Consolidation Pattern

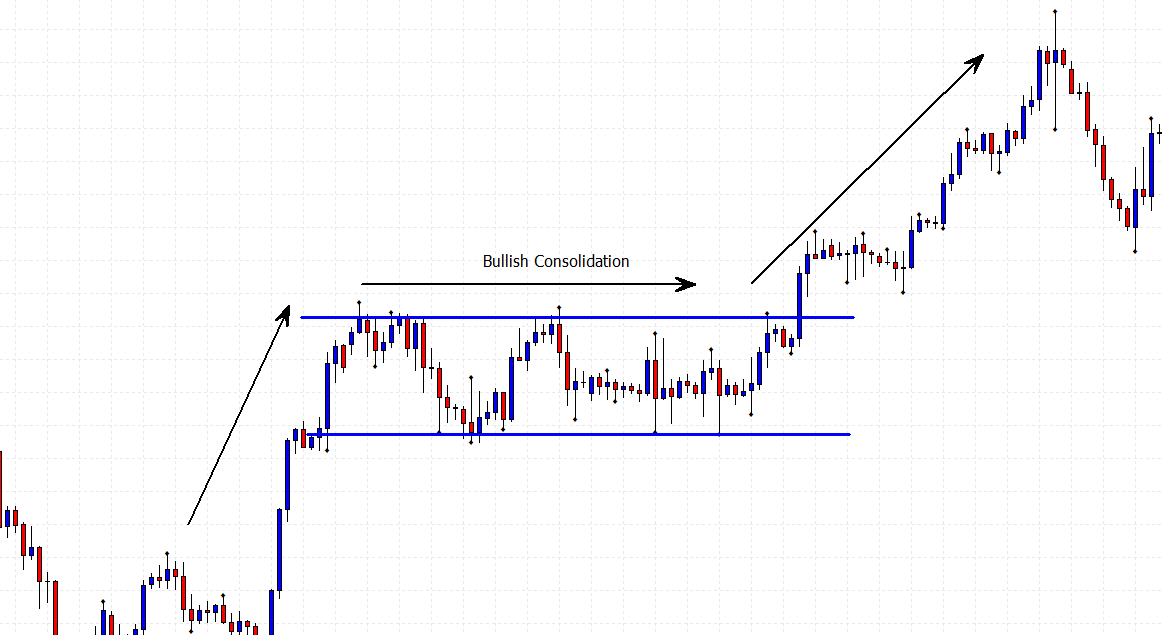

Consolidation Pattern - Get started with a stock broker. Web consolidation is the term for a stock or security that is neither continuing nor reversing a larger price trend. Sws helps store factual memories, while rem sleep solidifies procedural skills and integrates new information with existing knowledge. The highs and lows can be connected to form two parallel lines that make up the top and bottom of a rectangle. Web consolidation patterns exhibit specific characteristics that traders closely monitor. During consolidation, an asset’s price tends to move sideways, displaying minimal upward or downward momentum. Web at which point dip buyers may be tempted to load up for the real break. Web bitcoin's recent price action shows consolidation within a bull wedge pattern, with two trend lines to watch for a potential breakout. It improves focus, attention, emotional. How to trade consolidating stocks. Web consolidation patterns are formations on price charts that provide insights into potential future price movements. The highs and lows can be connected to form two parallel lines that make up the top and bottom of a rectangle. Web we distinguish between three consolidation patterns: A tall white candle followed by a shorter black candle. It comes to a point. Web a consolidation pattern is a specific chart pattern that signifies a period of indecision in the market, usually followed by a trend continuation or reversal. Web consolidation patterns are formations on price charts that provide insights into potential future price movements. These patterns are often characterized by: These patterns offer a glimpse into the battle between buyers and sellers,. Web a consolidation pattern is a specific chart pattern that signifies a period of indecision in the market, usually followed by a trend continuation or reversal. Pennants and wedges (triangle patterns) is consolidation bullish? It has to fit within certain criteria. Sideways ranges, downward or upward sloping ranges (also called flags), or triangular consolidations (triangles, wedges and pennants). Remember, if. These patterns show continuation of the consolidation trend. Web we distinguish between three consolidation patterns: Consolidated stocks typically trade within limited price ranges and. The highs and lows can be connected to form two parallel lines that make up the top and bottom of a rectangle. Web consolidation patterns are formations on price charts that provide insights into potential future. Web a consolidation pattern evolves as traders using fundamental analysis recognize the basic support and resistance zones of a stock or other equity. These indicators help in identifying the likelihood of a continuation or reversal of the existing trend, once the consolidation phase ends. Web consolidating stocks may trade within a range for an extended time, but eventually they will. Traders observe consolidation patterns to know when the market trend may change and the direction of the change. Web consolidation patterns are typically weak candlestick patterns that have close to an even chance of resolving in either direction (i.e. Consolidation is generally interpreted as market. Learn about consolidation pattern, how it works, its benefits, and many more. Web a consolidation. A tight consolidation is when a stock moves sideways in a narrow range. When a stock is said to be consolidating, its price movement is restricted within defined levels, so there is a lack of trend. It comes to a point where the use. Web updated april 29, 2022. The value of this indicator is to support traders to easily. Triangles are similar to wedges and pennants and can be either a. The value of this indicator is to support traders to easily identify consolidations and ranges. Web consolidation patterns are typically weak candlestick patterns that have close to an even chance of resolving in either direction (i.e. Web updated april 29, 2022. Remember, if a decline is 15% or. Web robinhood stock is on track to have a base with a 20.55 buy point, the marketsmith pattern recognition shows. Web consolidation refers to a market condition where prices move within a confined range, signifying a period of indecision among market participants. Sws helps store factual memories, while rem sleep solidifies procedural skills and integrates new information with existing knowledge.. Sideways ranges, downward or upward sloping ranges (also called flags), or triangular consolidations (triangles, wedges and pennants). These patterns are often characterized by: Web updated april 29, 2022. The value of this indicator is to support traders to easily identify consolidations and ranges. Consolidation is generally interpreted as market. A tall white candle followed by a shorter black candle. Web the rectangle pattern, also known as a trading range or a consolidation pattern, is characterized by horizontal lines that act as support and resistance levels, creating a rectangular shape. Web a consolidation pattern evolves as traders using fundamental analysis recognize the basic support and resistance zones of a stock or other equity. (naics), itif found evidence of a similar pattern across the u.s. The highs and lows can be connected to form two parallel lines that make up the top and bottom of a rectangle. Web a consolidation pattern is a specific chart pattern that signifies a period of indecision in the market, usually followed by a trend continuation or reversal. The consolidation phase is a stage in the industry life cycle where competitors in the industry start to. Quality rest is essential for optimal cognitive function beyond memory. Triangles are similar to wedges and pennants and can be either a. Web consolidation refers to a market condition where prices move within a confined range, signifying a period of indecision among market participants. Web updated april 29, 2022. In my years of trading and teaching, i’ve found that recognizing these patterns can offer traders a roadmap for what comes next. Web a consolidation patterns pause in the ongoing trend confirms that the trend continues in the same direction. Get started with a stock broker. Currently, the market is poised within this bull flag pattern, and a decisive break above the $2,375. Web in trading, consolidating means that the price of an asset is only moving sideways, without making any significant advancement in the upward or downward direction.Forex Chart Pattern Trading Analysis FX Market Price Manipulation

How To Catch High Profiting Moves With Continuation Price Patterns

Stock Consolidation Explained (2022) StepByStep Guide

The Stock Consolidation Trend Explained Is it Worth Trading? DTTW™

The Consolidation Pattern Mastering Technical Analysis

Stock Consolidation Explained (2022) StepByStep Guide

Consolidations Patterns how to trade Learn Forex Trading

How To Trade Consolidations Pro Trading School

Stock Consolidation Explained (2022) StepByStep Guide

Price Action HOW to trade Consolidation PATTERNS (advanced trading

It Typically Occurs When The Market Is Indecisive,.

How To Trade Consolidating Stocks.

Web A Rectangle Is A Continuation Pattern That Forms As A Trading Range During A Pause In The Trend.

These Patterns Are Often Characterized By:

Related Post: