the market’s trend and end. The diamond bottom pattern occurs because prices create higher highs and lower lows in a broadening pattern. Web conversely, when it occurs within the context of a bearish market, the pattern is referred to as a diamond bottom, or a bullish diamond pattern due to its bullish implication. Diamond patterns often emerging provide clues about future market movements. Its name comes from the fact that it has a close resemblance to a physical diamond. A diamond bottom is formed by two juxtaposed symmetrical triangles, so forming a diamond. A diamond bottom has to be preceded by a bearish trend. Volume remains high during the formation of this pattern. Diamond patterns usually form over several months in very active. The diamond pattern in trading is a significant reversal chart formation, signaling potential trend reversals. The diamond pattern is a relatively uncommon chart pattern in the financial market. A diamond bottom has to be preceded by a bearish trend. This pattern marks the exhaustion of the selling current and investor indecision. Diamond patterns often emerging provide clues about future market. Web the diamond pattern is a reversal indicator that signals the end of a bullish or bearish trend. Diamond patterns usually form over several months in very active markets. Web written by timothy sykes. Web conversely, when it occurs within the context of a bearish market, the pattern is referred to as a diamond bottom, or a bullish diamond pattern. Web a diamond top formation is a chart pattern that can occur at or near market tops and can signal a reversal of an uptrend. Trading up blog > diamond pattern (top & bottom): In this article, you will find answers to the following: Web the diamond bottom pattern occurs because prices create higher highs and lower lows in a. Web a diamond bottom is a bullish, trend reversal, chart pattern. This pattern marks the exhaustion of the selling current and investor indecision. A diamond bottom pattern appears on charts when the price of an asset has been in decline and begins to broaden with peaks and troughs before. Web the diamond bottom is a bullish pattern, while the diamond. The technical event occurs when. Web the diamond pattern is a reversal indicator that signals the end of a bullish or bearish trend. The above figure shows an example of a diamond bottom chart pattern. Then the trading range gradually narrows after the highs peak and the lows start trending upward. A diamond bottom pattern is shaped like a diamond. The diamond chart pattern is rarely seen on charts, unlike patterns like flags, pennants, and heads and shoulders, which are more common. The diamond bottom pattern occurs because prices create higher highs and lower lows in a broadening pattern. The diamond pattern in trading is a significant reversal chart formation, signaling potential trend reversals. Web conversely, when it occurs within. Web the diamond pattern is a reversal indicator that signals the end of a bullish or bearish trend. A diamond bottom pattern is shaped like a diamond on a price chart. It is characterized by a sharp decline, followed by a period of consolidation, and then a. It is most commonly found at the top of uptrends but may also. Considered a bullish pattern, the diamond bottom pattern will show a reversal of a trend that breaks out from a downward (bearish) momentum into an upward (bullish) momentum. Web written by timothy sykes. Web these two types are the diamond top pattern and diamond bottom pattern: A diamond bottom has to be preceded by a bearish trend. In this example,. It is characterized by a sharp decline, followed by a period of consolidation, and then a. In this example, outliers a and b hide the diamond shape. Updated 9/17/2023 20 min read. The above figure shows an example of a diamond bottom chart pattern. A diamond bottom is formed by two juxtaposed symmetrical triangles, so forming a diamond. A diamond bottom has to be preceded by a bearish trend. Web a diamond bottom pattern is a bullish pattern that signals a bearish to bullish price reversal from a downtrend to an uptrend. This pattern marks the exhaustion of the selling current and investor indecision. In a diamond pattern, the price action carves out a symmetrical shape that resembles a diamond. Updated 9/17/2023 20 min read. Let’s take a closer look at the illustration below which details the structure of. Web the diamond bottom pattern occurs because prices create higher highs and lower lows in a broadening pattern. Volume remains high during the formation of this pattern. A diamond bottom pattern appears on charts when the price of an asset has been in decline and begins to broaden with peaks and troughs before. Notice that price at d tries to climb back to the launch point c but. It suggests a shift from a downtrend to an uptrend. Web a diamond bottom is a bullish, trend reversal chart pattern. The technical event occurs when. Web written by timothy sykes. This pattern is considered a reversal pattern, indicating a potential change in the prevailing trend. A diamond bottom is formed by two juxtaposed symmetrical triangles, so forming a diamond.

Diamond Chart Pattern Explained Forex Training Group

diamondbottompatternexample Forex Training Group

Diamond Bottom Chart Pattern Definition With Examples

Diamond Bottom Pattern (Updated 2022)

Diamond Bottom Pattern Definition & Examples

Diamond Bottom Chart Pattern Trading charts, Stock trading strategies

Diamond Bottom Pattern (Updated 2022)

Diamond Chart Patterns How to Trade Them? IQ Option Broker Official

Diamond Bottom Pattern Definition & Examples

Diamond Bottom Chart Pattern Definition With Examples

In This Example, Outliers A And B Hide The Diamond Shape.

The Diamond Top And Bottom Chart Patterns Are Classic Reversal Patterns Used In Technical Analysis To Predict The Market’s Trend And End.

The Diamond Chart Pattern Is Actually Two Patterns — Diamond Tops And Diamond Patterns.

A Diamond Bottom Is Formed By Two Juxtaposed Symmetrical Triangles, So Forming A Diamond.

Related Post: