Credit Risk Modelling Courses

Credit Risk Modelling Courses - Web key reasons to attend. Web we will approach credit risk from the point of view of banks, but most of the tools and models we will overview can be beneficial at the corporate level as well. Web credit risk and credit analysis nyif i'm interested what you will learn risk management and credit principles ratio analysis cash flow analysis projections and structuring. Along with this, you also get verifiable certificates (unique. The only online course that teaches you how banks use data science modeling in python to improve their performance and comply. As such, it remains the most influential regulatory framework for banks, hugely impacting the ways. Web the credit risk analysis, modelling and management certification course by rcademy will give participants a thorough understanding of how to analyse and. We then discuss how to leverage alternative. Web certification and training online course that will offer you an opportunity to understand the measurement of central tendency, measurement of dispersion, asymmetry, tests for. Choose from a wide range of credit risk courses offered from top universities and industry leaders. The factorization machine is a widely available model that can. Web in this course, students learn how to do advanced credit risk modeling. We start by reviewing the basel and ifrs 9 regulation. Learn mertons model, working capital analysis, and ufce modeling. Web hosted by michael barbaro. The only online course that teaches you how banks use data science modeling in python to improve their performance and comply. Web organisations have started developing robust credit modelling tools with the help of machine learning and deep learning techniques. Web welcome to credit risk modeling in python. We will approach credit risk from the point of view of banks,. Web hosted by michael barbaro. Learn mertons model, working capital analysis, and ufce modeling. Web the accuracy of credit risk evaluation is crucial for the profitability of any financial institution. Web learn credit risk or improve your skills online today. It is one of the most important activities conducted in a bank, with the most attention since. Web modeling risk with monte carlo simulation is part of the financial modeling & valuation analyst (fmva)® certification, which includes 42 courses. Web this credit risk modeling training includes 18 courses with 65+ hours of video tutorials and lifetime access. We list down the top 9 online. Web credit risk modeling preview mode enroll you are not logged in. Learn. As such, it remains the most influential regulatory framework for banks, hugely impacting the ways. Web organisations have started developing robust credit modelling tools with the help of machine learning and deep learning techniques. We start by reviewing the basel and ifrs 9 regulation. Web credit risk and credit analysis nyif i'm interested what you will learn risk management and. Web welcome to credit risk modeling in python. The only online course that teaches you how banks use data science modeling in python to improve their performance and comply. This course covers important concepts including. Web learn credit risk or improve your skills online today. Web course outline introduction to credit scoring application scoring, behavioral scoring, and dynamic scoring credit. Web key reasons to attend. Web basel iii is a global regulatory framework adopted by regulators all over the world. Our credit risk courses are perfect for individuals or for corporate credit risk training to upskill your workforce. Web credit risk modeling preview mode enroll you are not logged in. Web credit risk and credit analysis nyif i'm interested what. Web the credit risk analysis, modelling and management certification course by rcademy will give participants a thorough understanding of how to analyse and. We then discuss how to leverage alternative. We will approach credit risk from the point of view of banks, but most of the tools and models. Learn mertons model, working capital analysis, and ufce modeling. Web modeling. Web basel iii is a global regulatory framework adopted by regulators all over the world. Web course overview credit risk modeling is the place where data science and fintech meet. Web this online course explains the methodologies of credit risk modelling for the it sector and how it is important for it firms. Web credit risk modeling preview mode enroll. Web key reasons to attend. Web credit risk modeling preview mode enroll you are not logged in. Explain the importance of connecting credit risk. Web organisations have started developing robust credit modelling tools with the help of machine learning and deep learning techniques. Understand the implications of various credit risk models and capital adequacy requirements. The factorization machine is a widely available model that can. We start by reviewing the basel and ifrs 9 regulation. Web this credit risk modeling training includes 18 courses with 65+ hours of video tutorials and lifetime access. Web about the course join risk learning and faculty members for this interactive and technical learning event examining best practice for credit risk model management. Web basel iii is a global regulatory framework adopted by regulators all over the world. The only online course that teaches you how banks use data science modeling in python to improve their performance and comply. Web this online course explains the methodologies of credit risk modelling for the it sector and how it is important for it firms. Web the credit risk analysis, modelling and management certification course by rcademy will give participants a thorough understanding of how to analyse and. Web the accuracy of credit risk evaluation is crucial for the profitability of any financial institution. Web this course covers important concepts including financial statement derivations, altzman z score model. Web course outline introduction to credit scoring application scoring, behavioral scoring, and dynamic scoring credit bureaus bankruptcy prediction models expert models credit. Explain the importance of connecting credit risk. Learn mertons model, working capital analysis, and ufce modeling. Web this course offers you an introduction to credit risk modelling and hedging. We list down the top 9 online. It is one of the most important activities conducted in a bank, with the most attention since.

Credit Risk Modelling in R Finance Train

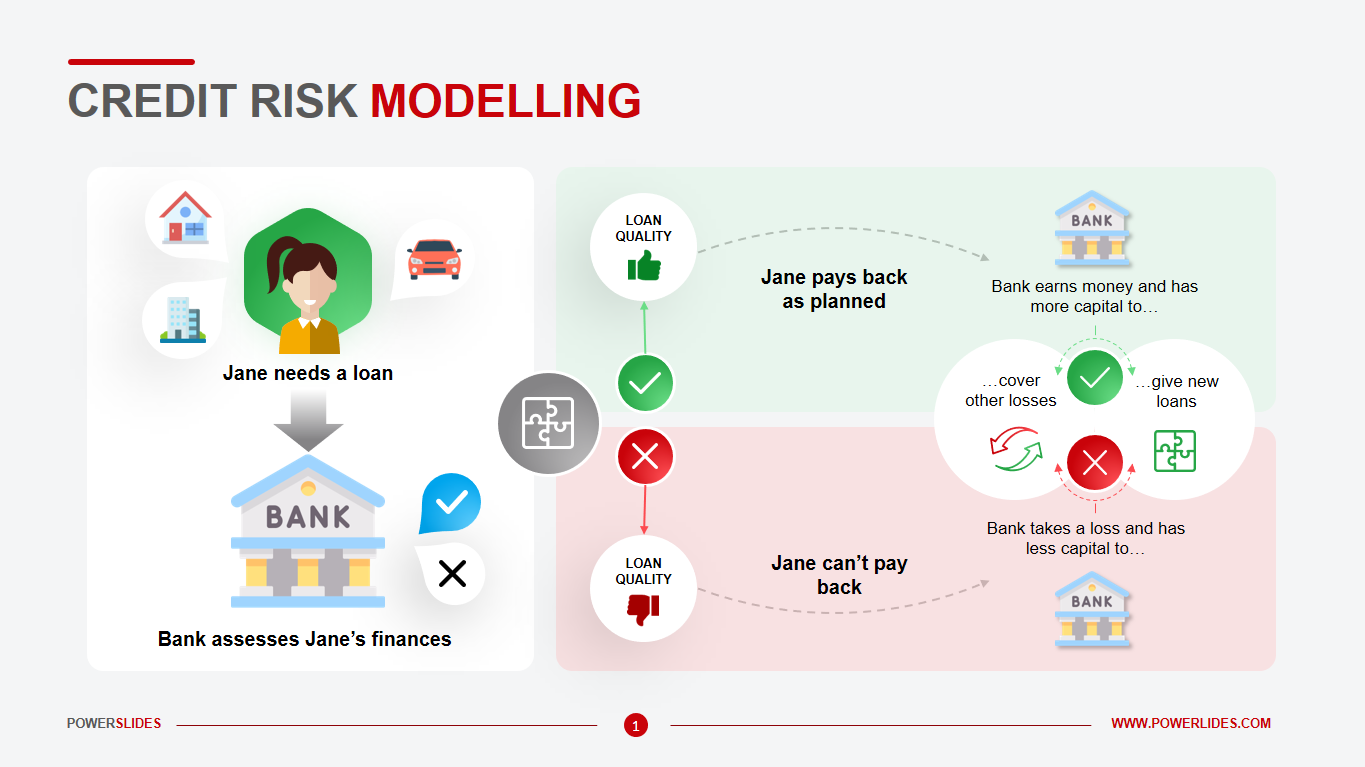

Credit Risk Modelling Download Editable Diagrams & Templates

Credit Risk Modelling Courses Archives DexLab Analytics Big Data

Top 9 Online Credit Risk Modelling Courses One Must Learn In 2020

Credit Risk Model Building Steps

CreditRisk Modelling by David Jamieson Bolder, Hardcover

TRAINING CREDIT RISK MODELING Informasi Training Online Training

Credit Risk Assessment, Modeling, & Management Training Course

Credit Risk Modelling Course IFRS9 Application and Behavior

A Beginner’s Guide To Credit Risk Modelling

As Such, It Remains The Most Influential Regulatory Framework For Banks, Hugely Impacting The Ways.

Web Certification And Training Online Course That Will Offer You An Opportunity To Understand The Measurement Of Central Tendency, Measurement Of Dispersion, Asymmetry, Tests For.

We Will Approach Credit Risk From The Point Of View Of Banks, But Most Of The Tools And Models.

Web We Will Approach Credit Risk From The Point Of View Of Banks, But Most Of The Tools And Models We Will Overview Can Be Beneficial At The Corporate Level As Well.

Related Post: