Cup And Handle Pattern

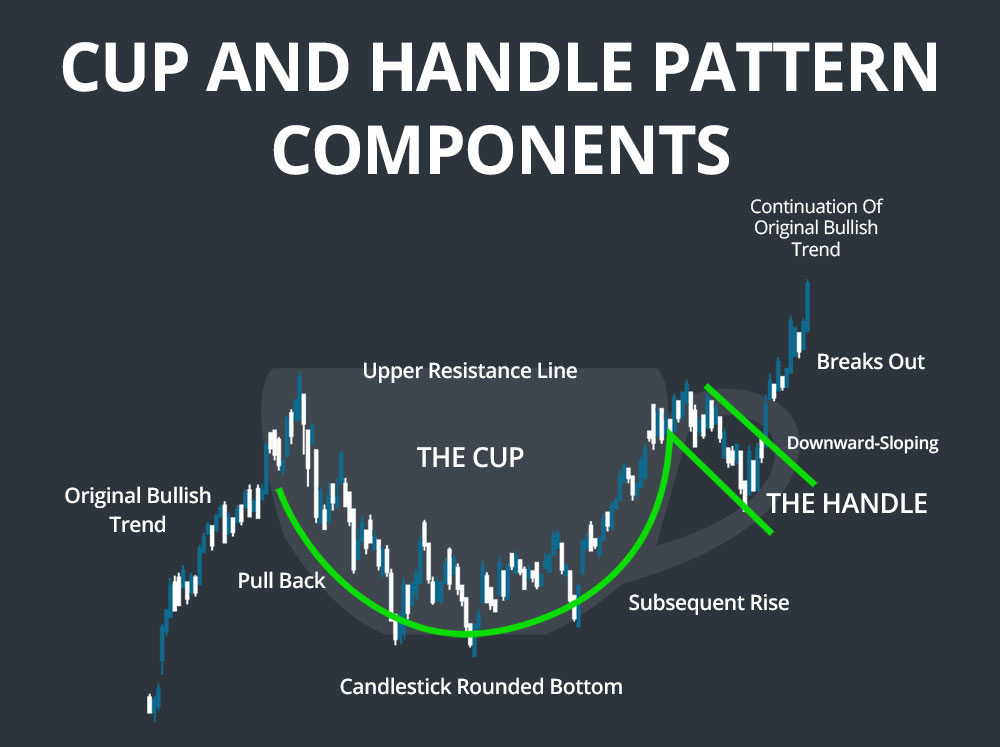

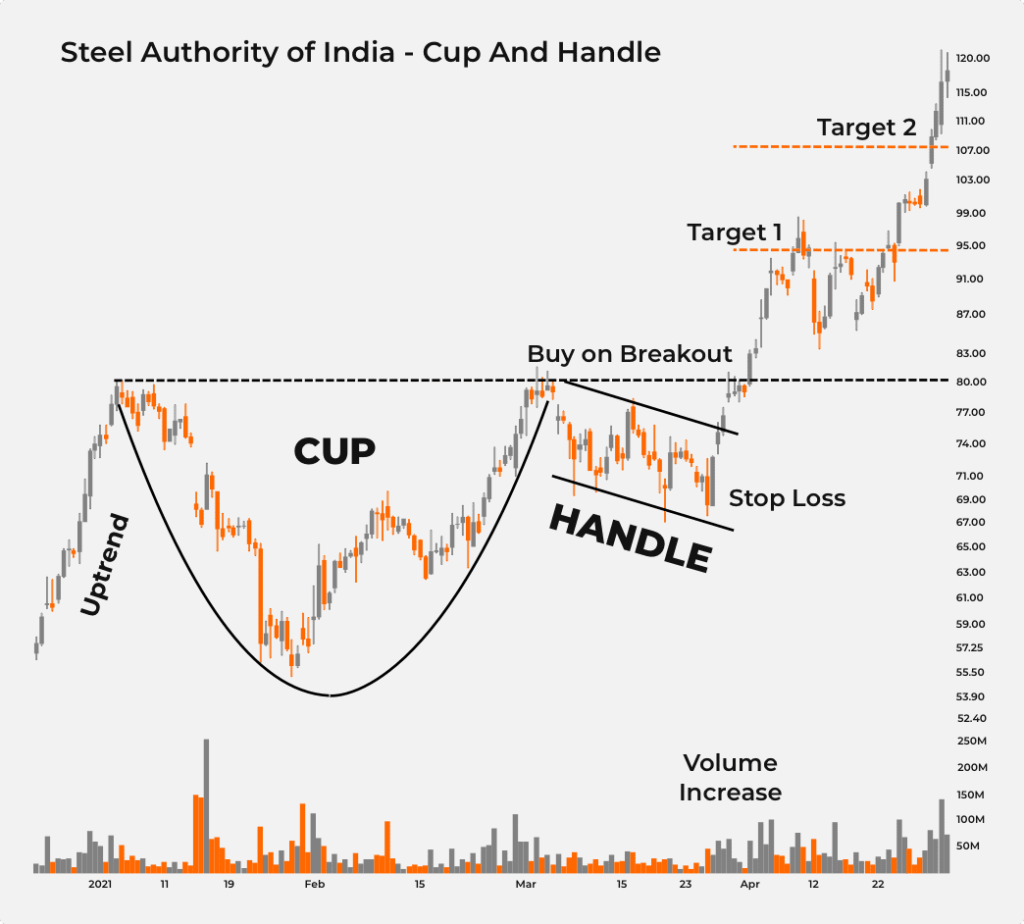

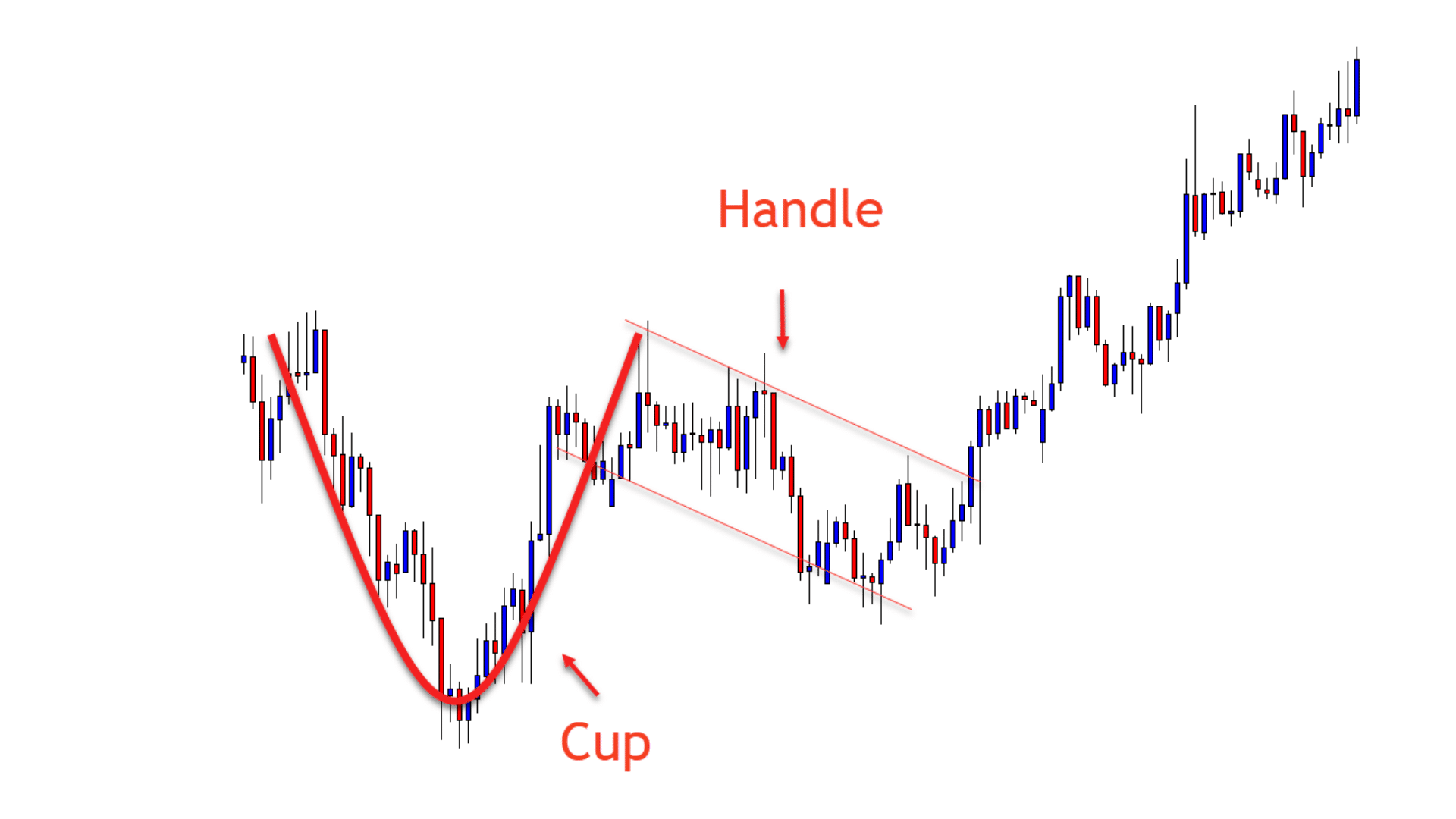

Cup And Handle Pattern - An inverse cup and handle pattern forms with the bottom of the. The cup forms after an advance and looks like a bowl. The cup forms after an advance and looks like a bowl or rounding bottom. It starts when a stock’s price runs up at least 30%. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. Eventually, the stock finds a floor of support for weeks or longer before climbing again. Web the standard cup and handle pattern is a bullish signal, but there is also a bearish version of this pattern called “inverse cup and handle” pattern. Web cup and handle chart patterns can last anywhere from seven to 65 weeks. It topped out at $41.66 in april and pulled back to the 38.6% retracement of the last trend leg. As its name implies, there are two parts to the pattern—the cup and the handle. There are two parts to the pattern: Web a cup and handle can be used as an entry pattern for the continuation of an established bullish trend. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. It´s one of the easiest patterns to identify. An inverse cup and handle pattern forms. An inverse cup and handle pattern forms with the bottom of the. The cup is shaped as a u and the handle has a slight downward drift. Web cup and handle chart patterns can last anywhere from seven to 65 weeks. This uptrend must happen before the cup base’s construction. A cup and handle pattern on bar charts resembles its. Web a cup and handle can be used as an entry pattern for the continuation of an established bullish trend. Web the standard cup and handle pattern is a bullish signal, but there is also a bearish version of this pattern called “inverse cup and handle” pattern. It was developed by william o'neil and introduced in his 1988 book, how. Web the cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web the standard cup and handle pattern is a bullish signal, but there is also a bearish version of this pattern called “inverse cup and handle” pattern. A cup and handle pattern on bar charts resembles its namesake, a cup with. It´s one of the easiest patterns to identify. After forming the cup, price pulls back to about ⅓ of the cups advance, forming the handle. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web the cup with handle is a bullish continuation pattern that marks a consolidation period. The cup forms after an advance and looks like a bowl or rounding bottom. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. A cup and handle pattern on bar charts resembles its namesake, a cup with a handle. It was developed by william o'neil and introduced in his. The cup and the handle. The cup is shaped as a u and the handle has a slight downward drift. The cup forms after an advance and looks like a bowl. Eventually, the stock finds a floor of support for weeks or longer before climbing again. It topped out at $41.66 in april and pulled back to the 38.6% retracement. Web cup and handle: The cup is shaped as a u and the handle has a slight downward drift. A cup and handle pattern on bar charts resembles its namesake, a cup with a handle. It topped out at $41.66 in april and pulled back to the 38.6% retracement of the last trend leg. It starts when a stock’s price. The cup and the handle. Web cup and handle chart patterns can last anywhere from seven to 65 weeks. It topped out at $41.66 in april and pulled back to the 38.6% retracement of the last trend leg. This uptrend must happen before the cup base’s construction. The cup forms after an advance and looks like a bowl. The cup forms after an advance and looks like a bowl or rounding bottom. This uptrend must happen before the cup base’s construction. It starts when a stock’s price runs up at least 30%. There are two parts to the pattern: Web a cup and handle can be used as an entry pattern for the continuation of an established bullish. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. As its name implies, there are two parts to the pattern—the cup and the handle. The cup and the handle. This uptrend must happen before the cup base’s construction. It´s one of the easiest patterns to identify. Web the standard cup and handle pattern is a bullish signal, but there is also a bearish version of this pattern called “inverse cup and handle” pattern. It starts when a stock’s price runs up at least 30%. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. Web cup and handle chart patterns can last anywhere from seven to 65 weeks. The cup is shaped as a u and the handle has a slight downward drift. Web the cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. It topped out at $41.66 in april and pulled back to the 38.6% retracement of the last trend leg. Web cup and handle: Eventually, the stock finds a floor of support for weeks or longer before climbing again. The cup forms after an advance and looks like a bowl. A cup and handle pattern on bar charts resembles its namesake, a cup with a handle.

Cup and Handle Pattern Trading Strategy Guide Synapse Trading

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Pattern How to Identify and Trade It?

.png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup and Handle Pattern How to Find and Trade

Master the Cup and Handle Pattern Simple 10Step Checklist for

Web A Cup And Handle Can Be Used As An Entry Pattern For The Continuation Of An Established Bullish Trend.

An Inverse Cup And Handle Pattern Forms With The Bottom Of The.

The Cup Forms After An Advance And Looks Like A Bowl Or Rounding Bottom.

There Are Two Parts To The Pattern:

Related Post: