Descending Triangle Stock Pattern

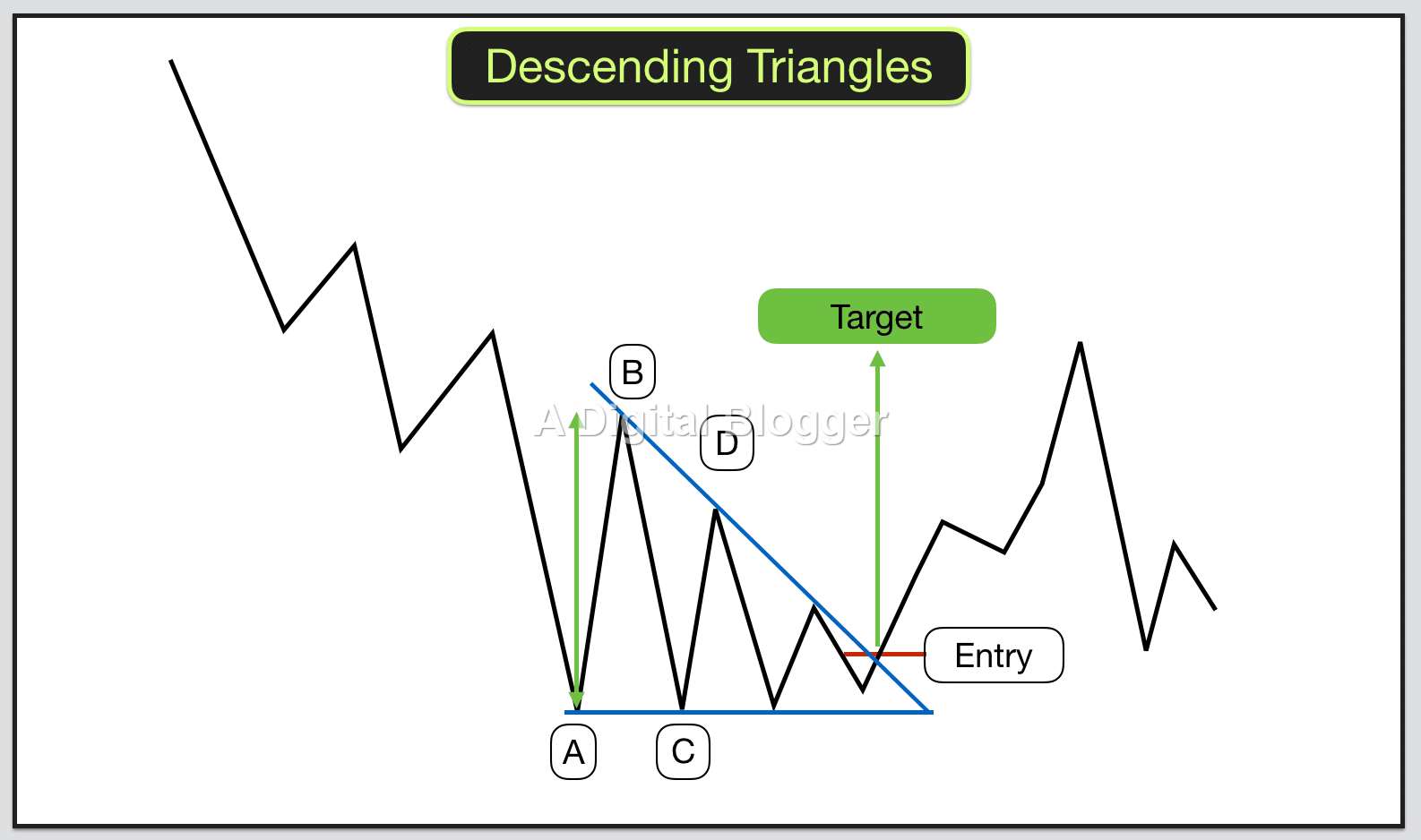

Descending Triangle Stock Pattern - ️ the lower trend line must be a rising trend line. Features that help to identify the ascending triangle: A descending triangle pattern forms in the middle of an already established bearish trend. Less than 1 day ago. To identify this pattern, traders should look for the following key components: Web the descending triangle pattern suggests a potential bearish continuation or reversal in price trends. Web as illustrated below, the descending triangle is a bearish continuation chart pattern. Web the descending triangle is a bearish pattern that is characterized by a descending upper trendline and a flat lower trendline that acts as support. However, it can also occur as a consolidation in an uptrend as well. It typically occurs during a downtrend when sellers are in control, and the pattern signifies a period of consolidation before the. Features that help to identify the ascending triangle: Web the descending triangle is a notable technical analysis pattern that indicates a bearish market. Web a descending triangle is a technical analysis bearish continuation pattern that is caused by a sharp bearish trend in a market followed by a price consolidation and an eventual price breakdown. Web the descending triangle pattern. Web the descending triangle is a bearish pattern that is characterized by a descending upper trendline and a flat lower trendline that acts as support. This pattern indicates that sellers are. It forms during a downtrend as a continuation pattern, characterized by a horizontal line at the bottom formed by comparable lows and a descending trend line at the top. It forms during a downtrend as a continuation pattern, characterized by a horizontal line at the bottom formed by comparable lows and a descending trend line at the top formed by declining peaks. Less than 1 day ago. The lower trendline should be horizontal, connecting. When the pattern forms, it suggests a security’s price will likely continue trending in the. Image by julie bang © investopedia 2019. Web there are basically 3 types of triangles and they all point to price being in consolidation: The lower trendline should be horizontal, connecting. The descending triangle is recognized primarily in downtrends and is often thought of as a bearish signal. Also called a falling triangle pattern, this pattern helps traders identify potential. Web vestinda dec 10, 2023. A descending triangle is an inverted version of the ascending triangle and is considered a breakdown pattern. There is an average price surge of 38% upon breaching resistance levels. As the stock makes a series of lower highs, it will bounce between these two converging trend lines, forming the shape of a triangle tilted down.. Triangle chart patterns offer valuable insights into market dynamics, symbolizing a clash between buyers and sellers within a contracting price range. Web a descending triangle is a technical analysis bearish continuation pattern that is caused by a sharp bearish trend in a market followed by a price consolidation and an eventual price breakdown. You’ll then see a brief period of. A descending triangle is an inverted version of the ascending triangle and is considered a breakdown pattern. Web descending triangles have a falling upper trendline as a result of distribution and are always considered bearish signals. There is an average price surge of 38% upon breaching resistance levels. Web a symmetrical triangle chart pattern is a period of consolidation before. Less than 1 day ago. Scanner guide scan examples feedback. The price action trades in a clear downtrend, as there is a series of the lower lows and lower highs. It is also a versatile pattern — it can show continuation or a reversal. It forms during a downtrend as a continuation pattern, characterized by a horizontal line at the. The sellers, who are in control of the price action, take a temporary pause to consolidate their most recent gains before extending the downtrend lower. It forms during a downtrend as a continuation pattern, characterized by a horizontal line at the bottom formed by comparable lows and a descending trend line at the top formed by declining peaks. Web there. Web the descending triangle pattern suggests a potential bearish continuation or reversal in price trends. It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to be. Web a descending triangle is a technical pattern that indicates a bearish trend. The descending triangle is recognized primarily in. As the stock makes a series of lower highs, it will bounce between these two converging trend lines, forming the shape of a triangle tilted down. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting as resistance and an ascending trend line acting as support) and descending (price is contained by a horizo. Web the descending triangle is a notable technical analysis pattern that indicates a bearish market. Features that help to identify the ascending triangle: Also called a falling triangle pattern, this pattern helps traders identify potential trend reversals or the continuation of a downtrend. Web a descending triangle chart pattern is a bearish pattern that traders and analysts use in price action trading. There is an average price surge of 38% upon breaching resistance levels. Stock passes all of the below filters in cash segment: Web the descending triangle chart pattern is one of the most important and popular chart patterns because it’s simple to understand and exhibits the demand for, or lack thereof in, the stock. It forms during a downtrend as a continuation pattern, characterized by a horizontal line at the bottom formed by comparable lows and a descending trend line at the top formed by declining peaks. Web as illustrated below, the descending triangle is a bearish continuation chart pattern. The pattern usually forms at the end of a downtrend or after a correction to the downtrend. The descending triangle pattern is a type of chart pattern often used by technicians in price action trading. These patterns are often classified as continuation or neutral patterns, suggesting that the price is likely to persist in its existing trend after the pattern concludes. Web descending triangles have a falling upper trendline as a result of distribution and are always considered bearish signals. ️ there should be an existing uptrend in the price.

How To Trade Descending Triangle Chart Pattern TradingAxe

Descending triangle pattern Detailed Guide On How To Master It

Triangle Pattern Characteristics And How To Trade Effectively How To

Descending Triangle Pattern Start Using Descending Triangle in Trading

The Descending Triangle What is it & How to Trade it?

Descending Triangle Pattern 5 Simple Trading Strategies TradingSim

"DESCENDING TRIANGLE (TREND CONTINUATION)" by trader stephenleachman

Descending Triangle Trading Strategy Guide

Triangle Pattern Characteristics And How To Trade Effectively How To

Descending Triangle Chart Pattern Profit and Stocks

️ The Lower Trend Line Must Be A Rising Trend Line.

Web A Descending Triangle Pattern Is Typically Considered A Bearish Continuation Pattern.

It Forms During A Downtrend As A Continuation Pattern, Characterized By A Horizontal Line At The Bottom Formed By Comparable Lows And A Descending Trend Line At The Top Formed By Declining Peaks.

The Descending Triangle Is Recognized Primarily In Downtrends And Is Often Thought Of As A Bearish Signal.

Related Post: