Cup With Handle Pattern Chart

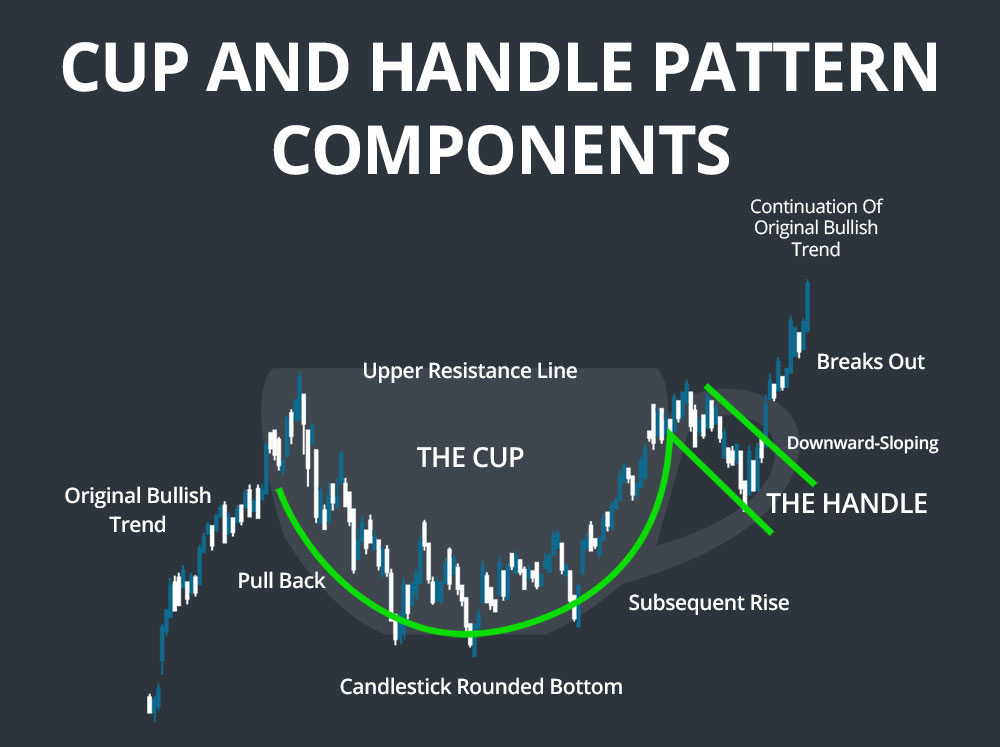

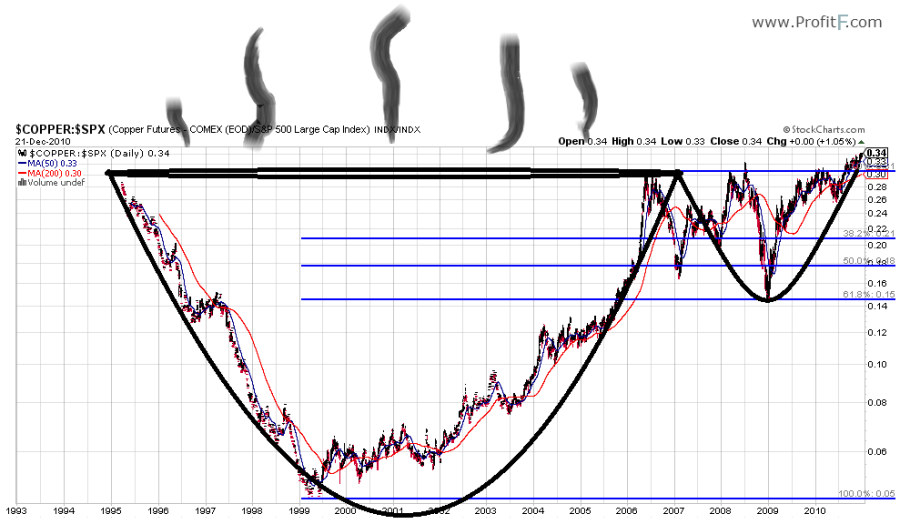

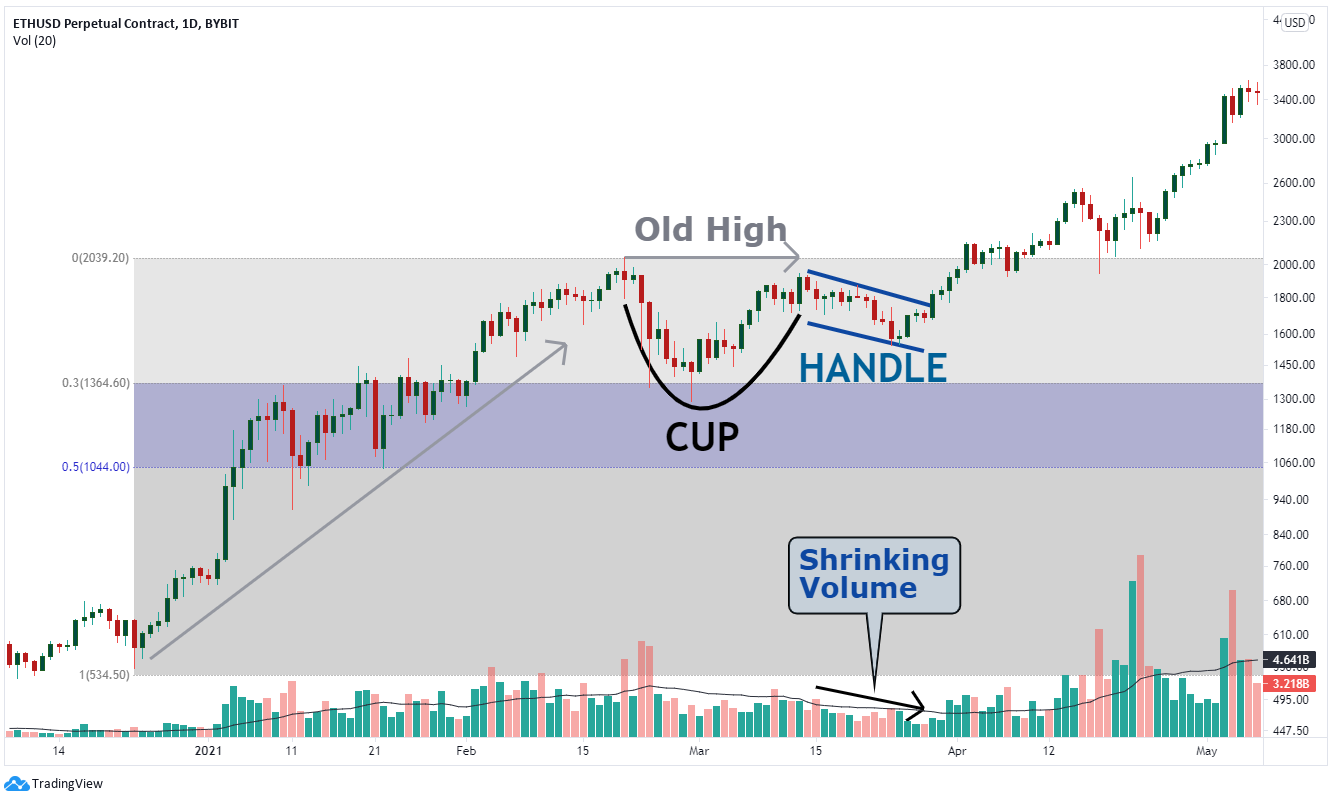

Cup With Handle Pattern Chart - It starts when a stock’s price runs up at least 30%. This is characterized by a gradual decline in price, followed by a rounded bottom and a subsequent increase in price. The price drop in a proper handle should be within 12% of its peak. The cup looks like a “u” or a bowl with a. The entire pattern can be anywhere between 1 month to a little more than year. This uptrend must happen before the cup base’s construction. As its name implies, there are two parts to the pattern—the cup and the handle. The cup forms after an advance and looks like a bowl or rounding bottom. Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example, a cup and handle. The cup pattern happens first and then a handle happens next. It´s one of the easiest patterns to identify. It is a bullish continuation pattern that marks a pause (sideways trend) in the bullish trend. In the cup base, the high was 134.10 and the low was 92.80. Sometimes it forms within a few days, but it can take up to a year for the pattern to fully form. A cup. The cup forms after an advance and looks like a bowl. As the name suggests, the pattern is made up of two sections; There are two parts to the pattern: Web cup and handle chart pattern. Almost a quarter (23%) of cup with handles see price rise no more than 15% before dropping. It is a bullish continuation pattern that marks a pause (sideways trend) in the bullish trend. Sometimes it forms within a few days, but it can take up to a year for the pattern to fully form. The cup looks like a “u” or a bowl with a. Web after an upward breakout from a cup with handle chart pattern,. Sometimes it forms within a few days, but it can take up to a year for the pattern to fully form. The price drop in a proper handle should be within 12% of its peak. As its name implies, the pattern consists of two parts — the cup and the handle. In the cup base, the high was 134.10 and. Firstly, it does not occur within a specific timeframe. Web this decline along the handle should take at least a week on a weekly chart, but it could go on for weeks. As its name implies, there are two parts to the pattern—the cup and the handle. Web the cup and handle chart pattern does have a few limitations. In. The price drop in a proper handle should be within 12% of its peak. The entire pattern can be anywhere between 1 month to a little more than year. The cup looks like a “u” or a bowl with a. Sometimes it forms within a few days, but it can take up to a year for the pattern to fully. A cup and handle can be used as an entry pattern for the continuation of an established bullish trend. Secondly, you need to learn to identify the length and depth of a true cup and handle, as there can be false signals. After forming the cup, price pulls back to about ⅓ of the cups advance, forming the. The first. It starts when a stock’s price runs up at least 30%. Web to identify the cup and handle pattern, traders should keep an eye out for the following key elements: The cup forms after an advance and looks like a bowl. This chart pattern is shaped like and resembles like a cup and handle that's why its named the same. Cup and handle pattern rules: This is characterized by a gradual decline in price, followed by a rounded bottom and a subsequent increase in price. As its name implies, there are two parts to the pattern—the cup and the handle. The cup pattern happens first and then a handle happens next. Eventually, the stock finds a floor of support for. The cup looks like a “u” or a bowl with a. The cup is shaped as a u and the handle has a slight downward drift. Web cup and handle. Web the cup and handle chart pattern does have a few limitations. A cup and handle pattern on bar charts resembles its namesake, a cup with a handle. Web let's take the cup with handle fashioned by baidu (see the chart below) in 2007. Web the cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. The cup and the handle. The cup forms after an advance and looks like a bowl. A cup and handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout. Web this decline along the handle should take at least a week on a weekly chart, but it could go on for weeks. Web to identify the cup and handle pattern, traders should keep an eye out for the following key elements: It is a bullish continuation pattern that marks a pause (sideways trend) in the bullish trend. The cup looks like a “u” or a bowl with a. A cup and handle pattern on bar charts resembles its namesake, a cup with a handle. This is characterized by a gradual decline in price, followed by a rounded bottom and a subsequent increase in price. Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example, a cup and handle. After the cup with handle confirmed as a valid chart pattern, valaris (val) coughed up a fur ball at a. It´s one of the easiest patterns to identify. Eventually, the stock finds a floor of support for weeks or longer before climbing again. The pattern happens when bulls are overpowered by bears in.

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup And Handle Pattern How To Verify And Use Efficiently How To

Trading the Cup and Handle Chart pattern

Cup and handle chart pattern How to trade the cup and handle IG UK

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup and Handle Patterns Comprehensive Stock Trading Guide

.png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Web After An Upward Breakout From A Cup With Handle Chart Pattern, 47% Of The Time, The Stock Retraces Significantly.

The Entire Pattern Can Be Anywhere Between 1 Month To A Little More Than Year.

The Cup Forms After An Advance And Looks Like A Bowl Or Rounding Bottom.

Sometimes It Forms Within A Few Days, But It Can Take Up To A Year For The Pattern To Fully Form.

Related Post: