Delta Footprint Charts

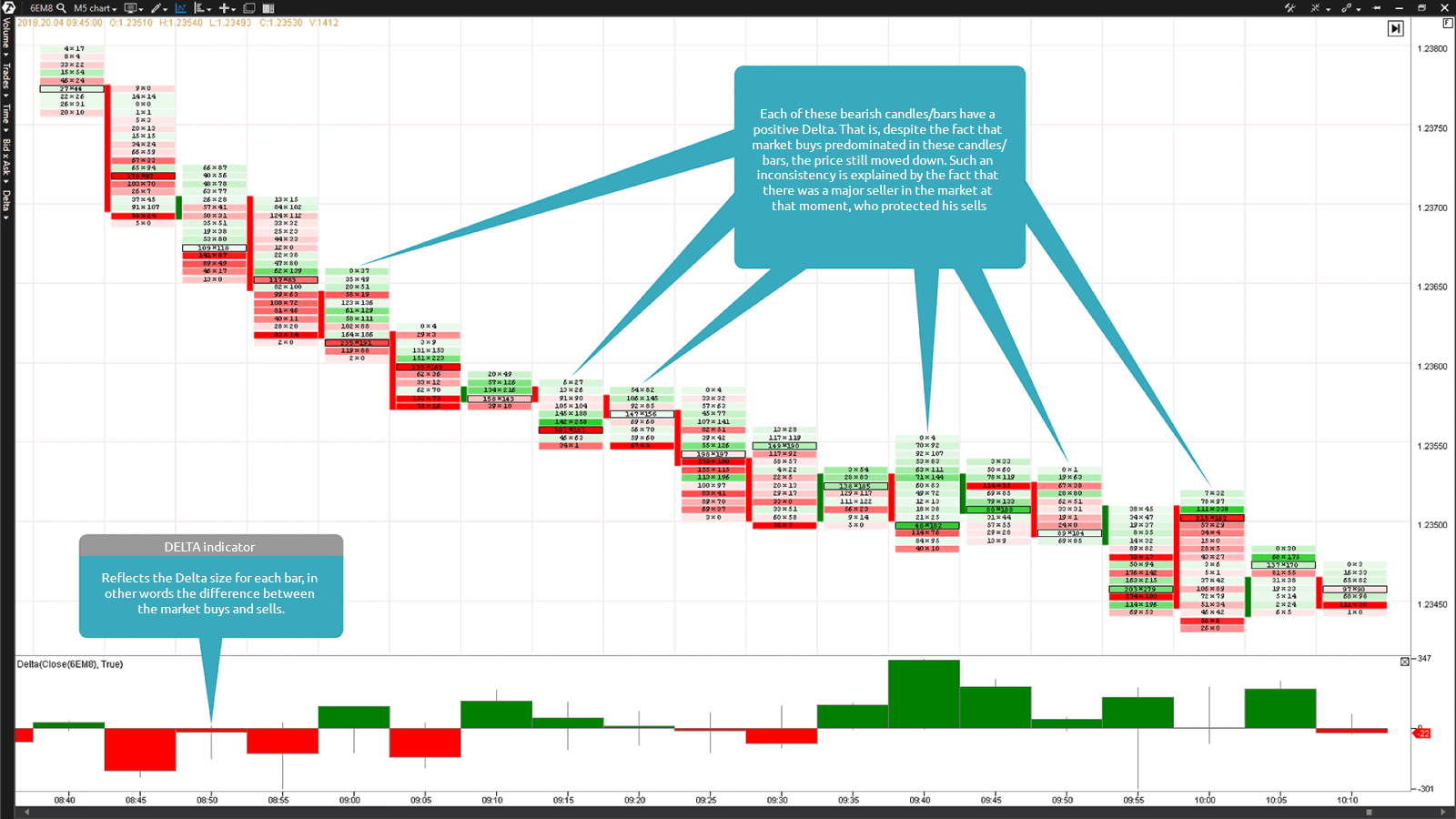

Delta Footprint Charts - Web these patterns suggest a potential reversal in the current trend. They often reveal large hidden orders of bid versus ask. In order for any trade to take place, a market order has to fill a. We’ll start with the bid/ask footprint (seen above),. The bid/ask footprint, delta footprint, and volume footprint. You can choose from three different. Web to use max delta and min delta for order flow analysis in trading, enter trades on strong max delta at swing lows for buy signals and strong min delta at swing highs for sell. It’s calculated by taking the difference of the volume that traded at the offer price and the. Web the footprint chart reflects the positive and negative delta values inside each candle as it can be seen in chart 1. Web this article serves as an introduction to two ways of interpreting delta when daytrading futures instrukments: They look like a shift in market participants’ initiative. If an order is traded on the bid, it means a seller. A negative delta indicates aggressive selling and a larger number of sales at the bid. Web this article serves as an introduction to two ways of interpreting delta when daytrading futures instrukments: In order for any trade to take. They often reveal large hidden orders of bid versus ask. Use this guide to learn more about the various ways to use the. Web there are three primary styles of footprint charts including: A negative delta indicates aggressive selling and a larger number of sales at the bid. The footprint chart provides increased market transparency for active traders and delivers. 3.5k views 7 months ago. exploring the power of footprint charts! 5.1k views 5 months ago. Delta footprint charts are a great way to see absorption taking place in the order flow. Web this article serves as an introduction to two ways of interpreting delta when daytrading futures instrukments: A negative delta indicates aggressive selling and a larger number of sales at the bid. The delta footprint displays positive or negative values. It’s calculated by taking the difference of the volume that traded at the offer price and the. Web chart settings > select your active footprint layer > toggle: Jigsaw daytradr charts beta 7 is out now. Web footprint is a type of the chart where you can see sum of the traded volumes at a specified price for a certaing period. You can choose from three different. Delta footprint charts are a great way to see absorption taking place in the order flow. Web there are three primary styles of footprint charts including: Web to use. We would also like to introduce you to our second forex tool. 5.1k views 5 months ago. Traders will see the delta data at every price level in such clusters. Web the footprint chart reflects the positive and negative delta values inside each candle as it can be seen in chart 1. Web marketdelta® offers unique tools and analytics to. Discover the benefits of #footprintcharts for traders. We would also like to introduce you to our second forex tool. It’s calculated by taking the difference of the volume that traded at the offer price and the. Data, charting, & trading in a single platform. Web there are three primary styles of footprint charts including: Web footprint is a type of the chart where you can see sum of the traded volumes at a specified price for a certaing period. Web marketdelta® offers unique tools and analytics to empower the trader to see more, do more, and make more. In order for any trade to take place, a market order has to fill a. Web. They often reveal large hidden orders of bid versus ask. Peter davies / 1 min read. Web the footprint chart display modes in the form of delta. Web footprint is a type of the chart where you can see sum of the traded volumes at a specified price for a certaing period. This is often observed through color changes (delta). You can choose from three different. 3.5k views 7 months ago. This is often observed through color changes (delta) on. Web the footprint chart reflects the positive and negative delta values inside each candle as it can be seen in chart 1. They often reveal large hidden orders of bid versus ask. Web to use max delta and min delta for order flow analysis in trading, enter trades on strong max delta at swing lows for buy signals and strong min delta at swing highs for sell. It’s calculated by taking the difference of the volume that traded at the offer price and the. 3.5k views 7 months ago. If an order is traded on the bid, it means a seller. Web footprint charts provides information about traded contracts in high detail. Discover the benefits of #footprintcharts for traders. They look like a shift in market participants’ initiative. Data, charting, & trading in a single platform. The delta footprint helps traders confirm that a. In order for any trade to take place, a market order has to fill a. This is often observed through color changes (delta) on. You can see if orders are traded on the bid or ask. The delta footprint displays positive or negative values. They often reveal large hidden orders of bid versus ask. 5.1k views 5 months ago. We would also like to introduce you to our second forex tool.

Swing Charts, Cumulative Delta, Footprint charts on MultiCharts YouTube

Strategy of using the footprint through the example of a currency futures

Stock Market Analysis Delta Footprint Charts

Todays AMP Futures Webinar Understanding Market Delta Footprint Charts

The Ultimate Guide To Profiting From Footprint Charts

How to View Cumulative Delta on a Footprint Chart YouTube

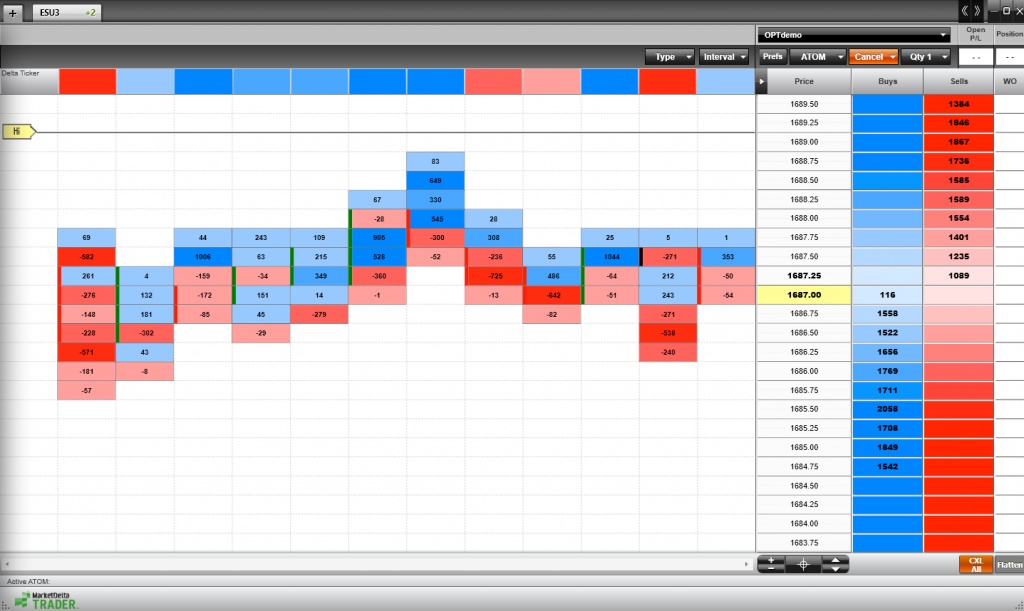

FootPrint® Charting Introduction Market Delta Optimus Futures

Footprint charts in XTick software

Delta and Cumulative Delta how could they help a day trader?

Footprint Charts The Complete Trading Guide

Web The Footprint Chart Display Modes In The Form Of Delta.

Use This Guide To Learn More About The Various Ways To Use The.

Web Marketdelta® Offers Unique Tools And Analytics To Empower The Trader To See More, Do More, And Make More.

Web There Are Three Primary Styles Of Footprint Charts Including:

Related Post: