Debt Snowball Spreadsheet Printable

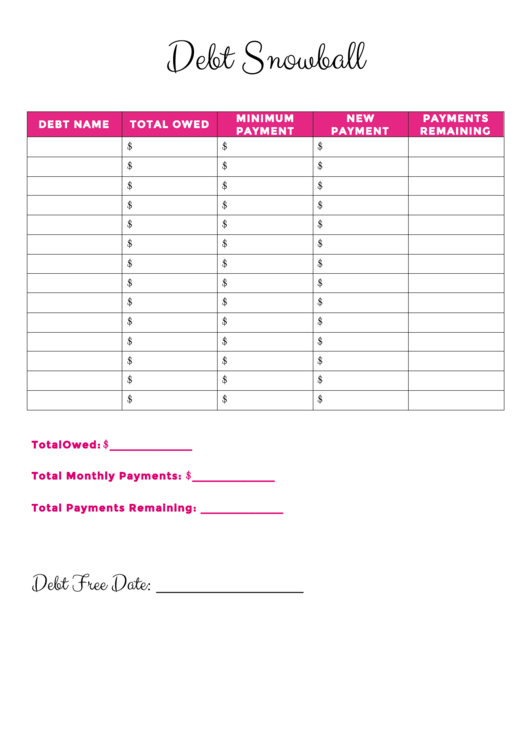

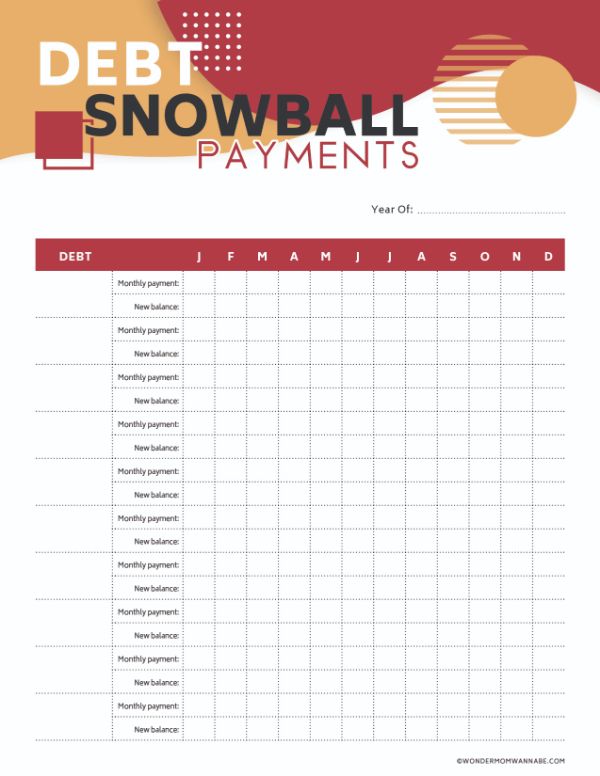

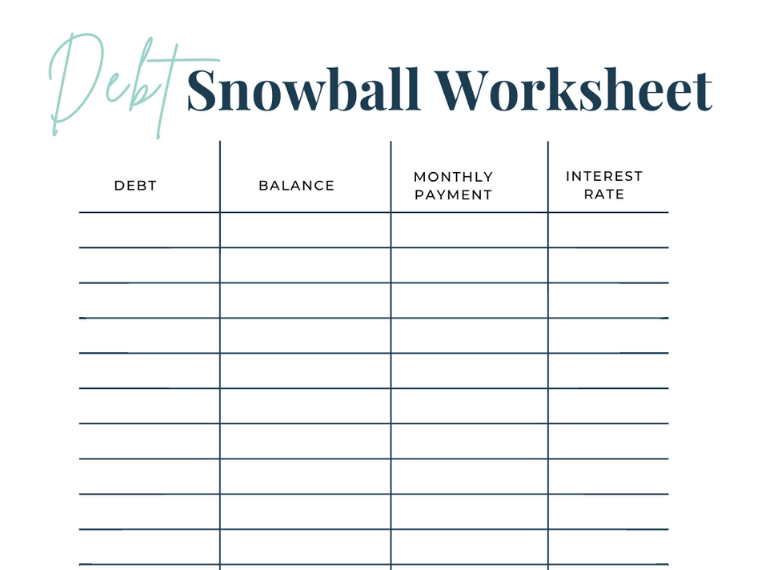

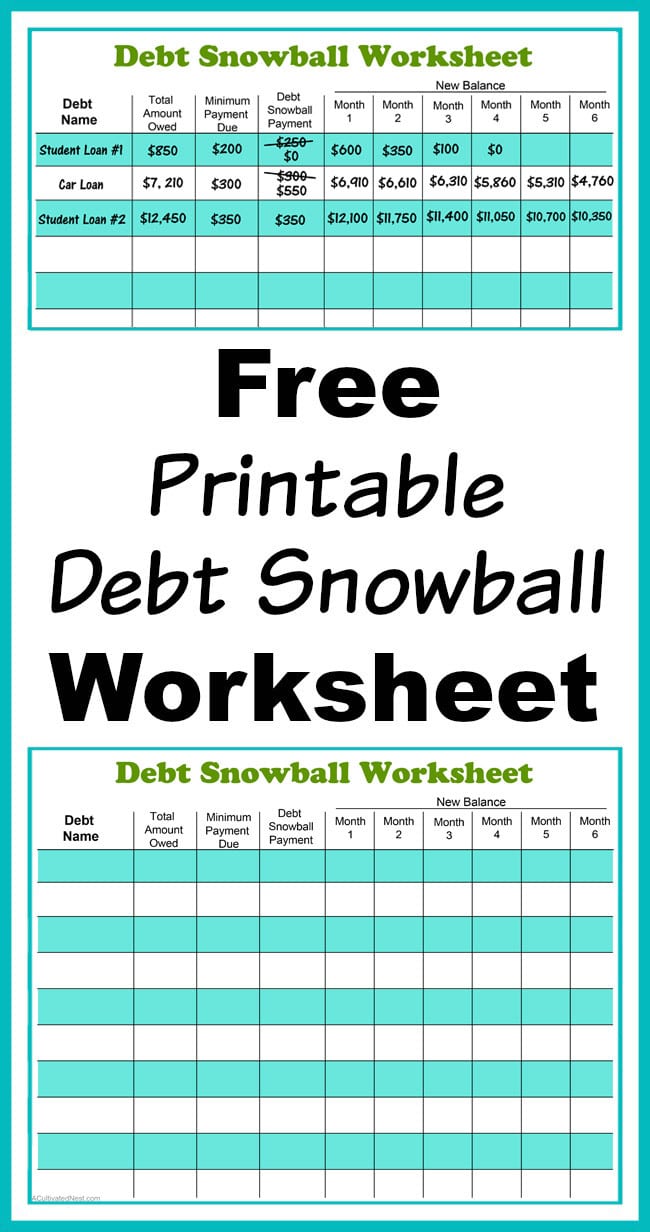

Debt Snowball Spreadsheet Printable - Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. We can’t help but recommend our own debt snowball worksheet ( you can download it for free here) as a great option if you’re looking to track your debt payoff journey. Web the debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. You will also include your monthly payment and the amounts you have paid on it each month. 2.1 this method will build momentum as time goes by; Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. In the first worksheet, you enter your creditor information and your total monthly payment. Write down the amount you plan to pay on that debt each month. Web this free printable debt snowball worksheet is pretty easy to use. However, on debt 1, you would pay the minimum payment plus an additional $740. Web all you need to do is download and print the debt snowball tracker worksheets. Web the site even has a printable debt thermometer template. The second credit card is $9,000 at 9% interest. Follow the steps below to set one up on your own. 4 how does the snowball method for paying off. The note on line 3 mentions that you only need to input values in cells marked yellow. In month one, you would pay the minimum payments to debts 2, 3, and 4. Pay the minimum payment on every debt except the sma llest. This process works, and you can see how effective it is on our printable guide. This spreadsheet. 2 the benefits of using the debt snowball method. Web spreadsheet budget excel worksheet template compensation printable calculator ramsey snowball debt insurance contents dave baseball students team income rental blank rental income calculation worksheet and rent collection spreadsheet newincome worksheet fannie mae calculation form fillable pdffiller calculation income. I have the perfect worksheet to help you with this step. On. Pay the minimum payment on every debt except the sma llest. Web debt snowball illustration & free printable debt payoff worksheet pdf. List the balance, interest rate, and minimum payment. Tagged debt payoff debt snowball f6f5f0 google sheets templates microsoft excel template. This debtbuster worksheet works best if you put the smallest debt at the top of the list and. $1,000 ($50 minimum payment) + $740. This variety of debt trackers also includes ones for car loans, credit card debt, mortgages, student loans, and blank ones that allow a variety of debt sources to. With the snowball method, you always start with the lowest payment first. Put any extra dollar amount into your smallest debt until it is paid off.. With the snowball method, you always start with the lowest payment first. However, on debt 1, you would pay the minimum payment plus an additional $740. Pay the minimum payment for all your debts except for the smallest one. The note on line 3 mentions that you only need to input values in cells marked yellow. On the left you. Web here’s how the debt snowball works: 4 how does the snowball method for paying off. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. The second credit card is $9,000 at 9% interest. Web debt snowball spreadsheet instructions 1. The vertex42 debt snowball spreadsheet includes a snowball calculator and a payment schedule feature so you can design several debt. Repeat until each debt is paid in full. Web this free printable debt snowball worksheet is pretty easy to use. $1,000 ($50 minimum payment) + $740. Pay as much as possible on your smallest debt. We can’t help but recommend our own debt snowball worksheet ( you can download it for free here) as a great option if you’re looking to track your debt payoff journey. $1,000 ($50 minimum payment) + $740. There are tons of ways to pay off debt, but i would argue that this method is the most successful. Web the first. Pay as much money as possible to the smallest debt. Web the first free printable debt snowball worksheet is a tracking sheet. This is the exact debt snowball form that we used to get out debt in that short period of time. Web debt snowball illustration & free printable debt payoff worksheet pdf. This process works, and you can see. On the second page is a debt tracker that lets you record your. Pay the minimum payment on every debt except the sma llest. Pay as much as possible on your smallest debt. Web now to see it in action, assume the following is your debt snowball strategy. I have the perfect worksheet to help you with this step. Web debt snowball spreadsheet instructions 1. The first page in the kit is the debt snowball payments page. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. However, on debt 1, you would pay the minimum payment plus an additional $740. When you pay off the smallest debt, add that minimum payment amount to your next smallest debt payment. Web debt snowball illustration & free printable debt payoff worksheet pdf. The set includes a debt overview sheet, a debt payoff tracking sheet, and a debt thermometer to give you a visual of your progress as you. In the first worksheet, you enter your creditor information and your total monthly payment. Do the same for the second smallest debt untill that one is paid off as well. This spreadsheet includes additional information about. Write down the amount you plan to pay on that debt each month.

Free Printable Snowball Debt Spreadsheet Printable World Holiday

38 Debt Snowball Spreadsheets, Forms & Calculators

Debt Snowball Tracker Printable Debt Free Chart Debt Payoff Etsy Israel

Free Printable Debt Snowball Worksheet Printable Templates

![]()

10 Free Debt Snowball Worksheet Printables to Help You Get Out Of Debt

Free Printable Debt Snowball Worksheet To Payoff Debt In 2022

Debt Snowball Tracker Printable Debt Payment Worksheet Debt Payoff

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/05/debt-snowball-excel.jpg?gid=443)

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball.jpg)

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Free Printable Debt Snowball Worksheet Pay Down Your Debt —

Web Creditor Starting Balance Minimum Payment Date Payment Balance Creditor Starting Balance Minimum Payment Date Payment Balance Creditor Starting Balance

The Second Credit Card Is $9,000 At 9% Interest.

Web The First Free Printable Debt Snowball Worksheet Is A Tracking Sheet.

This Variety Of Debt Trackers Also Includes Ones For Car Loans, Credit Card Debt, Mortgages, Student Loans, And Blank Ones That Allow A Variety Of Debt Sources To.

Related Post: