Cup Handle Chart Pattern

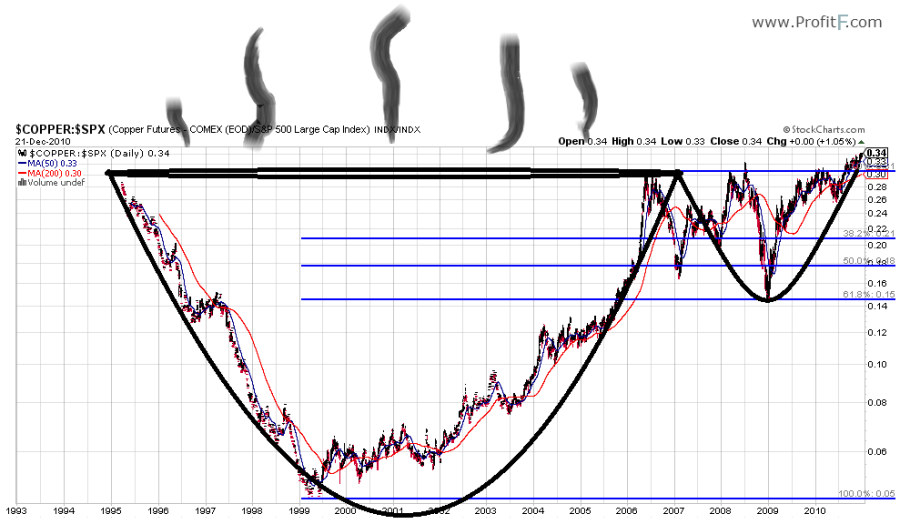

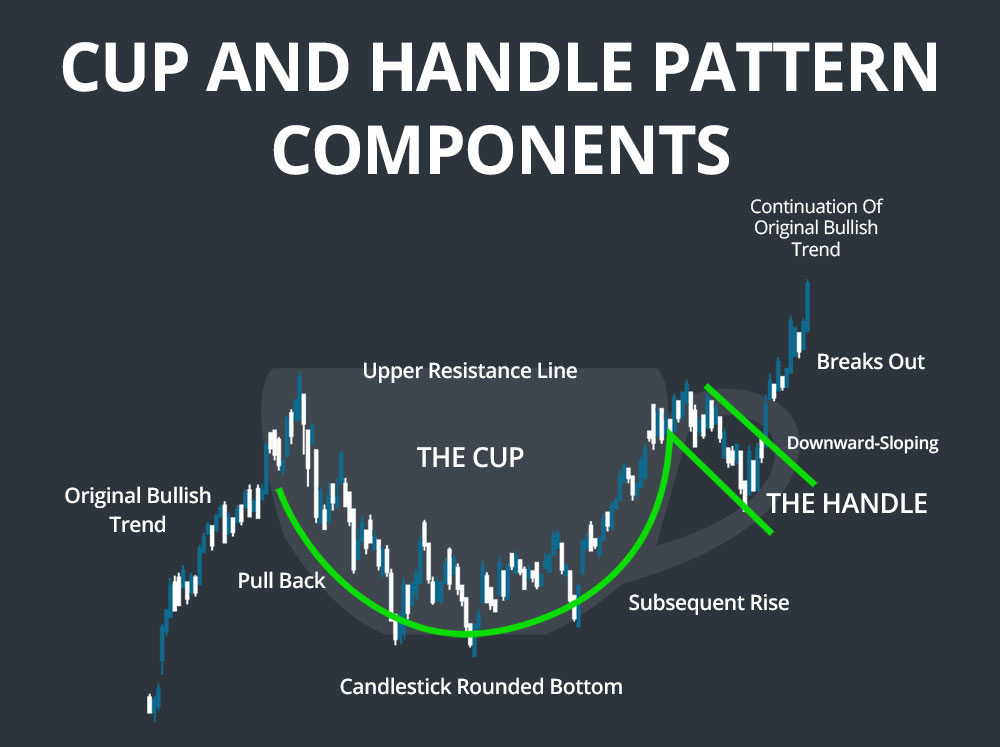

Cup Handle Chart Pattern - The cup and handle chart pattern does have a few limitations. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. It gets its name from the tea cup shape of the pattern. He had clear criteria defining this pattern. 11 chart patterns for trading symmetrical triangle. As its name implies, the pattern consists of two parts — the cup and the handle. The figure on the right shows an example of a cup with handle chart pattern. Web in order to prevent a false signal, it’s important to receive cup and handle pattern confirmation before buying. Web the cup and handle is a popular technical analysis chart pattern that has been used by traders for many years. Web a cup and handle can be used as an entry pattern for the continuation of an established bullish trend. It is important to note that like all technical analysis patterns, the cup and handle pattern is not a guarantee of future price movements and should be used in conjunction with other analysis. The cup and handle pattern is a pattern that traders use to identify whether the price of an asset will continue moving upwards. The handle — a. As its name implies, the pattern consists of two parts — the cup and the handle. Web the cup and handle pattern strategy is a formation on the price chart of an asset that resembles a cup with a handle. The cup and handle is a technical chart pattern. The cup and the handle. It was developed by william o'neil. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. Learn how to trade this pattern to improve your odds of making profitable trades. It is important to note that like all technical analysis patterns, the cup and handle pattern is not a guarantee of future price movements and should be used. Web which chart pattern is best for trading? As the name suggests, the pattern is made up of two sections; Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. After forming the cup, price pulls back to about ⅓ of the cups advance, forming the handle. Web in order to. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. Web one such chart pattern that has proven to be powerful for financial traders is the cup and handle pattern. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled. Web a cup and handle chart pattern consists of five basic components. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. The cup forms after an advance and looks like a bowl or rounding bottom. Web a cup and handle is a bullish technical price pattern that appears in the shape of. Learn how it works with an example, how to identify a. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Web a cup and handle chart pattern consists of five basic components. The cup and handle pattern is a pattern that traders use to identify. Web which chart pattern is best for trading? The cup and handle is a technical chart pattern. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. It is a bullish pattern that indicates a potential trend reversal or continuation of an upward trend. Web a cup and handle chart. As its name implies, there are two parts to the pattern—the cup and the handle. He had clear criteria defining this pattern. It gets its name from the tea cup shape of the pattern. The cup pattern happens first and then a handle happens next. After forming the cup, price pulls back to about ⅓ of the cups advance, forming. As its name implies, the pattern consists of two parts — the cup and the handle. It gets its name from the tea cup shape of the pattern. The cup and handle pattern is a pattern that traders use to identify whether the price of an asset will continue moving upwards. As the name suggests, the pattern is made up. I’ll cover that in this post. It was first defined by william o’neil in his classic book “how to make money in stocks.” o’neil called it a “cup with handle” pattern. How to become a professional trader : What is the cup and handle pattern? It is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web in order to prevent a false signal, it’s important to receive cup and handle pattern confirmation before buying. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. The cup forms after an advance and looks like a bowl or rounding bottom. The cup — the market show signs of bottoming as it has bounced off the lows and is making higher highs towards resistance. It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. There are 2 parts to it: It gets its name from the tea cup shape of the pattern. Web the cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. As the name suggests, the pattern is made up of two sections; The cup and handle pattern is a pattern that traders use to identify whether the price of an asset will continue moving upwards..png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup And Handle Pattern How To Verify And Use Efficiently How To

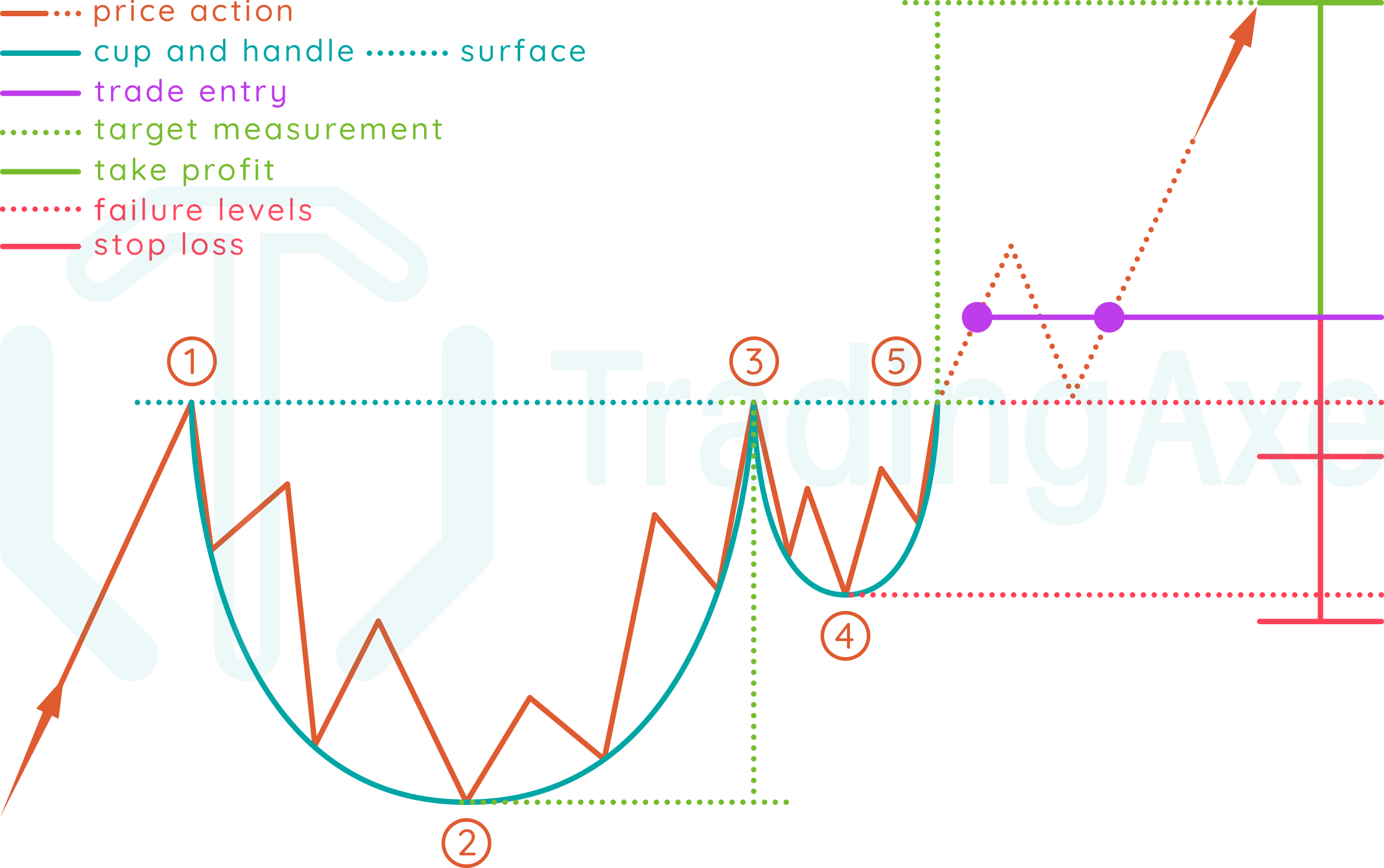

How To Trade Cup And Handle Chart Pattern TradingAxe

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup And Handle Pattern How To Verify And Use Efficiently How To

Trading the Cup and Handle Chart pattern

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and handle chart pattern How to trade the cup and handle IG UK

The Rise Leading To The Cup With Handle Begins At C And Reaches The Left Cup Lip At Point A.

The Handle Will Typically Form A Descending Trendline.

The Figure On The Right Shows An Example Of A Cup With Handle Chart Pattern.

The Cup And Handle Chart Pattern Is Considered Reliable Based On 900+ Trades, With A 95% Success Rate In Bull Markets.

Related Post: