Cup And Handle Pattern Target

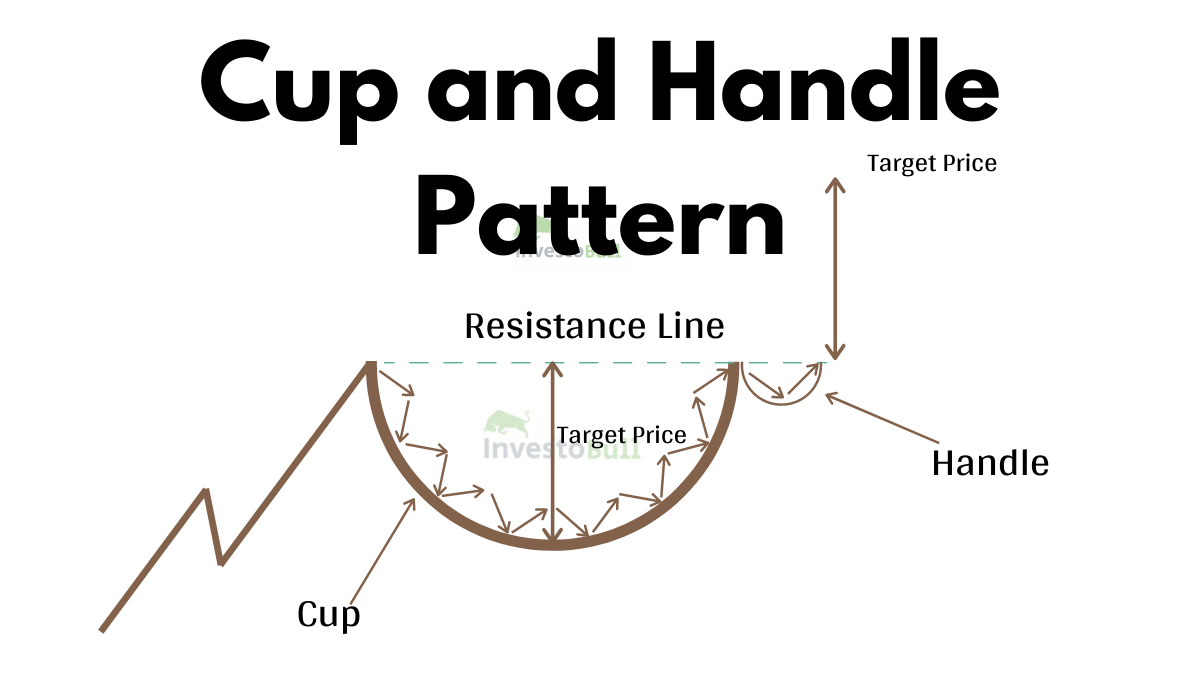

Cup And Handle Pattern Target - With 61% of cup and handle pattern trades reaching the average price target, this is a good trading setup. Web the cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Eventually, the stock finds a floor of support for weeks or longer before climbing again. If the cup had the depth that brought a 2% downfall in the price. Web what is the target for cup and handle pattern. There are two parts to the pattern: Web a cup and handle can be used as an entry pattern for the continuation of an established bullish trend. Learn how to trade this pattern to improve your odds of making profitable trades. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. In the easiest words, the target in a cup and handle pattern is equivalent to the depth of the cup. Eventually, the stock finds a floor of support for weeks or longer before climbing again. Learn how to trade this pattern to improve your odds of making profitable trades. For example, if the buy entry price is $30 and the height of the pattern high and low is $10,. Then, the trader should target a 2% up move in the. Web a trader using the cup and handle pattern would ideally set up a long position once the price breaks above the $50 resistance line, following the completion of the handle. Web how to success in swing trading?cup and handle chart pattern is one of the best price action patterns for swing trading forex.learn how to identify bullish a. Web. The trader can set a target price for selling by adding the depth of the cup to the breakout point. For example, if the cup forms between $100 and $99 and the breakout point is $100, the target is $101. Web a trader using the cup and handle pattern would ideally set up a long position once the price breaks. However, the pattern can also form a bullish reversal pattern at the end of a downtrend. Web a trader using the cup and handle pattern would ideally set up a long position once the price breaks above the $50 resistance line, following the completion of the handle. The cup looks like a “u” or a bowl with a rounded bottom.. Web cup and handle: For example, if the buy entry price is $30 and the height of the pattern high and low is $10,. Web the presence of a cup and handle pattern is a strong technical indication of a bullish continuation and is one of the easier trading patterns to spot on a chart with clearly defined entry, stop. These patterns are nothing but simple tools that work in understanding trading through technical analysis. It´s one of the easiest patterns to identify. Then, the trader should target a 2% up move in the price from the breakout point at the neckline. The cup and handle pattern is made up of two parts: Web cup and handle: The cup forms after an advance and looks like a bowl or rounding bottom. Web what is the target for cup and handle pattern. For example, if the buy entry price is $30 and the height of the pattern high and low is $10,. Web cup and handle: Measure the height from the right cup lip (a) to the lowest. Then, the trader should target a 2% up move in the price from the breakout point at the neckline. Web the cup — the market show signs of bottoming as it has bounced off the lows and is making higher highs towards resistance. Learn how it works with an example, how to identify a target. It is used to identify. If the cup had the depth that brought a 2% downfall in the price. In the easiest words, the target in a cup and handle pattern is equivalent to the depth of the cup. Then, the trader should target a 2% up move in the price from the breakout point at the neckline. Today in this article, we will talk. We can go short at the breakout of the handle’s structure with a protective stop above the handle’s high. If the cup had the depth that brought a 2% downfall in the price. The trader can set a target price for selling by adding the depth of the cup to the breakout point. Avoid pattern trading in cups and handles. The cup and handle is reliable and accurate but can be difficult to identify. Web cup and handle: Web cup and handle pattern example. For example, if the cup forms between $100 and $99 and the breakout point is $100, the target is $101. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. After forming the cup, price pulls back to about ⅓ of the cups advance, forming the handle. That figure is the price target. The trader can set a target price for selling by adding the depth of the cup to the breakout point. People who read this also viewed: Web profit target for the cup and handle pattern. Web the cup — the market show signs of bottoming as it has bounced off the lows and is making higher highs towards resistance. With 61% of cup and handle pattern trades reaching the average price target, this is a good trading setup. Web list of important points. If the cup had the depth that brought a 2% downfall in the price. A cup and handle pattern on bar charts resembles its namesake, a cup with a handle. The cup and handle pattern is made up of two parts::max_bytes(150000):strip_icc()/CupandHandleDefinition1-c721e47fd1f7451997d0d5d941f6e174.png)

Cup and Handle Pattern How to Trade and Target with an Example

Cup and Handle Pattern Meaning with Example

Cup and Handle Patterns Comprehensive Stock Trading Guide

Analyzing Chart Patterns Cup And Handle

.png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and Handle Pattern Trading Strategy Guide Synapse Trading

Cup And Handle Pattern How To Trade And Target With An, 60 OFF

Cup And Handle Pattern Artinya

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup And Handle Pattern How To Verify And Use Efficiently How To

The Shallower And More Rounded The Cup, The Better The Pattern.

The Cup Forms After An Advance And Looks Like A Bowl.

Web A Cup And Handle Is A Bullish Technical Price Pattern That Appears In The Shape Of A Handled Cup On A Price Chart.

Eventually, The Stock Finds A Floor Of Support For Weeks Or Longer Before Climbing Again.

Related Post: