Continuation Chart Patterns

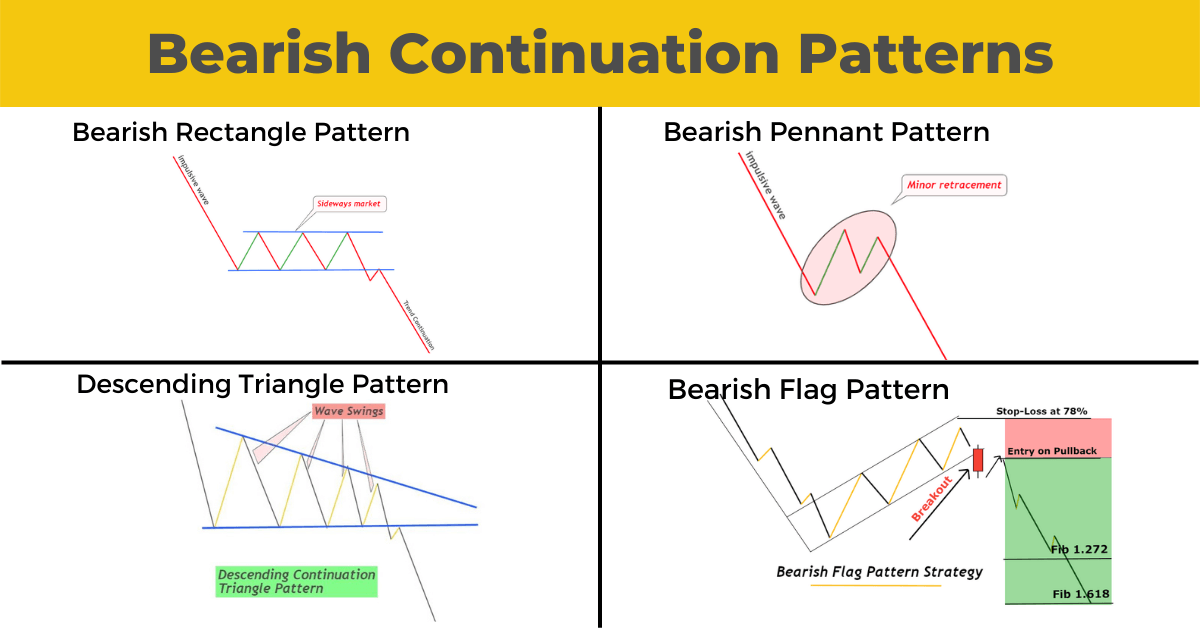

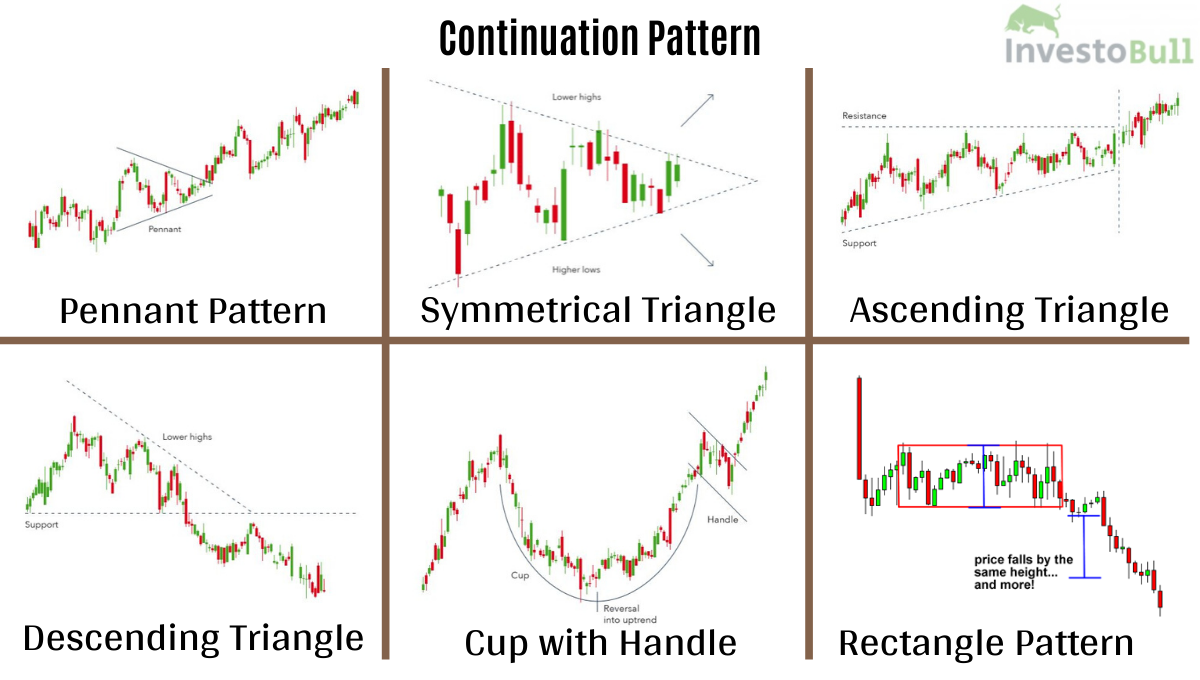

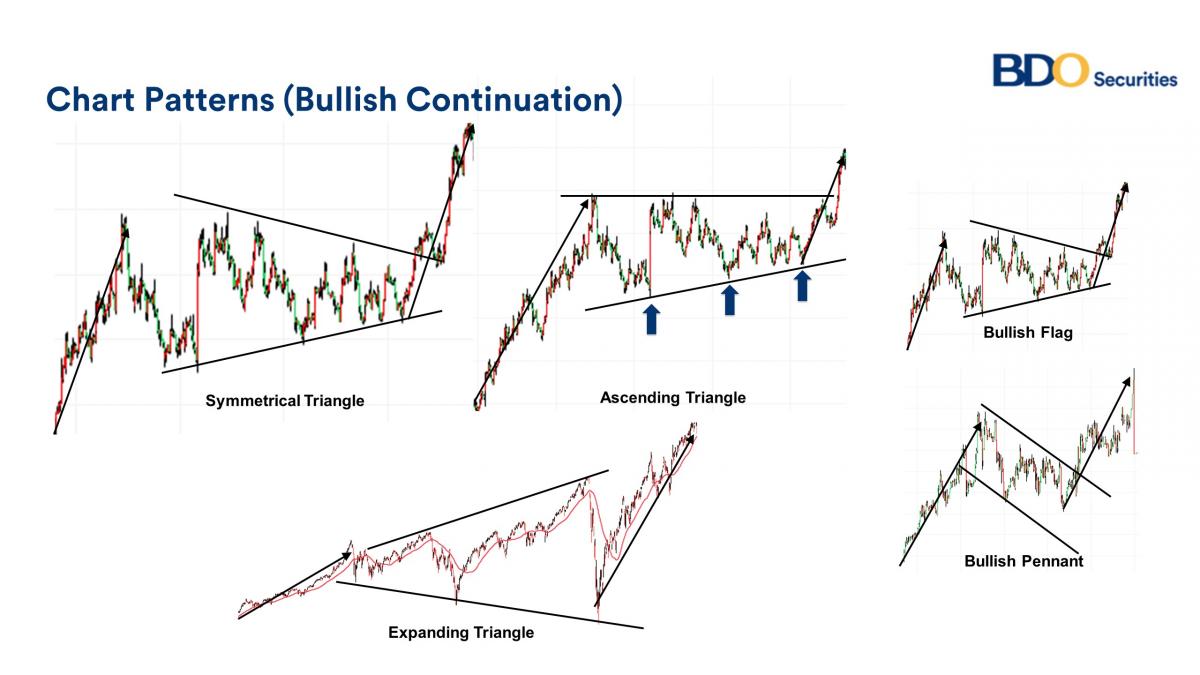

Continuation Chart Patterns - Bullish continuation patterns are ascending triangles, bull flags, bullish. See examples of bullish and bearish. Find out how to spot, enter, and. Web updated 4/18/2022 16 min read. Web learn how to identify and trade continuation patterns in the financial markets, such as triangles, pennants, flags, and rectangles. Two basic tenets of technical analysis are that prices trend and that history repeats itself. These patterns indicate that the price trend. In the stockcharts platform, you can. Find out how triangles, flags, pennants and rectangles can help you predict the direction of a trend and. Flags and pennants require evidence of a sharp advance or decline in heavy volume. Why new traders with small accounts should learn continuation patterns… how to build a solid trading. Bullish continuation patterns are ascending triangles, bull flags, bullish. Understanding these components enables traders to use. Web the most common continuation patterns are: See examples of bullish and. Web the most common continuation patterns are: Web learn what continuation chart patterns are and how they indicate a trend continuation in the market. Web continuation patterns are a type of chart pattern that forms during a temporary pause in an existing market trend before it resumes. Web learn how to identify and trade continuation patterns, which are chart formations. In the stockcharts platform, you can. Find out how to spot, enter, and. Web pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis. Triangles and wedges are intermediate term continuation patterns whereas. Find out how triangles, flags, pennants and rectangles can help you predict the direction of a trend and. Included in this type are the most common patterns which have been. Web reversal patterns indicate a trend change, whereas continuation patterns indicate the price trend will continue after a brief consolidation. Web learn how to use continuation patterns, such as flags, rectangles, pennants, and wedges, to identify and trade with the trend direction of an asset. Bullish continuation patterns. A continuation pattern can be considered a pause during a. Find out how to spot, enter, and. Web updated 4/18/2022 16 min read. A doji is a candle where the opening price and closing. Bullish continuation patterns are ascending triangles, bull flags, bullish. Web learn what continuation chart patterns are and how they indicate a trend continuation in the market. Web a continuation pattern is a recognizable chart pattern denoting temporary consolidation during a period before carrying on in the original trend’s direction. Web continuation candlestick patterns uptrend and downtrend. Triangles are similar to wedges and pennants and can be either a. It's. A continuation pattern can be considered a pause during a. Triangles are similar to wedges and pennants and can be either a. Bullish continuation patterns are ascending triangles, bull flags, bullish. Web ultimately, the mechanics of continuation patterns blend market psychology, volume analysis, and price action. See examples of bullish and bearish. These patterns indicate that the price trend. Web most reversal and continuation patterns have specific criteria. Web reversal patterns indicate a trend change, whereas continuation patterns indicate the price trend will continue after a brief consolidation. See examples of bullish and bearish. Web continuation pattern types are triangles, flags, pennants, continuation gaps, and rectangles. In the stockcharts platform, you can. Triangles are similar to wedges and pennants and can be either a. Web learn how to identify and trade continuation patterns in stocks. Web learn what continuation patterns are and how to spot them on price charts. Web learn how to identify and trade continuation patterns in the financial markets, such as triangles, pennants,. These patterns indicate that the price trend. Web continuation candlestick patterns uptrend and downtrend. Web learn how to identify and trade continuation patterns, which are chart formations that signal a temporary consolidation before a trend resumes. It's important to look at the volume in a. Web a continuation pattern is a chart pattern described as a series of price movements. Web updated 4/18/2022 16 min read. Web continuation patterns are a type of chart pattern that forms during a temporary pause in an existing market trend before it resumes. Included in this type are the most common patterns which have been. Web learn how to identify and trade continuation patterns in stocks. Two basic tenets of technical analysis are that prices trend and that history repeats itself. Triangles and wedges are intermediate term continuation patterns whereas. In the stockcharts platform, you can. These patterns suggest that the forex. Below you can find the schemes and explanations of the. Web learn how to use continuation patterns, such as flags, rectangles, pennants, and wedges, to identify and trade with the trend direction of an asset. Web reversal patterns indicate a trend change, whereas continuation patterns indicate the price trend will continue after a brief consolidation. Web some of the most common continuation patterns include: Web learn what continuation chart patterns are and how they indicate a trend continuation in the market. These patterns indicate that the price trend. Web most reversal and continuation patterns have specific criteria. Triangles are similar to wedges and pennants and can be either a.

Continuation Forex Chart Patterns Cheat Sheet ForexBoat Trading Academy

Continuation Chart Patterns

Continuation Chart Patterns Stock Market Analysis Tutorial

Bearish Continuation Chart Patterns And How To Trade Them Equitient Riset

Continuation Price Patterns vs. Reversal Price Patterns Synapse Trading

Introduction to Chart Patterns Continuation and reversal patterns

UNDERSTANDING TREND CONTINUATION PATTERNS for FXCADCHF by AlanTradesFX

Continuation Patterns in Crypto Charts Understand the Basics

Continuation Candlestick Patterns Cheat Sheet

Continuation Patterns

Web Learn How To Identify And Trade Continuation Patterns In The Financial Markets, Such As Triangles, Pennants, Flags, And Rectangles.

These Patterns Signal That A Trend Will Continue And Give You Clear Entry Signals.

Flags And Pennants Require Evidence Of A Sharp Advance Or Decline In Heavy Volume.

Discover The Features, Benefits, And Types Of.

Related Post: